Table Of Contents

Value Date Meaning

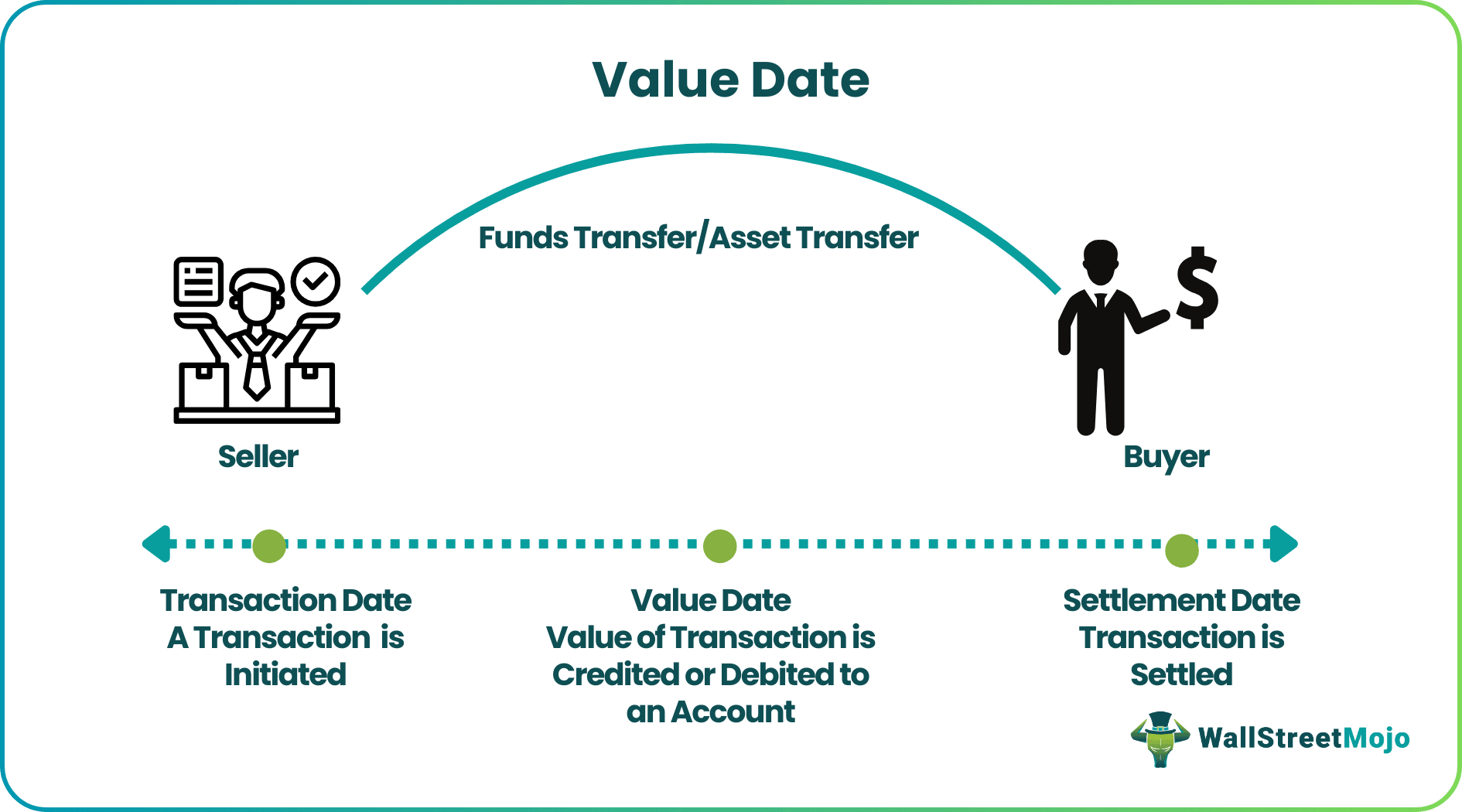

A value date is a future date on which a transaction, asset, or fund becomes effective. It is a crucial date in banking, trading, and accounting. Value dates are particularly important when discrepancies arise due to differences in asset valuation timing.

The value date is also used to estimate the present value of an asset that is expected to experience price fluctuations in the future. As a result, it plays a crucial role, particularly in options contracts, forward currency contracts, and derivatives. The concept is also relevant in forex markets for trade settlement purposes.

Table of contents

- Value Date Meaning

- The value date refers to the date a financial transaction, such as a wire transfer or foreign exchange transaction, is considered effective and final.

- It is important because it determines when the recipient can access the funds, when the sender's account will be debited, and when the exchanged currencies will be delivered and exchanged in a foreign exchange transaction.

- It is agreed upon by the parties involved and may differ from the transaction date or the settlement date.

- It can have implications for things like interest accrual, currency fluctuations, and cash flow, so it's important for all parties involved to be clear on the agreed-upon value date and any associated deadlines.

Value Date Explained

The value date implies the potential date of a finalization of a transaction or purchase of asset, or maturity of a fund. It is important in finance, banking, accounting, trading, etc. But it indicates slightly different things in each of these areas. So let's look at them in detail.

- Banking: The bank value date is when the amount from an actual transfer is realized in the account holder's account. In this regard, it is also the date when the bank estimates that this realization will occur. Banks also use this parameter to estimate the interest payment date. Let's understand how this works in checks. When an accountholder in a certain bank (payee) deposits a check, the payee's bank doesn't immediately receive the funds from the payor's bank. Instead, it might take one or two days. However, if the payee tries to withdraw or use the funds for their purposes before their bank receives the funds, the bank would have a negative cash flow. Thus, to avoid this situation, the payee's bank estimates when the payor's bank would transfer the amount, and the payee would only be able to use the funds after this value date.

- Trading: Firstly, the value date is when the price is determined for an asset that fluctuates in price. Secondly, for bonds, it is the date when the interest is calculated. Finally, it plays an important role in forex transactions. It is when a certain trade can be expected to be settled. In forex forward transactions, the value date is when the parties agree upon delivery and transfer of ownership; therefore, it is the delivery date. In spot trades, it is the date when the currencies are traded. This usually falls two business days after the transaction date due to differences in time zones.

- Accounting: The value date in accounting can be when the transaction is realized or when the funds become effective. The amount is reflected in the receiver's bank account on this date. Similarly, interest accrual and deferral calculations are also based on this date.

Examples

Here are some examples.

Example #1

Karen writes a check for $1000 to Kate on Tuesday. Kate deposited the check in her bank on the same day at 4 p.m. Kate's bank estimates that the amount from Karen's bank will be received on Thursday. Thursday would be the value date, as the bank expects the fund transfer on that particular day. Therefore, Kate will be able to use the funds only after Thursday.

Thus, if the bank receives the funds on Thursday, and Kate can use the amount (credited to her account), it would be the value and settlement date. However, if the funds are transferred on Friday at 4:59 p.m. but Kate's account is credited only on Saturday at 9:05 a.m., that would be the settlement date.

Example #2

The following information identifies the value, transaction, trade, and settlement dates.

- Luke buys a laptop from xyz.com on Saturday night and pays immediately.

- The amount is deducted from Luke's account instantly.

- xyz.com's bank receives the amount on Monday.

- xyz.com's account is credited on Tuesday.

Trade date = Saturday

Transaction date = Saturday

Value date = Monday

Settlement date = Tuesday

Value Date vs Trade Date vs Settlement Date

Value, trade, and settlement dates are important timeframes in banking and trading transactions. However, there are important distinctions that need to be understood.

- The trade date is when a particular order is placed or the transaction for that particular order is executed from the payor's end. The value date is when the payee's bank estimates the receipt of that amount from the payor's bank. Thus, the payee's bank will most likely receive the amount on this date. Finally, the settlement date is when the transaction is finalized or completed; thus, the payee's account is credited.

- Usually, for stocks and bonds issued by companies and forex trade, the settlement date comes after two business days following the transaction date (T+2). On the other hand, it is T+1 business day for government securities.

- The value date usually coincides with the settlement date but is not always necessary. This is because the former can fall on weekends or holidays, but the settlement date has to be a working or business day.

- In the case of assets, the transfer of ownership is finalized on the settlement date.

Frequently Asked Questions (FAQs)

In foreign exchange, it is the date on which the two parties involved in the transaction agree to settle their respective obligations. In addition, it represents the day the exchanged currencies will be delivered and exchanged at the agreed-upon exchange rate. Therefore, the value date is important for determining the settlement amount and the date each party will receive the exchanged currency.

Value date and posting date are two terms used in banking to refer to different transaction stages. The value date is when the funds involved in a transaction become available to the receiving party, while the posting date is when a transaction is recorded in an account. In other words, the value date is when the transaction is considered complete, while the posting date is when it is recorded in the account.

The value date in a wire transfer refers to the date the fund's transfer is considered effective and final. It is the date when the recipient can access the funds, and the sender's account will be debited. This date is important for both parties involved in the wire transfer.

Recommended Articles

This has been a guide to Value Date and its meaning. We compare it with the settlement date and trade date and explain it with its examples. You can learn more about accounting from the following articles –