Table Of Contents

What Is Windfall Tax?

A windfall tax is a charge levied by federal governing bodies on business entities when they make abnormal gains from financial windfalls. The idea behind such taxes is to reallocate favorably abnormal profits in one sector for social causes.

Taxes like lottery tax or tax on winnings from game shows and horse racing, gambling or betting are examples of windfall taxes. They are financial gains that are unexpected and crosses a particular limit. It helps the government take away some part of the extra profit earned by entities and use it for the infrastructural and othe development of the community or state.

Key Takeaways

- A windfall tax is a levy federal regulatory authorities impose on corporate companies when they experience disproportionate financial gains.

- These taxes aim to redistribute excessive earnings from specific sectors for social reasons, promoting fairness and equity.

- Examples of windfall taxes include taxes on lottery winnings, taxes on winnings from game shows, and taxes on wagers placed on horses or other sporting events.

- The additional revenue generated from a windfall tax can be used to repay national debts owed to international financial organizations and support the domestic economy.

How Does Windfall Tax Work?

Windfall tax is a form of tax that is imposed by governments on business entities or individuals who get some sudden gain from some sources like property, lottery, stock market, sudden rise in commodity prices, etc. Those who oppose such taxes reduce the business interest to reap profits. They also are of the view that business entities should reinvest such profits to encourage scientific and business development, which in some way will empower the social status of the country and its regions.

As an instance, the government as of mid-2018 was mulling over the idea to levy an energy windfall tax on Oil and natural gas producing companies to bring down the prices of fuel and petrol. Under this scheme, fuel-producing companies are paid international rates for the fuel they produce domestically and will have to be part of the earnings.

These windfall tax rate will always remain an arguable or debatable issue between the equity shareholders of well-performing companies and people from the other sections of the society. The concern of such taxation got attention when oil and gas companies, namely Exxon Mobil that reported a profit of $36 Billion for the fiscal year encountered super profits due to surging fuel prices.

Windfall taxes also relate to individual and non-corporate entities who suddenly see a surge in their income levels by receiving a large corpus of wealth from gifts, inheritance, the game of chance, gambling, or lottery winnings. In many cases, inheritance, gifts from friends or relatives are tax exempt in the hands of the recipient. However, central or regional taxes may be levied on the giver of such inheritance. Income from winnings from lottery and gambling is charged to tax either in the hands of the recipient or the giver of such income. These winnings must be reported in the income tax returns filed with the federal tax authorities.

Types

This type of tax can be in various forms as given below:

- Financial gain- Sometimes the corporations or individuals can benefit from some kind of windfall gain such as a sudden boom in the stock market of any merger or acquisition from which the entity had a huge financial gain. In such cases the entity or individual will have to pay the tax.

- Natural resource – Many companies gain from natural resources such as oil or minerals. This happens when suddenly the commodity prices rise. But such profits should be energy windfall tax.

- Property gain – The governments of some countries levy tax on gain from rise in property values.

Example

A perfect example of this kind of tax is the tax that was levied on the oil companies of the United Sates in the 1980s. there was a sudden rise in oil prices due to the crisis of oil in 1979, leading to windfall gain for the companies in the sector later on.

The companies had to pay extra tax on the profits that they earned from the sale of crude oil. If the gain were above a certain limit, the tax would be 70% of the gain amount. From 1980 to 1988, it continued as a good revenue source for the government.

Critics were against this system, which according to them, discouraged the reinvestment of the amount in the business which would have lead to further growth and expansion of the oil industry.

Purpose

There are various purposes for which the tax is levied. They are mentioned below:

- Windfall taxes are levied with the objective of tax companies to bring down the general price levels of goods and services so that it benefits the end consumer.

- Keeping in view of all tax schemes proposed and implemented by the government, there lies a rift between those that are for and against the tax schemes. The merit of a windfall tax rate is that the governments can use the taxed funds to maintain the state of the economy and fight several glaring social causes.

- Windfall taxes provide a good source of revenue to the government as it follows the principle that those who have earned a surplus through windfalls to be taxed and also discouraging businesses of the lottery, gambling, horse racing, etc.

However, The policy of the government may backfire as it may lower the investment by private sector companies as it may hit their after-tax profits (PAT), which in turn would affect their bottom line and jeopardize their survival in the market.

Advantages

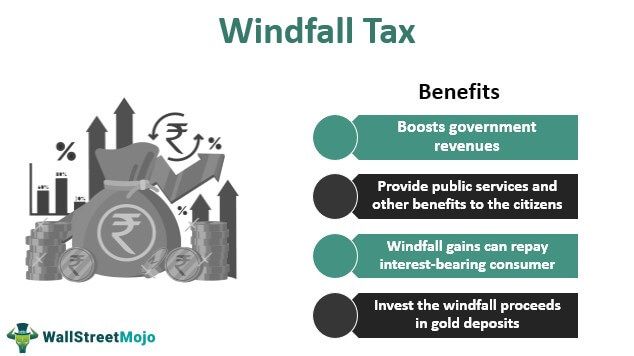

- The most certain benefit of windfall tax economics is that it boosts government revenues. It enables them to substantially provide public services and other benefits to the citizens of the country like building civil infrastructure, health facilities, sanitation, and also building the nation’s military strength.

- The additional funds raised through windfall tax payment can service the debts by the countries to various global financial institutions and may bolster the national economy. However, it may also act as a disincentive to companies.

- If companies become aware that windfall gains will be taxed, they may not seek out such profits with innovative business plans. A part of these receipts has to be parked in a personal contingency fund in bank fixed deposits.

- The beneficiary of windfall tax payment can repay interest-bearing consumer or car loans, in which case the asset depreciates to lower than the loan outstanding. The other part of windfall gains can be used to repay housing loans to bring down interest costs and EMI’s.

- The other viable option can be to invest the windfall proceeds in gold deposits. One part of the corpus can be given to a charitable organization of repute who is catering to the cause of education or health or child welfare. The donations made to charitable causes can be used to claim deductions from 50% to 100% from the income liable to tax.

Disadvantages

- The economic impact of windfall taxation should lead to its immediate rejection. Firstly, such an arbitrary taxation system would increase the risks of investing. As a result, investors will demand a higher return on their investments, or they may choose to stop investing altogether.

- These taxes may reduce the dividend payout to investors investing in oil-producing companies. These companies are not owned by cash-rich investors but by pension funds and insurance companies. Finally, it would reduce the funds available for investment in sources of fuel, thereby spiking the energy costs. The windfall tax economics may affect people; it was created to help and reduce long term tax income.