Table Of Contents

What Is Withholding Allowance?

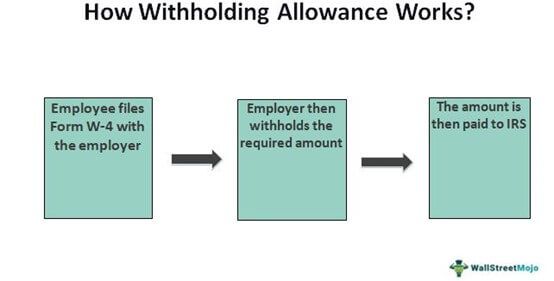

Withholding allowance refers to a certain amount of money withheld from the employee's paycheck by the employer. The employer then pays the amount to the IRS (Internal Revenue Service) on behalf of the employee. Therefore, the more allowances one claims, the less tax one must pay.

Employees have to fill out the IRS Form W-4 for the same. Employers shall pay the determined amount correctly. If the amount exceeds the value, the employee becomes eligible for a refund. If it is underpaid, it is subjected to a surprise tax. Employees must typically submit the form once a year.

Key Takeaways

- Withholding allowances are the amount deducted by employers from an employee's paycheck to pay the IRS (Internal Revenue Service).

- If employees do not pay their taxes through withholding, they may be required to pay an estimated tax.

- There are a few exceptions to this, which are subjected to IRS regulations.

- Employees must complete Form W-4 when starting a new job, annually, or whenever there are changes.

- The amount of income earned and the information provided on Form W-4 calculate withholding allowances. The withholding allowances show the employee's claims for a reduction in the amount withheld.

Withholding Allowance Explained

Withholding allowances decide the amount of payable income tax exempted from an employee's paycheck. In other words, employees may have to pay an estimated tax if they don't pay their taxes through withholding or don't pay enough tax that way. Most self-employed people also pay their taxes similarly. Employees shall fill in Form W-4 while entering a new job, yearly, or when there are changes. The adjustment of the withholding rates depends majorly on the following changes:

#1 - Tax law changes

When the government notifies new rates of taxes or exemptions, employees shall file the form according to the new rates.

#2 - Alterations in lifestyle

Changes in one's life, such as marrying or divorcing a partner, or adding responsibilities, such as having children, can affect taxes. Likewise, retirements affect a person's income. Events such as buying a house may also allow lowering taxes if employees can claim a write-off for mortgage interest.

#3 - Employment changes

Entering new jobs or having additional side gigs for extra income alters the individual's income as well. As a result, there will be an increase in the withholding for the primary job to cover the resulting difference. Therefore, when the individual or the individual's spouse becomes unemployed, the individual should notify unemployment status to avoid unnecessary payments.

#4 - Tax deductions and credit shifts

Individuals shall clearly state the eligible deductions and credit shifts applicable to withhold the right amount. For example, they need to state the income adjustments if there are any individual retirement account (IRA) deductions, student loan interest deductions, and alimony expenses. In addition, tax credits include medical expenses, interest expenses, taxes, gifts donated to charity, dependent care expenses, education expenses, child tax credits, and earned income credits.

Taxable income, such as income from interest, dividends, capital gains, IRA (individual retirement account distributions), etc., are not subjected to withholding. Also, employees withholding allowance rates shall differ in different states if the business transactions occur within their territories. Apparently, it shall have a substantial difference from the federal withholding allowance.

Calculating Withholding Allowance

According to the internal revenue service, to calculate employees withholding allowance, individuals shall take the following into account:

- Regular wages, commissions, and vacation compensations.

- Payments under a non-accountable plan for other expense allowances and reimbursements.

- Pensions, bonuses, commissions, winnings from gambling, and other sources of income.

Employees withholding allowance calculation is dependent on:

- The total amount of income earned

- Information provided on Form W-4, Employee's Withholding Allowance Certificate, regarding the following:

- Status of filing: If the individual withholds at the single rate or a lower married rate.

- The number of withholding allowances claimed: The amount withheld decreases with each allowance claimed by the individual.

- Whether the individual withholds an additional amount: Individuals can request extra money withheld from each paycheck.

On Form W-4, employees must choose a filing status and several withholding allowances to complete filing. For this purpose, employees can utilize the withholding allowance calculator from the website of IRS to arrive at correct figures to avoid penalties.

Exemption

An employee shall claim an exemption from withholding for the year 2022 if they meet all of the conditions given below:

- They incurred no federal income tax liability in the previous financial year, 2021, and they do not anticipate paying any in the current year, 2022.

- They incurred no federal income tax liability in 2021 if:

(1) Their total tax on line 24 of their Form 1040 or 1040-SR in 2021 was zero (or less than the sum of lines- 27a, 28, 29, and 30), and

(2) They did not had to file a return since their earnings fell below the filing threshold.

The employee can claim an employee withholding allowance exemption if the word "exempt" is present on the form. It shall be written after ensuring that the employees meet the aforementioned conditions. Exemptions do not get carried over, and therefore the employee shall revise the status and update it by filing a new form the next year. If they claim an exemption, they have no income tax withheld from their salary and shall owe taxes and penalties on filing their tax returns in 2022.