Table Of Contents

What Is The Working Ratio?

The working ratio represents the company's financial sustainability by measuring the capacity of a company to recover operating expenses using its annual gross revenue. The operating expenses include expenses such as depreciation and exclude any finance expenses such as interest on debts.

The lower the ratio, the higher the level of financial sustainability since it would mean that fewer revenues are being used to meet the expenses. However, the ideal working ratio is one. A company that cannot cover the operating expenses it incurs on its business activities can’t survive for long.

Table of contents

- What is the Working Ratio?

- The working ratio evaluates a company's financial sustainability by gauging its ability to cover operating expenses with annual gross revenue. It includes operating expenses like depreciation but excludes finance expenses such as interest on debts.

- A lower working ratio signifies higher financial sustainability, as it indicates that less revenue is used to cover expenses, leaving more funds available for other purposes.

- The working ratio directly compares a company's expenses to its revenue. A ratio of less than one indicates expenses are covered, while greater than one suggests they are not fully covered. An exact ratio of one implies a balance between expenses and revenue.

Formula

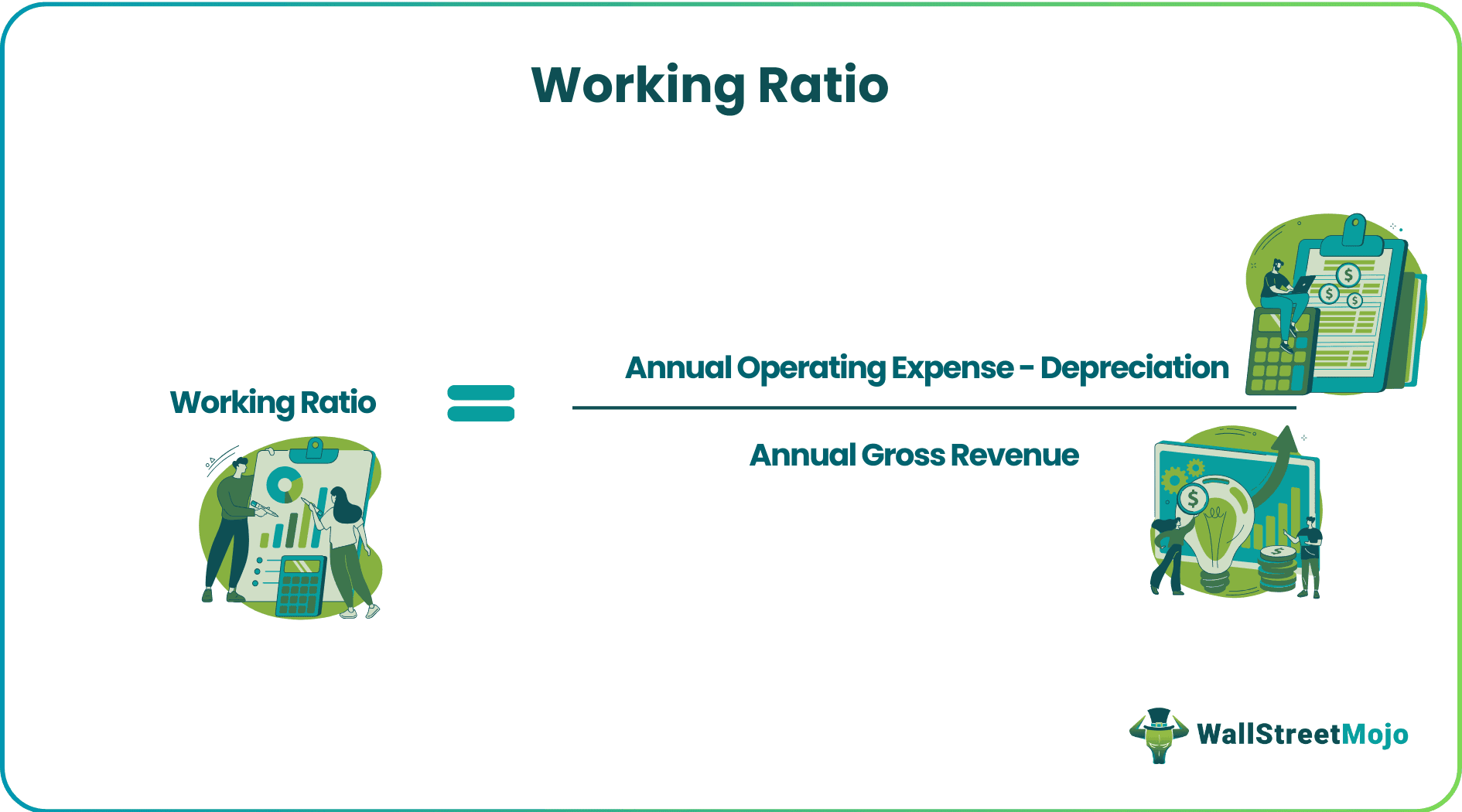

To calculate the working ratio, annual operating expenses are divided by annual gross revenue. However, depreciation is to be excluded from the annual operating expenses.

Examples of Working Ratio

Let us understand its calculation with the help of the following example:

Now, let us calculate the working ratio using the above data.

Here the working ratio is 0.40, which is favorable for the company since it can recover its annual operating expenses from the annual gross revenue. The company is financially sustainable as less portion of revenues is going towards recovering expenses.

Importance

The working ratio is important for assessing the financial sustainability of the company. It reflects what extent the company’s revenue can cover its operating expenses. A ratio below one indicates that the company can recover its operating expenses through its gross revenue. On the contrary, a ratio above one indicates that the company cannot meet its operating expenses through its gross revenues. A ratio equivalent to one shows an equilibrium position.

Companies need to have a ratio either equal to or less than one. This would mean that they can recover their annual operating expenses from the income generated through gross revenues.

Advantages

It is an important financial ratio and is helpful for analysis due to the following reasons:

- It helps the finance managers determine the company's financial sustainability by comparing the annual operating expenses against the gross annual revenue.

- Based on this ratio, the management can take action to manage its cash flow.

- The management can also decide what steps are to be taken to reduce unnecessary expenses and increase the company's sales.

Disadvantages

There are many limitations. Some of them are listed below for your reference:

- The ratio uses gross revenue in the denominator instead of net revenue. The ratio doesn’t consider important factors relating to revenue, such as sales returns and any allowances.

- There is no consideration of changes expected to occur in operating expenses in the coming years, as no effect of inflation is taken into account.

- Financing expenses are excluded from the calculation of the working ratio though they have to be borne by the company and affect its sustainability.

- The ratio suggests the company’s ability to meet its operating expenses from the gross revenue. However, it doesn’t consider that all expenses and revenues might not affect cash flows.

Conclusion

The working ratio helps determine the company's ability to meet its annual operating expenses from its annual gross revenue. It determines the financial sustainability of the company. However, this ratio alone doesn’t give us fruitful results. Other financial ratios shall also be considered for reaching a meaningful conclusion; otherwise, the conclusion arrived might not be accurate.

Frequently Asked Questions (FAQs)

The current ratio compares a company's current assets (such as cash, inventory, and accounts receivable) to its current liabilities (short-term debts due within a year). It measures the company's ability to meet short-term obligations. Whereas the working ratio, also known as the operating ratio, compares a company's operating expenses to its net sales.

The best working ratio varies by industry and business model. Generally, a lower working ratio is considered better because it indicates higher operational efficiency. A lower working ratio means that a company is spending a smaller portion of its revenue on operating expenses, which may lead to higher profits.

The working ratio finds applications in financial analysis and decision-making. It is particularly useful for comparing the operational efficiency of companies within the same industry. Investors and management use the working ratio to identify trends, cost inefficiencies, and potential areas for improvement in a company's operations. A declining working ratio over time may signal improved operational efficiency and cost control.

Recommended Articles

This has been a guide to what is Working Ratio and its definition. Here we discuss its calculations along with formulas, examples, advantages, and disadvantages. You may learn more about financing from the following articles –