Table Of Contents

Vesting Meaning

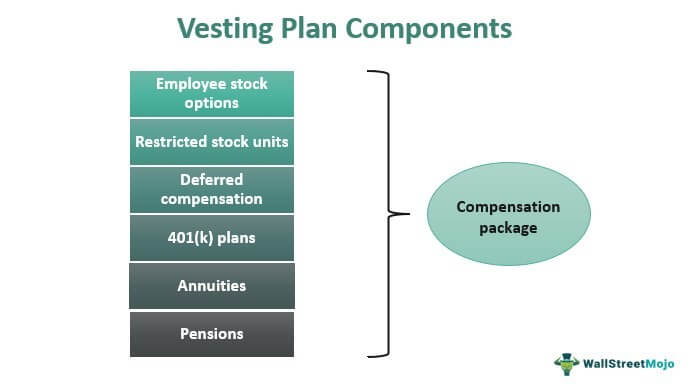

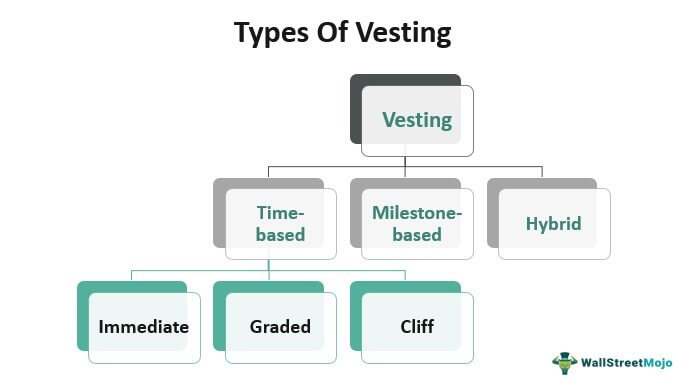

Vesting refers to a process granting an employee complete control or ownership over the employer-sponsored investment assets or accounts over time. The company usually offers funds or accounts as part of the compensation package under a set schedule. It can be time-based, milestones-based, or hybrid.

It is a good retirement option for individuals who want to work for a long time in one firm and contribute to its growth and development. In return, they can acquire a stake in employer-sponsored plans and contributions like stock options, deferred compensation, 401(k), annuities, pensions, etc. Employees can vest a certain percentage of the asset each year, accumulating their shares for the duration of their employment.

- Vesting is a corporate practice where an employee gains complete control or ownership of employer-sponsored financial assets or accounts. It can be time-based, milestone-based, or a mix of both.

- Employees can gain non-forfeitable rights to employer-sponsored plans and contributions such as stock options, deferred compensation, 401(k) plans, annuities, pensions, and so on in exchange for their loyalty.

- The vesting period could be three to five years, which signifies when the stock option becomes vested, and the employee can purchase or own shares.

- While employer contributions to retirement plans are usual, employee contributions toward these are always fully vested.

How Does Vesting Work?

Vesting is an all-in-one response to all sorts of financial insecurities that employees have about their lives post-retirement. It is a process through which the company assures its workers that their future is secure, provided they continue to work hard and contribute to its success. As a result, employees have non-forfeitable rights to assets under employer-sponsored benefit schemes, such as stock incentives and pensions based on their tenure with the firm.

It is worth noting that employers frequently make contributions to employer-specific retirement schemes, and the employee contributions to these are always fully vested.

When people join a firm, they pledge to be loyal in every way and to participate in the profit-making process. Whether they are founders, entry-level or executive-level personnel, they can expect reasonable compensation in exchange for their services.

Vesting occurs when the company decides to offer employees stock options, restricted stock units, or other retirement plan benefits as part of their compensation package. These incentive compensations encourage employee retention. However, the only stipulation is that they work for it for at least a year, demonstrating their worth to acquire those funds. This process allows employees to prove their worth to their employers.

It rewards employees for their loyalty by giving them complete control or ownership of the employer's contributions. Therefore, an employee needs to understand the process to secure their financial future and avoid losing any employer contributions upon leaving the company.

Vesting Conditions

- Every employee earns or owns a specific amount of their retirement savings each year by vesting of shares.

- The amount of funds grows until the employee is fully vested.

- If an employee has 100% vested in their retirement account, they will be entitled to 100% ownership of it, with no right for the employer to forfeit their funds.

- If the employee does not vest as needed, the employer may forfeit the same. It usually occurs when an employee resigns or loses their job or does not work for 500 hours or more in a year for at least five years.

- People joining a company receive stock options gradually rather than all at once. The recipients must vest such stocks for a set amount of time.

- As the employee tenure progresses, they become more trustworthy, allowing them to receive additional stock options.

- An employee with fully vested employer-sponsored assets can withdraw funds (employee contributions + employer match) only after retirement.

What Is Vesting Schedule?

Although the plan can vary by company, the vesting schedule is three to five years. This period determines when the stock option is considered vested, and the employee wins the right to buy or own the shares. It only applies to funds contributed on behalf of employees by their employers. The term also ensures the retention of employees who work hard for the company through compensation or equity appreciation.

The first 12 months of the schedule are referred to as cliff. It is the time during which employees, especially from a start-up, do not vest anything. A classic pension plan typically consists of a 5-year cliff vesting term or a 3-to-7-year graded vesting time.

Once the cliff period is over, employees can vest every month. And the employer will essentially offer stock options frequently. Employees working for firms without a schedule own the entire amount soon after it is paid into their accounts.

Types Of Vesting

Vesting can be based on the schedule followed, the milestone achieved, or a combo of the two:

#1 - Time-Based Vesting

In this type, employees earn a share of their stock-option plans gradually over a period. The portion of the equity to be offered depends on the vesting term and cliff. Employees do not get all stocks at once but with their time in an organization – typically one year. As soon as the cliff occurs, employees start receiving the rest of the stock options monthly or quarterly. It can be classified as follows, depending on the schedule:

- Immediate: Here, employees are immediately fully vested in 100% of the contributions received from their employers into their accounts. It means if they leave the job in just a couple of months, they can still enjoy the rights over the employer-sponsored assets, such as 401(k).

- Graded: Here, employees receive complete ownership of the 100% of the employer contributions over five years. As soon as the cliff period of 12-month is over, the company begins contributing a percentage of the stock option. Typically, it is 20% after two years, 40% after three years, 60% after four years, etc.

- Cliff: Here, the employee obtains full ownership of 100% of the employer contributions after a set period. It means that if they leave the company before the specified period, any fund contributed by the employer will be lost.

#2 - Milestone-Based Vesting

In this type, employees receive 100% ownership of stock options or other employee-specific contributions once they reach a milestone. It may include completing a project successfully or accomplishing a business goal.

#3 - Hybrid Vesting

It is a combination of both time-based and milestone-based. It means employees have to remain associated with their companies for a specific period while also achieving the required milestones from time to time to gain full ownership of the employer-sponsored stock options.

Examples Of Vesting

Let us consider the following vesting examples to understand the concept even better:

Example #1

Ronald joined a company as a software engineer and was promised 2% of the company's equity. However, he had to wait for the vesting period, i.e., four years, in this case, to get activated. So he did not receive the 2% equity as a compensation package all at once.

For a corporation with a $20 million turnover, the 2% stock would be worth $400,000. Ronald expected to earn $100,000 per year over the four years by demonstrating his value as a company asset. However, he had to leave the post after three years owing to personal issues. According to the company plan, Ronald would receive 75% of the shares out of 2%. As a result, the final sum he received was $300,000.

Example #2

Vesting in 401(k) plans has made a big difference in the lives of people who are concerned about their financial security in the future. The company awards funds to an employee through its 401(k) match in this situation. While only a few corporations provide a rapid process, the rest need employees to wait up to six years or longer to vest their funds. In other words, this approach refers to the percentage of the employer match the employee truly owns.

Frequently Asked Questions (FAQs)

Vesting is an employer's all-in-one approach to a variety of financial concerns that employees may have. It is a process in which companies promise employees that their future is secure if they continue to put out the effort and contribute to their success. Time-based, milestone-based, and hybrid are the three types of it.

A typical vesting term is a time that determines when the stock option becomes vested, allowing the employee to purchase or own the shares. It could be three to five years and ensures that the employees who work hard for the company are retained through equity compensation or appreciation initiatives. It only covers funds contributed on behalf of employees by their employers.

Vesting in 401 (k) implies employee ownership of a certain percentage of their retirement account annually. In this case, the company grants funds to the employee through its 401(k) match. If the employee has 100% vested in the account, they are entitled to 100% ownership of it, with no right for the employer to take their money.

Recommended Articles

This has been a Guide to what is Vesting and its Meaning. Here we discuss types of vesting, conditions, and how it works along with its examples. You may also have a look at the following articles to learn more –