Table Of Contents

What Is The Wash Sale Rule?

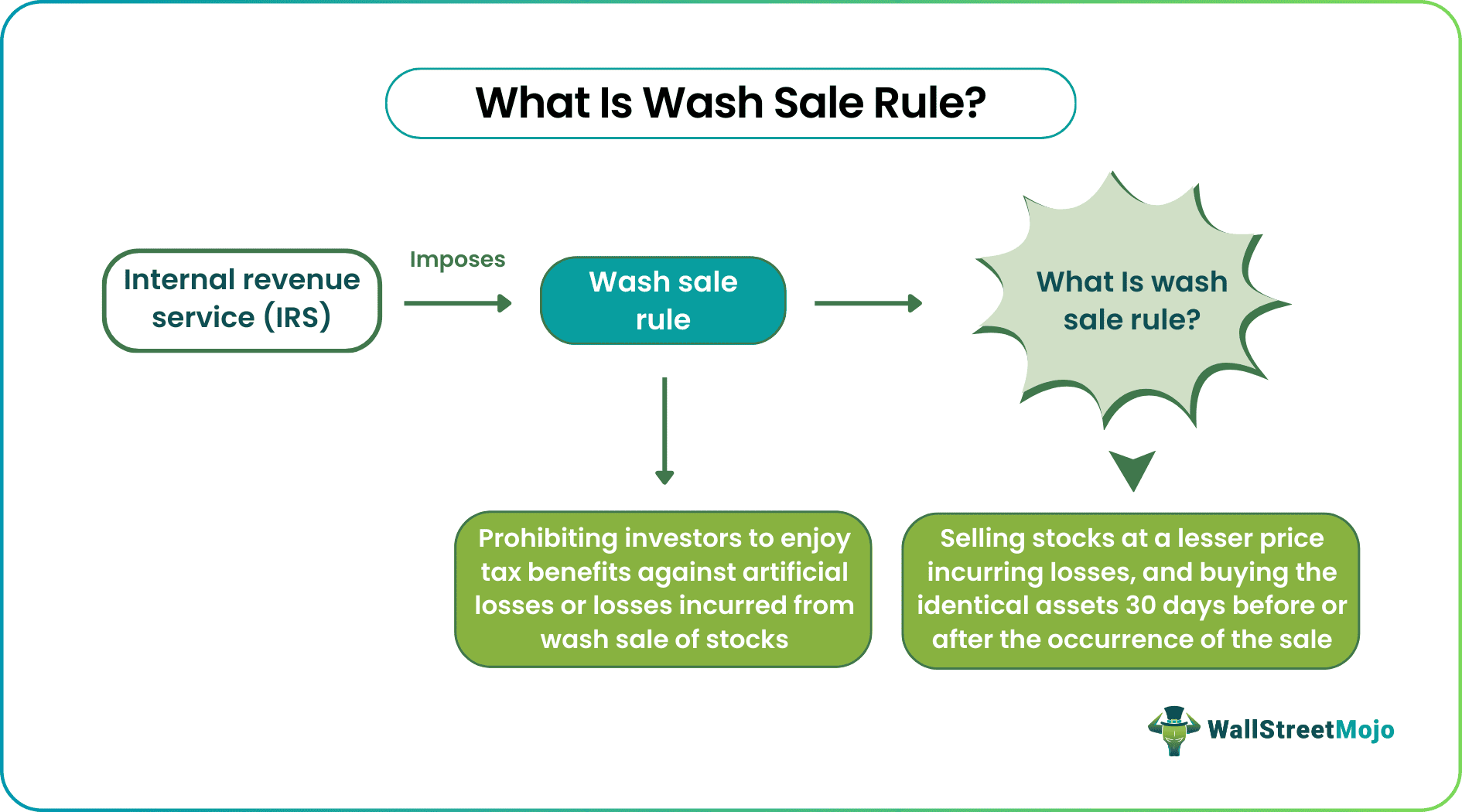

The Wash Sale Rule is a regulation framed by the Internal Revenue Service (IRS) to prohibit investors from enjoying tax benefits for the stocks and securities sold in the wash sale. A wash sale is when investors sell stocks at a lesser price, incur losses, and then buy identical securities in the same amount within 30 days of buying or selling those stocks.

Individuals involved in loss-incurring deals in the wash sale tend to benefit from the tax rules. However, the wash sale rule for day traders stops them from taking advantage of the tax guidelines in the United States and other countries.

Table of contents

- What is the Wash Sale Rule?

- The Wash Sale Rule is a regulation laid down by the Internal Revenue Service (IRS) of the United States to disallow a tax deduction when an investor sells the security at a loss and then buys the same or identical security from the market within 30 days.

- It remains effective for 61 days, starting 30 days before the purchase of the stock or bond and 30 days after the sale of it in the market.

- Investors must maintain long records to organize information, like the date of purchase, date of sale, and date of repurchase, to avoid violating the rule.

- It is framed to ensure taxpayers do not take advantage of the tax deduction provisions.

How Does The Wash Sale Rule Work?

The IRS wash sale rule helps authorities ensure that investors do not misuse the tax benefits. The wash sale involves selling stocks at a lower price and buying a substantial set of assets 30 days before or after the sale.

The wash sale regulation does not allow investors to purchase the same form of assets within those 61 days. Thus, if investors want to book a loss in their tax return merely by selling the security, they must be careful with the buy and sell dates since it significantly affects the taxation process.

This rule does not allow taxpayers to take undue advantage of the price fall to book the capital losses and then repurchase the same to rebuild their lost position. In addition, it helps authorities curb malpractices and strictly restrict investors from tax avoidance or claiming deductions.

The wash sale rule options allow authorities to enhance revenue by preventing artificial loss deduction claims. Plus, stock manipulations are under the regular supervision of tax authorities, given the traders' control over the investors, who are likely to file fake tax deductions.

The disallowed capital losses are used as an addition to the cost of stock acquisition and as a deduction from the further sale of the repurchased security.

If the authorities disregard the loss, it gets added to the stock's purchase price since the tax on it has already been paid. This new cost is the acquisition price for the security, which becomes a deduction when traders sell the security further in the market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us consider the following wash sale rule examples to understand the concept better:

Example #1

Xavier bought 1000 shares of Apple on January 1, 2022, amounting to Rs $50,000 at $50 per share. However, on January 8, the price of the shares fell to $40, reflecting a notional loss of $10,000 for him. Thus, he immediately sells the stock in panic and buys back the same on January 20. This way, the investor rebuilds his earlier position and books a loss in his return of income to the IRS.

Here, the wash sale regulation applies as Xavier sold and bought the stock back within 30 days of the sale. Accordingly, the IRS disallowed the capital loss and added it back to the acquisition cost on January 20, 2022.

Example #2

Mr. A bought 1000 shares of Google at $100 on January 15, 2022. He sold the same on January 31 and purchased it on March 1 of the same year. There is no problem with the buyback date since it is after 30 days from the sale date. However, suppose he had sold them before the expiry of 30 days; the wash sale regulation would have been applicable. As a result, the capital loss would be ineligible to reap returns for that year.

Exceptions

There are instances where investors buy stocks after a wash sale, with the number of purchased stocks being more than the ones sold. In such a scenario, the wash sale regulation does not apply, given the number of stocks not identical to what they sold in the wash sale. They can sell those additional stocks after 31 days of purchasing them.

Though this approach makes investors sell additional assets at a loss, they still choose it to nullify the relevance of the wash sale regulation in the matter. However, this approach might be risky for them as they receive more exposure in the market, giving them recognition, which might not let them use such tricks moving ahead.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The wash sale regulation does not apply to cryptocurrencies. This rule is valid for securities, and IRS does not identify crypto as a security. Instead, cryptocurrencies are recognized as property, so laws concerning securities may not apply here.

There are multiple ways to avoid the rule's applicability:

a. Investors can purchase more stocks than they sell through wash sales.

b. They can trade in those stocks only after 61 days.

c. The traders have a chance to search for a substitute in the form of mutual funds or exchange-traded funds belonging to the same industry.

There is no fine or penalty that applies to investors. However, if caught violating the guidelines, the authorities cancel or disapprove the tax benefits they claim for the artificial losses.

Recommended Articles

This article has been a guide to What is Wash Sale Rule and its meaning. Here, we explain how it works, along with examples and exceptions. You can learn more from the following articles –