Table of Contents

Weighted Average Cost of Capital Meaning

The weighted average cost of capital (WACC) is the average rate of return a company is expected to pay to all its shareholders, including debt holders, equity shareholders, and preferred equity shareholders. WACC Formula = + .

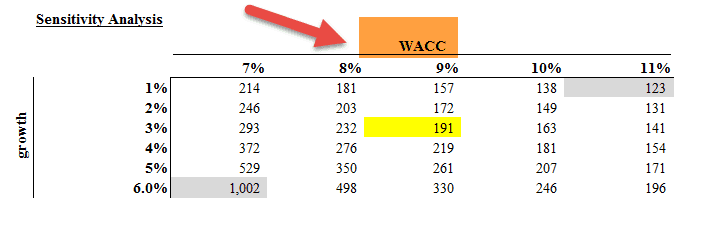

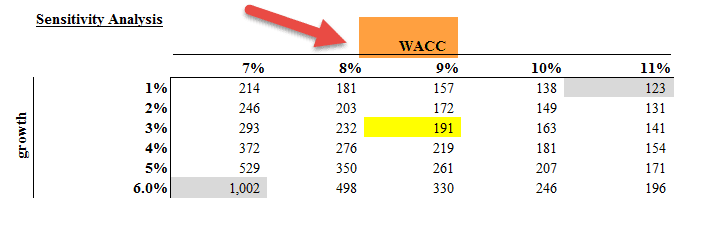

WACC is very useful if we can deal with the above limitations. It is exhaustively used to find the DCF valuation of the company. However, WACC is a bit complex and needs a financial understanding to calculate the Weighted Average Cost of capital accurately. Only depending on WACC to decide whether to invest in a company or not is a wrong idea.

Weighted Average Cost of Capital Explained

WACC is the weighted average of a company’s debt and its equity cost. Weighted Average Cost of Capital equation assumes that capital markets (both debt and equity) in any given industry require returns commensurate with the perceived riskiness of their investments. But does WACC help the investors decide whether to invest in a company or not?

To understand the Weighted Average Cost of Capital, let’s take a simple example.

Suppose you want to start a small business! You go to the bank and ask if you need a loan to start. A bank looks at your business plan and tells you that it will lend you the loan, but there is one thing that you need to do. Bank says that you need to pay 10% interest over and above the principal amount you borrow. You agree, and the bank lends you the loan.

You agreed to pay a fee (interest expense) to avail the loan. This “fee” is the “cost of capital” in simple terms.

As businesses need a lot of money to invest in expanding their products and processes, they need to source money. They source money from their shareholders in the form of Initial Public Offerings (IPO), and they also take a loan from banks or institutions. Companies need to pay the cost to have this large sum of money. We call this the cost of capital. If a firm has more than one source which they take funds from, we need to take a weighted average of the cost of capital.

If individuals want to learn about this concept in further detail, they can choose to enroll in the Valuation Certification Course. In the program, the instructor, who is an ex-investment banker, explains WACC calculation with the help of an example, which can help develop detailed practical knowledge.

WACC Video

Formula

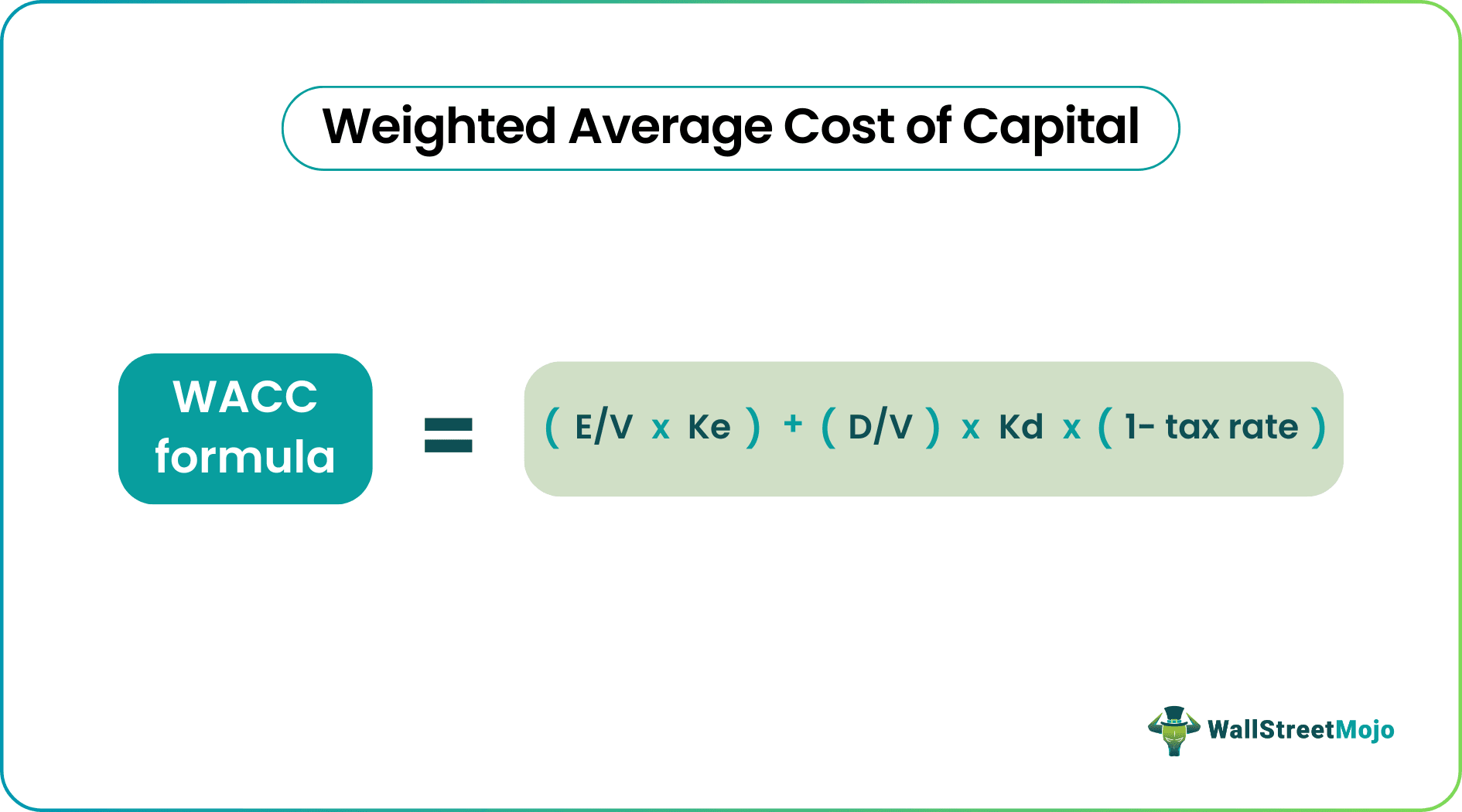

Many investors don’t calculate WACC because it’s a little more complex than the other financial ratios. But if you are one of those who would like to know how weighted average cost of capital (WACC) works, here’s the formula for you.

WACC Formula = (E/V * Ke) + (D/V) * Kd * (1 – Tax rate)

- E = Market Value of Equity

- V = Total market value of equity & debt

- Ke = Cost of Equity

- D = Market Value of Debt

- Kd = Cost of Debt

- Tax Rate = Corporate Tax Rate

The equation may look complex, but it will begin to make sense as we learn each term. Let’s begin.

Market Value of Equity

Let’s start with the E, the market value of equity. How should we calculate it? Here’s how –

- Let’s say Company A has outstanding shares of 10,000, and the market price of each of the shares at this moment is US $10 per share. So, the market value of equity would be = (outstanding shares of the Company A * market price of each share at this moment) = (10,000 * US $10) = US $100,000.

- The market value of equity can also be termed market capitalization. By using the market value of equity or market capitalization, investors can know where to invest their money and where they shouldn’t.

Market Value of Debt

Now, let’s understand the meaning of the market value of debt, D. How to calculate it?

- It’s difficult to calculate the market value of debt because very few firms have their debt in outstanding bonds.

- We can directly take the listed price as the debt’s market value if the bonds are listed.

- Now, let’s go back to the Weighted Average Cost of Capital and look at V, the total market value of equity and debt. It is self-explanatory. We need to add the market value of equity and the estimated market value of debt, and that’s it.

Cost of Equity

- Cost of Equity (Ke) is calculated using the CAPM Model. Here’s the formula for your reference.

- Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-free Rate of Return)

- Here, Beta = Measure of risk calculated as a regression of the company’s stock price.

- The CAPM model was discussed extensively in another article CAPM Beta. Please do have a look at it if you need more information.

Cost of Debt

- We can Calculate the cost of debt using the following formula – Cost of Debt = (Risk-Free Rate + Credit Spread) * (1 – Tax Rate)

- As the cost of debt (Kd) is affected by the tax rate, we consider the After-Tax Cost of Debt.

- Here, credit spread depends on the credit rating. Better credit rating will decrease the credit spread and vice versa.

- Alternatively, you can also take a simplified approach to calculating the Cost of Debt. You can find the cost of Debt as Interest Expense / Total Debt.

- Tax Rate is the Corporate Tax Rate, which is dependent on the Government. Also, note that if preferred stock is given, we also need to take into account the cost of preferred stock.

- If preferred stock is included, here would be the revised WACC formula – WACC = E/V * Ke + D/V * Kd * (1 – Tax Rate) + P/V * Kp. Here, V = E + D + P and Kp = Cost of Preferred Stocks

Examples

As there are so many complexities in WACC calculation, we will take one example each for calculating all the portions of the weighted average cost of capital. Then we will take one final example to ascertain the WACC.

Example #1

Step # 1 – Calculating Market Value of Equity / Market Capitalization

Here are the details of Company A and Company B –

| In US $ | Company A | Company B | ||

| Outstanding Shares | 30000 | 50000 | ||

| Market Price of Shares | 100 | 50 |

In this case, we have been given both the numbers of outstanding shares and the market price of shares. So let’s calculate the market capitalization of Company A and Company B.

| In US $ | Company A | Company B | ||

| Outstanding Shares (A) | 30000 | 50000 | ||

| Market Price of Shares (B) | 100 | 90 | ||

| Market Capitalization (A*B) | 3,000,000 | 4,500,000 |

Now we have the market value of equity or market capitalization of Company A and Company B.

Step # 2 – Finding Market Value of Debt

Let’s say we have a company for which we know the total debt. Total Debt (T) = US $100 million. To find the market value of debt, we need to check if this debt is listed.

If yes, then we can directly pick the latest traded price. So, for example, if the trading value was $84.83 for a face value of $100, then the market value of debt will be $84.83 million.

Step # 3 Calculate Cost of Equity

- Risk Free Rate = 4%

- Risk Premium = 6%

- Beta of the stock is 1.5

Cost of Equity = Rf + (Rm-Rf) x Beta

Cost of Equity = 4% + 6% x 1.5 = 13%

Step # 4 – Calculate the Cost of Debt

Let’s say we have been given the following information –

- Risk free rate = 4%.

- Credit Spread = 2%.

- Tax Rate = 35%.

Let’s calculate the cost of debt.

Cost of Debt = (Risk Free Rate + Credit Spread) * (1 – Tax Rate)

Or, Kd = (0.04 + 0.02) * (1 – 0.35) = 0.039 = 3.9%.

Step # 5 – WACC Calculation

So after calculating everything, let’s take another example of WACC calculation (weighted average cost of capital).

| In US $ | Company A | Company B | ||

| Market Value of Equity (E) | 300000 | 500000 | ||

| Market Value of Debt (D) | 200000 | 100000 | ||

| Cost of Equity (Re) | 4% | 5% | ||

| Cost of Debt (Rd) | 6% | 7% | ||

| Tax Rate (Tax) | 35% | 35% |

We need to calculate WACC for both of these companies.

Let’s look at the WACC formula first –

WACC Formula = E/V * Ke + D/V * Kd * (1 – Tax)

Now, we will put the information for Company A,

weighted average cost of capital formula of Company A = 3/5 * 0.04 + 2/5 * 0.06 * 0.65 = 0.0396 = 3.96%.

WACC formula of Company B = 5/6 * 0.05 + 1/6 * 0.07 * 0.65 = 0.049 = 4.9%.

Now we can say that Company A has a lesser cost of capital (WACC) than Company B. Depending on the return both of these companies make at the end of the period, we would be able to understand whether, as investors, we should invest into these companies or not.

Example #2

Assuming that you are comfortable with the basic WACC examples, let us take a practical example to calculate the WACC of Starbucks. Please note that Starbucks has no preferred shares and hence, the WACC formula to be used is as follows –

WACC Formula = E/V * Ke + D/V * Kd * (1 – Tax Rate)

Step 1 – Find the Market Value of Equity

Market Value of Equity = Number of shares outstanding x current price.

The market value of equity is also market capitalization. Let us look at the total number of shares of Starbucks –

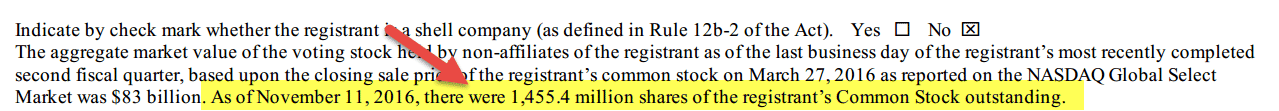

source: Starbucks SEC Filings

- As we can see from above, the total number of outstanding shares is 1455.4 million

- Current Price of Starbucks (as of the close of December 13, 2016) = 59.31

- Market Value of Equity = 1455.4 x 59.31 = $86,319.8 million

Step 2 – Find the Market Value of Debt

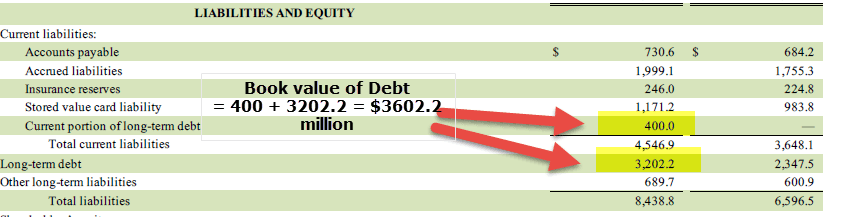

Let us look at the balance sheet of Starbucks below. As of FY2016, the book value of debt is current.

As of FY2016, book value of Debt is the current portion of long-term debt ($400) + Long Term Debt ($3202.2) = $3602.2 million.

source: Starbucks SEC Filings

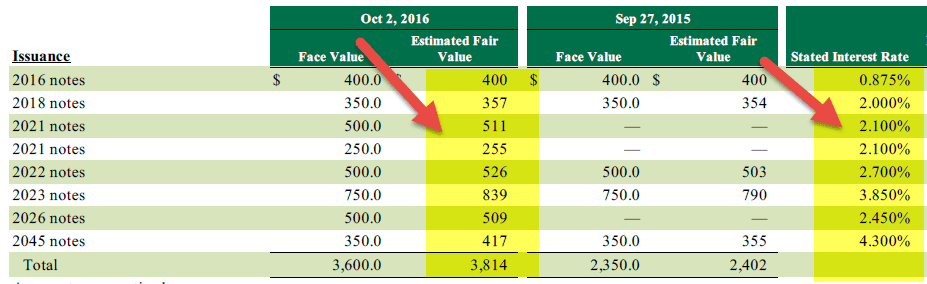

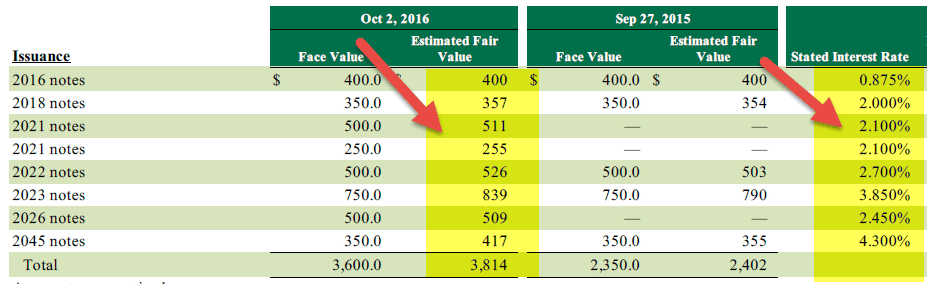

However, when we further read about Starbucks debt, we are additionally provided with the following information –

source: Starbucks SEC Filings

As we note above, Starbucks provides the fair value of the Debt ($3814 million) as well as the book value of debt. Therefore, in this case, it is prudent to take the fair value of debt as a proxy for the market value of debt.

Step 3 – Find the Cost of Equity

As we saw earlier, we use the CAPM model to find the cost of equity.

Ke = Rf + (Rm – Rf) x Beta

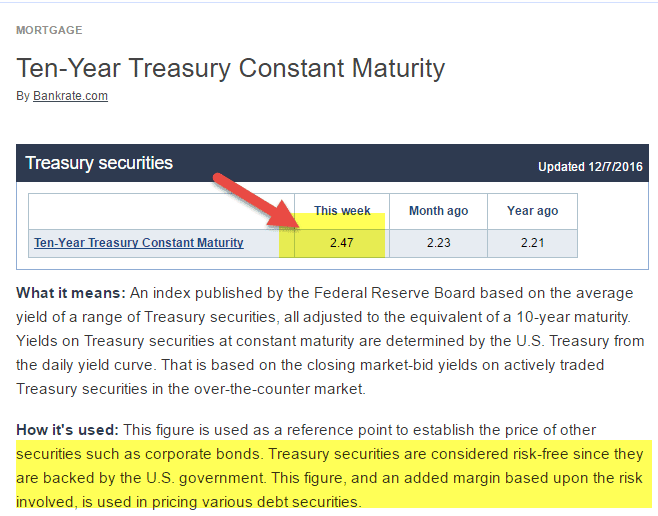

Risk-Free Rate

Here, I have considered a 10-year Treasury Rate as the Risk-free rate. However, some analysts also take a 5-year treasury rate as the risk-free rate. Please check with your research analyst before taking a call on this.

source – bankrate.com

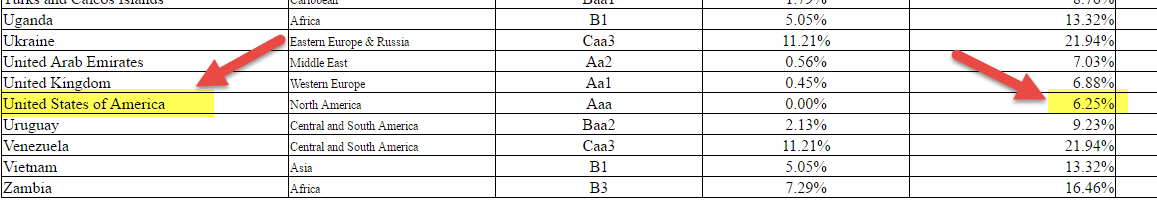

Equity Risk Premium (Rm – Rf)

Each country has a different Equity Risk Premium. Equity Risk Premium primarily denotes the premium expected by the Equity Investor.

For the United States, Equity Risk Premium is 6.25%.

source – stern.nyu.edu

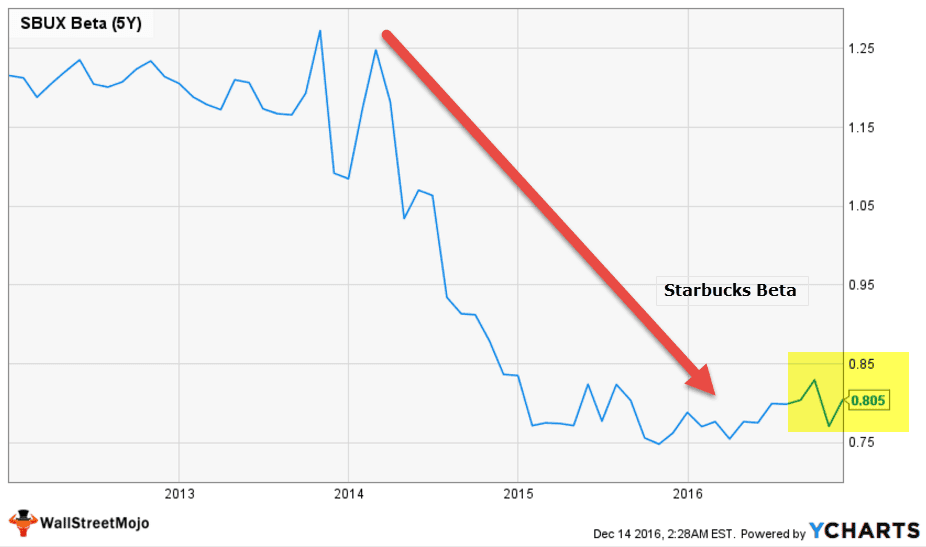

Beta

Let us now look at Starbucks Beta Trends over the past few years. The beta of Starbucks has decreased over the past five years. This means that Starbucks stocks are less volatile as compared to the stock market.

We note that the Beta of Starbucks is at 0.805x

With this, we have all the necessary information to calculate the cost of equity.

Cost of Equity = Ke = Rf + (Rm – Rf) x Beta

Ke = 2.47% + 6.25% x 0.805

Cost of Equity = 7.50%

Step 4 – Find the Cost of Debt

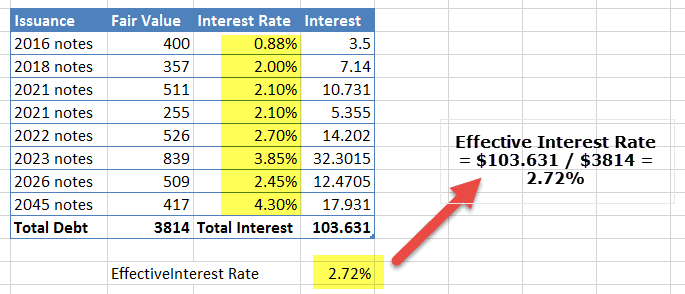

Let us revisit the table we used for the fair value of debt. We are additionally provided with its stated interest rate.

Using the interest rate and fair value, we can find the weighted average interest rate of the total fair value of Debt ($3,814 million)

Effective Interest Rate = $103.631/$3,814 = 2.72%

Step 5 – Find the Tax Rate

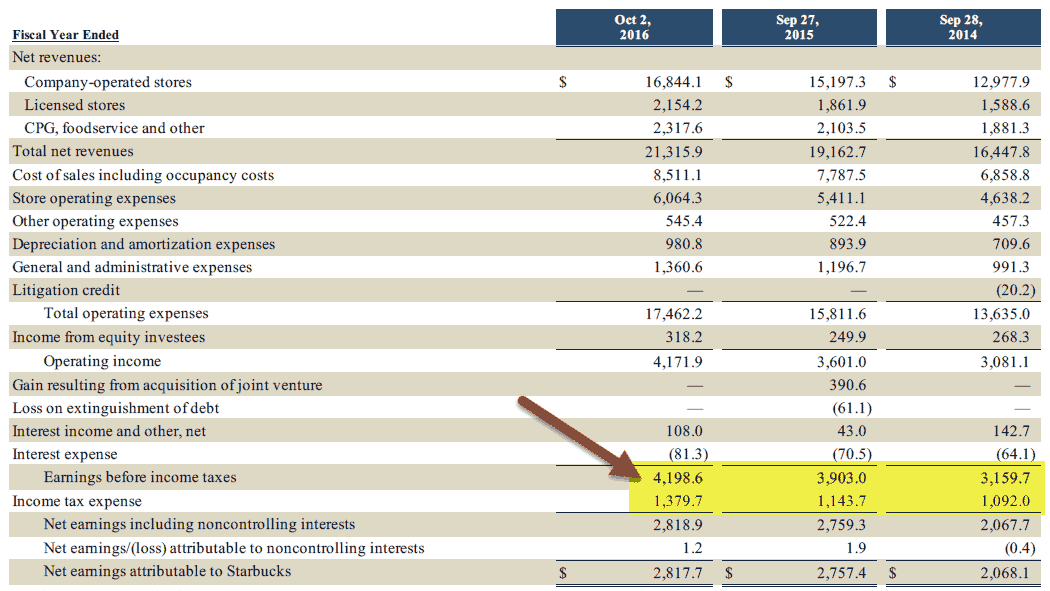

We can easily find the effective tax rate from the Income Statement of Starbucks.

Please see below the snapshot of its income statement.

For FY2016, Effective tax rate = $1,379.7 / $4,198.6 = 32.9%

Step 6 – Calculate the weighted average cost of capital (WACC) of Starbucks

We have collected all the information that is needed to calculate WACC.

- Market Value of Equity = $86,319.8 million

- Market Value of Debt (Fair Value of Debt) = $3814 million

- Cost of Equity = 7.50%

- Cost of Debt = 2.72%

- Tax rate = 32.9%

WACC Formula = E/V * Ke + D/V * Kd * (1 – Tax Rate)

= (86,319.8/90133.8) x 7.50% + (3814/90133.8) x 2.72% x (1-0.329)

= 7.26%

Interpretation

The interpretation depends on the company’s return at the end of the period. If the company’s return is far more than the Weighted Average Cost of Capital Equation, then the company is doing pretty well. But if there is a slight profit or no profit, the investors need to think twice before investing in the company.

Here is another thing you need to consider as an investor. If you want to calculate the Weighted Average Cost of Capital, there are two ways you can use. The first is the book value, and the second is the market value approach.

As you can see that if you consider the calculation using market value, it’s far more complex than any other ratio calculation; you can skip and decide to find the weighted average cost of capital (WACC) on the book value given by the company in their Income statement and in the Balance Sheet. However, book value calculation is not as accurate as the market value calculation. In most cases, market value is considered for the Weighted Average Cost of Capital (WACC) calculation for the company.

Importance

The Weighted Average Cost of Capital calculator holds immense significance in corporate finance and investment decision-making due to its multifaceted role in assessing cost-efficiency, guiding financing choices, and evaluating project feasibility. Let us understand its importance through the points below.

- Cost Measurement: WACC provides a comprehensive measure of the average cost of capital for a company, considering various funding sources like equity and debt.

- Capital Budgeting: It serves as the discount rate in capital budgeting, helping evaluate the viability of potential investments and projects by comparing their expected returns to the company’s cost of capital.

- Financing Decisions: WACC aids in determining the optimal capital structure by analyzing the impact of different debt-equity ratios on overall cost and risk.

- Valuation: WACC is used to discount future cash flows in valuation models, such as discounted cash flow (DCF) analysis, ensuring that the cash flows are adjusted for the company’s cost of capital.

- Investor Expectations: WACC reflects investor expectations regarding the company’s risk and return, influencing investor decisions and perceptions about the company’s value.

- Performance Evaluation: It offers a benchmark for evaluating a company’s performance. If a project’s return exceeds the WACC, it indicates that the project generates value for shareholders.

- Mergers and Acquisitions: WACC is used to assess the feasibility of mergers and acquisitions by evaluating whether the combined entity’s cost of capital would decrease post-transaction.

- Risk Assessment: By factoring in both equity and debt, WACC accounts for the risk associated with the company’s entire capital structure.

Limitations

Despite the advantages and importance mentioned about the weighted average cost of capital calculator, there are a few limitations that are discussed through the points below.

- It assumes that there would be no change in the capital structure, which isn’t possible all over the years, and if there is any need to source more funds.

- It also assumes that there would be no change in the risk profile. As a result of faulty assumption, there is a chance of accepting bad projects and rejecting good projects.