Table Of Contents

Wyoming CPA Exam

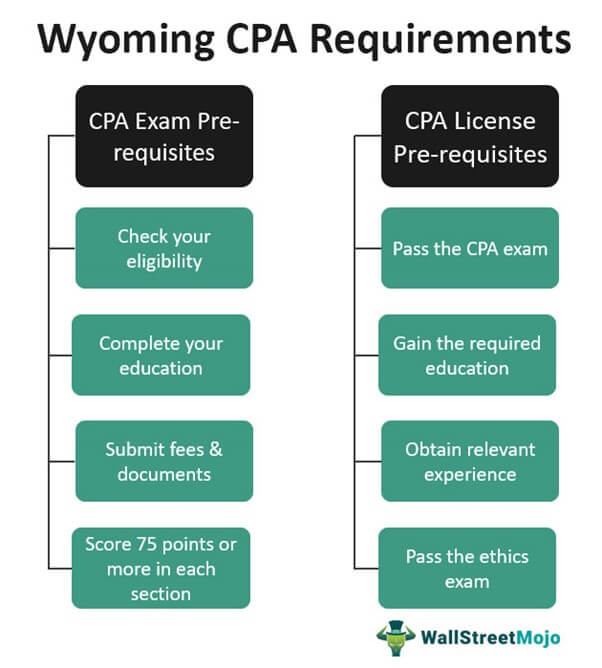

Wyoming CPA (Certified Public Accountant) License is the highest accounting credential conferred by the Wyoming Board of Certified Public Accountants (WBCPA) to qualified professionals. Moreover, Wyoming CPA aspirants must fulfil the state-specific education, exam, and experience requirements to earn the license.

The “Equality State” follows a one-tier licensing system. So, you may pass the CPA exam and meet the education and experience requirements to apply for the CPA license directly. Furthermore, the Wyoming State Board of Accountancy is the license-issuing authority.

| Particulars | Requirements |

| Minimum age | 18 years |

| U.S. Citizenship | Not required |

| Residency | Required |

| Social Security Number (SSN) | Required |

| Education requirement for CPA Exam | Bachelor’s degree with

|

| Minimum passing score in CPA Exam | At least 75 points in each exam section |

| Education requirement for licensure | 150 semester hours |

| Experience requirement for licensure | 1 year in public accounting |

| Ethics exam | AICPA Professional Ethics Exam |

Please note that the state of Wyoming also participates in the International Examination Program. Now, let’s take a closer look at Wyoming CPA Exam and License Requirements.

Wyoming CPA License Requirements

Wyoming CPA Exam Requirements

CPA Exam is a computer-based standardized test comprising four sections to be passed within 18 months. The period starts from the date you sat for the first passed section. Furthermore, the examination analyses your intelligence and aptitude to pursue public accountancy.

Passing the CPA Exam is the primary requirement for attaining the Wyoming CPA License. The American Institute of Certified Public Accountants (AICPA), the National Association of State Boards of Accountancy (NASBA), and the state boards jointly supervise the test.

Moreover, you must pass all exam sections with at least 75 points each on a scale of 0-99.

| CPA Exam Section | Exam Time | Testlets | Question types | ||

| Multiple-choice questions | Task-based simulations | Written communications | |||

| Auditing & Attestation (AUD) | 4-hour | 5 | Yes | Yes | No |

| Business Environment & Concepts (BEC) | 4-hour | 5 | Yes | Yes | Yes |

| Financial Accounting & Reporting (FAR) | 4-hour | 5 | Yes | Yes | No |

| Regulation (REG) | 4-hour | 5 | Yes | Yes | No |

Exam Eligibility Requirements

Here are the standard Wyoming exam eligibility requirements:

- At least 18 years of age

- Any one of the following:

- Wyoming driver’s license

- Current and valid Wyoming street address

- Wyoming employment proof or job offer to join within six months

- Students at a Wyoming community college or the University of Wyoming

Exam Education Requirements

Bachelor’s degree with at least:

- 24 semester hours in an accounting course

- 24 semester hours in a business course

| Accounting subjects | Business-related subjects |

Financial accounting and reporting for

| Business law |

| Auditing and attestation services | Economics |

| Managerial or Cost accounting | Management |

| Taxation | Marketing |

| Fraud examination | Finance |

| Internal controls and risk assessment | Business communications |

| Financial statement analysis | Statistics |

| Accounting or tax research and analysis | Quantitative methods |

| Accounting information systems | Technical writing |

| Ethics | Information systems or technology |

| - | Ethics |

| - | Data Analytics |

You may include up to six semester hours for internships in the subjects mentioned above.

On meeting all the education requirements, submit your exam application to the Wyoming state board with the required fee and academic transcripts. Please visit the Wyoming website to know the complete application procedure. Furthermore, fill out the Request for Accommodation of Disabilities form to avail of the required facility.

Fees

- First-time applicants - Those who have never applied or not re-applied within the last three years as a Wyoming CPA exam candidate.

| Particulars | Amount | Total Fees | |||

| Application Fee | - | $110 | |||

| Examination Fees | AICPA | Prometric Test | Prometric Security | NASBA | - |

| AUD | $110 | $84.84 | $6.31 | $25 | $226.15 |

| BEC | $110 | $84.84 | $6.31 | $25 | $226.15 |

| FAR | $110 | $84.84 | $6.31 | $25 | $226.15 |

| REG | $110 | $84.84 | $6.31 | $25 | $226.15 |

| Total Amount | - | $1014.6 |

- Re-examination Candidates - Those who have applied within the last three years.

| Particulars | Amount | Total Fees | |||

| Application Fee | - | $50 | |||

| Examination Fees | AICPA | Prometric Test | Prometric Security | NASBA | - |

| AUD | $110 | $84.84 | $6.31 | $25 | $226.15 |

| BEC | $110 | $84.84 | $6.31 | $25 | $226.15 |

| FAR | $110 | $84.84 | $6.31 | $25 | $226.15 |

| REG | $110 | $84.84 | $6.31 | $25 | $226.15 |

| Total Amount | - | $954.6 |

Submit the examination fees through a NASBA Payment Coupon. Moreover, ensure to attempt the applied section(s) within six months of the Notice-to-Schedule (NTS) date.

Required Documents

You must submit the below-mentioned documents to WBCPA:

| Documents | Submission |

|---|---|

| Official school transcripts | Your school/institution |

| International Evaluation Summary (if applicable) | You/NIES/Evaluation agency |

| Request for Accommodation of Disabilities (if applicable) | You |

Applicants with foreign education credentials must get their transcripts evaluated by NASBA International Evaluation Services (NIES) or a board-approved agency. Moreover, you may utilize NASBA Advisory Evaluation ($100) to pinpoint any academic inadequacy in the documents before the final submission.

Wyoming CPA License Requirements

Wyoming CPA licensure applicants must fulfill the 3E’s:

- Education - Bachelor’s degree with at least 150 semester hours

- Exam - Pass each CPA exam section with at least 75 points

- Experience - Obtain at least 1-year full-time accounting work experience

You must be at least 18 years old with Wyoming residency and a valid SSN to apply for the CPA license. After passing the CPA Exam and meeting other requirements, ensure to submit your license application with the required fees ($225) and documents to the Wyoming state board.

Education Requirements

Gain 150 semester hours (including a bachelor’s degree) with 24 semester credit hours each in accounting and business courses. Please refer to the Exam Education Requirements section for the detailed subject list.

Exam Requirements

Wyoming CPA licensure applicants must pass all four CPA exam sections within the rolling 18-month testing period. Ensure to score at least 75 points on a scale of 0-99 in each section. For further details, kindly check the Wyoming Exam Requirements section.

Experience Requirements

You must gain at least one year (2000 hours) of accounting experience. An active CPA must verify the work experience.

Candidates may also submit an unverified equivalent experience. They should provide the required documentation, including the job title, employment period, and detailed description of duties. Also, they must get it affirmed by the concerned supervisor.

Here lies the list of qualifying experiences and fields.

| Qualifying Experience | Qualifying Field | |

| Verified Experience | Unverified Experience | |

| Accounting | Financial statement preparation | Government |

| Auditing | Financial statement consolidation | Industry |

| Review | Trial balance/General ledger/Fixed asset | Academia |

| Compilation | Audit support | Public accounting practice |

| Management Advisory | Software conversion/Installation of financial systems | |

| Financial Advisory | Account Reconciliation | |

| Tax | Expense account analysis | |

| Consulting | Tax payments & returns, etc. |

Ethics Requirements

Finally, CPA candidates must complete the AICPA’s professional ethics course and take the examination. They must score at least 90% to pass the exam. For more information, take a look at the below-mentioned details.

| Particulars | Details |

| What to study | Professional Ethics: AICPA’s Comprehensive Course |

| Mode | Online and text version |

| Type of course | Self-study |

| Cost | AICPA members – $179 |

| Non-members – $225 | |

| Topics covered | AICPA Code of Professional Conduct |

| Ethics | |

| Independence | |

| Conceptual framework | |

| Regulatory Rules | |

| Code – Importance & how it is organized | |

| How to study | Sign-up for the course |

| Get an online or text version of the course | |

| Read the study material | |

| Take the ethics exam | |

| Exam Format/Type/Questions | Timed |

| MCQs | |

| Minimum Passing Mark (for licensure) | 90% |

Continuing Professional Education (CPE)

Wyoming CPAs must attain 120 CPE credit hours over a rolling three-year period to renew their license. Moreover, they should choose only the programs offered by Wyoming board-approved regulatory and professional ethics course providers. Let’s see the details of the CPE requirements.

| Particulars | Details | |

| License renewal date | December 31 (Annually) | |

| CPE reporting period | January 1-December 31 (Triennially) | |

| CPE requirements | 120 CPE hours (rolling 3-year period) | |

| Ethics requirement (board approved course) | First permit renewal | 4-hours within 6 months of the initial permit date |

| Subsequent permit renewal | 4 hours | |

| Other requirements | 80 hours in Code A subjects | |

| Credit limitations | Independent study | Maximum 12 hours |

| Instruction | Maximum 60 hours (no repetitions) | |

| Published materials | 30 hours | |

| Fields of study | Specific subject areas are limited | |

| Credit calculation | Instruction | 1 Credit hour = 3 times the presentation time |

| Partial credit | Half credits are accepted after the first CPE hour | |

| University/college credit | 1 Semester hour = 15 CPE hours | |

| 1 Quarter hour = 10 CPE hours |

Congratulations to those who managed to fulfill all the Wyoming CPA exam and license requirements and attain the license! You have earned the most prestigious and globally recognized accounting credential. Now, you may choose your specialization area and build networking opportunities. Last but not least, don’t forget to keep renewing your license every three years.

Wyoming Exam Information & Resources

1. Wyoming Board of CPAs (https://sites.google.com/a/wyo.gov/wyoming-cpa/home)

325 W 18th St, Suite 4

Cheyenne, Wyoming 82002

Phone: 307-777-7551

Email: wycpaboard@wyo.gov

2. Wyoming Society of CPAs (https://www.wyocpa.org/)

504 W. 17th St., Suite 200

Cheyenne, Wyoming 82001

Ph: 307-634-7039

admin@wyocpa.org

3. Wyoming Secretary of State (https://sos.wyo.gov/)

Herschler Building East

122 West 25th St

Suites 100 & 101

Cheyenne, WY 82002-0020

4. NASBA (https://nasba.org/)

150 Fourth Avenue North

Suite 700

Nashville, Tennessee37219-2417

Tel: 615-800-4200

Fax: 615-880-4290

5. AICPA (https://www.aicpa.org/)

E-mail: AICPA 220 Leigh Farm Road Durham, North Carolina 27707- 8110

Phone: +1.919.402.4500

Fax: +1.919.402.4505

Examination: 609-671-2900

Recommended Articles

This article is a guide to Wyoming CPA Exam & License Requirements. Here, we discuss the Wyoming CPA Requirements and license requirements in Wyoming. You may consider the following CPA Review providers to prepare for your exams: -