Table Of Contents

Value Investing Definition

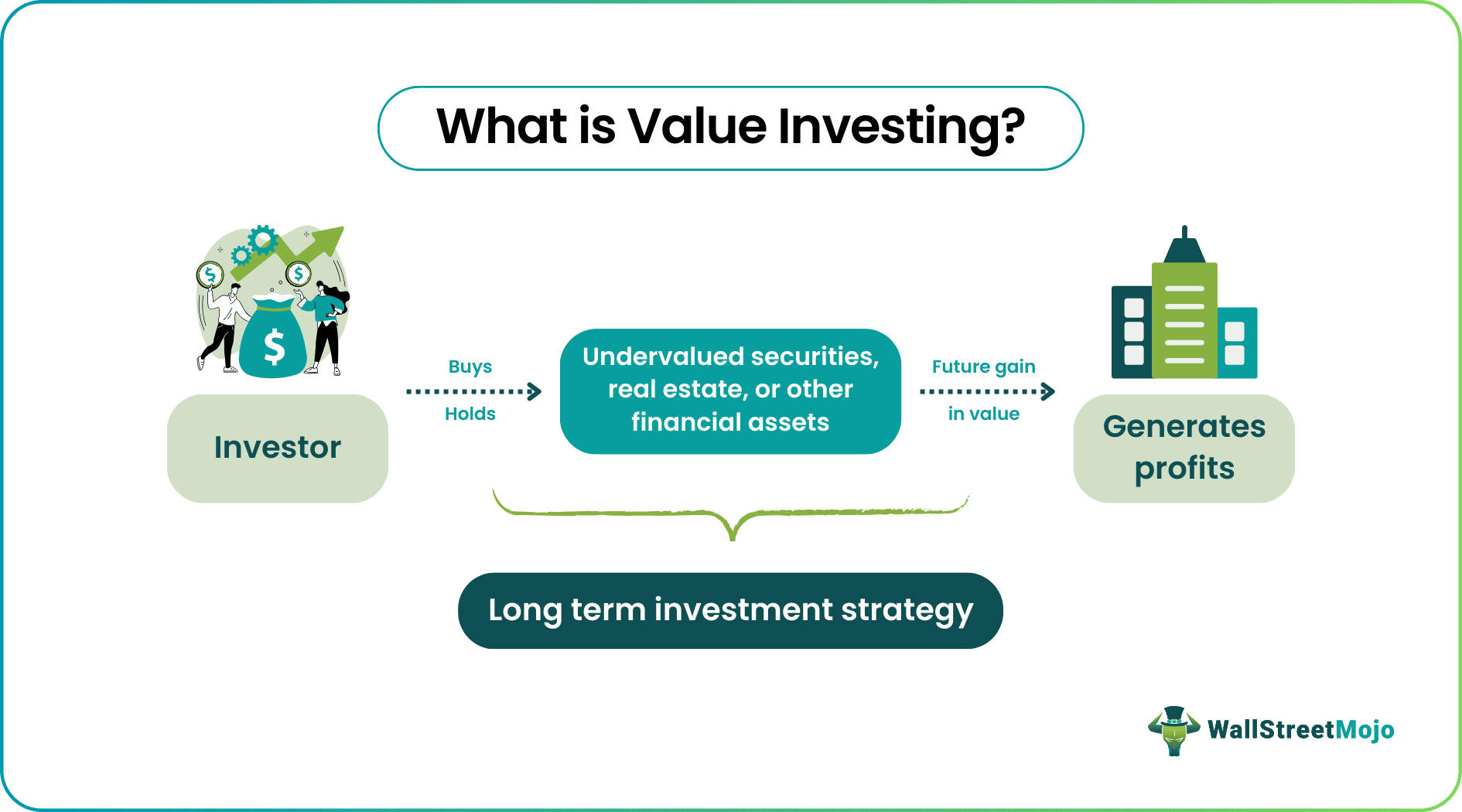

Value investing is a long-term strategy that involves buying and holding undervalued securities, real estate, or other financial assets. However, it is more prevalent in the stock market, where investors buy equities that trade below their intrinsic, inherent, or book value. Any future gain in value generates profits for investors.

This investment strategy requires buyers to conduct a comprehensive fundamental analysis of a company to determine its underlying value. Value investing entails analyzing financial statements and other metrics like P/E, P/B, PEG, D/E ratio, etc. Investing in underpriced stocks allows traders to build wealth from the price increase in the long run.

Key Takeaways

- Value investing is a long-term investment strategy that entails purchasing and keeping discounted shares, bonds, real estate, and other financial assets. Investors profit from any future increase in value.

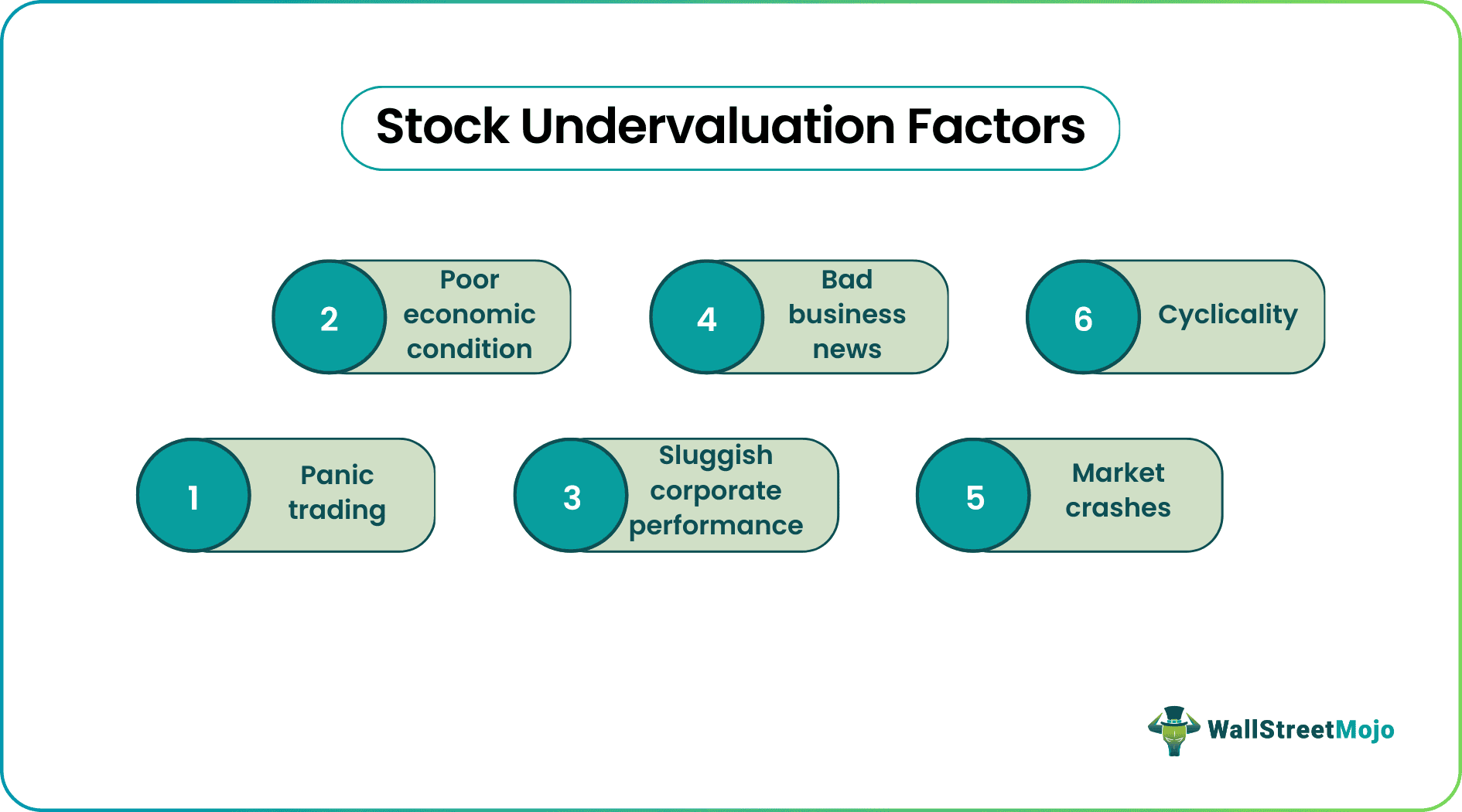

- The market undervalues a stock due to panic trading, the poor state of the economy, struggling corporate performance, not-so-good business news, market crashes, and cyclicality.

- Investors perform a comprehensive analysis of the company that includes analyzing financial statements, balance sheets, P/E, P/B, PEG, and D/E ratio to assess its underlying value.

- Value investing is not the same as growth investing, which is buying stocks that have a chance of outperforming the market.

How Does Value Investing Work?

Value investing strategy enables investors to buy stocks at discounted prices for the long-term and benefit from the market overreaction. These are the securities that are likely to be valued at a high price. Value investing differs from growth investing, in which investors invest in stocks with the potential of giving higher-than-average returns. The concept was first proposed by two American economists, Benjamin Graham and David Dodd, in 1928.

The market underestimates and overestimates an asset, depending on trading volume, economic condition, company performance, business news, etc. Other factors that can affect the stock performance include market crashes, cyclicality, and unpopularity. Investors keep a tab on these activities and invest in stocks on sale in the hopes of selling them at a higher price than their intrinsic value. In doing so, they follow the margin of safety principle to minimize the loss if the stock price declines post-purchase.

Margin of Safety = Intrinsic value - Current value

Assessing the intrinsic value of an asset necessitates an in-depth financial analysis of the company, including its revenue, brand value, business model, competitive edge, etc. Also, value investing considers the company’s position in the books, records, financial statements, and balance sheets. Despite having an excellent track record, some companies are undervalued in the market, presenting an investment opportunity before they reach or exceed their actual value. Hence, investors use value investing metrics to determine whether purchasing their stocks is worthwhile.

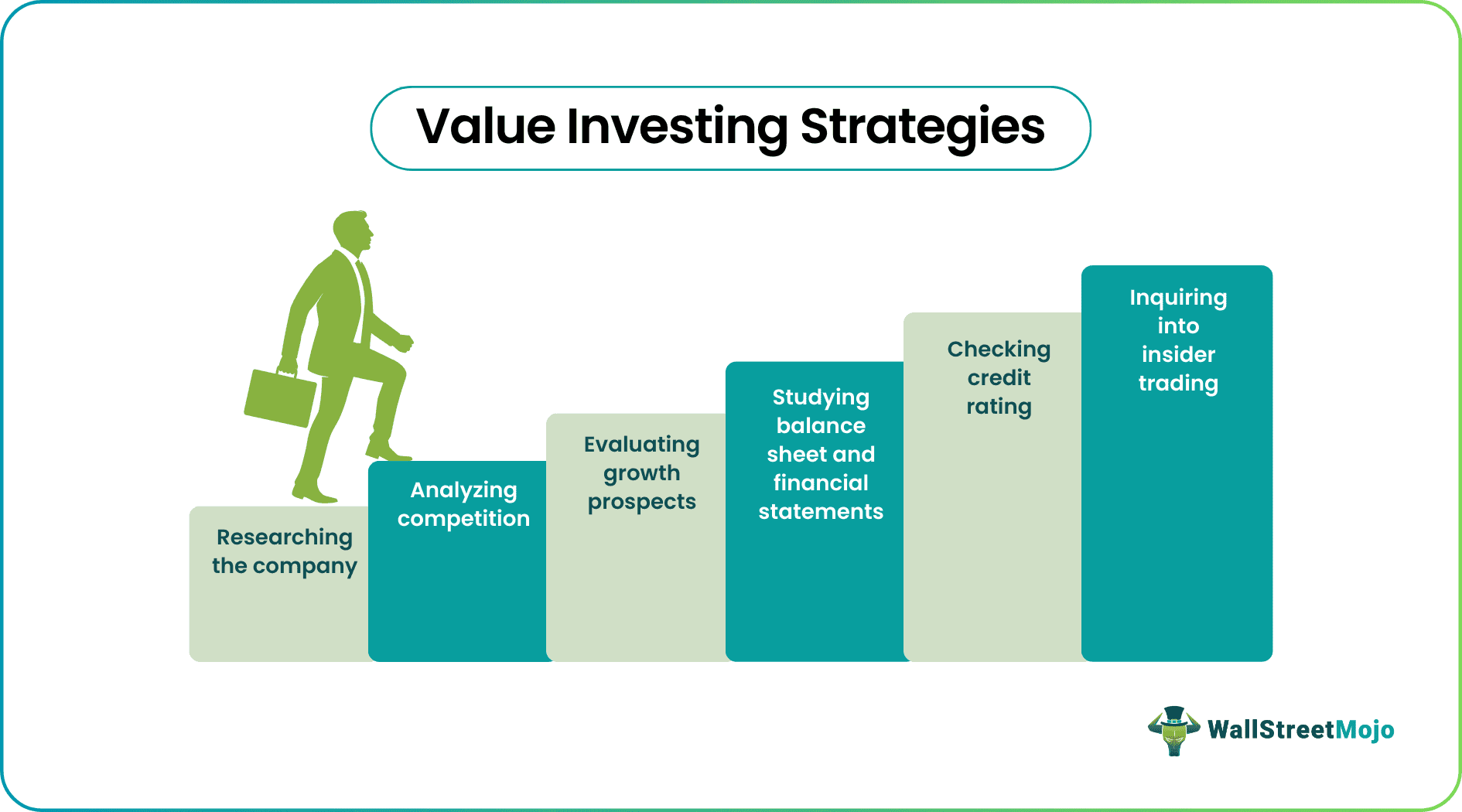

Value Investing Strategies

Investors need to adopt a well-thought-out strategy to get the most out of value investing stocks, such as:

- Researching the company history and reputation

- Analyzing its products and services and competitors

- Evaluating its growth strategies and prospects

- Looking into its balance sheet, i.e., assets, liabilities, and equity

- Studying its financial statements for operating expenses and business profits

- Examining its credit rating and involvement in any financial scams

- Investigating insider trading by company officials

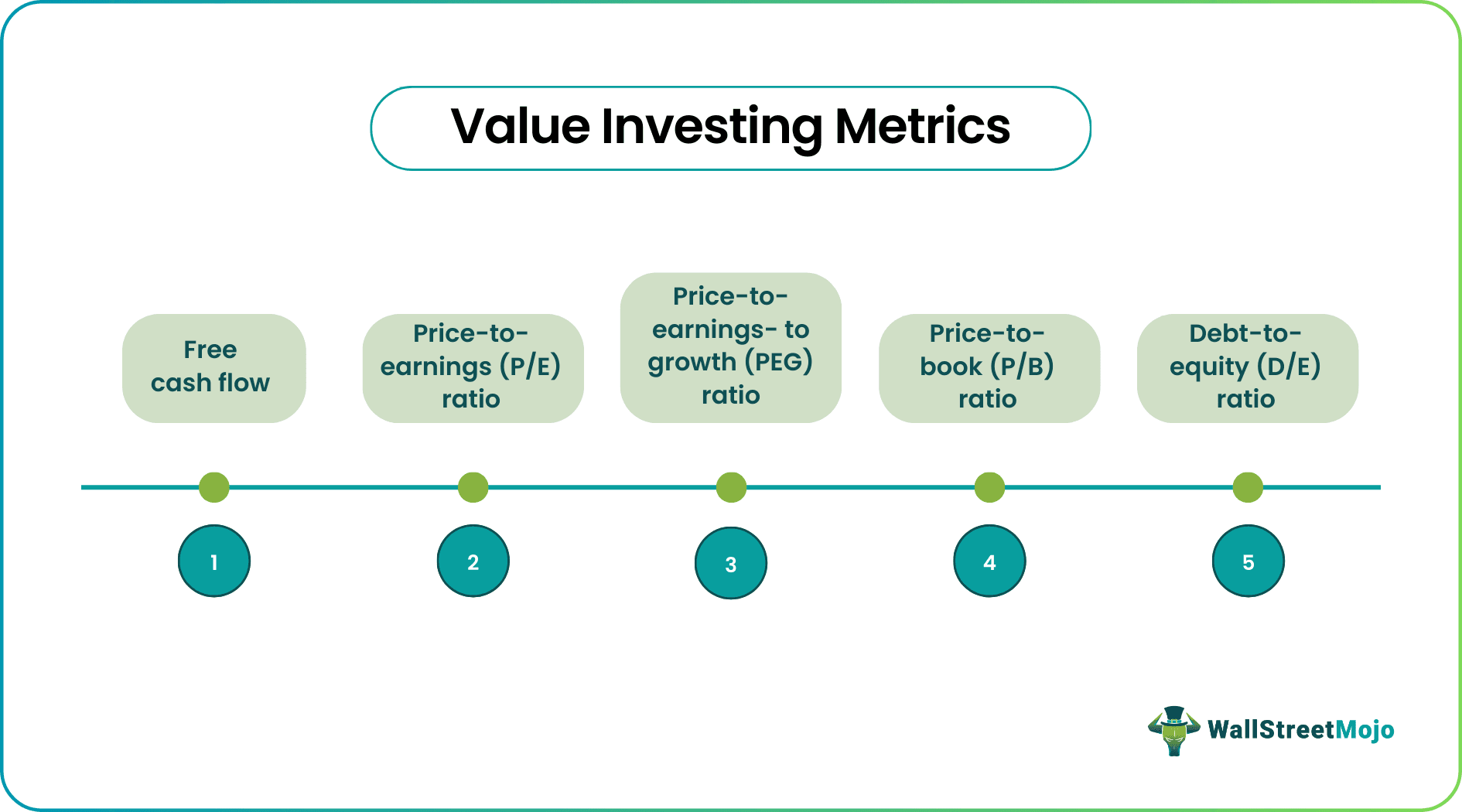

Value Investing Metrics

Value investors utilize different metrics to perform value investing, including:

#1 - Free Cash Flow

It determines the amount of cash available after paying operating minus capital expenses for the company administration, operation, and upkeep. It also aids in the payment of dividends, interest, and creditor debts.

Free Cash Flow = Cash for Operations – Capital Expenditures

#2 - Price-to-Earnings (P/E) Ratio

PE Ratio is the proportion of the market price of a company’s share to its annual earnings per share. In most cases, a smaller ratio indicates that the stock is cheap or value stock, and vice versa.

P/E Ratio = Market value per share / Annual earnings per share

#3 - Price-to-Earnings-to-Growth (PEG) Ratio

It is an enhancement to the P/E ratio since it considers the company's unanticipated growth returns. The PEG ratio is often considered one of the most accurate indications of a stock's underlying value.

PEG Ratio = P/E ratio / EPS Growth

Here, EPS denotes earnings per share = (Net Income – Preferred Dividends) / Average Common Shares

#4 - Price-to-Book (P/B) Ratio

Price to Book Value compares the market value of a company's assets in the financial statements and book with its stock price. If the share price remains lower than the book value or below 1, it signifies the undervalued stock.

P/B Ratio = Market price per share / Book value

Here, Book Value = Company’s net worth (assets – liabilities) / Total outstanding shares

#5 - Debt-to-Equity (D/E) Ratio

Debt to Equity Ratio gauges the financial stability of a company based on its current liabilities and shareholder equity. Calculating a company’s assets backed by debts is difficult as they vary from one industry to another.

D/E Ratio = Company’s total liabilities / Shareholder equity

Learn value investing in detail from the comprehensive course of Financial Modeling and Valuation of WallStreetMojo, that has been designed keeping in mind the complexities and intricacies of finance. This course will give a robust insight into the current worth and future opportunities of a business and prove why it is worth investing in it. It will teach the required skill-set and techniques that will help in organizing data in a way that can be interpreted for decision making. Given below is a snapsnot of how the explanation process will take place within the course bundle.

Examples

Let us look at the following examples to understand the value investing strategy better:

Example #1

Richard, who has only recently begun investing, is unfamiliar with stock exchanges and financial markets. To diversify his portfolio, he invested some of his money in blue-chip and midcap stocks. He wishes to invest a significant amount of money in equity for a long time, making value investing rather than direct investments.

A new food service company launches its initial public offering (IPO) on the stock market at a lower price. It sparks speculation that the firm will underperform in the stock market. Richard, on the other hand, has a different opinion. So he starts researching the company, examines its records, balance sheet, financial statements, and prospects based on various value investing metrics.

The fundamental analysis concludes that the company stock is undervalued. However, it has tremendous potential for high market returns. So Richard invests a significant sum of money in the company's stock, and five years later, he earns far more than he anticipated.

Example #2

In the first quarter of 2021, value stocks in the United States grew dramatically, supported by the resurgence in technology equities. It happened due to investors buying shares in companies in the hopes of prices going up post the COVID-19-affected U.S. economy. However, the growth was akin to the financial crisis of November 2008, as it remained 11% below their historical average market discount.

These stocks traded 74% cheaper than growth equities, as measured by the Russell 1000 value index. Besides, Credit Suisse predicts corporate earnings to expand by 26.4% in 2021, while the Federal Reserve forecasts the U.S. economy to grow at 6.5%.