Table Of Contents

What Is Willingness To Pay (WTP)?

Willingness to pay (WTP) is the maximum price a customer is ready to pay for a particular good or service. It can be denoted by a set figure of value or a price range. The willingness to pay is affected by factors like demographics, customer behavior, the nation's economy, etc.

It is a common and critical metric used in pricing research studies for any company offering a product or service. Understanding the willingness to pay makes it easier for businesses to set their products and services at optimum prices to attract customers while maximizing their profits.

Table of contents

- Willingness To Pay Explained

- Formula and Calculations

- Examples

- Factors

- Willingness To Pay vs Willingness To Accept

- Frequently Asked Questions (FAQs)

- Recommended Articles

- Willing to pay is a metric that determines the maximum price that a customer is ready to pay for a product or service.

- Companies set the price of their products based on the metric to ensure maximum profit and sales.

- It is never common for any two products and fluctuates, generally in a price bracket depending on various factors that directly or indirectly affect it.

- The willingness to pay and willingness to accept are two inversely proportional metrics used in price determination.

Willingness To Pay Explained

The willingness to pay theory is an economic concept that describes the maximum price a customer is ready to pay for a product or service. In any business transaction, a company wants to attain maximum profit to set a higher price, while a customer wants to pay the minimum price for a product. Between both aspects lies an optimal pricing strategy based on the maximum money buyers are ready to pay for goods or services.

Enterprises tend to seek the correct WTP figure to ensure that customers pay the price parallel to the business's profit. It is an in-depth concept and is used in internal pricing studies to understand the baseline of customers' motivation to buy something. There is no particular willingness to pay graphs, but the area under the demand curve represents it.

A consumer's willingness to pay directly measures the threshold or limit beyond which a customer will not purchase. Any price below it is in favor of the consumer though it does not make a sale benefit for the business. Therefore, for any business to survive and grow, it is important to understand the market dynamics and changing trends and adjust their product prices accordingly.

Formula and Calculations

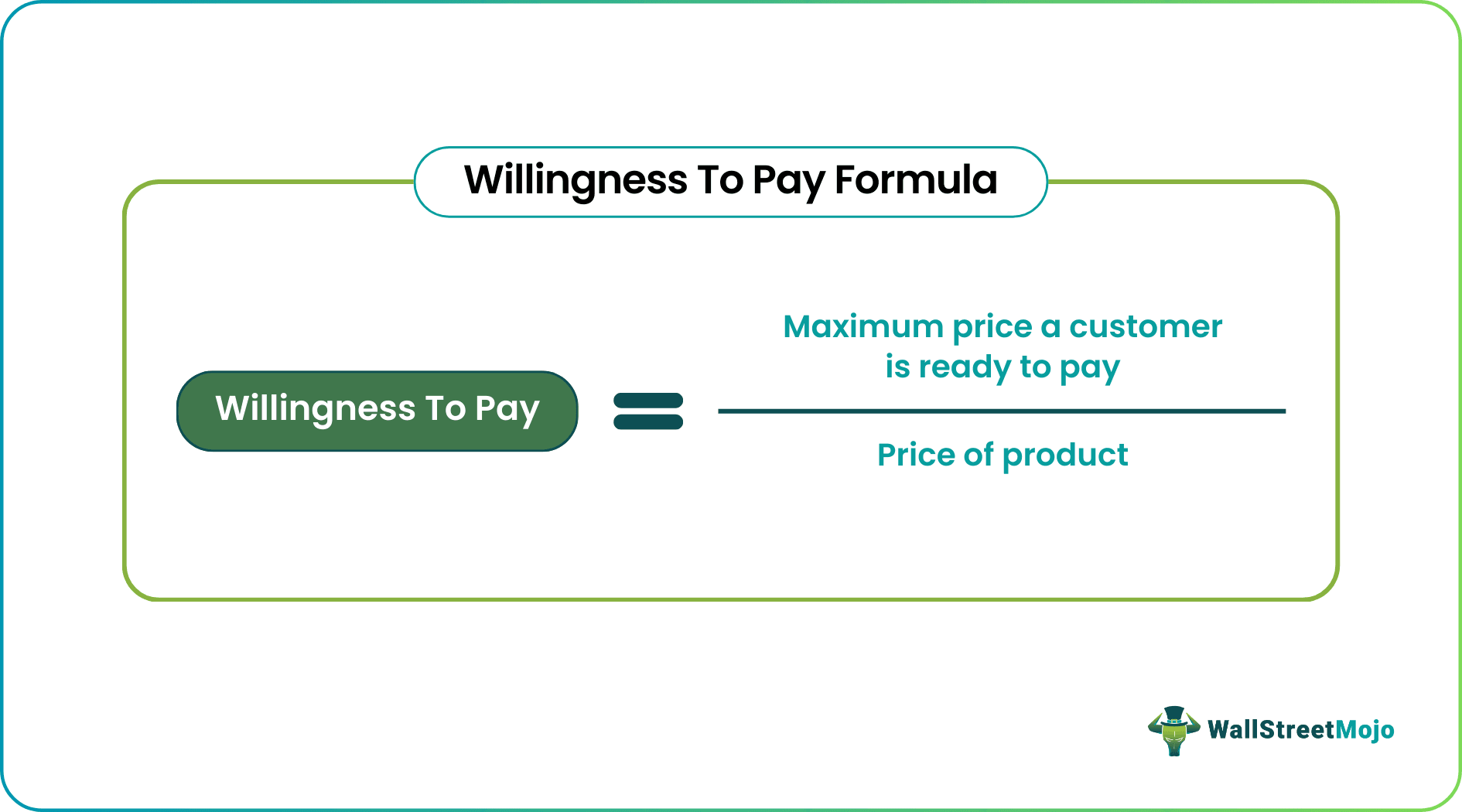

The formula to calculate willingness to pay is given by:

There are several methods to calculate willingness to pay –

#1 - Market Research

The basic method to derive the WTP of customers or people is to understand the market and its prevailing conditions. Often, the market follows a trend, and it is important to consider it.

#2 - Customer Behavioral Study

When people shift their choice and buying behavior, it is readily visible and observed by the sales figure. However, sometimes the WTP factor must include qualitative factors that attract customers to spend on a product. Therefore, many economists define willingness to pay as a behavioral science to understand how a customer's mindset works to maximize profit and attract more customers.

#3 - Competitor's Analysis

One of the key ways to determine the WTP metric is to study the competitors and the structure of their product pricing. Most businesses have competitors, and knowing how they plan their future strategies and learn from their past implementations is important. If a customer has a high WTP for a similar product, it explains how businesses can adjust their prices to compete in the market.

#4 - Surveys

From time to time, many companies conduct willingness-to-pay surveys to adjust their product prices based on the views and changing trends and consumer buying behaviors. These surveys are filled with simple yes or no questions and one-line queries that help businesses understand, filter, and tend to their target market and potential customers.

Examples

Check out these examples to get a better idea:

Example #1

Suppose Frank has always been a smart businessman. He has a textile factory where he manufactures shirts and jeans. But it is a local brand, and people need to learn about it, or his business will keep losing. So to understand the willingness to pay metric of customers, he conducts a market survey and finds out that people are highly willing to pay for branded clothes and apparel. Furthermore, he observes that most customers are interested in buying branded labels and are ready to pay a higher price.

Frank starts marketing his brand and ensures that most local and mid-level celebrities and known personalities advertise his shirts and jeans. With time, the popularity of Frank's brand grows, and now the sales are coming in positive figures. Understanding the concept of WTP, Frank purposefully keeps a higher price for his brand clothes but deliberately less than his competitors.

This one strategy helps Frank garner massive sales and profit. In addition, it is a clear example explaining how the metric can help businesses make important pricing decisions.

Example #2

An investment report related to the shipping industry suggests that despite many economic challenges, businesses are willing to pay approximately an +80% premium for zero-carbon shipping as of 2022. Parallel to this, the urgency to acknowledge and respond to climate issues has also grown.

The report has a long-term vision and shows that more investment is needed. A WTP premium of 3% is still needed to fund decarbonization by 2050 and would need a 10% to 15% premium. This report signifies the importance of consumer demand and behavior in industries like shipping.

Factors

The willingness to pay is based on different factors such as

#1 - Income

The very first and critical factor is the customer's income. Typically there is a budget that every family household follows, and they do not buy anything that their budgets don't allow them. On the contrary, the more income increases, the more a customer's ability to pay increases, and vice versa.

#2 - Product Quality

A high-quality product that has no match for its competitors will always be set at a higher price, and customers will most certainly like to pay it because of the true value and long-term sustainability a product offers to them.

#3 - Urgency

An urgent requirement is an essential factor as, at times, a customer with an abrupt requirement will have a maximum willingness to pay for it because of the urgency. Of course, it is subjective, as though a rational customer may think twice before purchasing. Still, it plays a pivotal role in a particular scenario when no other option is available.

#4 - Substitute

Suppose a substitute for a high-priced product is at a comparatively low price, or alternatives are available. In that case, a customer will choose it as it supports other factors like income, budget, and rational buying behavior. In contrast, if there is no substitute and the product has a monopoly.

#5 - Demand

A high-demand product that is in trend will certainly attract customers with a higher willingness to pay for it. However, with time if the good's demand declines, so will its price, and in that scenario, the bargaining power of a customer will increase.

Willingness To Pay vs Willingness To Accept

Here are the key differences between the two:

- Willingness to pay is the maximum price a customer is ready to pay. In contrast, willingness to accept (WTA) is the metric that represents the minimum price companies are willing to take.

- Willingness to pay is the perspective of buyers. On the other hand, willingness to accept is the seller's perspective.

- While WTP represents what a buyer can afford, WTA is the price the seller can afford and still make a profit.

Frequently Asked Questions (FAQs)

The WTP generally increases in circumstances where -

- The product is rare

- The nation's economy is booming

- Goods offered are of high quality

- Products are in trend

- Solves a big problem

When a product gets an upgrade, and the customers are willing to pay a certain extra amount over the WTA for the added feature or update, it is called the marginal willingness to pay. Simply put, the extra price a customer is ready to pay for a feature is the MWTP of a good or service. The customer may refuse to pay anything for a feature.

According to the World Health Organization, it represents the estimation of healthcare customer willingness to pay for a health benefit. It differs from nation to country as per capita GDP determines it. For example, though it was introduced in 1982, in the US, the WTP threshold of $50 000 to $100 000 is still used as a reference point by public and private policymakers, researchers, and insurers.

Recommended Articles

This article has been a guide to what is Willingness To Pay. We explain it with how to calculate it, its examples, and comparison with the willingness to accept. You may also find some useful articles here -