Table Of Contents

What Is Weak Form Efficiency?

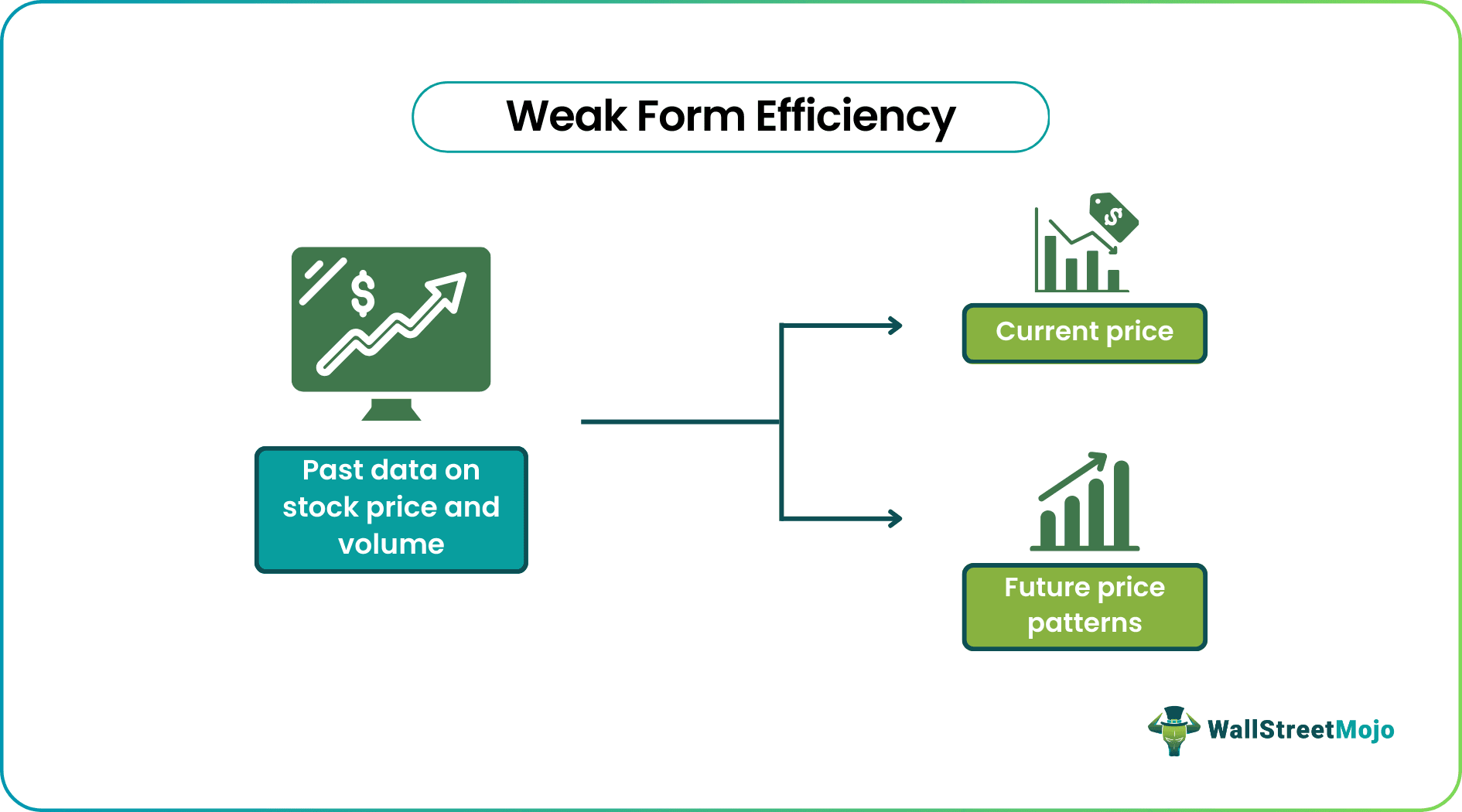

Weak Form Efficiency or random walk theory refers to the theory of Efficient Market Hypothesis (EMH), which states that the current security prices are independent of the historical price movements, earnings, volume, and trends. Therefore, the technical analysis based on past data is irrelevant for such stock price predictions.

Such a model is used to gauge the competency of technical indicators in assuming the future price trend when the security prices fluctuate randomly since such a strategy may not yield extraordinary profits. Thus, the analysts need to determine the actual value of the stocks through the fundamental analysis of the company's financial statements for estimating its future profitability and financial health.

Table of contents

- What Is Weak Form Efficiency?

- Weak form efficiency is an approach under the Efficient Market Hypothesis (EMH) that assumes a stock's current price represents its historical price data and volume and that no further technical analysis can gauge its future price trend.

- Also, the analysts should consider the fundamental analysis of the underlying company's financial reports and statements to book abnormal profits on such stock's performance.

- It differs from the semi-strong form efficiency that conceptualizes the current stock prices as a reflection of all the publicly disclosed information and emphasizes that no fundamental or technical analysis can be used for the prediction of future price movement.

Weak Form Efficiency Explained

Weak form efficiency or the random walk theory is an Efficient Market Hypothesis approach to figuring out the competency of the technical indicators in future stock price predictions. However, it conceptualizes that the current security prices accurately demonstrate the historical price and volume data and cannot be used for establishing potential price patterns.

It, thus, states that the stock price fluctuations in financial markets (especially the daily price movements) are independent of each other, and there can be no correlation established between the same to make room for above-average returns. Moreover, suppose a trader wants to make a high profit on their stock investment. In that case, they should track the financial performance of the underlying company rather than relying on market trends and technical indicators.

The idea of weak form EMH was initially proposed by Burton G. Malkiel, who was an economics professor at Princeton University. He ideated this concept in 1973 in his book A Random Walk Down Wall Street. He explained that investors and traders can reap consistent extraordinary profits from their financial market investments since the current stock price incorporates all the past information and everything remains intact.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

When markets are efficient, the degree of efficiency can only be analyzed through the use of Efficient Market Hypothesis (EMH) approaches. Let us understand how this theory plays a significant role in stock price predictions:

Example #1

Suppose Amy is a stock market trader, and she figures out a stock price movement trend in the XYZ retail grocery chain by establishing a stock chart pattern. She noticed that the XYZ stocks tend to rise sharply in the first week of every month and then decline gradually, being the lowest at the end of the month.

Therefore, he decides to buy these securities on the last day of the month and sell them on the 4th day of the month. However, her strategy failed, and the XYZ stock prices remained stable even on the month's last day. Thus, the market reflects the existence of weak form efficiency where the technical analysis failed to interpret the potential price pattern of the XYZ stocks.

Example #2

Suppose Jane first examines the simple moving average chart of a company's past 6 months' performance to establish a price trend for deciding his trading move. However, he couldn't determine a clear stock price pattern, as the current price predominantly mirrors historical price data. Assuming that the technical indicators will be unsuitable for such a market, Jane then employs the fundamental analysis measures. Thus, he carefully studied the company's quarterly financial statements, and he might identify a significant trend.

In his analysis, he found that the past three quarters exhibited a consistent decline in sales, signaling a challenging period for the business. In contrast, the most recent quarter indicates an upswing in revenue, suggesting a positive shift. He framed his trading strategy based on the anticipated future price movements through fundamental analysis rather than relying on technical analysis.

Weak Form Efficiency vs Semi-Strong Form Efficiency

The weak and semi-strong form efficinecies are the different approaches under the Efficient Market Hypothesis, employed to determine whether there is any way out to make extraordinary profits through efficient markets. Let us now understand their dissimilarities:

| Basis | Weak Form Efficiency | Semi-Strong Form Efficiency |

|---|---|---|

| Definition | Weak form efficiency is the efficient market hypothesis theory, which explains that the current security prices are indicative of the historical price data, and there can be no technical analysis possible for estimating the future price trend. | Semi-strong form efficiency is another Efficient Market Hypothesis theory that assumes that all the publicly available information is technically and fundamentally analyzed to gauge the current stock price and cannot determine the potential price pattern. |

| Belief | It is essential to predict the financial health of the company through fundamental analysis of its financial records and statements to derive abnormal profits from a particular stock. | For maximum returns on such stock investment, it is essential to acquire and analyze the non-public information about the company. |

| Requires | Fundamental analysis of the company's income statement, balance sheet, cash flow statement, and shareholder's equity | Access to undisclosed information |

| Stock’s Current Prices Reflects | Past price data | Overall information available publicly |

| Presence of Anomalies | Markets are efficient, but some degree of anomalies are sustained. | Due to current prices based on publicly disclosed information, there are few chances of anomalies. |

| Existence | Such an EMH form is generally evident in most of the markets | It seems unrealistic in the actual market scenario. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Analysts, traders, and investors often use the random walk model to identify the existence of this theory in a particular financial market. Given below are the two distinct tests in this context:

1. Statistical tests - Parametric and non-parametric tests.

2. Mechanical trading rules.

The markets showcasing this theory are considered to be fair and less volatile where the current prices clearly mirror the past data, I.e., the prices and volume of the stocks historically traded. Thus, the speculators have no window for making exceptional gains except through the fundamental analysis of the underlying company.

In markets characterized by this theory, technical analysis, which relies on historical price and volume data, could be more effective. This theory suggests that current stock prices already fully incorporate all past trading information, rendering attempts to predict future prices using past trends unproductive.

Recommended Articles

This article has been a guide to what is Weak Form Efficiency. Here, we explain the concept along with its examples & differences with semi-strong form efficiency. You may also find some useful articles here -