Table Of Contents

What Is Variation Margin?

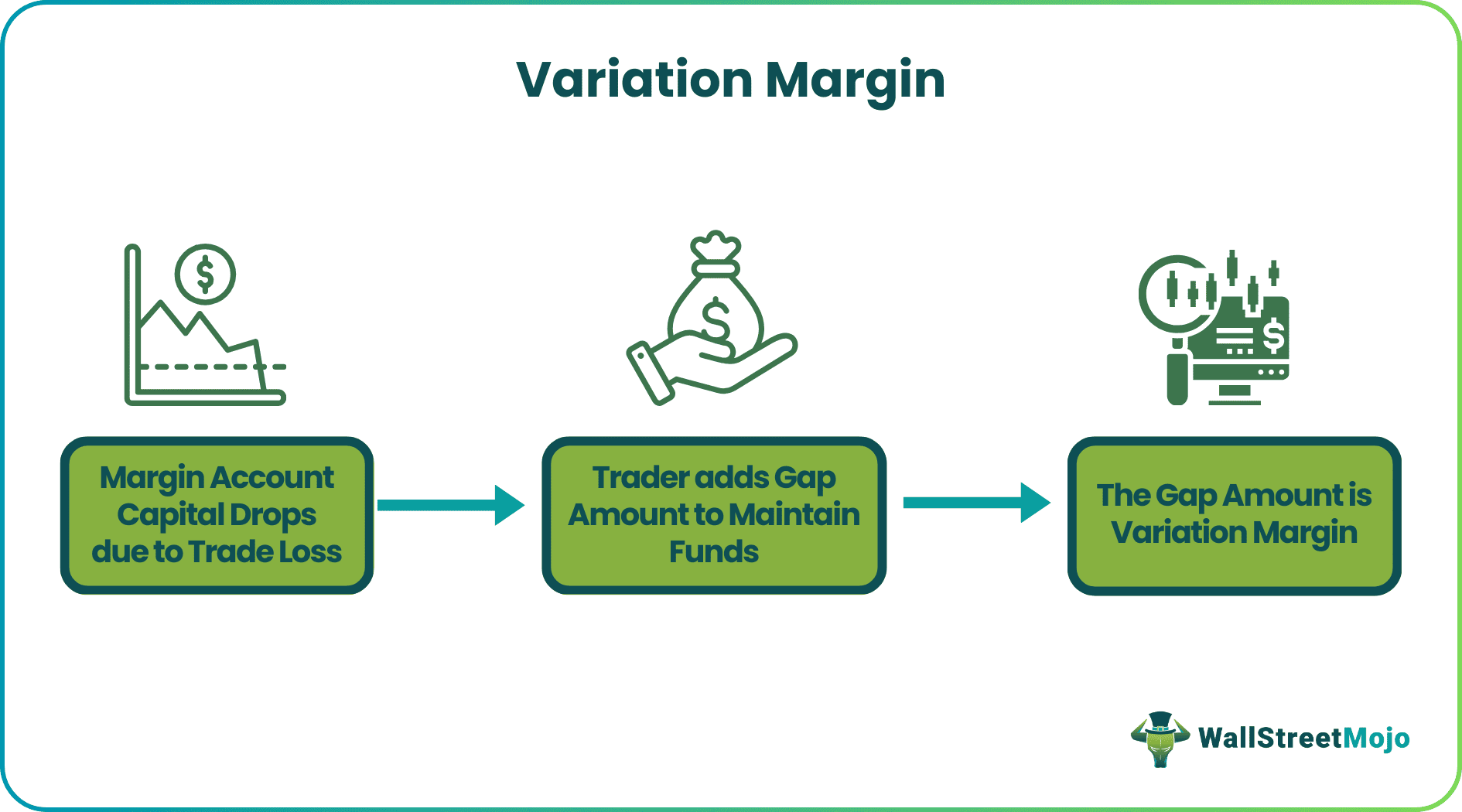

Variation margin refers to the intraday-based payments made by futures brokers into the margin account. The amount depends on the underlying securities’ type and its price movement associated with futures contracts to minimize the risk exposure from the ongoing trades. It shows the daily market value fluctuations.

Margin accounts allow the clearing members to trade on borrowed funds. Therefore, a certain capital must be available in the account to initiate the trade. If the capital drops from the required level, the broker must add the difference to return it to acceptable levels. It is done to cover the potential risks linked to trade.

Table of contents

- What Is Variation Margin?

- Variation margin refers to the minimum amount of funds required to maintain in the margin account to execute trading.

- The VM rules may differ from broker to broker but are settled daily based on the price movement and type of security.

- It works like collateral under the margin trading rules to avert the risk of an investor defaulting on payments or regulating balance.

- The clearing houses collect these payments from brokers to sustain their targeted risk level, maintaining the ability to offer debt to brokers.

Variation Margin Explained

Variation margin is the amount a margin trader deposits in their margin account to ensure that the right amount of funds is always available to support any potential loss from a trade underway. An investor can register high profits when it comes to variation margin futures contracts. But it is equally riskier if the price movement does not go in the anticipated direction.

The variation margin states that as per Federal Industry Regulatory Authority (FINRA), a trader must always avail a certain amount of funds to cover potential losses. If the capital drops by any amount, the investor must soon deposit the remainder to bring it back to the set level to avoid margin calls. Compared to general trading, future contracts have a higher degree of risk of losing money.

The variation margin protects the clearing houses and minimizes the exposure of risk that is always present in margin trading because the clearing members are already liable to pay interest on borrowed funds. On top of that, if there is a loss, it can become exponentially higher than the expected profits.

In simple terms, the variation margin collateral ensures that traders fulfill their obligations and minimum requirements. If a trader fails to balance the margin amount or defaults on payments, they can invite huge losses, penalties, and associated charges that may lead to legal actions against them.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Calculate?

The variation margin calculation is done on a transaction-by-transaction basis as it depends on the type of security and its price movement.

Variation margin = Initial margin - Margin balance

The three important factors to know here are -

- Initial margin requirement

- Maintenance margin requirement

- Underlying security’s current price

Examples

Check out these examples to get a better idea:

Example #1

Suppose Benedict is an old investor who often spots opportunities, and if he lacks proper funds, he buys securities using his margin account. Benedict recently bought 45 shares of a stock with a market price of $99 each. The total purchase amount becomes $4455. The basic initial margin is set at 50%, which means that Benedict has to bring in 50% of the cash, and the other 50% he can borrow from his broker.

Therefore, 50% of 4455 = $2227.5

The same amount should be in the margin account for the broker to execute the trade. Now suppose the maintenance margin of Benedict’s account as per his brokerage firm is $900.

If the share price declines to $89, the broker will deduct $450 in losses from the margin balance. The current initial margin balance left is $450. Again, the new initial margin amount requirement becomes $900. So Benedict should add another $450 as a variation margin payment to balance the new margin requirement.

Variation margin = Initial margin - Margin balance

Here, the initial margin balance is 900, and after the deduction for losses, the margin balance becomes $450

Putting the values in the formula

Variation margin = 900 - 450

=$450

This is a simple variation margin example. However, brokerage firms have separate rules, fees, and margin requirement percentages.

Example #2

The European Supervisory Authorities (ESA) published regulatory technical standards (RTS), which introduce new variation margin futures requirements for physically settled forwards under the European Market Infrastructure Regulation (EMIR) framework. The RTS revises and updates the current system and especially focuses on the variation margin rules regarding the OTC derivatives trades that go hand in hand with the BCBS-IOSCO standards, with broad and additional jurisdictions.

This explains how changes bring new order to the system. The current framework was brought into establishment on March 8, 2016, which was further taken as the delegated regulation by the European Commission on 4 October 2016. The new variation margin requirements align with the leading global markets and parallel the international standards under the Basel Committee on Banking Standards and the International Organization of Securities Commissions framework.

Variation Margin vs Initial Margin

- Variation margin refers to the amount paid when the security trading on margin declines in value. In comparison, the initial margin is the upfront cash paid to buy securities on margin.

- It is paid daily on intraday in cash. In contrast, the initial margin is paid before buying securities.

- The amount varies depending on the type of security and price movement. On the contrary, As per FINRA, there is a 50% requirement of the initial margin of the security’s market price.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The derivatives market has two types of collateral: the initial margin and the variable margin. Variation margin collateral is present in the OTC derivatives market to protect the parties involved in the trade. It is paid daily from one side to the other to reflect the trade’s current market value.

As per the variation margin definition, its value can be positive or negative. Compared to the positive value, the negative VM defines that a loss has been incurred, denoting a debit variation margin by the trade, and the margin funds are required in the margin account.

Maintenance margin is another term used for variation margin and is commonly used by investors involved in margin trading. It represents the minimum amount a trader must always maintain in their margin accounts. As per FINRA, the maintenance margin should be 25% of the market price of total securities held in the account.

Recommended Articles

This article has been a guide to what is Variation Margin. We explain the topic in detail including its comparison with the initial margin, calculation, & examples. You may also find some useful articles here -