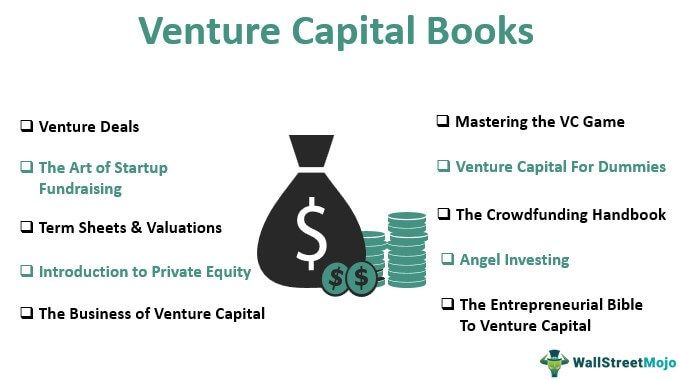

10 Best Venture Capital Books [2025]

In this era of innovative business ideas, it has become almost imperative to have the right kind of funding to put these ideas into action. Fortunately, several wealthy investors are willing to support these ventures by providing much-needed capital, hence "venture capital." In this guide, we discuss the list of the best ten venture capital books that you must read in 2025

- Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist (Get this book)

- The Art of Startup Fundraising: Pitching Investors, Negotiating the Deal, and Everything Else Entrepreneurs Need to Know (Get this book)

- The Entrepreneurial Bible To Venture Capital: Inside Secrets from the Leaders in the Startup Game (Get this book)

- Term Sheets & Valuations: A Line by Line Look at the Intricacies of Term Sheets & Valuations (Bigwig Briefs) (Get this book)

- Introduction to Private Equity: Venture, Growth, LBO and Turn-Around Capital (Get this book)

- The Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies (Wiley Finance) (Get this book)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your Terms, Kindle Edition (Get this book)

- Venture Capital For Dummies (Get this book)

- The Crowdfunding Handbook: Raise Money for Your Small Business or Start-Up with Equity Funding Portals (Get this book)

- Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups (Get this book)

Also, check out the key differences between Venture Capital and Private Equity

#1 - Venture Deals:

Be Smarter Than Your Lawyer and Venture Capitalist

by Brad Feld (Author), Jason Mendelson (Author), Dick Costolo (Foreword)

Review:

An excellent book for entrepreneurs, venture capitalists, and lawyers to acquire an in-depth understanding of the venture capital deal structure and strategies. This work presents a detailed view of what it takes to be a successful entrepreneur and decodes the venture capital term sheet for lay readers and professionals. In addition, the authors discuss useful strategies for entrepreneurs seeking venture capital, things that might go right or wrong along the way, and what it means for those involved. Another interesting aspect is how the individual roles of people typically involved in a venture capital deal are defined, bringing an exceptional level of clarity to work. An absorbing read for anyone interested in understanding nuances of how venture capital deals are made and unmade.

Best Takeaway:

This book offers a balanced perspective of venture capital and how entrepreneurs should strategize to attract the desired funding while avoiding potential mistakes committed by startups. Not focused on a specific role, this work affords a more decentralized view of how things work out for entrepreneurs and venture capitalists, depending on how a deal is structured. A recommended read for students, professionals, entrepreneurs, and venture capitalists.

#2 - The Art of Startup Fundraising:

Pitching Investors, Negotiating the Deal, and Everything Else Entrepreneurs Need to Know

by Alejandro Cremades (Author), Barbara Corcoran (Foreword)

Review:

It is a brilliant exposition of how technological and regulatory changes have helped transform the startup landscape and what it means for entrepreneurs seeking venture capital to support their business ideas. This work builds up a strong case for online startup funding and how old rules for success in the field have lost much of their relevance in light of new regulations. The author diligently analyses how startups can source funding at different stages of their development and why it is a must to identify the right investors for a venture. A stand-alone work that offers updated information on the trends and techniques for startup fundraising in the digital world.

Best Takeaway:

This venture capital book focuses on online sources of startup funding and addresses some of the fundamental issues associated with the same. In addition, the author helps the reader understand that any funding is not necessarily good funding and offers useful guidance on how to identify the ideal investors for a particular venture. An excellent updated guide for entrepreneurs to better understand legal aspects and regulatory changes associated with digital fundraising.

#3 - The Entrepreneurial Bible To Venture Capital:

Inside Secrets from the Leaders in the Startup Game

by Andrew Romans (Author)

Review:

This phenomenal work offers a rare insight into startup fundraising, encompassing an entire range of concepts from angel investing to venture capital and crowdfunding reader become acquainted with complex venture capital terminologies without breaking a sweat. Drawing on his years of professional experience, the author clearly defines what makes for a successful fundraising strategy and what investors look for in a startup. This venture capital book is meant for the curious at heart, exploring every aspect of the subject, starting with why venture capital (VC) firms exist, how they function, and how an entrepreneur needs to get that much-needed VC funding. Extending the scope of this work, it also includes an extended treatment of building a successful business and making a successful business exit through M&A or other routes.

Best Takeaway:

A highly recommended nuts and bolts book on Venture Capital, angel investing, crowdfunding, and other sources of startup fundraising for entrepreneurs in the making. It stands apart for an easy-to-understand and almost conversational writing style, which makes complex concepts accessible to the reader. In addition, drawing on real-life examples, the author brings added practical value to this work.

#4 - Term Sheets & Valuations

A Line by Line Look at the Intricacies of Term Sheets & Valuations (Bigwig Briefs)

by Alex Wilmerding (Author), Aspatore Books Staff (Author), Aspatore.com (Author)

Review:

An excellent practical guide for entrepreneurs and finance students to understand the terminology employed in a venture capital term sheet and stepwise valuation. It is seemingly limited in its scope, but that is what makes this of real practical value for readers who need to study a term sheet using appropriate valuation parameters. In addition, the authors describe West Coast and East Coast rules and offer a section-by-section treatment of a term sheet, using an actual term sheet from a leading law firm. In short, an immensely helpful guide for studying a venture capital term sheet in all its subtleties.

Best Takeaway:

A comparatively brief treatise specifically aimed at helping the reader interpret a venture capital term sheet and valuation methodologies employed. Of great practical value and a must-read for entrepreneurs, executives, finance students, and professionals.

#5 - Introduction to Private Equity

Venture, Growth, LBO and Turn-Around Capital

by Cyril Demaria (Author)

Review:

A comprehensive book on the private equity market and how it is being reshaped in an increasingly interconnected global industry, leading to the emergence of crowdfunding, among other innovations in the field. The current second edition of this work focuses on the evolution of private equity in the post-credit crunch era and emerging challenges for the future. Providing a detailed insight into the structure and organization of the private equity industry at large, the author proceeds to analyze industry segments, including leveraged buy-outs, mezzanine financing, venture capital, turn-around capital, growth capital and fund of funds among others. As a result, an almost academic read offers a rare understanding of private equity as an industry.

Best Takeaway:

This venture capital book focused on past developments and future challenges for private equity as an industry, making it an ideal academic companion for those interested in acquiring a broader understanding of the subject. One of the few works offers a balanced perspective on how private equity functions as an industry and on the level of individual venture capital firms involved in valuing private businesses for investment purposes. A recommended reference work for amateurs and professionals alike.

#6 - The Business of Venture Capital

Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies (Wiley Finance)

by Mahendra Ramsinghani (Author)

Review:

A complete treatise on venture capital that explores various aspects of this field in a detailed and systematic manner. This work is divided into two parts; the first one is aimed at simplifying the process of fundraising and helping create a theoretical understanding of due diligence criteria for funds and explaining technical terms, while the second part focuses on the execution part. The author has also included interviews of twenty-five leading venture capitalists featured in the Forbes' Midas List, enriching this work with practical insights of industry experts on what can make or break a venture capital deal. The people interviewed include Leading Limited Partners, Top Tier Capital Partners, Grove Street Advisors Pension Fund Managers along with others. On top of it all, the companion website offers some useful tools and knowledge resources for the reader.

Best Takeaway:

This venture capital book offers exceptional practical value to the reader with a stepwise introduction to the underlying theoretical concepts related to venture capital and how to successfully apply them. Interviews of leading experts in the field make it an invaluable guide with useful insights and resources for finance professionals, venture capitalists, and entrepreneurs. The companion website brings added value to the work. A commendable work on venture capital covering every aspect in a well-structured manner along with expert insights.

#7 - Mastering the VC Game

A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your Terms

by Jeffrey Bussgang (Author)

Review:

It is a compelling work on how entrepreneurs should go about sourcing investments and identifying the right kind of investor to achieve what they set out to. The author asserts that any funding is good funding 'only' if the goals of a venture capitalist and entrepreneur are carefully aligned, which can be a key element for any startup to succeed. Drawing on his experience working on both sides of the venture capital game, he offers interesting insights and anecdotes on the subject. In addition, he shares the experience of other experts in the form of interviews with some of the most noted individuals in the field, including Twitter's Jack Dorsey and LinkedIn's Reid Hoffman. In short, a complete guide for entrepreneurs on how to strike the right chord with investors and enter a good partnership.

Best Takeaway:

It is an insightful book for entrepreneurs seeking venture capital for their startups and the dos and don'ts they need to adhere to when identifying the right investor. The author brings additional value to the work with his and others' experience and detailed insights into creating the perfect pitch for the right investor and entering a mutually beneficial partnership. A must-read for entrepreneurs and finance professionals to understand the intricacies of the venture capital game.

#8 - Venture Capital For Dummies

by Nicole Gravagna, Peter K. Adams

Review:

A complete beginner's manual on entrepreneurship and startup fundraising. The fundamentals of venture capital are explained in an easy-to-understand language and commonly used technical terms. As a result, entrepreneurs can learn how to get a business going and develop it into a potentially attractive investment for venture capitalists. It's a simple yet highly structured approach to the subject that can be immensely useful for readers not acquainted with key terms and concepts in venture capital. A highly recommended guide for anyone interested in learning the basics of venture capital.

Best Takeaway:

This book offers a wealth of information on venture capital, startup funding, and technical terms employed in the venture capital term sheet and valuations. The authors have presented the fundamentals with an almost exceptional level of clarity, making it easy for entrepreneurs to understand what they need to do to get the desired funding and succeed as a business.

#9 - The Crowdfunding Handbook:

Raise Money for Your Small Business or Start-Up with Equity Funding Portals

by Cliff Ennico (Author)

Review:

A masterful treatise on crowdfunding, one of the most innovative funding avenues for startups and small business ventures, finally took off in a big way with the implementation of the JOBS Act. Realizing that in an increasingly competitive industry, almost every startup is aiming for venture capital with little assurance of success, equity crowdfunding was developed as a viable alternative for entrepreneurs bold enough to make the most of it. First, the author has conducted thorough research on the latest regulations to provide unambiguous responses to oft-repeated queries on the legal and regulatory aspects. Then, going a step ahead, he explains how equity crowdfunding works and why it is the future of startup funding. One of the most recommended venture capital books for next-age entrepreneurs.

Best Takeaway:

In-Depth work on equity crowdfunding and how it could well be the future of startup funding. Readers can find invaluable information on the regulatory aspects of crowdfunding, which makes this work of immense practical value for entrepreneurs and finance professionals. In addition, it offers invaluable insights into how crowdfunding works and why it is here. A thorough research resource on crowdfunding in all its aspects.

#10 - Angel Investing

The Gust Guide to Making Money and Having Fun Investing in Startups

by David S. Rose (Author), Reid Hoffman (Foreword)

Review:

A compelling work on angel investing, intended to create an interest in this oft-neglected form of startup investing and demonstrate how it can be an exciting experience for the investors. Having bet his money in more than 90 companies as an angel investor in the last 25 years, the author shares some incredible stories with the readers, providing detailed insights into the world of startups and why some of them succeed while others fail. In addition, he offers a wealth of information on the latest regulations, discusses how online platforms have made startup investing more accessible, and builds up a strong case of why angel investing is no longer the domain of the privileged few. A must-read for anyone interested in alternative forms of startup investments.

Best Takeaway:

A highly successful angel investor with decades of experience shares his wisdom on what it takes to be a success with angel investing. Busts several myths about angel investing and lays down how to identify good prospects to invest in clear terms. Online platforms and the changing face of startup investing is discussed, along with relevant regulatory aspects. A recommended read for finance students, professionals, and future angel investors.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com