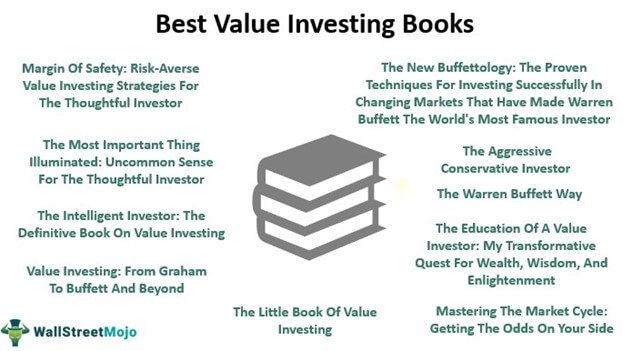

Top 10 Best Value Investing Books

Value investing refers to the investment approach where the investors only select stocks that are trading below their intrinsic and book value. Identifying and investing in such stocks takes a lot of calculation and knowledge of ratios, charts, graphs, and market cycles. Since it could be challenging for beginners and even professionals, there are multiple books from experts to help them.

The core idea of value investing lies in the fact that an undervalued stock over a long time will bring huge growth and tremendous returns to an investor. Many famous and wealthy investors like Warren Buffet have used the power of value investing and made a fortune. Summing up their tricks and tips, here are some of the best value investing books of all time –

- Margin Of Safety: Risk-Averse Value Investing Strategies For The Thoughtful Investor ( Get this book )

- The Most Important Thing Illuminated: Uncommon Sense For The Thoughtful Investor ( Get this book )

- The Intelligent Investor: The Definitive Book On Value Investing ( Get this book )

- Value Investing: From Graham To Buffett And Beyond ( Get this book )

- The Little Book Of Value Investing ( Get this book )

- The New Buffettology: The Proven Techniques For Investing Successfully In Changing Markets That Have Made Warren Buffett The World’s Most Famous Investor ( Get this book )

- The Aggressive Conservative Investor ( Get this book )

- The Warren Buffett Way ( Get this book )

- The Education Of A Value Investor: My Transformative Quest For Wealth, Wisdom, And Enlightenment ( Get this book )

- Mastering The Market Cycle: Getting The Odds On Your Side ( Get this book )

Let us walk through each of the books to understand the crux of value investing –

#1 – Margin Of Safety

Risk-Averse Value Investing Strategies For The Thoughtful Investor

By Seth A. Klarman

The book came out in 1991 and gave a detailed view of how investors should do value investing.

Book Review

The book deals with the idea of senseless investing and ranks high among the top value investing books. The author states that most of the people who trade in the stock market want to earn millions of dollars in the smallest period, and for this, they run into senseless trading and lose their hard-earned money. He highlights the smart investing rules and takes account of value investing rather than following a herd of investors.

Key Takeaways

- The book suggests investors take advantage of value investing and invest their money in the right direction.

- The author highlights the use and importance of margin of safety in investment.

- He points out how people make investment decisions close to gambling choices, risk factors, and certain rationales work.

#2 – The Most Important Thing Illuminated

Uncommon Sense For The Thoughtful Investor

By Howard Marks

The book was published in 2011 and compiled a list of comments and views of many famous investors. It is one of the best value investing books for beginners.

Book Review

The author of this book depicts second-level thinking. The book has insights into patient opportunism, market cycles, and risk assessment. In addition, the author explains the key to smart investing and the pitfalls one should avoid while making decisions about money and investments. It is the author’s wisdom that makes the book a smart choice for amateurs as well as advanced investors. He believes that it requires thoughtful attention to make good investments.

Key Takeaways

- The book discusses defensive investing, price/value relationships, etc.

- It is part memoir, subjective to investment, and very insightful.

- Each chapter has its richness of knowledge and essential information while investing.

- The author is known for studying and researching market trends and cycles.

#3 – The Intelligent Investor

The Definitive Book On Value Investing

By Benjamin Graham

Accordingly, the book is treated as the gospel of investment.

Book Review

In this widely acclaimed book, Benjamin Graham offers many strategies to use value investing. Famous investors like Warren Buffet recommend this book to new investors. Unfortunately, many investors have unrealistic expectations from the stock market and make losses. This book teaches how to calculate ratios and what charts and graphs must be kept in mind while selecting stocks. The book is lengthy and has many graphs, calculations, and visual representations.

Key Takeaways

- This is one of the best books ever written on investment, financial literacy, and the stock market.

- Benjamin Graham postulates some of the core ideas of value investing and how to pick stocks and ratios and do calculations and analyses.

- It is one of the most acclaimed and top value investing books of all time.

#4 – Value Investing

From Graham To Buffett And Beyond

By Bruce C. N. Greenwald, Judd Kahn, Paul D. Sonkin, and Michael van Biema

The book was released in 2001, and the authors provide an extensive guide on value investing. It also covers some of the best investments made by famous investors.

Book Review

The book single-mindedly focuses on value investing and explains its applications in the stock market. It has several case studies and stories to support the idea and importance of value investing. The book covers all the important points made by notable investors, from Benjamin Graham to Warren Buffet. In addition, the book highlights the power of compounding.

Key Takeaways

- The book talks about how value investing can make people wealthy in the long run.

- The authors talk about being patient and only investing in a particular type of stock based on the fundamental analysis.

- The book has many broad points to understand and stress over becoming a long-term investor.

- It ranks as one of the good value investing books for beginners.

#5 – The Little Book Of Value Investing

By Christopher H. Browne

The book came out in 2006, and the author ardently believes that even though there are numerous ways of making money in today’s world, value investing has proved its significance from time to time.

Book Review

The author advises investors that value investing is the practice of long-term investing in undervalued stocks. The book states that people need to invest but not be overly smart about it. The author speaks about intrinsic value and margin of safety to ensure that people use their money correctly and do not lose it.

Key Takeaways

- The book holds many key points for stock selection.

- The author talks about the mindset of rational investors.

- He guides investors to be under their circle of competence.

- The book is filled with lifelong lessons regarding investing, stocks, risk, profits, etc.

#6 – The New Buffettology

The Proven Techniques For Investing Successfully In Changing Markets That Have Made Warren Buffett The World’s Most Famous Investor

By Mary Buffett and David Clark

The book was published in 1997, and it was specifically written for investors in the bullish market. The authors in the book talk about effective Warren Buffet’s strategies.

Book Review

The book serves as a guide to Warren Buffet’s investment strategy and how new and amateur investors can follow the same to register long-term gains. It teaches people how to use financial information and determine its potential to ensure whether to invest in them or not. The book has step-by-step calculations and equations deciphering what stocks to buy and sell. It stands high on the list of top value investing books.

Key Takeaways

- The book is prominently focused on investments in bull market environments.

- It enables new investors with a roadmap of investment planning and execution.

- The authors provide insights on selecting stocks based on the Warren Buffet way of investing.

#7 – The Aggressive Conservative Investor

By Martin J. Whitman and Martin Shubik

The book was first released in 1979 and put forward the concept of cheap and safe investing strategies.

Book Review

The book contains simple and general ideas about investing. The authors discuss the power of long-term investing and emphasize compounding. The book can be read by any amateur or professional investor. The authors provide a brief idea of how street people with a simple understanding of the stock market can invest in the right stocks. They also talk about the changes that have come in value support.

Key Takeaways

- The book sheds light on the general approach and mindset to successful investing.

- The authors motivate people to think straight before making any investment decision.

- They believe that anyone with a simple understanding of the market can understand the risk issues and prevent them from happening.

- The book consists of several case studies about value investing.

#8 – The Warren Buffett Way

By Robert G. Hagstrom

The book was originally released in 1995, and the author takes the reader inside the life story of Warren Buffet with some of the best investment decisions he has made.

Book Review

The book’s initial chapters tell the story of Warren Buffet, and later, it takes the reader on a journey of financial literacy and wealth management. With the help of this book, the author gives four principles – business, management, financial, and market. This book also tells the reader that Buffet learned many good tips from his friend Benjamin Graham, the well-acclaimed author of the book – “The Intelligent Investor.”

Key Takeaways

- This book is for investors, economics students, or someone interested in wealth management.

- It gives a brief idea and knowledge about the life of Warren Buffet.

- The author talks about the four important principles of investing.

#9 – The Education Of A Value Investor

My Transformative Quest For Wealth, Wisdom, And Enlightenment

By Guy Spier

The book was released in 2014, and from then on, many good investors have shown interest and taken some of the key tips from this book to get started with value investing.

Book Review

Guy Spier, the book’s author, shares the path he chose to become a value investor. The book accounts for his successful decisions and failures and how and what he learned from them. In addition, the author speaks about his consistency in starting a financial career and the roadblocks. The book provides ample knowledge of Wall Street practices and thus becomes one of the best value investing books for beginners.

Key Takeaways

- The book sheds light on how Warren Buffet’s investing method adds more meaning to life and not just in investments.

- It is like an inside story with different examples leading to investments.

- The author shares a glimpse of his finance career and investing journey.

#10 – Mastering The Market Cycle

Getting The Odds On Your Side

By Howard S. Marks

The book was released in 2018, and the author addresses the hidden logic behind identifying the market trends and patterns.

Book Review

The book talks about when people should take advantage of the market cycles. The author says that people are prone to investment risks and are accustomed to market rises and falls. Still, in certain ways, this book can help them move in and out of the market just in time to save themselves from bad decisions and huge losses. The book suggests people study past market cycles and try to make sense of them.

Key Takeaways

- The book addresses how the market rise and fall disrupt the economy and human psychology and behavior.

- It is a great book for traders and not primarily for long-term investors.

- The author shows how to identify market cycles.

- The book is beneficial from the point of in-depth market knowledge.