Table Of Contents

Whipsaw Meaning

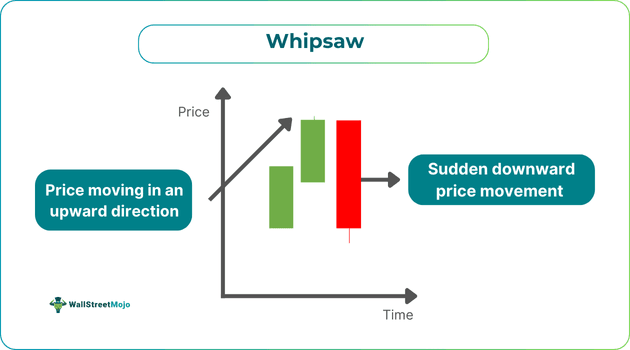

Whipsaw refers to a sudden sharp surge or drop in a financial instrument’s price against the trend prevailing in the market. This unexpected change in the direction of an asset’s price can lead to significant losses. Hence, traders must try and avoid it.

This phenomenon is unlike any other reversal as, in this case, the security’s momentum suddenly changes shortly after traders open a position. There are two types of whipsaw in forex or trading in general —upward and downward. This pattern is quite common in volatile financial markets. Different factors, like unanticipated geographical events or economic news, can trigger it.

Key Takeaways

- Whipsaw meaning refers to a pattern that arises in an asset’s price chart when the price moves quickly in a certain direction but declines suddenly. If individuals cannot avoid this phenomenon when trading, they may suffer serious financial losses.

- When trading, individuals can avoid making losses resulting from this pattern by taking different measures, like placing a trailing stop loss order, using multiple timeframes, and staying updated with the latest news and events that may impact the asset.

- A whipsaw in trading can be upward or downward and may be caused by economic events, major news, etc.

Whipsaw In Trading Explained

Whipsaw meaning refers to a phenomenon in volatile markets where an asset’s price moves in a particular direction but suddenly pivots, moving in the opposite direction. Since this sudden change in price movement can result in losses for traders, they must take precautions to limit the potential losses.

As noted above, there are two kinds of whipsaw price action. Let us look at them.

- Downward: In the case of a downward whipsaw in trading, a security’s price starts decreasing and may even fall a support level, indicating it is a great time to short sell. However, just when a trader enters a short position, the price jumps in the opposite direction.

- Upward: In this case, the price of an asset starts surging, maybe even giving the impression that it may breach a resistance level. However, just when a trader enters a position, the price drops sharply.

Besides causing financial losses, this phenomenon may impact traders in many ways. For example, it may cause emotional stress and increase the chances of overtrading as traders may try to recover the losses. This can lead to more losses. Moreover, this phenomenon can lead to a rise in transaction costs as traders may frequently place buy and sell orders.

How To Identify?

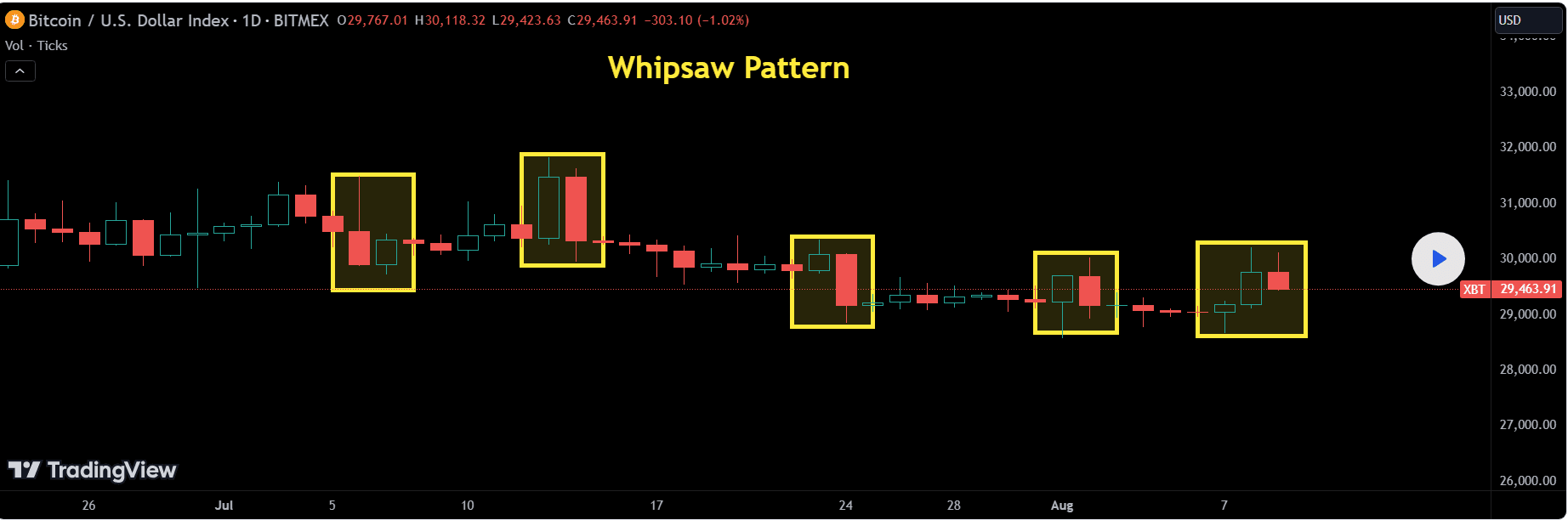

Identifying this pattern once it forms in a price chart is straightforward. Let us look at this TradingView chart as an example to understand how one can easily identify it.

Source: TradingView

In the above Bitcoin/U.S. Dollar chart, one can observe several whipsaws. For example, one can find that the price went up on July 13, 2023. However, in the following trading session, i.e., on July 14, 2023, the price moved in the opposite direction, leading to the pattern’s formation.

One must note predicting this pattern’s formation is quite difficult for traders. However, there are some signs that can indicate that a whipsaw might materialize. Let us look at them.

- High Volatility: If significant price fluctuations are taking place in a market, it is a sign that the phenomenon might occur.

- News And Major Events: Any noteworthy news or events can cause unanticipated price reversals.

- Crucial Price Levels: This phenomenon often materializes close to significant price levels, for example, the support and resistance levels.

Individuals can also utilize some popular technical analysis indicators to predict that this pattern might appear in an asset’s price chart. Examples of such technical indicators include Bollinger bonds, moving averages, moving average convergence divergence or MACD, etc.

Examples

Let us look at a few whipsaw examples to understand the concept better.

Example #1

Suppose Tom is a novice trader who is looking to make financial gains by trading stocks. He saw that Stock A’s price was rising quickly. He viewed it as a great opportunity and placed a buy order, purchasing 20 shares. However, within a few minutes, the price started moving in the opposite direction, and bullish momentum increased significantly, leading to a whipsaw.

The pattern formed because news came out that the company misrepresented its previous year’s financial statements. By the time he knew about it and offloaded his holdings, all his gains were wiped out, and he even suffered significant losses.

Example #2

On July 1, 2021, Chewy Inc. shares initially surged as high as 10% before a whipsaw appeared, wiping out the gains. The reason behind the sudden downward movement resulted from the news about Keith Gill’s disclosure that he holds a passive stake of 6.6% in the company that engages in retailing pet food and products online. Per a Securities and Exchange Commission filing, he bought roughly 9 million shares in Chewy. The stock closed 6.6% lower that day.

How To Avoid?

Let us look at some strategies traders can utilize to steer clear of this phenomenon and prevent financial losses.

- Place A Trailing Stop Loss Order: This kind of order adjusts to the volatility in the market, helping traders secure gains and restrict losses.

- Avoid chasing the market: One must steer clear of jumping into a trade just because the price increases or decreases quickly.

- Use Multiple Timeframes: Traders must utilize different timeframes when making buy or sell decisions. This is because a financial instrument that seems to be bullish on a 1-minute chart might be bearish on a daily chart.

- Utilize Options Strategies: Advanced traders can utilize options trading strategies, for example, straddle or strangle to make financial gains irrespective of the direction of price movement.

Lastly, individuals must remain updated regarding significant news or events that may result in significant price movements.