Table Of Contents

Voluntary Liquidation Meaning

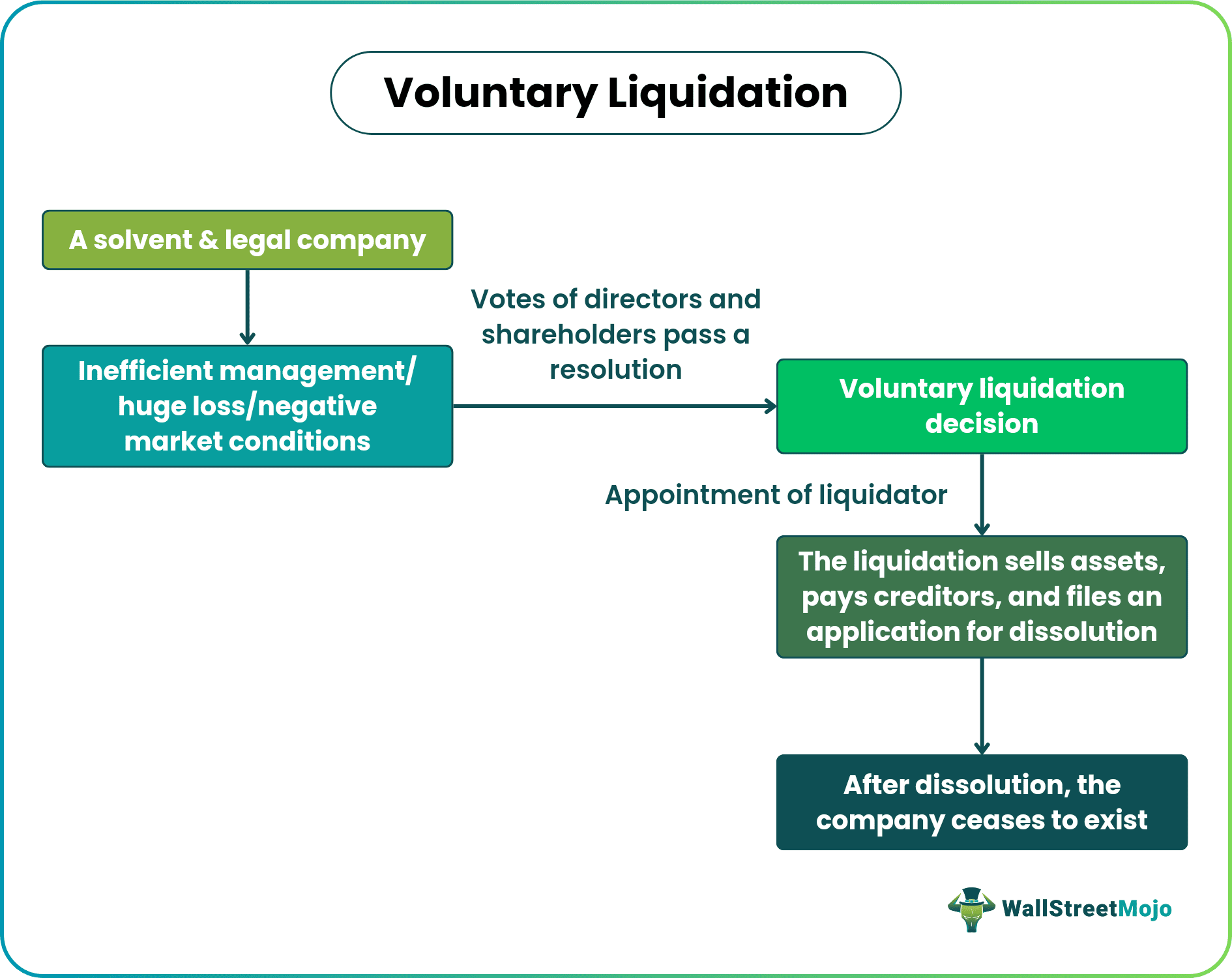

Voluntary liquidation is the process of formally ending the operation of a company with the approval of its shareholders. It is a decision of the company management and not a court order, and it happens when the administration feels that the entity does not require to continue working anymore.

This liquidation is not due to insolvency or any illegal operation. On the contrary, during such liquidation, the company pays back the creditors, sells the assets, and dismantles the entire procedure. However, because of tenure expiration, as mentioned in the Articles of Association, the company may wind up with or massive loss due to an unforeseen event.

Key Takeaways

- Voluntary liquidation occurs when the company's directors and shareholders feel the entity does not require to work anymore and decides to terminate its operation.

- It is a decision the organization’s management takes and is not a court order.

- It is not the result of insolvency due to the inability to pay the debt or any unlawful operation of the organization.

- The voluntary liquidation process involves clearing off creditors’ debt according to their priority, the sale of assets, and the complete discontinuation of the entity.

How Does Voluntary Liquidation Work?

Voluntary liquidation of an entity occurs when the management decides to end the operation due to certain conditions like a considerable loss, an unforeseen event, expiry of tenure as mentioned in the Articles of Association, etc.

The voluntary liquidation of the company starts when the majority of directors, partners, and shareholders pass a resolution through voting, as follows:

- The company has no debt or can pay its debts if any.

- The company's dissolution is not due to illegal activity or intending to commit fraud.

Within four weeks of the resolution, the voluntary liquidation process starts by selling assets to pay off the creditors. First, however, creditors representing one-third of the total debt value must approve the sale. Thus, subject to fulfillment of the above conditions, the company dissolution takes place with the help of a professional liquidator.

The liquidator plays the following role in the process:

- First, they issue a circular inviting the shareholders to submit their claim value.

- Verification of shareholders’ claims.

- Arrange or sale of assets.

- Distributes sale proceeds to pay off creditors and meet shareholder claims.

- File the required application for the dissolution process.

The voluntary liquidation regulations require that the liquidator should prepare the following reports:

- A preliminary report.

- A report about the annual status of the company.

- Minutes of meeting with the stakeholders.

- Final report leading to company dissolution.

After the voluntary liquidation of the company, the company ceases to exist. Such closure of the business operation may be due to poor performance, unfavorable market conditions, fulfillment of tenure as per the Articles of Association, or any unforeseen contingency. The cost of voluntary liquidation may vary depending on the type of company, size, asset class, quality of management, etc.

Types

An entity does various types of voluntary liquidation. They are as follows:

- Liquidation voluntarily initiated by creditors – Here, the creditors, not the entity’s directors, choose to dissolve it. During the process, the creditors vote for the resolution, and if the number of votes meets the requirement, dissolution od carried forward. The sale proceeds of assets help to pay off the debts, the liquidator prepares the necessary reports, and the company ceases to operate after the final verification.

- Liquidation voluntarily initiated by members – Here, the directors cease the company operation, which might be due to a director’s retirement, unforeseen circumstance, completion of the company tenure according to the Articles of Association, etc. A liquidator is appointed to supervise and complete the process. Upon completion of the creditor and directors voting and meeting and after the liquidator meets the voluntary liquidation regulations, the company permanently closes its operation.

Examples

Let us look at some examples to understand the process better:

Example #1

Fortune International, a company that is in the hotel and restaurant business, is headquartered in California. It has been performing very well and getting many customers from far-off places throughout the year. The service ranged from economical to luxury standards, catering to individuals, families, and corporates.

However, the company’s performance slowed due to a sudden change in management. After the retirement of two efficient directors, new members were appointed, who started exploiting the resources for their benefit. As a result, the auditors detected money laundering cases, and services deteriorated. As a result, the customers lost faith in the company leading to massive losses.

Thus, the management decided to go for voluntary liquidation before losses piled up, leading to bankruptcy. The management appointed Jules & Associates as the liquidator to initiate the process. The directors declared that the company has enough assets to pay the creditors and does not intend to deceive its stakeholders.

Finally, Jules & Associates arranged for the sale of assets and paid the creditors, and Fortune International stopped its operations. As a result, the entire chain of hotels and restaurants was closed.

Example #2

According to Reuters, many companies based in England and Wales opted for voluntary liquidation because of a lack of support following massive losses during COVID-19.

The pandemic, which led to the entire economy shutting down, resulted in a massive loss of revenue. But despite putting in a lot of effort, companies could not increase their performance because of inflation and the risk of recession. Companies that could not adapt quickly to change circumstances found themselves stuck with abysmal performance leading to the dissolution of operation.

Example #3

According to the Amendment and Amendment Regulation Act of the British Virgin Islands, there are some changes made to the company’s voluntary liquidation regulations. Previously, the process was possible only if the entity was solvent, which meant it could pay off the creditors. In addition, there was a liquidator appointed for the purpose. Regarding this, the directors had to sign a declaration.

Under the new rule, firstly, the liquidator has to possess specific qualifications to be eligible for the job. Secondly, the company has to abide by some residency requirements. Thirdly, the liquidators must collect some accounting records of the company, and the liquidator would send copies of those records to the entity's registered agent.

Advantages & Disadvantages

Voluntary liquidation is when the company wants to voluntarily dissolve its operation, not by the court's order, due to poor performance, expiry of operation tenure, or any unforeseen contingency. However, it has certain advantages and disadvantages, as given below:

Advantages

- Control with the management – If the liquidation is voluntary, the power of the process is more with the directors.

- Assets repurchase is possible – If, after liquidation and after paying off creditors, the company still has funds left, it can use the fund to purchase back some of the assets and utilize them for a better purpose.

- Relief from creditors – After the assets sale, the company uses the fund to pay off the creditors.

- Less risk of information misuse – Since the board has total control during the entire liquidation process, outsiders have significantly less opportunity to misuse information.

Disadvantages

- Management investigation – A liquidation process will always lead to a detailed analysis of the internal management process to eliminate any concern regarding unlawful practices.

- Public advertisement – Immediately after the liquidation decision, and the appointment of a liquidator for the process, a public announcement has to be made so that the shareholders can submit the details of their claims.

- Shareholders may not get claims – There is every possibility that after the liquidation is complete, the shareholders may not get any refund for their claims because their claims have the least priority.

- Call for any personal guarantee - Anyone signed up as a personal guarantor for the entity will have to pay the loan if the company is liquidated and cannot pay its creditors.

Voluntary Liquidation vs Compulsory Liquidation vs Strike Off

Voluntary liquidation is when an organization ends its operation voluntarily and can pay off creditors by selling its assets. Compulsory liquidation is when the court orders a company to initiate the liquidation procedure due to bankruptcy. Finally, strike off is removing the company's name from the register maintained by the registrar of companies. The differences between them are as follows:

| Voluntary Liquidation | Compulsory Liquidation | Strike Off |

| The management decides on liquidation. | The court decides on liquidation. | The Registrar of Companies strikes off the company name. |

| The liquidator undertakes the work of investigating the management. | The official receiver undertakes the work of investigating the management. | The company management itself undertakes the work of investigating and clearing dues. |

| The fund realized from the sale of assets goes to management to pay the creditors. | The fund realized from the sale of assets goes to a bank account held by the government. | The fund realized from the sale of assets goes to management to pay the creditors. |

| Only the liquidator can start the process. | The directors can start the process. | Internal management can start the process. |

| In this case, the company is not insolvent or into any illegal practice. | In this case, the company is insolvent or is into any illegal practice. | The company is solvent and working legally. |

| The company’s image is not affected. | It affects the image of the company. | The company’s image is not affected. |

Frequently Asked Questions (FAQs)

The process can take a few months or sometimes a year, depending on the nature and size of the entity. However, since starting the liquidation process without a liquidator is impossible, the appointment process should be fast to complete the entire dissolution process without much delay.

Yes, it is possible to sue a company in voluntary dissolution. But it is difficult because during the liquidation process, there are many steps the company undergoes, and it is difficult to handle any individual claim during that time. The liquidator may take a court stay order. In that case, an individual must take a court leave to sue the company, which is at the court’s discretion.

Voluntary liquidation costs depend on the number of employees, the value of creditors and assets, the type of directors and shareholders, and the company's financial condition. The cost might start from $4000.