Table Of Contents

Vendor Financing Meaning

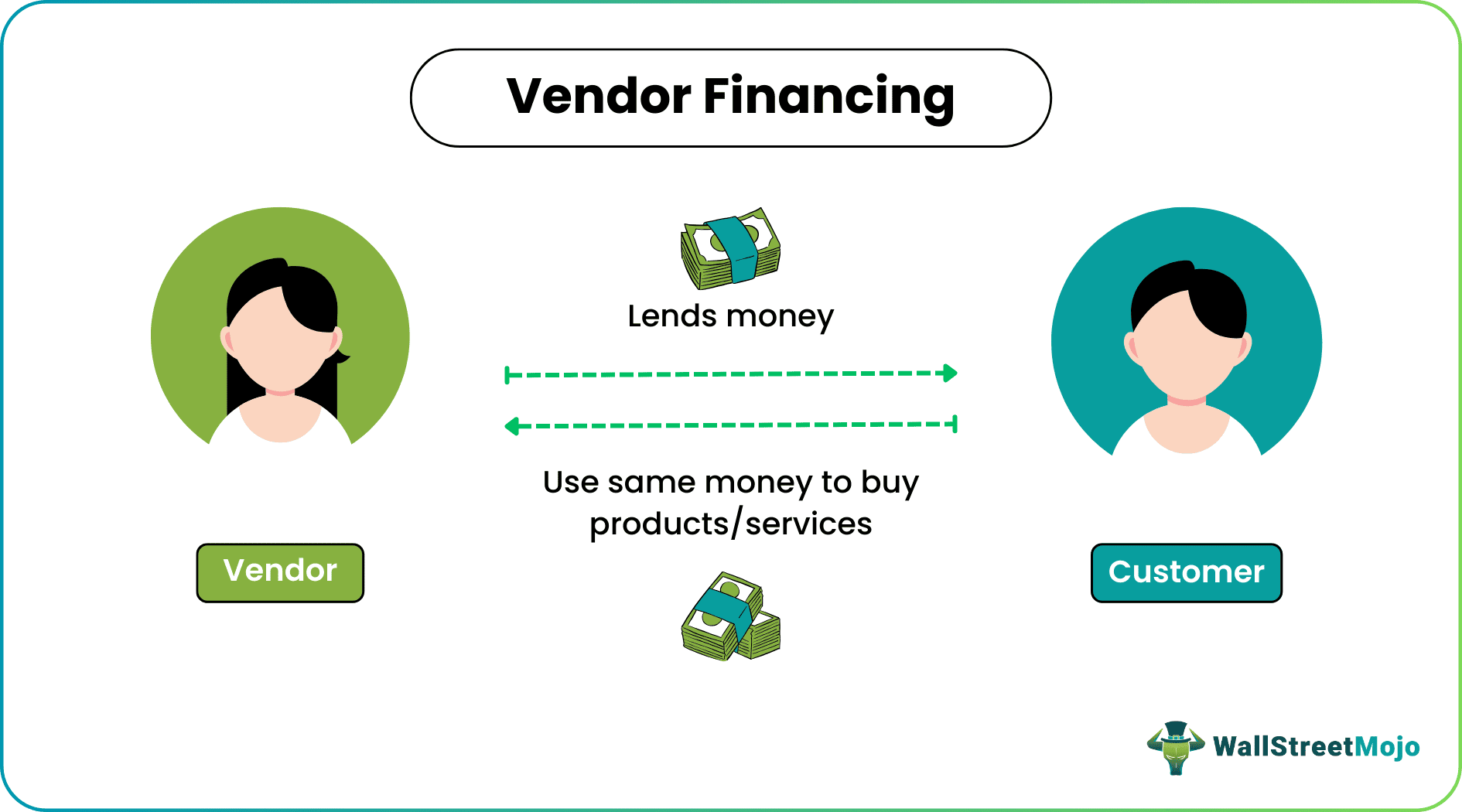

Vendor Financing, also known as trade credit, is the lending of money by the vendor to its customers, who use the money to buy products/services from the same vendor. Customers need not pay for the products upfront when buying the goods but after the product's sale. The vendor gives a line of credit to its customer based on their goodwill and rapport to pay for the products after a certain period or over a while.

Key Takeaways

- Vendor Financing is the lending of money by the vendor to its customers, who use the money to buy products/services from the same vendor.

- The two types of vendor financing are Debt Financing and Equity Financing. Debt financing involves the borrower receiving the products/services in debt, while equity financing involves the borrower receiving the products/services.

- It is important because it allows business owners to purchase the required goods and services without approaching financial institutions for funds, helps save interest on borrowed amounts

Types of Vendor Financing

#1 - Debt Financing

The borrower receives the products/services in debt financing at a sales price but with an agreed interest rate. The lender will earn this interest rate when the borrower pays the installments. If the borrower defaults, he is marked as a defaulter, and the loan is written down under bad debts.

#2 - Equity Financing

In equity financing, the borrower receives the products/services in exchange for the agreed number of the stocks. Since the vendor is paid in shares (upfront or at a particular time), the borrower need not pay any cash for the transaction to the supplier. The vendor becomes the shareholder and will start receiving dividends. The vendor will also make a major decision in the borrowing company as he is also the owner (to the extent of the number of shares held) of the borrower company.

Example of Vendor Financing

Assume a manufacturing company A wants to procure raw materials from company B worth 10 Million. However, company A can only pay 4 million to company B due to its liquidity crunch. In this case, company B agrees to give raw materials worth 10 Million after taking 4 million. For the remaining 6 million outstanding amount, company B charges the company a nominal interest rate of 10% for a certain period. Now company A can procure raw materials worth 10 million by paying 4 million upfront and the remaining 6 million in installments for 10% of the interest rate.

Importance

Vendor financing allows the business owners to purchase the required goods and services without approaching the financial institution for funds. This will help them save a good interest on the borrowed amount. Sometimes banks also ask for collateral to give loans which can be mitigated if opted for vendor financing. Moreover, the business owners can use the credit limit given by banks for other ventures (expansion, machinery, supply chain, resource). This will, in turn, boost the revenue. The crucial point is that it establishes a relation between a borrower and the vendor.

Not receiving cash for goods/services is not ideal for business, but making and generating sales is better. The vendor also earns interest on their financed amount. A small business firm often uses equity vendor financing, sometimes referred to as inventory financing. On giving the finance to the business owner, the vendor receives a vendor note mentioning all the particulars of the transactions and the terms.

Benefits

- The vendor increases his sales by a significant amount.

- The vendor earns interest on the outstanding amount with the borrower. This interest is usually higher than other financial institutions.

- The relationship with the vendor and borrowing company improves with better understanding.

- Borrower company provides shares to the vendor. In other words, it is offering partial ownership of the company.

- The transaction and the purchase of goods become attractive, thus bringing down price sensitivity.

- The procurement for the borrowing company becomes smooth and need not go in search of the lender to finance the transaction.

- The purchaser can buy goods that otherwise they cannot afford due to financial limitations.

- The borrower's cash flow is eased as they have fixed the outflow of payments for the next few years.

- Some vendors also provide leasing out options for borrower firms. This mitigates full payment and is very tax effective.

Limitations

- The main reason a borrower company opts for vendor financing is due to the liquidity cash crunch. Providing loans to such firms can lead to default in payment and the loan being counted under bad debt in the books of a lending company (vendor).

- The shares received by the vendor in case of equity financing can be of no value if the borrower company goes liquid and files for bankruptcy.

- Agent companies find the vendor to finance for the blue-chip companies. For the service, these agents charge a commission that is a cost and expense for the vendor's lending company. Sometimes they charge a commission to the borrowing company also.

- During a recession or when the economy is not performing well, companies usually choose to go for vendor financing to solve their liquidity problems and help their cause with working capital management.

- The vendor charges higher interest than the usual banks for the borrower when they know the borrower has limited options to finance the sales.

- The default risk has to be taken by the vendor. If the borrower defaults and doesn't make the payment, the vendor's profitability will hit.

Conclusion

Vendor financing is an excellent feature in business that a borrowing (customer) company and lending (vendor) company can make use of. The borrower can benefit from it in case of a liquidity crunch scenario, and the lender can lend to earn some extra cash through the interest rate charged on its customers. The vendor must be sure before availing of this option and take the risk if a borrower defaults on the payment or liquidates in a worst-case scenario. Thus, it is both a boon and a ban in the field of business, which should be executed with utmost caution and only upon requirement under certain conditions. If the transaction runs smoothly, this type of financing will only improve the relationship between a vendor and the borrower.