Table Of Contents

What Is Velocity Of Money Formula?

The velocity of money formula is the method of calculating the frequency with which a currency unit can be exchanged for purchasing the goods and services manufactured domestically during the specified period, i.e., it is the number of times money moves from one entity to another entity.

The currency may be dollars, euros, or any such currency used for exchanging or purchasing goods and services. It depends on the capacity of an individual or an economy to spend money. Consequently, the velocity increases with the rise in income or the necessity of transacting goods and services, sometimes leading to inflation.

Key Takeaways

- The velocity of money refers to the frequency with which a currency unit can be used to purchase goods and services produced domestically within the defined period.

- It is calculated using dividing the nominal gross domestic product by the average money circulated in the country.

- Some critics contend that prices should be resistant to change and that the velocity of money is not very stable.

- Market expectations will change when there is a change in the money supply, which will also impact inflation and money velocity.

Velocity Of Money Formula Explained

The formula for velocity of money explains the method of computing the economy’s currency circulation speed due to purchasing and exchanging goods and services. It can also be referred to as the currency supply turnover.

The formula used for calculating the velocity of money is as follows:

Where,

- NGDP = Nominal Gross Domestic Product - The Nominal Gross Domestic Product will be calculated first either using the expenditure method or income method or factor of production method.

- AM = Average amount of money that circulates in the country. This figure can be obtained from the central bank of the country.

The details given above helps in understanding what is the velocity of money formula.

Examples

Let us try to understand the concept with the help of some velocity of money formula example.

Example #1

Consider the nominal GDP of country Y is $2,525, and the average amount of money circulation in the economy is $1345. Then, based on the above information, you must calculate the velocity of money.

Solution

We are given both the nominal gross domestic product and average money circulation. We can use the below income velocity of money formula to calculate the velocity of money. Use the below-given data for the calculation.

Therefore, the calculation of the velocity of money is as follows,

=2525.00/1345.00

The velocity of money will be -

- The velocity of money = 1.8773

Therefore, the velocity of money is 1.8773.

Example #2

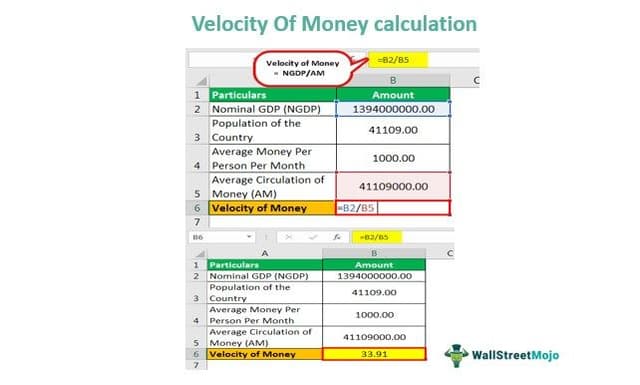

St. Maarten is a very small island near the Caribbean island. The average population on the island is 41,109, as per the latest census data available. Assuming that the average amount of money kept per individual per month is $1,000. The country's nominal GDP per the latest publicly available data is $1.394 billion. The finance minister was asked to calculate the money velocity of the country as the average growth has not crossed 2% for some of the last periods. The minister was advised to increase the money supply in the economy if the money velocity is below 50.

Based on the above details, we are required to use the income velocity of money formula to calculate the velocity of money and comment on whether more printing of the money would be necessary

Solution

We are given the Nominal Gross Domestic Product as $1.394 billion and average money circulation will be calculated per below:

Average Circulation of Money can be calculated using the below formula as,

The average amount of money per person in the economy x population of the country

=41109.00*1000.00

- Average Circulation of Money =41109000.00

Therefore, the calculation of the velocity of money is as follows,

=1394000000.00/41109000.00

The velocity of money will be -

- Velocity of Money = 33.91

Therefore, the velocity of money is 33.91 and since it is below 50, the country will be required to print more money.

Example #3

Another velocity of money formula example will give a better understanding. Economic Z is a special economy. Due to the recent war, two individuals have decided to start the business. One person named X has started a food business, and another named Y has started a clothing business. Following transactions had taken place during 1st month of that year when initially they had $300:

- X purchases food for $150 from Y.

- X purchases food again for $150.

- Y then purchases cloth from X for $200.

- Y then purchases cloth for his family from X for $100.

They continue these transactions for the next 11 months as well.

Based on the above information, you are required to calculate the velocity of money for this economy where currently only two traders are there.

Solution

The Nominal GDP would be $300 x 12 which is $3,600 as a nominal GDP. The average money that the economy had was $300.

Therefore, the calculation of the velocity of money is as follows,

=3600.00/300.00

The velocity of money will be -

- The Velocity of Money = 12

Therefore, the velocity of money is 12.

Therefore the above examples have cleared the concept of what is the velocity of money formula.

Relevance And Uses

To be more specific, the economists are of differing opinions on whether theformula for the velocity of money concept can be used to measure the country's health or the inflationary pressures. Some monetarists argue that the money velocity can remain stable during changing expectations. Still, when there is a change in the supply of money, that shall alter the market expectations, and subsequently, inflation and money velocity would also be impacted. For example, when there is an increase in the supply of money, that should theoretically also lead to a price increase commensurately as there is more supply of the money which shall be chasing a similar level of services and goods in the country.

Then there will be vice versa with a decrease in the money supply. But, on the other hand, some critics argue that the velocity of money is not very stable, that it keeps on changing, and prices shall be resistant to change, which shall result in an indirect link and weaker link between the inflation and supply of money in the short period.

If the supply of money increases, but there is a decrease in velocity, then GDP might even decline or stay the same. Conversely, the GDP could rise if the money supply has not increased, but the money velocity has increased.