Table Of Contents

What Is A Wrap Account?

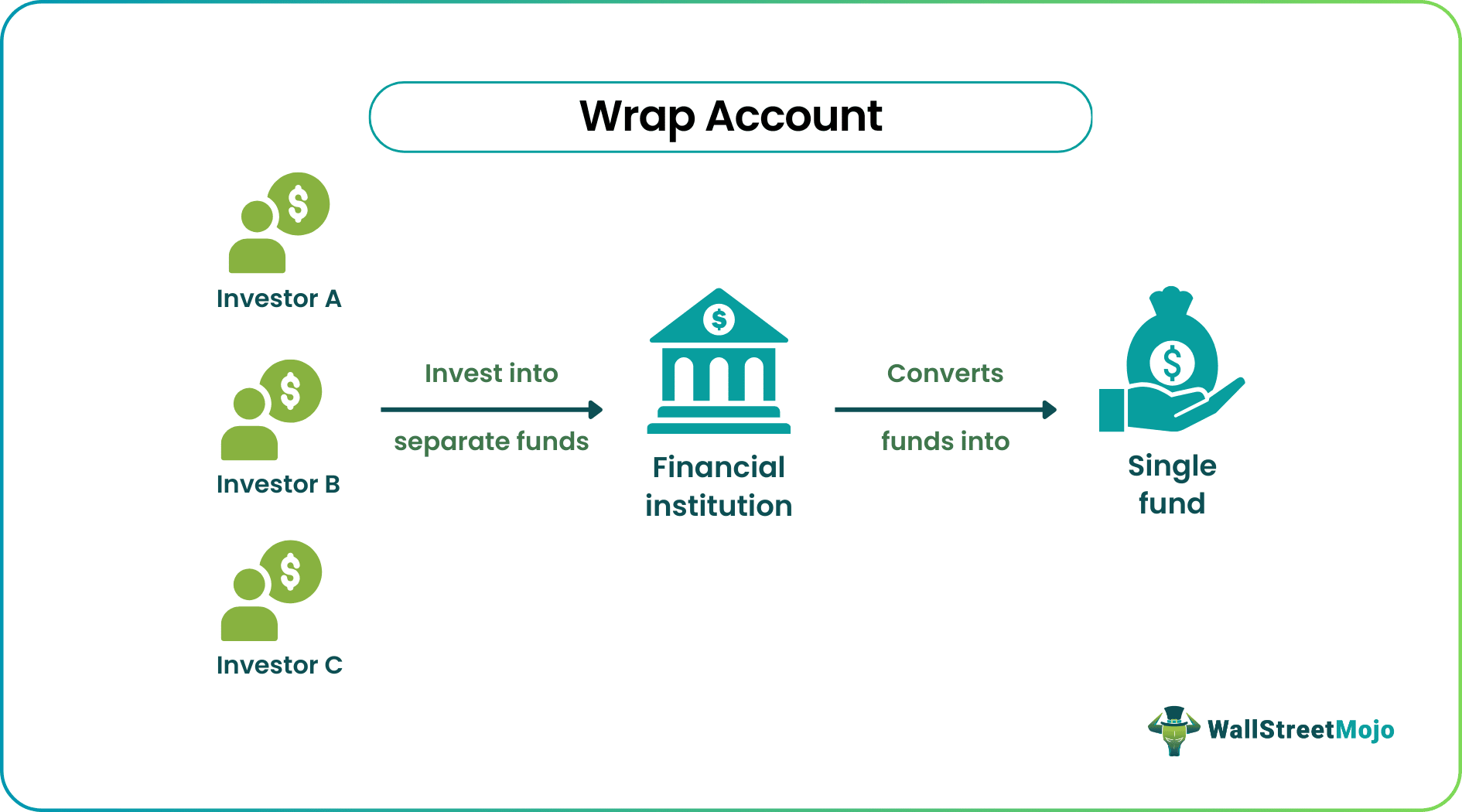

A wrap account is a financial arrangement where a financial institution bundles various investment products, such as mutual funds or separately managed accounts, into a single, unified package for an investor. The aim is to provide investors with a comprehensive and bundled investment management service that includes a range of services for a single, bundled fee.

It aims to provide investors with access to professional portfolio management expertise. This can be especially beneficial for individuals needing more time, knowledge, or desire to manage their investments actively. Portfolio managers in this account typically diversify investments to spread risk across different asset classes and securities, aiming to reduce the portfolio's overall risk.

Table of contents

- What Is A Wrap Account?

- A wrap account offers a bundled investment management service that includes portfolio management, administration, and other related services for a single, bundled fee.

- Investors benefit from the expertise of portfolio managers or advisors who make investment decisions on their behalf, aiming to optimize returns and manage risk.

- It tailors investment strategies to match investors' financial goals, risk tolerance, and time horizon.

- It diversifies investments across various asset classes and securities to reduce risk.

Wrap Account Explained

A wrap account, or a wrap fee or wrap program, is a bundled investment account offered by financial institutions, such as brokerage firms or investment advisory firms. The primary aim of a wrap account is to provide investors with a comprehensive and bundled investment management service that includes a range of services for a single, bundled fee. These services often include:

- Professional Portfolio Management: The core feature of it is the professional management of the client's investment portfolio. The portfolio manager or advisor selects and manages a diversified portfolio of investments on behalf of the investor. This can include stocks, bonds, mutual funds, ETFs (Exchange-traded funds), and other asset classes based on the investor's financial goals and risk tolerance.

- Personalized Investment Strategy: The portfolio management is tailored to the specific needs and objectives of the investor. This customization ensures that the investment strategy aligns with the client's financial goals, risk tolerance, and time horizon.

- Account Administration: It often provides administrative services, such as account maintenance, record-keeping, and reporting. This simplifies the administrative aspects of managing investments for the client.

- Trading and Rebalancing: The portfolio manager handles all the trading and rebalancing of the portfolio as needed to maintain the desired asset allocation and risk level.

- Performance Reporting: Investors typically receive regular performance reports detailing their investments' performance and the fees associated with the wrap account.

- Consolidated Fee Structure: Instead of paying separate fees for each service (e.g., advisory fees, trading commissions), investors pay a single, bundled fee that covers all of the services provided within the wrap account. This fee structure aims to provide transparency and simplify fee calculations.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Investment In Wrap Account

Here's a step-by-step explanation of how investment in a wrap account works:

- Selecting a Provider: Choose a financial institution or investment advisor offering wrap account services. Researching and selecting a provider that aligns with financial goals, risk tolerance, and investment preferences is essential.

- Opening the Wrap Account: Once a provider has been chosen, open a wrap account. This process usually involves completing paperwork, providing information about the financial situation and investment goals, and agreeing to the terms and conditions of the account.

- Initial Investment: Fund the wrap account by depositing an initial lump sum. This is the capital that the financial institution will use to invest.

- Defining Investment Objectives: Work with the provider to establish investment objectives and risk tolerance.

- Portfolio Allocation: Based on defined objectives, the financial institution's portfolio managers will create an investment strategy tailored to the needs.

- Professional Management: The portfolio managers within the financial institution's team will actively manage your investments according to the agreed-upon strategy.

- Fee Structure: Pay a fee for the services provided within the wrap account. This fee typically covers professional management, administrative expenses, and access to the underlying investment products.

- Regular Reporting: The provider will provide regular reports detailing the wrap account's performance. These reports typically include information on returns, fees, and asset allocation.

- Communication: One can expect ongoing communication with the provider throughout the investment journey. This can include discussions about changes in the financial situation, updates on the portfolio's performance, and adjustments to investment strategy if goals or risk tolerance change.

Examples

Let us understand it better with the help of examples:

Example #1

Suppose there is an investor named Henry. He has $100,000 that he wants to invest, but he needs more time and expertise to manage investments actively. He opens a wrap account with an imaginary financial institution called "WealthGuard Advisors."

In this wrap account scenario:

- He will open a wrap account with WealthGuard Advisors.

- He will discuss our financial goals with the team, which include long-term wealth growth and moderate risk tolerance.

- WealthGuard Advisors creates a customized investment strategy for him, allocating funds across a mix of stocks, bonds, and mutual funds.

- The portfolio managers at WealthGuard actively manage investments, making adjustments as needed to maintain the desired asset allocation.

- He will pay an annual fee of 1% of your assets under management to WealthGuard Advisors, which covers all the management and administrative costs.

- Every quarter, one receives performance reports from WealthGuard Advisors detailing the performance of their wrap account.

Example #2

Suppose John Smith opens a WealthGuard WealthBuilder Wrap Account with an initial investment of $250,000 for his retirement planning. WealthGuard Investment Services designs a customized investment strategy tailored to John's moderate risk tolerance and 20-year time horizon. The portfolio combines mutual funds, ETFs, and fixed-income securities, emphasizing dividend-paying stocks.

WealthGuard's team of portfolio managers actively manages and rebalances the portfolio to maintain the desired asset allocation. John pays an annual fee of 1.25% of assets under management, covering all costs, deducted quarterly. He receives comprehensive performance reports, ensuring transparency on fees and portfolio performance. This wrap account offers professional management, aligning with John's retirement goals while simplifying investment costs.

Pros And Cons

Here's a summary of the pros and cons of a wrap account:

| Pros of a Wrap Account | Cons of a Wrap Account |

|---|---|

| Professional Management: Portfolio managers provide expertise and actively manage your investments. | Fees: Wrap accounts typically have higher fees compared to DIY investing. The bundled fee may include management, administrative, and underlying fund expenses. |

| Diversification: Investments are diversified across asset classes, reducing single-stock risk. | Limited Control: Investors have limited control over individual investment decisions, as professionals make them on their behalf. |

| Customization: Investment strategies can be tailored to your financial goals and risk tolerance. | Potential Conflicts of Interest: Some providers may have incentives to select certain investment products due to fee structures or partnerships. |

| Simplified Administration: Administrative tasks, including record-keeping and reporting, are handled by the provider. | Minimum Investment: Some wrap accounts require a substantial minimum investment, making them inaccessible to smaller investors. |

| Transparency: Performance and fee reports are typically provided, enhancing transparency. | Potential for Underperformance: Not all portfolio managers deliver market-beating returns, and your investments may underperform market benchmarks. |

| Accessibility: Access to professional management is available to a wide range of investors. | Tax Efficiency: Wrap accounts may not offer the same tax benefits as managing your investments directly, as tax strategies may not be tailored to your specific situation. |

Wrap Account vs Full-Service Brokerage Account

Here's a comparison of a Wrap Account and a Full-Service Brokerage Account:

| Aspect | Wrap Account | Full-Service Brokerage Account |

|---|---|---|

| Definition | A professionally managed investment account with a bundled fee for various services, including portfolio management and administration. | An account with a brokerage firm that offers a wide range of investment services, including buying and selling securities, research, and advice. |

| Portfolio Management | Professionally managed with portfolio managers making investment decisions on behalf of the investor. | It may offer advisory services and investment recommendations but often leaves trading decisions to the client. |

| Investment Options | Typically includes a selection of mutual funds, ETFs, and managed portfolios. | Provides access to a broad range of investment products, including stocks, bonds, mutual funds, ETFs, options, and more. |

| Customization | Strategies are customized based on the investor's financial goals and risk tolerance. | Can be tailored to the investor's preferences, but the investor often has more control over individual investment choices. |

| Fees | Charges a bundled fee, often a percentage of assets under management, which covers management, administration, and underlying fund expenses. | May charge commissions for trades, advisory fees, and other fees, which can vary depending on services used. |

| Control | Investors have limited control over individual investment decisions, as portfolio managers make them on their behalf. | Investors have more control over buying and selling decisions and can choose their own investments. |

Wrap Account vs Non-Wrap Account

Here's a comparison of Wrap Accounts and Non-Wrap Accounts (standard investment accounts):

| Aspect | Wrap Account | Non-Wrap Account (Standard Investment Account) |

|---|---|---|

| Definition | Bundled investment management service with a single fee, including portfolio management and administration. | Standard investment account where investors manage investments themselves or hire separate advisors. |

| Portfolio Management | Professionally managed by portfolio managers or advisors. | Investors manage their investments directly, possibly with the assistance of separate advisors. |

| Investment Options | Includes a selection of mutual funds, and managed portfolios. | Offers a wide range of investment products such as stocks, bonds, mutual funds, ETFs, and more. |

| Customization | Strategies tailored to the investor's financial goals and risk tolerance. | Investors have complete control over individual investment choices and portfolio customization. |

| Fees | Single bundled fee, usually a percentage of assets under management (AUM). Covers all services and expenses. | Separate fees for trading (commissions), advisory services (if used), and administrative costs. |

| Control | Limited control over investment decisions, made by portfolio managers or advisors. | Full control over investment choices, including buying and selling decisions. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Choosing the right provider involves researching and evaluating factors such as the provider's track record, reputation, fees, investment strategies, and alignment with your financial goals. It's essential to select a provider that suits your needs and risk tolerance.

Yes, these are subject to regulatory oversight. Financial institutions offering wrap account services must comply with securities regulations and disclose fees, services, and potential conflicts of interest to investors.

Yes, you can have multiple wrap accounts with different providers if it aligns with your investment strategy and goals. However, it's important to carefully manage and monitor all your investments to ensure they align with your overall financial plan.

Recommended Articles

This article has been a guide to what is Wrap Account. We explain its pros, comparison with non-wrap & full-service brokerage accounts, investment, and examples. You may also find some useful articles here -