Table Of Contents

Winner's Curse Meaning

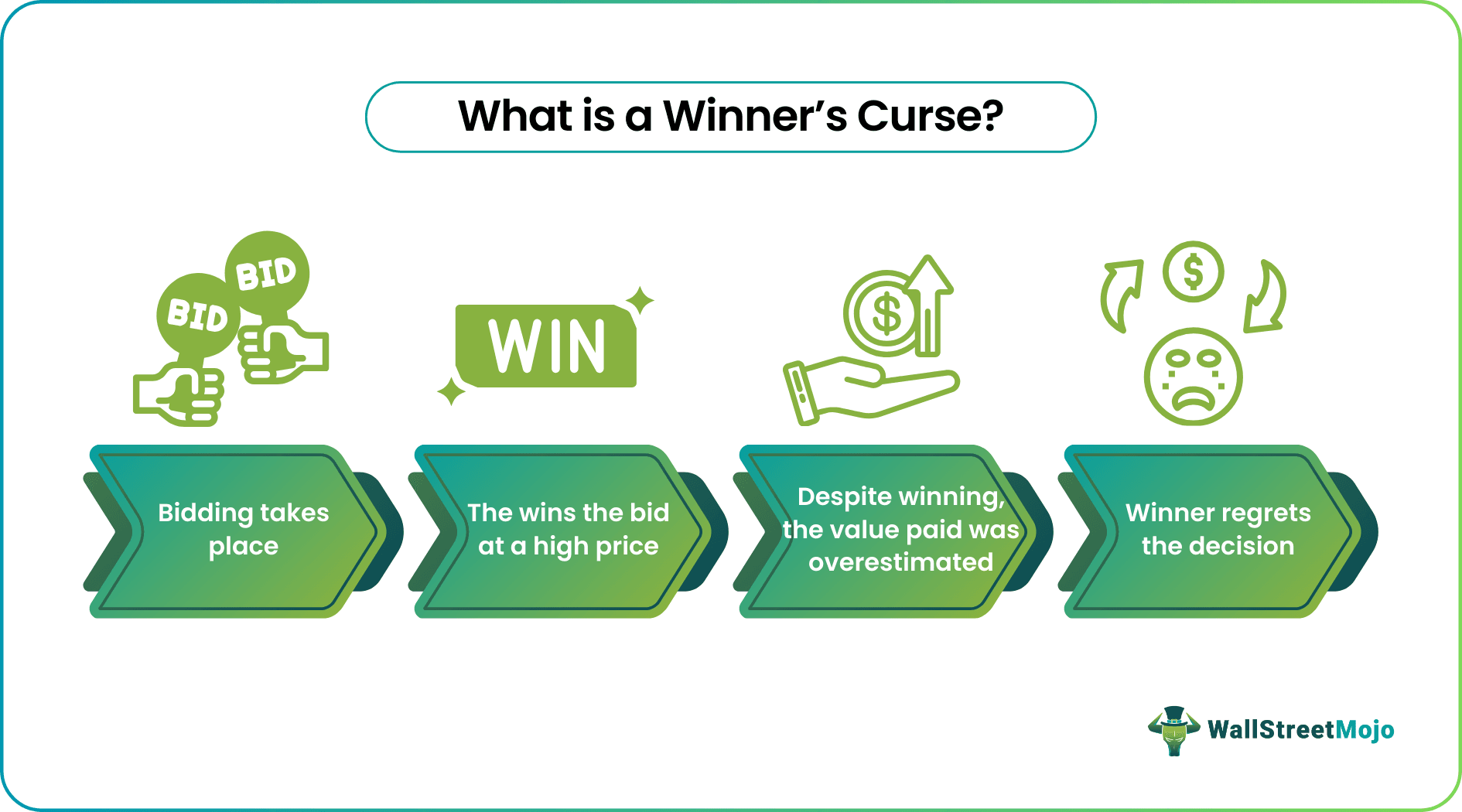

The 'winner's curse' is a situation where the winning bid often exceeds the value of the object, such as in auctions. The bidder who wins is seen to overestimate the items' worth as they go above and beyond what a rational person would want to bid. The purpose of understanding the winner's curse is to avoid overvaluing a stock during an IPO and mitigate potential losses.

Auctions can be quite stressful and exhausting. It can be challenging to decide on an item's value during an auction logically, and people frequently succumb to the winner's curse. Thus the individual who wins the auction by placing the highest bid may later regret doing so.

Table of contents

- Winner's curse meaning

- The winner's curse happens when the winning bidder estimates a higher value than the asset's value. The curse is the higher cost the winner has to pay, which means the win is not a win but a loss.

- It is generally seen in auctions but could also happen in business decisions. An acquisition overvaluation results in lower gains, higher debt loads, and a decline in the company's stock prices.

- Incomplete information and overestimating the item's value are the major factors contributing to the curse. They are interlinked and result in the suggestion of higher prices, eventually leading to a loss.

Winner's Curse Explained

The winner's curse happens when the winning bidder estimates a higher value than the asset's value. The curse is the higher cost the winner has to pay, which means the win is not a win but a loss. It is fundamentally a problem of information asymmetry, as the buyer is unaware of the true value of the purchase. This is because valuing objects or decisions is complicated and subjective.

Moreover, the information available to bidders may vary, and different bidders have different interpretations of the same information. The issue is further aggravated in competitive bidding circumstances when there are multiple possible purchasers and a limited time to make decisions.

It is often referred to in the situation of auction. Typically, when participating in an auction, one places their offer based solely on the price they are prepared to pay for the item. Factors such as how much other bidders are willing to pay for the same thing or the item's actual value are not considered. The values are independent, so the bidders only know their values for the item, not the values the other bidders' place. Due to this, it might be challenging for the bidder to estimate the item's genuine value, and they frequently end up paying far too much for it.

People frequently base their choices on inaccurate information they have, conflicting interpretations of that information, and, occasionally, their feelings and emotions. However, it is not restricted to auctions. Overpayment can happen outside of auctions; it could especially happen in business decisions. Overvaluing an acquisition has resulted in lower gains, higher debt loads, and a decline in the company's stock price.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Check out these examples to gain a better idea:

Example #1

Matt participated in an online auction of a mystic box. Such boxes do not reveal their contents; they mostly contain lost items, luggage, or returned items from online shopping. The interesting part is that they may contain valuable electronics, antique items, or, worse, sketch pens. The starting bid here was $50. There was fierce competition, and Matt ended the bid at $1000, hoping they contained valuable items.

However, when he received the box, it had items worth about $800. He had to pay more than the box contained. The win here lost its meaning due to overestimation. Had he known the products (if they were electronics- or clothing-related, and the size of the boxes), he could have made a better decision with the information.

Example #2

Three petroleum engineers for Atlantic Richfield were paying attention to the annual returns on investments for oil businesses. Edward Capen, Robert Clapp, and William Campbell studied the low profits from the Outer Continental Shelf oil lease auctions.

The profits were very low in 1971, and they began to review the records of several oil companies. They particularly took note of the oddly low returns being made by corporations bidding on oil in the Gulf of Mexico, which at the time had a lot of oil and gas. Typically these companies should have been able to purchase oil at a reasonable price and resell it for a healthy profit due to the region's abundance of oil and gas.

When oil is auctioned off, bidders must compete to outbid one another, even though the value of oil should be the same for all buyers. Unfortunately, the mechanism used to set up an auction ensures that the winner must be willing to spend more than everyone else. As a result, the winner is destined to offer more than the oil's intrinsic value. This was how the winner's curse theory came into existence.

How To Avoid?

The winner's curse and the nature of auctions must be properly understood by decision-makers (i.e., bidders), given how common they are in business today. One of the fundamental measures a bidder can do to avoid the curse is to bid less aggressively. Winning may not always be good, so caution must be maintained.

Similarly, developing an optimal bid is essential. This involves having an idea about the focus, item, or project that is kept for bidding. Based on that idea or the prospects, an optimal price can be determined beyond which the bidder has to quit the auction. This price should be kept at a level where a profit can be realized for the invested amount. The predicted profit reaches its maximum as a function of the hedging percentage at the optimal balance between risk and reward.

Another way is to be in the zone of the "rational thinker" and not get carried away by competition or emotions. This correlates with the first point of not being aggressive with the motive of winning. Another factor to focus on is examining the asset to see if it contains a common value element. A commodity, idea, or project with common value will be equally valuable to all bidders. In such cases, the bid has to be done carefully.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The winner's curse in negotiations can be due to two reasons. One is when the profit is dependent on the other side's acceptance. This is undesirable for the bidder and advantageous for the seller. The second is when the bidder needs more information. Uncertainty increases, and expected returns decline.

The winner's curse will be when the purchase value is higher than the expected takeover gains. The magnitude of the curse increases with the divergence of acquirer opinions on takeover gain sizes, the intensity of competition for control of the target company, and the winning bidder's pre-acquisition profitability.

The winner’s curse theory in businesses is the same as in an auction: bidders generally pay far larger acquisition premiums. Bidders who pay higher premiums have inferior returns immediately after merger announcements and over the long term.

Recommended Articles

This has been a guide to Winner's Curse and its meaning. Here, we explain the theory in detail, including its examples, and how to avoid the same. You can learn more about accounting from the following articles –