Table Of Contents

Washington CPA Exam

Washington CPA License duly qualifies you to perform the duties of a CPA in the U.S. capital. Like other jurisdictions, Washington also has a particular set of exam, education, and other requirements for earning a valid CPA license.

Washington State Board of Accountancy (WBA) is authorized to grant the license and regulate the professional practice of the licensed CPAs. Note that the WBA directly issues the CPA license on fulfilling all the prerequisites without conferring a CPA certificate. Hence, it is a one-tier state.

| Particulars | Requirements |

| CPA Exam Requirements | Check your eligibility |

| Submit the documents | |

| Pay up the required fees | |

| Score at least 75 points in each of the four sections | |

| Education Requirements for taking the CPA Exam | 150 semester hours

|

| CPA License Requirements | Obtain a valid Social Security Number (SSN) |

| Complete your education | |

| Pass the Uniform CPA Exam | |

| Gain relevant work experience | |

| Pass the AICPA Ethics Exam | |

| Education Requirements for obtaining the license | 150 semester hours |

| Experience requirement for obtaining the license | 1-year general experience |

The Evergreen State doesn’t have any age, citizenship, or residency requirement. However, it participates in the International CPA Examination Program. Now, let’s discuss the Washington CPA exam and license requirements in detail.

Contents

Washington CPA Exam Requirements

Washington CPA License Requirements

Washington CPA Exam Requirements

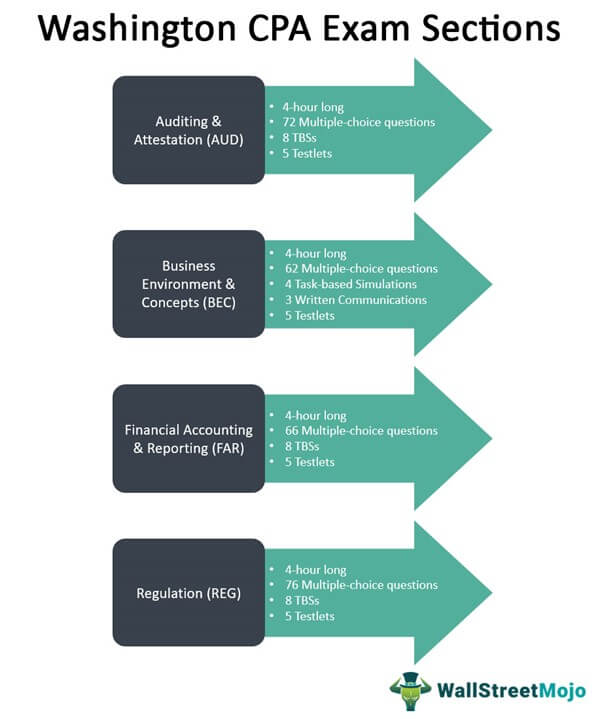

Washington CPA aspirants must pass the 16-hour-long computer-based professional licensure test. It comprises four sections to be taken individually, in any sequence. Each has a passing score of 75 points on a scale of 0-99.

Passing the exam ensures that you possess the required amount of accounting and financial knowledge. Know that you have 18 months to pass all CPA exam sections. This rolling period starts from the testing date of your first passed section.

The American Institute of Certified Public Accountants (AICPA), the state boards, and the National Association of State Boards of Accountancy (NASBA) develop and administer the exam.

Eligibility Requirements

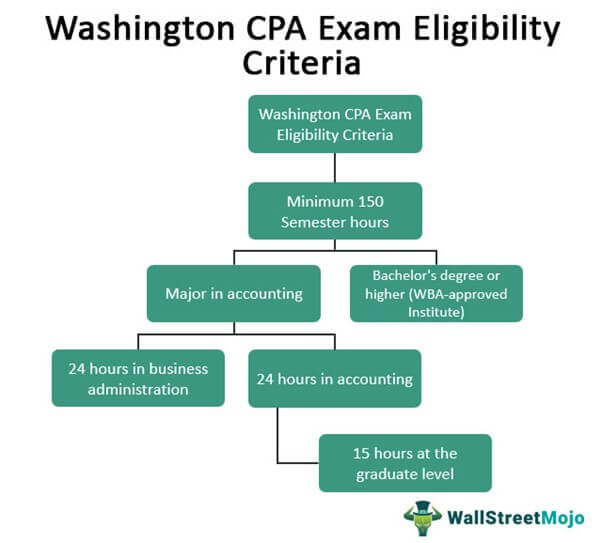

CPA exam applicants must obtain at least 150 semesters (225 quarter) hours accompanied by,

- A baccalaureate degree or higher with a concentration in accounting from a WBA-recognized institution, including

- 24 semester (36 quarter) hours in accounting subjects with at least 15 semesters (22.5 quarter) hours at the upper-division or graduate level

- 24 semester (36 quarter) hours in business administration subjects at the undergraduate or graduate level

Here lies the deadline for documents submission and fulfilling the eligibility criteria:

| Application Status | Details | Deadline |

| Education requirements fulfilled at the time of application | Documents submission | Within 45 days of submitting the exam application |

| Education requirements not fulfilled at the time of application | Degree requirements | Must be met within 180 days after sitting for the first test section |

| Final official transcript submission | Within 210 days of attempting the first test section |

Submit your exam application with the required documents and fees through CPA Examination Services (CPAES). Kindly visit the NASBA website to know the complete process. Moreover, NASBA Advisory Evaluation is available to spot any academic defect in the documents.

Fees

Initial applicants must submit the application and examination fees along with the application form. At the same time, re-examination candidates must pay up the registration and examination fees while registering. Both application and examination fees are non-refundable.

| Particulars | Exam Section Fees | First-time Applicant Fees | Re-examination Candidate Fees |

|---|---|---|---|

| Application fee | - | $170 | - |

| Registration fee | - | - | $90 |

| Examination fees | - | - | - |

| AUD | $238.15 | - | - |

| BEC | $238.15 | - | - |

| FAR | $238.15 | - | - |

| REG | $238.15 | $952.6 | $952.6 |

| Total Fees | - | $1,122.6 | $1,042.6 |

Please note that applicants currently enrolled in college but have previously appeared for the exam won’t be considered re-examination candidates.

Also, you don't have the option to withdraw from the exam or request a Notice-to-Schedule (NTS) extension. Thus, take up the applied exam section(s) within the NTS validity period (6 months).

Required Documents

Submit the below-mentioned documents to CPAES:

| Documents | Submission |

|---|---|

| Official transcript(s) | Applicant’s school |

| International transcripts (in the native language and English) | Applicant’s college/university |

| International Evaluation Report (if applicable) | International Evaluation Service |

| Certificate of Enrollment (COE) Form (if applicable) | Applicant’s college/university |

| Testing Accommodations Request Form (if applicable) | Applicant |

Please note that photocopied documents are unofficial and unacceptable.

Washington CPA License Requirements

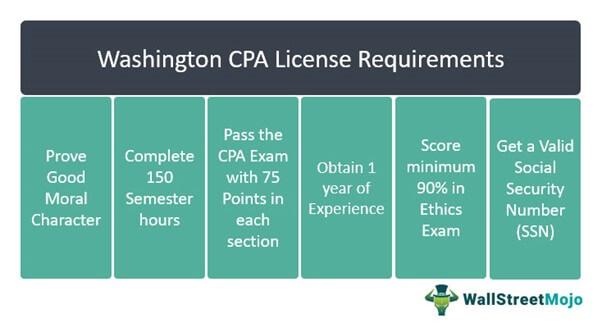

Washington CPA Licensure applicants must satisfy these requisites:

Always remember that SSNs is only required for U.S. citizens and not foreign applicants. Apply through the WBA website with the required fees and transcripts.

For information on the complete process, go through the official portal. Please note that you can use the CPA title only after the Washington state board posts its approval on the licensee database.

Education Requirements

You must complete a minimum of 150 semester (225 quarter) hours. Ensure to earn at least a bachelor’s degree with a major in accounting from a board-approved college/university. Further details are mentioned in the Eligibility Requirements section.

Exam Requirements

The Uniform CPA Exam includes four sections with a passing score of at least 75 points in each. In addition, you must pass the test within the rolling 18-month period. Check out the Washington CPA Exam Requirements section for more information.

Experience Requirements

Once you pass the CPA exam, ensure to gain at least 12 months (2000 hours) of accounting and auditing experience. Know that this time period need not be continuous. A licensed CPA must verify your experience and submit the Experience Affidavit Form to WBA.

Ensure to demonstrate your skills in the following areas:

- Preparation of reports to taxing authorities

- Budgeting

- Accounting for transactions

- Financial analysis

- Data analysis

- Internal auditing

- Controllership functions

- Performance auditing

Candidates must have obtained the required experience within eight years immediately preceding the date WBA receives their licensure application.

The required experience may be in public accounting, industry, or government employment. In specific circumstances, employment in the academic sector may also be considered to meet some or all of the requirements.

Ethics Requirements

Lastly, before applying for a license, Washington CPA candidates must fulfill the ethics exam requirements. They must take the AICPA’s professional ethics course and pass the ethics exam with 90% or more. Let’s view the details here.

| Particulars | Details |

| Study material | Professional Ethics: The AICPA’s Comprehensive Course |

| Course duration/type/format | 8-hour long |

| Self-study course | |

| Online & text-version | |

| Passing score | 90% |

| Qualified course provider | AICPA |

| Price | AICPA Members - $179 |

| Non-AICPA Members - $225 | |

| $45 off via the Washington Society of CPAs website | |

| Course content | AICPA Code of Professional Conduct – Importance & how it is organized |

| Conceptual Framework | |

| Ethical & Professional conduct – Basic tenets | |

| Principles of ethics | |

| Independence | |

| Activities discrediting the CPA profession | |

| Level | Basic |

WBA also identifies the Professional Ethics for CPAs (PETH) exam as meeting the ethics requirement.

Continuing Professional Education (CPE)

Washington CPAs must complete 120 CPE credit hours every three years. Moreover, the U.S. province accepts the required credits for programs provided by National Registry Sponsors.

Here are the details.

| Particulars | Details |

| Study material | Professional Ethics: The AICPA’s Comprehensive Course |

| Course duration/type/format | 8-hour long |

| Self-study course | |

| Online & text-version | |

| Passing score | 90% |

| Qualified course provider | AICPA |

| Price | AICPA Members - $179 |

| Non-AICPA Members - $225 | |

| $45 off via the WSCPA website | |

| Course content | AICPA Code of Professional Conduct – Importance & how it is organized |

| Conceptual Framework | |

| Ethical & Professional conduct – Basic tenets | |

| Principles of ethics | |

| Independence | |

| Activities discrediting the CPA profession | |

| Level | Basic |

The Washington CPA license makes up for all the pains you take to pass the rigorous exam and fulfill all other license requirements. It adds one more feather in your cap, a high-quality one indeed! It makes you a part of the elite group of accountants. Also, the credential offers impressive salary figures and exclusive rights.

So, don’t wait up and schedule your CPA exam at Mountlake Terrace, Puyallup, or Spokane. Moreover, keep a check on authorized websites like AICPA, NASBA, or WBA for updates.

Washington Exam Information & Resources

1. Washington Board of Accountancy (https://acb.wa.gov/)

711 Capitol Way S, Suite 400

Olympia, WA 98501

E-mail: customerservice@acb.wa.gov

Phone: (360) 753-2586

2. Washington Society of CPAs (https://www.wscpa.org/)

902 140th Ave NE

Bellevue, WA 98005

425-644-4800

memberservices@wscpa.org

3. Washington Secretary of State (https://www.sos.wa.gov/)

Legislative Building

PO Box 40220

Olympia, WA 98504-0220

secretaryofstate@sos.wa.gov

360-902-4151

Recommended Articles

This article has been a guide to Washington CPA Exam & License Requirements. We discuss Washington CPA requirements and license requirements in the U.S. capital. You may consider the following CPA Review providers to prepare for your exams –