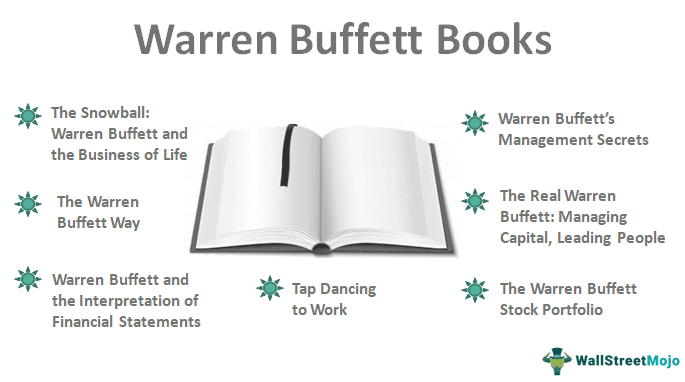

7 Best Warren Buffett Books [Updated 2025]

In the history of the world’s investment scenario, Warren Buffett has been seen as one of the most successful American investors until now. He is the owner and CEO of Berkshire Hathaway. Below is the list of some well-known recommended books on Warren Buffett you must read in 2025.

- The Snowball: Warren Buffett and the Business of Life ( Get this book )

- The Warren Buffett Way ( Get this book )

- The Real Warren Buffett: Managing Capital, Leading People ( Get this book )

- The Warren Buffett Stock Portfolio ( Get this book )

- Warren Buffett and the Interpretation of Financial Statements ( Get this book )

- Warren Buffett’s Management Secrets ( Get this book )

- Tap Dancing to Work ( Get this book )

Let us discuss each of the Warren Buffett books in detail, along with its key takeaways and reviews.

#1 – The Snowball: Warren Buffett and the Business of Life

Author: – Alice Schroeder

Book Review

It gives the readers a most detailed insight into the life of Warren Buffett. It is an accurately drawn profile of a man, about whom we know not much, apart from his visibility in the financial world. This book on Warren Buffett could be termed as a Bible for the capitalists, and complete biography of the man known by the name “The Oracle of Omaha.”

Key Takeaways

The best lesson to learn from this book is to learn the value of time in regards to education, knowledge, and decision making. Although Mr. Buffett is one of the world’s richest men, he had kept track of his life focused on humility, simplicity, and modesty.

Top 5 Lessons from Warren Buffet – Explained in Video

#2 – The Warren Buffett Way

Author: – Robert G. Hagstrom

Book Review

Everyone betting in the stock market wants to make money but doesn’t know-how. Such people, who are willing to make money, then look up to individuals who have succeeded. Warren Buffett is one such ultra-successful individual, who by his unique investing style and principles, has made astounding profits. This book on Warren Buffett illustrates the techniques and ideas he implemented behind the creation and maintenance of his financial empire.

Key Takeaways

Mr. Buffett always points to investors that, when investing, think of it as buying ownership in the business and not only buying it as a stock. Such thinking will widen your perspective as an investor. One will be more responsible while selecting stocks and study the business to its core before investing.

#3 – The Real Warren Buffett: Managing Capital, Leading People

Author: – James O’Loughlin

Book Review

What are the two most important factors required for a business to run smoothly? People and Capital. The author, in a detailed manner, wonderfully describes how Mr. Buffett had the knack of handling both: People and capital at the utmost efficiency that added to his monumental success. Buffett, as a CEO and sound capital allocator, has been portrayed in this book.

Key Takeaways

Easy access to funding causes one to make ill-disciplined decisions. Discipline regarding the use of money from the available resources is the most important lesson to be learned. Respecting people and giving them the importance they deserve no matter what stature makes a big difference in their attitudes towards us.

Besides books like these, individuals may take the help of this Trading Comp Valuation Course to gain knowledge of valuation concepts. The examples in the course can help develop a practical understanding and provide key insights.

#4 – The Warren Buffett Stock Portfolio

Warren Buffett Stock Picks: Why and When He Is Investing in Them

Author: – Mary Buffett & David Clark

Book Review

Which company to invest in? When to invest? What to look for before investing? These are the most common questions which are asked by any investor. What could be more fascinating than to learn all this from Warren Buffett himself? Formulating investing strategies by looking out for the ‘right and logical indicators,’ understanding the importance of doing fundamental research before investing is all the main contents of this read.

Key Takeaways

Research is of the utmost importance when it comes to investing. Buying when nobody wants the stock is the key to buying low. Identifying low priced stocks that are strong in nature is the key to enormous future profits.

#5 – Warren Buffett and the Interpretation of Financial Statements

The Search for the Company with a Durable Competitive Advantage

Author: – Mary Buffett & David Clark

Book Review

A novice or a master, artist, or engineer, no matter who you are, before investing, one needs to learn to understand the financial statements (Income Statement, Balance Sheet, and Cash Flow Statement). It forms the financial face of the company and depicts its financial health. To make sound financial decisions, it is imperative to know about what the company’s financial structure is made of and how durable it really is.

Key Takeaways

Reading between the lines is what this book will teach you about in regards to financial statements. Discovering the strengths or weaknesses of a company solely from its financial statements will give anybody a definite competitive edge in the investing premise.

#6 – Warren Buffett’s Management Secrets

Proven Tools for Personal and Business Success

Author: – Mary Buffett & David Clark

Book Review

A successful business largely depends on the management style its managers inculcate. Over the years, there have been ample strategies developed for efficient and productive management of various types of business. But the key lies in simplicity. Warren Buffett, as a manager, has always taken the role of leadership to increased levels of improvement. Mary Buffett and David Clark share the management styles of Buffett suitable for entrepreneurs and new managers.

Key Takeaways

Find managers with integrity, passion, and intelligence about the business. Motivating and encouraging them with the right ideas goes a long way. Placing the right kind of individual in the right place is the first step of an effective delegation, which leads to surprising results.

#7 – Tap Dancing to Work

Author: – Carol J. Loomis

Book Review

This best book on Warren Buffet is a collection of articles published by Fortune from 1966-2012 about Warren Buffett and some articles written personally by him. It provides the readers with meaningful insights into Buffett’s investment strategies, his views on management, policies relating to public, philanthropy, and to some extent, even on parenting. Readers of all facets will have an enriching view of the life of the successful business magnate.

Key Takeaways

The journey of Mr. Buffett in the universal investing scenario for the past 50 years gives us a mixing bucket of his unique and notable achievements in all facets of his life. The lessons he teaches about finding value in the organizations, people, and stocks and building upon them with the approach of compounding.

All the books written and related to Warren Buffett delve the reader deep into the world of a superior financial understanding and efficient financial and managerial decision making. For individuals or organizations, these books cater to the financial and management questions and issues relating to both categories. I hope you enjoy and learn a lot from reading them!