Table Of Contents

Waiver Meaning

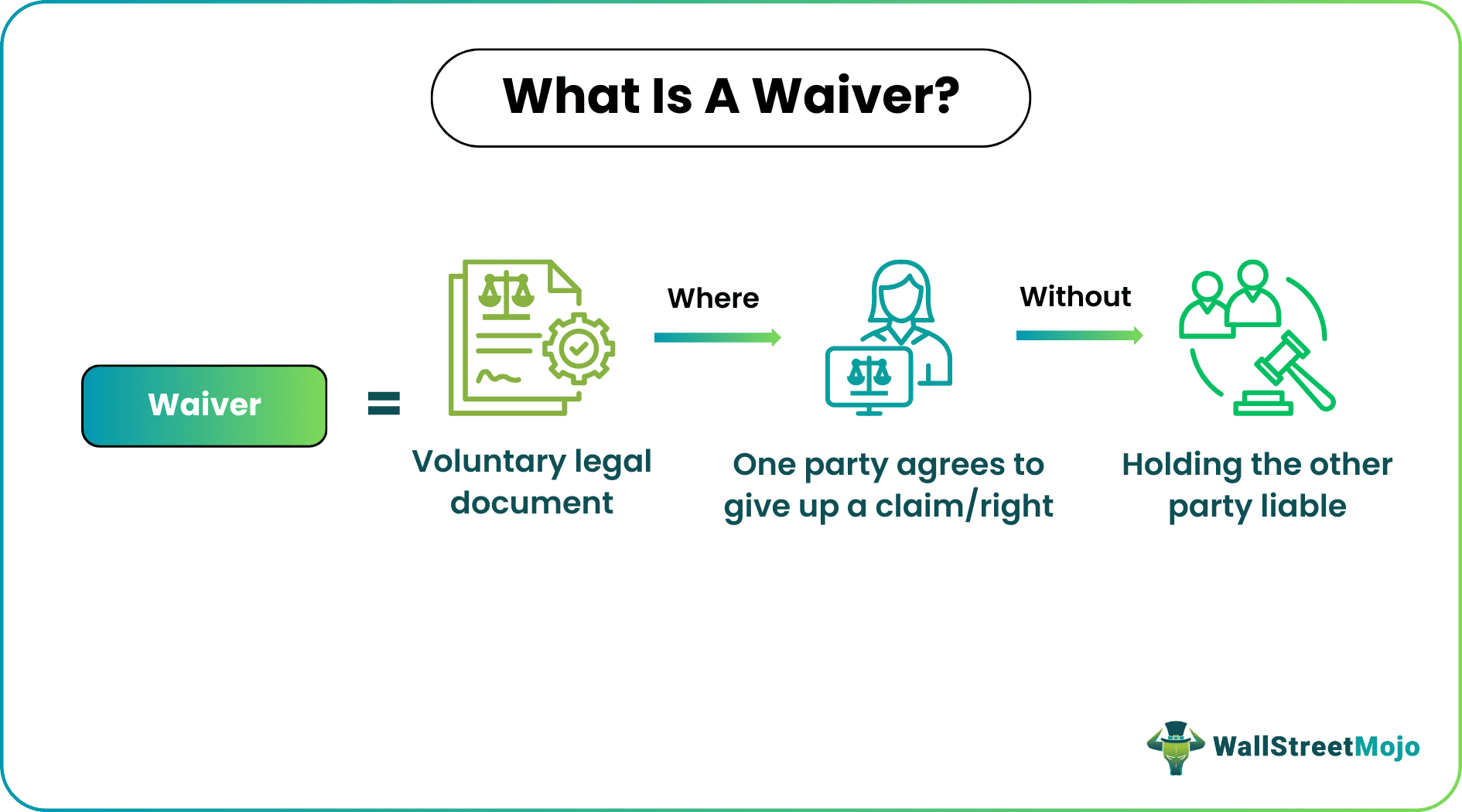

The waiver is a legal document signed and offered by a party to voluntarily forfeit their claim or right for which the other party is not liable. It is given freely without imposing any liability on the other party; on the contrary, it relieves the other party from any obligation to do or pay.

Such documents typically are produced in claim settlements where one party is ready to willingly pay a specific and slightly higher amount or award to the other party in exchange for them to sign and submit the waiver relinquishing their right to make any further legal action.

Key Takeaways

- A waiver is voluntarily signed and provided by one party to another, indicating their willingness to relinquish a claim and release the other party from related obligations.

- While they are commonly in written form, they can also manifest through actions that are eventually documented to mitigate potential future risks.

- It has diverse applications, spanning real estate, visas, education, cars, and various corporate affairs.

- It is frequently employed during the resolution of lawsuits to ensure that the involved party refrains from pursuing similar matters in the future.

Waiver Explained

A waiver is a legal document that signifies the voluntary relinquishment of one party's rights and the abandonment of their claim. This document holds significant importance in legal proceedings and court actions. This legal document emerges as a settlement means in numerous complex court cases where parties are at an impasse. They facilitate one party's voluntary surrender of rights, often in exchange for specific benefits or greater rewards offered by the opposing party.

The waiver definition also indicates that a particular party is absolved from any obligations or liabilities to make payments. Consequently, this party is not compelled to undertake specific actions or fulfill monetary commitments. Acquiring such a document is essential as proof that any obligations do not bind an individual or entity.

The concept of a "waiver fee" can be interpreted in various ways. It can denote the monetary sum one party offers another in exchange for abandoning claims and rights. The term has a distinct meaning in specific loan scenarios, particularly student loans. This meaning is influenced by factors such as the type of course, college, and application process. Each possesses its distinct utility and constraints. These attributes might not always favor the concerned matter or parties, yet they remain advantageous across diverse situations.

Types

Various scenarios and circumstances can lead to the formation of this document, but primarily, there are four distinct types as follows:

- Liability Waivers: It involves individuals voluntarily refraining from pursuing legal action against an organization, individual, or legal entity in case of injuries. These are typically signed before engaging in an activity and release the concerned organization from liability or obligations in the event of an unfortunate incident.

- Premium Waivers: These appear in insurance policy systems and explicitly state that the insured party can waive their obligation to pay premiums under specific circumstances. Insurance providers might impose elevated premiums to counterbalance non-payment risk under particular circumstances. As an illustration, in the event of an individual's disability, the insurance company could extend coverage to the policyholder even if they sustain a permanent disability that renders them incapable of premium payment.

- Waiver Subrogation: It pertains to cases where an insured person sustains damages caused by a third party, prompting the insurer to cover the incurred harm. It compels the insurer to pay for the damages in these instances. It places the insurance company at an elevated risk, as it relinquishes its right to recover costs from the responsible third party. As a result, the insurer often becomes liable for payment in most cases.

- Loan Waiver: It is typically issued by lenders or banks. Its purpose is to release borrowers from the obligation to repay a loan. In such scenarios, the lender assumes partial or complete responsibility for the principal loan amount. For example, eligible United States students can have their education loans waived by the federal government through various federal programs that meet specific criteria.

Examples

Below are two examples of this concept and their application in different circumstances.

Example #1

Suppose Henry is searching for an apartment to rent in New York and comes across one conveniently located near his workplace. The flat, although shabby and dysfunctional, seems suitable to Henry. He expresses his willingness to move in because Anthony, the apartment's owner, agrees to sign a waiver as part of the rental agreement.

According to this agreement, if Henry encounters any unfortunate incidents resulting in physical or financial harm during his tenancy, he assumes responsibility for the resulting damages. Anthony agrees to these terms, and Henry moves into the apartment. After just 45 days, Henry sustains a significant injury due to an issue with open wiring and faulty electrical work.

As per their agreement, Anthony, who had accepted liability, covered all the medical expenses and costs incurred by Henry due to the injury. This scenario exemplifies the concept of a liability agreement. However, it's crucial to consider various legal nuances and clauses in practical situations.

Example #2

In Bengaluru, India, multiple farmer organizations and the opposition parties have protested and pressured the government to implement a waiver for farm loans, particularly in light of the weakened monsoon conditions. These farmers assert that government intervention is essential to assist the struggling agricultural community.

The adverse impact of insufficient rainfall has resulted in crop failures. The government is deliberating on potential courses of action before reaching a final decision. Numerous leaders from opposition parties have extended their support to the farmers, emphasizing the urgency of the matter and stressing the need for swift government action to alleviate the challenges faced by the agricultural sector.

Pros And Cons

Let us understand the advantages -

- These are legal documents to protect either party in different situations.

- It legalizes the terms and prevents any future potential threat that can harm the parties in case of unfortunate events.

- Legally binds both parties and, at the same time, helps relieve them from any obligation or liability to pay or perform a specific action.

- Once signed, the parties can produce the document in case the other concerned party disavows it and takes legal action in the future.

Listed below are the disadvantages -

- Sometimes, it is inclined towards favoring one party over the other.

- It is unnecessary to be in a written agreement; therefore, there lies a degree of potential risk in such cases.

- These are utilized to settle between two parties where the subject to interest can be lost for anyone.

Waiver vs Disclaimer

Waivers and disclaimers are distinct documents, often needing clarification due to their similar nature. However, the key differences between the two are as follows:

- A waiver is an official and legally binding agreement, whereas disclaimers can be official or unofficial statements.

- A waiver involves the voluntary relinquishment of rights and claims. Conversely, a disclaimer is a statement used to define and limit the scope of rights and obligations.

- A waiver is intentionally created and developed. Conversely, disclaimers are employed to deny or repudiate responsibilities.

- A waiver serves as a dispensation from a rule or obligation. In contrast, disclaimers are utilized to disassociate and disown certain rights or liabilities.

Frequently Asked Questions (FAQs)

The duration of the process varies based on the specific office, legal context, and parties involved. In ideal circumstances, the process can be expedited smoothly, but in some instances, it might extend over several months.

The Interview Waiver Program (IWP) allows qualified visa applicants to electronically submit their applications without requiring an in-person appointment. The outcome of their visa application, whether approved or declined, is conveyed through the official visa service website. Individuals who previously obtained a US visa can apply for visa renewal through this program without an interview.

A waiver letter is generated when one party voluntarily relinquishes their claim, right, or interest to another party—the concerned party signs this letter, which serves as legal evidence of the granted dispensation. Subsequently, the same letter can be referenced for additional information and acknowledgment.