Table Of Contents

What Is Zig Zag Indicator?

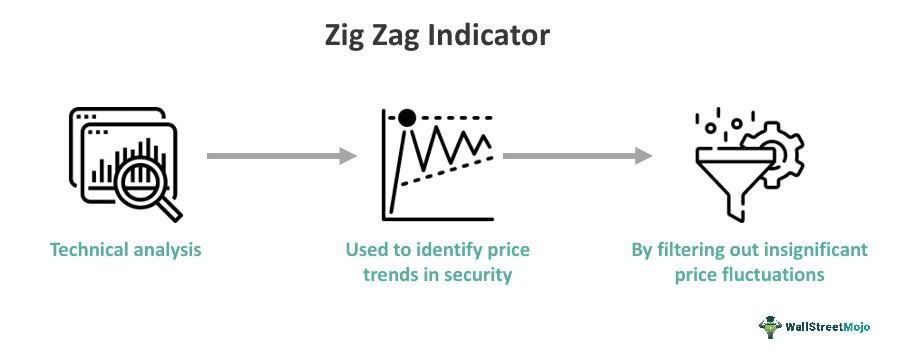

The zig zag indicator is a technical analysis tool used by traders to identify changes in the direction of price trends in financial markets. This indicator aims to assist traders and analysts in identifying trends, filtering out noise, and spotting potential trend reversals in financial markets.

It works by filtering out market noise and focusing on the most critical price movements. Hence, it does this by connecting the highest highs and lowest lows in the price action and ignoring the more minor price fluctuations in between. The Zigzag indicator is prevalent in the field of technical analysis for stocks, forex, and other financial instruments. Charting software commonly uses the Zig Zag indicator to highlight significant changes in price movements.

Key Takeaways

- The Zigzag indicator is a technical analysis tool used to identify trends in financial markets by removing unnecessary price fluctuations.

- Traders often use the indicator to identify potential entry and exit points for trades, as well as to set stop-loss orders.

- Moreover, these indicators filter out small price movements and focus on significant highs and lows.

- Hence, it aims to help traders visualize trends, locate key turning points, and reduce the impact of market noise. Therefore, it is a lagging indicator, and traders should use it in conjunction with other tools and analysis methods.

How Does Zig Zag Indicator Work?

The zig zag indicator is a technical analysis tool used to identify trends and trend reversals in financial markets. It is handy for identifying trend reversals and significant price movements in financial markets. The indicator uses a user-defined percentage or point change to identify significant price swings. Once the price has moved by the specified amount, it plots a line or arrow to indicate the direction of the trend. For example, if one set the percentage change to 5%, the indicator will ignore price movements less than 5% and will only connect points that are at least 5% away from each other.

Here's a step-by-step explanation of how it works:

- Setting parameters: Traders can customize this indicator by setting parameters, such as the percentage change required to define a significant high or low.

- Identifying peaks and lows: The zig zag indicator identifies peaks (highs) and lows in the price movement that meet the specified percentage change criteria. Generally, the percentage for selecting these points is often 5%.

- Drawing lines: The zig zag lines are then drawn on the price chart, connecting the significant peaks and troughs. These lines create a visual representation of the price movements that the indicator considers relevant. Thus, these lines appear only when there is a price fluctuation.

- Trend identification: By connecting key points, these lines help traders identify the prevailing trend. Therefore, an upward-sloping zig zag line suggests an uptrend, while a downward-sloping line indicates a downtrend.

- Trend reversal signal: When the zig zag line changes direction, it signals a potential reversal in the current trend. This occurs one can identify a new significant high or low based on the specified percentage change.

Additionally, the choice of parameters can affect the indicator's sensitivity and the signals it generates. Furthermore, it is essential to consider that the indicator is lagging, meaning it relies on historical price data to generate a signal.

Formula

The formula for calculating the zig zag indicator involves the following steps:

- Identify the highest high and lowest low prices over a given period.

- Calculate the percentage change between the highest high and lowest low prices.

- Determine the user-defined threshold percentage change that must occur for a new trend to be identified.

- When the price movement exceeds the threshold percentage change, a new trend is identified, and the zig zag indicator plots a line or arrow to indicate the direction of the trend.

Here is the formula for the Zig Zag indicator:

ZigZag(HL,%change=X,retrace=FALSE,LastExtreme=TRUE)

Where:

HL=HighLow price series or closing price series

%change=Minimum price fluctuations, in percentage

Retrace=Is change a retracement of the previous or an absolute change from high to low

LastExtreme=If the extreme price is the same over multiple periods, is the extreme price the first or last observation?

How To Use?

Here are some ways to use the zig zag indicator:

- Identify trend changes: The zig zag indicator can be used to identify changes in trend direction. When the indicator plots a new line or arrow, it indicates that a new trend may be emerging. Traders can use this information to look for trading opportunities in the new trend direction.

- Set stop-loss levels: It can be used to set stop-loss levels. Traders can use the indicator to identify critical support or resistance levels and set stop-loss orders accordingly.

- Identify potential buying or selling opportunities: It can help traders identify potential buying or selling opportunities. When the indicator plots a new line or arrow in the direction of a trend, traders may consider entering a long or short position, respectively.

- Use in conjunction with other technical indicators: To validate trading signals and raise the likelihood of profitable transactions, the zig zag indicator can be used in conjunction with other technical indicators like trend lines or moving averages.

- Adjust the parameters: It allows traders to adjust the parameters, such as the percentage change or point change, to suit their trading style and the financial instrument being analyzed.

Overall, the Zig Zag indicator is a versatile tool that can be used in a variety of ways to help traders identify potential trading opportunities in financial markets. To improve the likelihood of success, it should be combined with other technical analysis tools and a sound trading plan.

Let us look at the following Ethereum/Tether chart to understand the concept.

Simply put, the zigzag lines visually represent the significant price movements that the indicator deems relevant, thus assisting traders in identifying the trend prevailing in the market. As one can observe, the above chart demonstrates an ascending zigzag indicator by linking the noteworthy peaks and troughs. With the help of this indicator, one can find it easier to spot significant price movements and get valuable insights into market dynamics.

Individuals can consider looking at various other charts of zigzag indicators to develop a comprehensive understanding of this technical analysis tool. They can find such charts already published on TradingView.

Examples

Let us look at zig zag indicator examples to understand the concept better:

Example #1

Let's say a trader analyzes the price of a stock over 100 days. The trader has set the zig zag indicator to plot a line or arrow when the price moves by 5% or more. Thus, let us understand this as per different days:

- The stock price opens at $100 and closes at $105. The ZigZag indicator does not plot a line or arrow since the price change is less than 5%.

- The stock price opens at $105 and falls to $98 before rebounding to close at $102. The zig zag indicator plots a line connecting the high at $105 and the low at $98, indicating a new downtrend.

- The stock price opens at $102 and rises to $110 before closing at $107. The indicator does not plot a line or arrow since the price change is less than 5%.

- The stock price opens at $107 and rises to $115 before closing at $113. The indicator plots a line connecting the high at $115 and the low at $107, indicating a new uptrend.

- The stock price opens at $113 and falls to $105 before rebounding to close at $108. The indicator does not plot a line or arrow since the price change is less than 5%.

In this example, the zig zag indicator identified two new trends: a downtrend on day two and an uptrend on day 4. Traders could use this information to look for potential selling opportunities during the downtrend and buying opportunities during the uptrend. They could also use the indicator to set stop-loss levels and confirm trading signals from other technical analysis tools.

Example #2

Let's say investors analyze the price of the S&P 500 index over several months. The investor has set the zig zag indicator to plot a line or arrow when the price moves by 3% or more.

On March 23, 2020, the S&P 500 hit a low of 2,237.40, which was a 34% decline from its February 19, 2020, high of 3,393.52. The zig zag indicator plotted a line connecting the high at 3,393.52 and the low at 2,237.40, indicating a new downtrend.

Over the next several months, the S&P 500 gradually recovered, and by September 2, 2020, it had risen to a new all-time high of 3,580.84. Thus, the indicator plotted a line connecting the low at 2,237.40 and the high at 3,580.84, indicating a new uptrend.

Therefore, traders who were using this indicator could have used this information to look for selling opportunities during the downtrend and buying opportunities during the uptrend. They could have also used the indicator to set stop-loss levels and confirm trading signals from other technical analysis tools.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.