Table Of Contents

What is Financial Modeling?

Financial modeling is the process of estimating a project or business's financial performance by considering all relevant factors, growth, and risk assumptions clearly understand the impact. It enables the user to clearly understand all the variables involved in financial forecasting. It is also important to remember that the results’ accuracy heavily relies on the assumptions and inputs.

Financial modeling and analysis play a crucial role in decision-making for businesses and investors. It provides a structured framework to forecast financial performance, assess investment opportunities, and evaluate risk. Scenario analysis aids in making informed choices, optimizing resource allocation, and maximizing profitability, contributing significantly to informed financial planning and strategic decision-making in various industries.

Key Takeaways

- Financial modeling refers to a process that involves projecting a company’s future financial outcomes based on certain assumptions and historical performance.

- It aids in effective resource allocation and provides clarity concerning capital raising. Moreover, this process helps spot growth opportunities.

- Some of the prerequisites for conducting financial modeling in Excel include knowledge of accounting, Excel skills, presentation skills, and financial forecasting skills.

- Some of the crucial aspects that require one’s focus when carrying out this process include quality, presentation, accuracy, and planning.

Financial Modeling Explained

Financial Modeling is either building a model from scratch or maintaining the existing Model by implementing newly available data to it. As you can notice, all the above financial situations are of a complex and volatile nature. It helps the user to gain an in-depth understanding of all the components of the complex scenario.

In Investment Banking, it is used to forecast the potential future financial performance of a company by making relevant assumptions of how the firm or a specific project is expected to perform in the forthcoming years, for instance, how much cash flow a project is likely to produce within five years from its initiation.

It is easily possible to work on different individual parts of the Model without affecting the whole structure and avoiding huge blunders. It is useful when the inputs are volatile and are subject to change with newly available data. Therefore, there is a certain flexibility one can have with the structure when working on Financial Modeling as long as they are accurate.

Though financial modelling and analysis sounds complicated, it can be learned by steady practice and the appropriate know-how.

It can be done for various situations, e.g. valuation of a company, valuation of an asset, pricing strategies, restructuring situations (merger & acquisition), etc.

As we explore this topic, it’s interesting to note how a deeper understanding can enhance practical skills. For those looking to expand their expertise, consider checking out this Financial Modeling and Valuation Course Bundle that delve into this further.

Who Builds Them?

Let us understand who is bestowed the responsibility of building these models through traditional means or through financial modelling softwares through the explanation below.

- Investment Bankers

- Equity Research Analysts

- Credit Analysts

- Risk Analysts

- Data Analysts

- Portfolio Managers

- Investors

- Management/Entrepreneurs

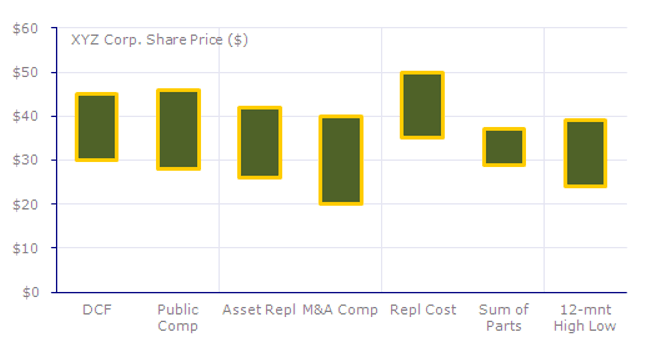

Majorly modeling is used for determining reasonable forecasts, prices for markets/products, asset or enterprise valuation Discounted Cash Flow Analysis, Relative Valuation), the share price of companies, synergies, effects of merger/acquisition on the companies, LBO, corporate finance models, option pricing, etc.

Prerequisites

Building these models using a Financial model software will only be fruitful when it is giving out results that are accurate and dependable. To achieve efficiency in preparing a model, one should have a required set of necessary skills. Let’s see what those skills are:

#1 - Understanding of Accounting Concepts

Building it is a pure financial document that uses financial numbers from a company or market. There are specific accounting rules and concepts that are constant in the financial industry worldwide, e.g., US GAAP, IFRS (International Financial Reporting Standards), etc. These rules help in maintaining the consistency of the presentation of financial facts and events. Understanding these rules and concepts are of extreme importance to maintain accuracy and quality while preparing to build a model in excel.

Our primary focus in Accounting is also to identify and predict the accounting malpractices by companies. These are typically hidden away. You can see the confessions in Satyam Fraud Case

#2 - Excel Skills

The primary financial Modeling in excel where is where a model is prepared is an application like MS Excel. It involves a wide range of complex calculations spread over multiple tabs interlinked to show their relationships with each other. Having an in-depth working knowledge of excel like formulas, keyboard shortcuts, presentation varieties, VBA Macros, etc. are a must while preparing a model. Keeping knowledge of these skills gives the analyst an edge in his working skills over others.

#3 - Interlinking of Financial Model Statements

A 3 statement financial modeling needs to be interlinked together. The interlinking allows vital numbers in the Model to flow from one statement to the other, thus completing the inter-relationship between them and showing us the complete picture of the financial situation of the company. Example of interlinking: 1) Net change in cash (from Cash Flow Statement) must be linked to Cash in Balance Sheet. 2) Net Income from Income statement should be linked to Retained Earnings in Statement of Stock Holder’s Equity.

#4 - Forecast

The skill of forecasting financial Modeling is important because usually, the purpose of it is to arrive at an understanding of the future scenario of any financial situation. Forecasting is both an art and a science. Using reasonable assumptions while predicting the numbers will give an analyst a close enough idea of how attractive the investment or company will be in the coming period. Good forecasting skills increase the dependability of a model.

#5 - Presentation

Financial Modeling is full of minute details, numbers, and complex formulas. Different groups use it like operational managers, management, and clients. These people will not decipher any meaning from the Model if the Model is looking messy and hard to understand. Hence, keeping the Model simple in presentation and at the same time rich in detail is of great importance.

How Do You Build a Financial Model?

Financial Modeling and analysis are easy, as well as complicated. If you look at the Model, you will find it involved; however, it has smaller and simple modules. The key here is to prepare smaller modules and interconnect each other to train the final financial model.

You can refer to this step-by-step guide on Financial Modeling in Excel for detailed learning.

You can see below various Schedules / Modules –

Please note the following –

- The core modules are the Income Statement, Balance Sheet, and Cash Flows.

- The additional modules are the depreciation schedule, working capital schedule, intangibles schedule, shareholder’s equity schedule, other long-term items schedule, debt schedule, etc.

- The different schedules are linked to the core statements upon their completion.

Full-Scale Modeling is a lengthy and complicated process and hence disastrous to go wrong. It is advisable to follow a planned path while working on a financial model to maintain accuracy and avoid getting confused and lost. Following are the logical steps to follow:

- A quick review of Company Financial Statements: A short review of the company financial statements (10K, 10Q, Annual reports, etc.) will give the analyst an overview of the company, as in, the industry of the company, segments, history of the company, revenue drivers, capital structure, etc. This helps plan the layout of financial Modeling by setting a guide path, which can be referred to from time to time as we progress.

- Historical Numbers: Once a fair idea is generated about the company and the types of financial models to be prepared, it is advisable to start with inputting Historical data. Past Financial Statements of the company can be found on the company website. Usually, the past three years data is added to the historical side, called actual numbers. Color code the cells so that historical and formulas can be quickly identified separately.

- Ratios and Growth rates: Once the historical numbers are added, the analyst can calculate the required Financial ratios (Gross Profit Ratio, Net Profit Ratio, etc.) and growth rates (YoY, QoQ, etc.). These ratios help in identifying a trend for high level strategizing and also forecasting.

- Forecasting: The next step after historical and ratios is implementing projections and forecasting. It is usually done for 3 to 5 years. Line items like Revenue are generally projected on Growth rates. Whereas cost items like COGS, R&D, Selling General & Admin exp. Etc. are projected on the base of revenue margin (% of sales). The analyst should be careful while making the assumptions and should consider the trends of the market.

- Interlinking of Statements: For the Model to reflect the flow from one statement to another, they must be linked together dynamically and accurately. If done correctly, the Model should balance out all the words, thus giving it a finalized outlook.

If learners wish to enhance their understanding of financial modeling in Excel, they can choose the Financial Modeling 2-Day Bootcamp. The expert-led financial modeling course includes case studies and real-world examples that can help individuals learn how to build a financial model from scratch.

Benefits Of Financial Modeling

Let us look at the advantages of carrying out financial modeling:

- Building a financial model can help spot growth opportunities. Moreover, it can help managers make improved financial decisions.

- It can help spot risks in the market, which, in turn, allows business leaders to make improved investment decisions.

- This process assists in building budgets, evaluating projects every year, and allocating more funds to those areas that have the potential to generate higher returns on investment.

- A financial model provides a clear picture of a company’s financial scenario, which allows it to raise funds from investors or banks.

- Additionally, building such a model can help provide key data regarding cash position, future stock dividends, and valuation to shareholders.

Tips For Creating A Seamless Model

While we have discussed the structures, types, and examples of financial modeling softwares, let us have a sneak peek into the ways to build a fool-proof model through the discussion below.

- Planning & Outlining: Before you rush into putting the historical numbers and start with your Model, always plan the whole project outline. Decide a timeline, the extent of the years of historical numbers, projection years, read about the industry and the company. Do an in-depth run of the recent Annual report or the situation at hand. This helps in giving you a steady head start.

- Quality: As you proceed through the complex process of financial modeling, do not forget about maintaining the quality of the same. At the start, it may look like an easy task, but once the Model gets chunky and complicated, it becomes difficult for an analyst to maintain their nerves about it. Be patient and work with confidence. Take breaks if required. There is a saying that “Trash in-Trash out.” It means if you are putting the wrong data, you will get the incorrect results.

- Presentation: The amount of effort you are putting in for financial Modeling will only be fruitful when used and understood by others easily. Color coding, font size, sectioning, names of line items, etc. are all included under the presentation. These may sound very basic, but the combined effects of all these make an enormous difference in the lookout of the Model.

Image Source: Financial Modeling and Valuation Course Bundle

- Assumptions: What we project in financial Modeling is only as good as the assumptions we are basing it on. If the premises are awry and lacking a good base, the projections will be useless considering the inaccuracy. Setting assumptions should have realistic thinking and reasonability in it. It should go with the industry standards and general market scenario. They shouldn’t be too pessimistic or too optimistic.

- Accuracy Checks: As the Model flows longer and longer, with multiple sections and parts, it becomes difficult for the analyst to check on the accuracy of the whole. So, it is essential to add Accuracy Checks wherever necessary and possible. It helps in keeping the modeling process under constant quality checks and avoids huge blunders at the end.

If individuals are finding it difficult to build a financial model from scratch, they may consider downloading financial modeling templates available online to practice and improve their practical understanding.

Examples

Various financial modeling examples are different in type and complexity as the situation demands. They are widely used for valuation, sensitivity analysis, and comparative analysis. There are other uses, like risk prediction, pricing strategy, effects of synergies, etc. Different examples cater to their own set of specialties, requirements, and users.

Following are some of the examples that are widely used in the Finance Industry:

Example #1

- This type of financial Model represents the complete economic scenario of a company and projections. This is the most standard and in-depth form.

- As the name suggests, the Model is a structure of all the three financial statements Income Statement, Balance Sheet, and Cash Flow Statement) of a company interlinked together.

- There are also schedules supporting the data. (Depreciation schedule, debt schedule, working capital calculation schedule, etc.).

- The interconnectivity of this Model sets it apart, which allows the user to tweak the inputs wherever and whenever required, which then immediately reflects the changes in the entire Model.

- This feature helps us to get a thorough understanding of all the components in a model and its effects thereof.

- The actual uses of this Model are forecasting and understanding trends with the given set of inputs.

- Historically the Model can stretch back as long as the conception of the company and forecasts can try up to 2-3 years depending requirement.

Example #2

Through this financial Model, you will learn Alibaba’s 3 statement forecasts, interlinkages, DCF Model – FCFF Formula, and Relative Valuation.

- The most widely used method of valuation in the finance industry is the Discounted Cash Flow analysis method, which uses the concept of Time Value of Money.

- The concept working behind this method says that the value of the company is the net present value (NPV) of the sum of the future cash flows generated by the company discounted back today.

- The discounting factor does the discounting of the projected future cash flows. One rather important mechanic in this method is deriving the ‘discounting factor.’ Even the slightest error in calculating the discounting factor can lead to enormous amounts of change in the results obtained.

- Usually, the Weighted Average Cost of Capital (WACC) of a company is used as the discounting factor to discount the future cash flows.

- DCF helps to identify whether a company’s stock is overvalued or undervalued. This proves to be a rather important decision making factor in case of investment scenarios.

- In simplicity, it helps to determine the attractiveness of an investment opportunity. If the NPV of the sum of future cash flows is more significant than its current value, then the option is profitable, or else it is an unprofitable deal.

- The reliability of a DCF model is vital as it is calculated on the base of Free Cash Flow, thus eliminating all the factors of expenses and only focusing on the freely available cash to the company.

- As DCF involves the projection of future cash flows, it is usually suited for working on financials of big organizations, where the growth rates and financials have a steady trend.

Example #3

- In a leveraged buyout deal, a company acquires other companies by using borrowed money (debt) to meet the acquisition costs. The cash flows from the assets and operations of the acquired company are used to pay off the debt and its charges.

- Hence, LBO is termed as a very hostile/aggressive way of acquisition as the target company is not taken under the sanctioning process of the deal.

- Usually, cash-rich Private Equity firms are seen to be engaged in LBOs. They acquire the company with a combination of Debt & Equity (where a majority is of debt, almost above 75%) and sell off after gaining substantial profit after a few years (3-5 years).

- So the purpose of an LBO model is to determine the amount of profit that can be generated from such a deal.

- As there are multiple ways debt can be raised, each having specific interest payments, these models have higher levels of complexity.

- The following are steps that go into making an LBO model;

- Calculation of purchase price based on forward trading multiple on EBITDA

- Weightage of debt and equity funding for the acquisition

- Building a projected income statement and calculate EBITDA

- Calculation of cumulative FCF during the total tenure of LBO

- Calculating Ending exit values and Returns through IRR.

Example #4

- The M&A model helps to figure out the effect of merger or acquisition on the earnings per share of the newly formed company after the completion of the restructuring and how it compares with the current EPS.

- If the EPS increases altogether, then the transaction is said to be “accretive,” and if the EPS decreases than the current EPS, the transaction is said to be “dilutive.”

- The complexity of the model varies with the type and size of operations of the companies in question.

- Investment Banking, corporate financing companies generally use these models.

- The following are steps that go into making an M&A model;

- Valuing Target & Acquirer as standalone firms

- Valuing Target & Acquirer with synergies

- Working out an Initial offer for the target firm

- Determining combined firms ability to finance transaction

- Adjust cash/debt according to the ability to finance the transaction

- Calculating EPS by combining Net income and figuring out an accretive/dilutive situation.

Example #5

- Valuing of huge conglomerates becomes challenging to value the company as a whole with one single valuation method.

- So, valuation for the different segments is carried out separately by suitable valuation methods for each element.

- Once all the segments are valued separately, the sum of valuations is added together to get the valuation of the conglomerate as a whole.

- Hence, it is called the “Sum-of-the-parts” valuation method.

- Usually, SOTP is suitable in the case of a spin-off, mergers, Equity carve-outs, etc.

Example #6

- Analysts, while working on a comparative valuation analysis of a company looking for other similar companies that are equal in terms of size, operations, and peer group companies.

- By looking at the numbers of its peers, we get a ballpark figure for the valuation of the company.

- It works on the assumption that similar companies will have comparable EV/EBITDA and other valuation multiples.

- It is the most basic form of valuation done by analysts in their firms.

Example #7

The transaction multiples Model is a method where we look at the past Merger & Acquisition (M&A) transactions and value a comparable company using precedents. The steps involved are as follows –

- Step 1 – Identify the Transaction

- Step 2 – Identify the right transaction multiples

- Step 3 – Calculate the Transaction Multiple Valuation

Financial Modeling Best Practices

- Flexibility: It should be flexible in its scope and adaptable in every situation (as contingency is a natural part of any business or industry). The flexibility of a financial model depends on how easy it is to modify the Model whenever and wherever it would be necessary.

- Appropriate: It shouldn’t be cluttered with excessive details. While producing a financial model, you should understand what a financial Model is, i.e., a good representation of reality.

- Structure: The logical integrity is of utter importance. As the author of the Model may change, the system should be rigorous, and integrity should be kept at the forefront.

- Transparent: It should be such and based on such formulas that can be easily understood by other financial modelers and non-modelers.

COLGATE BALANCE SHEET HISTORICAL DATA

Also, note the color standards popularly used in Financial Modeling –

- Blue – Use this color for any constant that is used in the Model.

- Black – Use Black color for any formulas

- Green – Green color is used for any cross-references from different sheets.