Table Of Contents

Value Added Tax (VAT) Definition

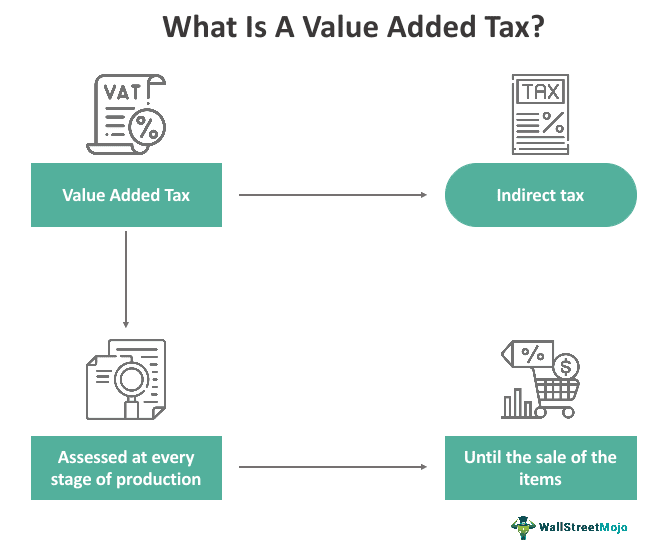

Value-added tax (VAT) is an indirect tax that is charged at the time of consumption of goods and services and is levied when a value has been added over various stages of production/ distribution, right from the purchase of raw materials till the final products are sold to the retail consumers.

The VAT is levied on the cost of the products at each stage, and its full burden is borne only by the final consumer since the product producer or supply chain distribution members can take the credit of VAT paid by them. (i.e.) until the purchaser is not the end-user, the goods procured are the cost to the business, and the tax paid on those purchases can be reduced from the tax they charge on their customers.

How Does Value Added Tax Work?

Value added tax is levied based on the consumption of goods and rather than the income of the consumers. VAT is one of the most effective tax systems. In underdeveloped and developing countries, it makes significant revenue contributions to the government as it is in the form of consumption tax. In VAT, tax evasion can be avoided, unlike sales tax, where it is easy to fiddle with. It brings a balanced tax system in the country. It also ensures fairness and uniformity in the process.

VAT is an incremental tax form, which is levied at every stage of production from distribution to shipment to the sale of the products. Also known as the Goods and Services Tax (GST) in some nations, this tax gives payers an opportunity to pay VAT for only the portion for which the VAT is not already paid. This is done by subtracting the paid VAT from the total VAT applicable. Hence, there is no double taxation here.

As VAT is a consumption-based tax, it is an additional burden to the end consumers. This tax is added to the price of the products, and the end consumer cannot avail of any credit or set off for the VAT paid by them. Therefore, it may affect the consumption pattern of the consumers, and demand & supply for the goods may vary. Though it contributes revenue to the government, it may reduce the purchasing power of the consumer, and it can cause revenue loss to the economy as a whole. Tax will be considered as inefficient if the revenue lost because of the shift in demand is more than the revenue gained by the government by levying VAT. It is also known as a deadweight loss.

Objectives

Value added taxes have been introduced to maintain uniformity in the tax system so far as buying and consuming goods and items are concerned. The tax levied on the products and services until they are sold remains the same for the entire state and hence there is no discrepancy. As a result, the tax paid for a product in Region 1 of the state would be the same for that product being bought in Region 2 of the state.

Secondly, VAT constitutes one single tax for products and items making it easier for the poor to have a lenient tax to pay on their required goods. This tax is levied at every stage of production of the products and hence no multiple points exist to add taxes on the items. As VAT has no cascading effect, those who are economically deteriorated also get a chance to pay less tax for products and have a good lifestyle.

Features

The features of VAT can be classified, considering how it is applied to the products and services. Here is a list of a few of them:

- VAT is charged on a wide range of items, hence it broad-based.

- It is a multi-stage tax as it is charged and collected at all levels of the economy.

- It is a consumption tax that is transferred to consumers with the products and services they buy.

- It is applied to import value, but not to the value of exports.

- It is levied on every supply of items, be it business-to-business, business-to-consumer, or government transactions.

Types

Value added tax normally exists in three forms – intake kind, income kind, and Gross National Product (GNP) type.

Intake Kind

It is the consumption tax levied on the consumption costs of items and services. Also known as the usage kind of VAT, it omits the resource items from the tax base of a year that are purchased from different firms. The depreciation cost is also not subtracted from the taxes firms are liable to pay.

Income Kind

Income or earnings kind, unlike the usage kind VAT, does not exclude resource materials bought from other companies from the tax base calculated for the year. However, the depreciation cost is excluded from the tax base of the subsequent years.

GNP Kind

This includes all materials purchased by a firm from another company in the tax base for the year. This tax is levied both on gross investment and intake. The base for this tax computation is Gross Domestic Product or GDP.

How To Calculate?

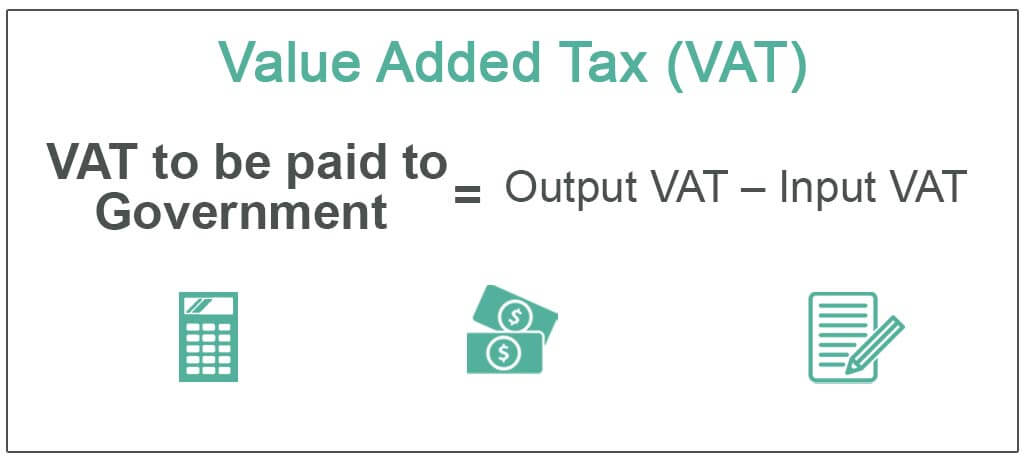

The mathematical expression that is used to calculate VAT is as follows:

VAT to be paid to Government = Output VAT – Input VAT

- Output VAT = It is a tax charged on the sale of goods. It is charged on the selling price of the goods.

- Input VAT = It is the tax paid on the purchase of goods. It is paid at the cost price of the goods.

Examples

Let us consider the following example to understand what is value added tax:

Example #1

Theo is a chocolate manufactured and sold in the US. The US has a 10% Value added tax.

- Theo’s Manufacturer procures the raw material at the cost of $10, plus VAT of $1 – payable to the US government. The total price paid is $11.

- The Manufacturer sells Theo to a retailer for $20 plus a VAT of $2 totals to $22. However, the Manufacturer pays only $1 to the US government as that is the total VAT to be paid at this point because the output VAT $2 is reduced by the input VAT of $1 paid during the procurement of raw materials. $1 paid represents the VAT on value addition made in the cost price of $10 ($20 – $10)

- The retailer then sells Theo to the end consumer for $30 plus a VAT of $3 totals to $33. The retailer pays $1 to the US government (Output VAT $3 reduced by the input VAT paid to Manufacturer $2). $1 paid represents the VAT on value addition made in the cost price of $10. ($30 -$20)

Example#2

Polo is a branded shirt in the US. The Rate of VAT/ sales tax in the US is 10%.

Without Any Tax:

The Manufacturer of Polo spends $20 in raw material to manufacture the shirt, then the same is sold to a retailer for $30, and the retailer then finally sells the shirt to the end consumer for $40.

With Sales Tax:

With the above example, the input cost for the Manufacturer will be $20. The same would be sold to a retailer at the price of $30, and the final price charged to consumers is $44 (Cost price 40 plus VAT @10 % is $4, so totals to $44). This consumer pays Sales tax of $4. The retailer collects the tax from the consumer and pays it to the government.

With VAT:

With the above example, the Manufacturer will pay $22 for raw material ($20 cost plus $2 VAT), the Manufacturer will take $2 VAT paid as input credit. The same would be sold to retailers by manufacturer at the price of $33 (Cost price + valued-added = $20+ $10 = $30 plus VAT @10 % is $3 so totals to $33). Here the manufacturer pays $1 to the government ($3 output VAT – $2 input VAT) and the final price charged to the consumer is $44 (Cost price + valued-added = $30+ $10 = $40 plus VAT @10 % is $4 so totals to $44). Here the retailer will pay $1 to the government ($4 output VAT – $3 input VAT). Though tax is collected at various stages, the end consumer bears the full tax of $4.

So both in VAT/sales tax, the tax amount remains the same, and it is borne only by the end consumer, but the preference is given to VAT since it is levied at every stage and every participant in the mechanism acts a tax collector for the government and tax evasion is minimal in it. It is more sophisticated than the sales tax.

Advantages and Disadvantages

VAT is levied on goods and services, at every stage of their production and it has its own set of advantages and disadvantages that one must know of:

Pros

- Revenue to the government under the VAT system will be constant as it is a consumption-based tax.

- It ensures better tax compliance and tax evasion is reduced to the extent possible due to its catch up effect.

- Revenue earned by the government via VAT is huge, as it is a low tax rate that is applied to the consumption of goods.

- The VAT can be monitored and administered more efficiently compared to other taxes prevailing.

- It is considered a neutral tax as it is levied on all types of business.

- Its laws and rules are very transparent, and the tax is collected over various stages in smaller parts.

- This tax is levied on the value-added at each stage and not on the total price, so there is no cascading effect.

- There are a number of taxpayers under this system as it is levied on various stages, and all the end consumers pay the tax on consumption irrespective of their income.

- The advantage to the government is that even for the goods which remaining in stock either with the distributor or retailer, the government receives part of the tax.

Cons

- VAT is a little complicated as the identification of value-added in each stage is not an easy job.

- Its implementation across the billing system can be expensive.

- It can be considered effective only when the end consumers are aware of the tax system; otherwise, tax evasion is possible.

- The manufacturer and distributors have to pay tax in advance as the payment of tax cannot be postponed till the goods are sold to end-users.

- End consumer doesn’t gain or lose anything in the VAT system as there is no credit for them.

- Since VAT is a tax on the expense, this tax is regressive in nature, and it affects the poor more than rich as they spend more proportion of their income.

VAT vs Sales Tax

Value added tax and sales tax are taxes that are assessed on goods and services. However, there are a couple of differences between them, which have been listed below:

- VAT is levied on the goods and services to be paid by the next entity to purchase or use them, while sales tax is levied on the cost of products to be paid by consumers.

- VAT is a multi-stage tax system, i.e., it is paid at multiple levels as it passes through multiple users before getting sold to consumers. On the other hand, sales tax is paid only once when the customers buy the items.