Upon enrolling in this course, you receive multiple benefits with unlimited access to the course content and modules for one year. Plus, watch these modules anywhere, anytime, by signing into your profile. Last but not least, you receive a certificate of completion that further enhances your career opportunities in this field.

Valuation Course!!

Master discounted cash flow, trading comps, and valuation ratios with hands-on Excel training | Earn a recognized certification | Enhance your career prospects in finance, investment banking, and equity research.FLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS OF VALUATION COURSE

Highlights of the Course

365 Days Access

365 Days Access : Learn at your own pace with one-year unlimited access.Comprehensive Learning

Comprehensive Learning : Covers DCF, valuation ratios, WACC, and more.Downloadable Excel Templates

Downloadable Excel Templates : Get hands-on experience with built-in tools.Certification of Completion

Certification of Completion : Enhance your resume with industry recognition.Career Growth

Career Growth : Improve job prospects in finance, investment banking, and equity research.Excel-Based Applications

Excel-Based Applications : Work with financial models like a pro.HURRY UP!

Unlock Premium Course Benefits Worth $499+!

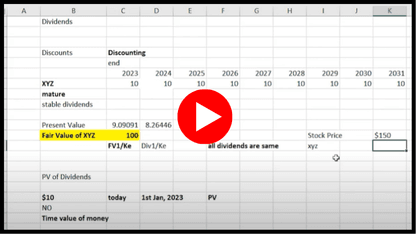

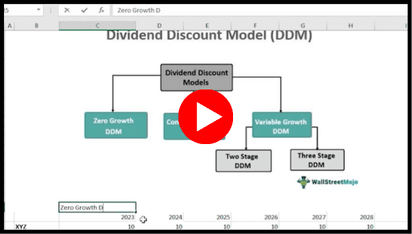

Dividend Discount Model

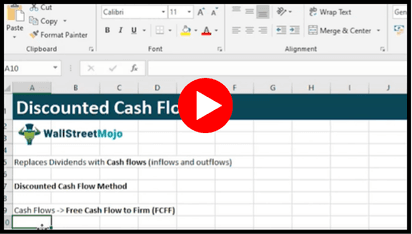

Dividend Discount Model : Master DDM with real case studies.Discounted Cash Flow Analysis

Discounted Cash Flow Analysis : Learn DCF valuation from scratch.Relative Valuation Techniques

Relative Valuation Techniques : Understand P/E, EV/EBITDA, and other multiples.Sensitivity & Scenario Analysis

Sensitivity & Scenario Analysis : Evaluate risk and market conditions.Financial Modeling Tips & Tricks

Financial Modeling Tips & Tricks : Build valuation models like a pro.VALUATION COURSE PREVIEW

Sample Videos

COURSE INSTRUCTOR

Learn Directly From The Industry Expert!

Dheeraj Vaidya, CFA, FRM is the Co-Founder & Course Director of WallStreetMojo.

With an extensive background as a former J.P.Morgan and CLSA Equity Analyst, Dheeraj brings expertise in financial modeling, forecasting, and valuations. Over the course of his nearly two-decade career, he has trained and mentored more than 100,000 students and professionals across various topics, including investment banking, private equity, accounting, and more.

BENEFITS AND FEATURES OF VALUATION CERTIFICATION COURSE

Explore the advantages

There are various career benefits available to those who complete this Valuation Course online. The advantages include —

#1 - Expertise:

With this finance Valuation Course, you will have an added advantage over your colleagues or other job applicants when applying for the analyst post. In fact, employers tend to choose candidates who have certifications demonstrating expertise in core finance areas of a business.

#2 - Skills development:

Witness a massive boost in your professional persona and skillset with this valuation course. Take your ability to analyze, forecast, and interpret financial data upgrades to the next level. Also, this course boosts your confidence concerning financial knowledge.

#3 - Real-World Application:

With the examples provided in the DCF training course, witness a practical application of the concepts in the industry. Plus, you also get familiar with useful Excel tools and tricks that can improve your work efficiency.

#4 - Career Enhancement:

After completing DCF training online and obtaining a certificate demonstrating the valuation skills, you could soon see a promotion or upgrade in your current position after your employer learns about this certification. Also, your salary may increase by a certain amount, too!

QUICK FACTS ABOUT VALUATION TRAINING COURSE

Industry Trends

SKILLS COVERED IN VALUATION TRAINING COURSE

What Will You Learn?

Enhance your knowledge in the finance domain with our valuation course which helps you develop company modeling and forecasting skills. Furthermore, gain analytical and presentation skills, which further help in communicating the details to the stakeholders. Also, get familiar with Excel tricks and tips to perform valuation quickly. Lastly, with a strategic thinking mindset make informed investment decisions regarding vital projects.

PROGRAM OVERVIEW FOR FINANCE VALUATION COURSE

Course Description

With this Valuation Course online, explore the dividend discount model, its types, sensitivity analysis, discounted cash flow (DCF), valuation ratios, and a simplified approach to the relative valuation model. It gives you a deep understanding of various types of dividend discount models (DDM) and helps in identifying companies for this model. More practically, sensitivity analysis can help in determining the cost of equity value and the company’s growth. However, the benefits do not end here.

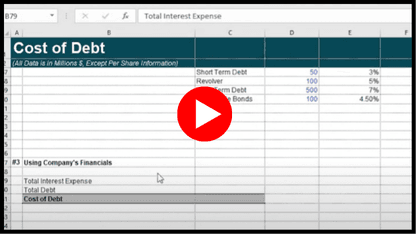

This valuation course acts as an excellent tool to calculate the company’s real value and how it is contributing to the stock price as well. With the different case studies, project the cash flow models and weighted average cost of capital (WACC) for the firms. Also, delve into the step-by-step approach of performing the DCF with the FCFE (Free cash flow to equity) model. Furthermore, get familiar with how to develop a company’s cost structure and calculation of terminal value as well.

ROLES FOR FINANCE WITH VALUATION CERTIFICATION

Career Options

#1 - Financial Analyst:

A financial analyst is a finance professional involved in creating financial models and forecasting financial statements as well. They are mostly hired by well-known companies like JPMorgan Chase, WellFargo, Amazon, Deloitte, and similar others. For the job role offered, the analyst receives around $79,018 and $98,193 annually, depending on the seniority level and other factors, for example, whether they have completed any online valuation training courses or any relevant finance certification program.

#2 - Equity Research Analyst:

Equity research analysts analyze financial information along with the different trends of different organizations and industries. They give an opinion or verdict to clients in their equity research report based on the analysis conducted and guide them on their investment decisions. Some of the popular hiring companies include Goldman Sachs, MorningStar, Barclays, CRISIL, and others. Individuals choosing this valuation career path earn around $76,997 per year plus some additional benefits.

#3 - Investment Banker:

Investment banking analysts have a similar job profile as equity analysts. However, they mostly run parallel with investment banking firms. For instance, they prepare financial models, perform financial analyses of companies, and likewise advise clients on buy or sell decisions. In addition, they also prepare pitchbooks for client meetings, including M&A and LBO pitchbooks. Some of the large investment banks like CitiGroup, JP Morgan Chase, HSBC, Credit Suisse, and others provide a higher salary of $132,932 annually to analysts.

#4 - Private Equity Analyst:

Another category of equity analysts is more connected with private firms. Here, analysts conduct research, forecast the performance of private firms (not listed on the stock exchange), perform ratio analysis, and give interpretations on private firms. Mostly, companies like Goldman Sachs, Blackstone, General Atlantic, and other private equity firms hire them. Generally, their average salary here is $94,063 on an annual basis.

#5 - Credit Analyst:

These analysts facilitate credit risk management by measuring the creditworthiness of the individual or a firm. They are generally employed by banks, credit card companies, rating agencies, and investment companies. A few popular banks include CitiGroup, American Express, Barclays, HSBC, and others. Here, the salary prospects range between $52,844 and $65,565 annually. Usually, completing certificate programs like the valuation course online can help one in getting a raise from their organization.

#6 - FP&A Analyst:

A Financial Planning & Analysis (FP&A) analyst is responsible for analyzing the various parts of the corporate industry for projecting the future financials and cash flow of the business industry. They work closely with the executive teams and help in strategic decision-making for the board of directors, like the CFO & CEO, etc.

On average, the salary of an FP&A analyst is between $61,248 and $73,933. However, with more years of experience and the acquisition of new skills through certificate programs like this finance Valuation Course, it can rise to $80k to $100k annually. Generally, companies like JPMorgan Chase, Amazon, Wells Fargo, and Deloitte hire individuals for this position.

WHAT WILL YOU GAIN FROM THIS VALUATION TRAINING COURSE?

Course Curriculum

Dividend Discount Model

Discounted Cash Flows

Relative Valuation

In this trading comp and discounted cash flow training, you will learn about different valuation methods like the dividend discount model, discounted cash flow (DCF), and relative valuation model. As the DDM method delves into the types and their stages, dive into the DCF model to understand concepts like WACC, cost of debt, cost of equity, free cash flow, and more. With the relative valuation method, get acquainted with enterprise value, terminal value, and various valuation ratios like P/E, P/BV, PEG, and more.

CERTIFICATION FOR THIS VALUATION COURSE

Earn a certificate on completion

As you successfully complete all exercises and pass the final assessment, you will receive a certificate of completion. It demonstrates your sufficient knowledge regarding the subject matter of valuation. Also, you must remember that you will gain unlimited access to the DCF training online course content, Excel templates, and related resources with 1-year validity.

For any further information or queries, feel free to contact us at support@wallstreetmojo.com. Don’t miss this limited opportunity to become the next financial analyst. Enroll now in this online DCF training program!

PREREQUISITES TO LEARN VALUATION TRAINING COURSE

What will you need?

Individuals need to meet specific requirements to take this finance valuation course online and develop a clear understanding of all the concepts. From basic knowledge of financial terms to having

- Familiarity with financial markets and company-related information

- Basic financial knowledge like financial statements, accounting principles, key ratios, and related concepts

- Good, stable internet connection

- Access to Microsoft Excel and knowledge about its basic tools

WHO ARE ELIGIBLE TO LEARN THIS VALUATION COURSE?

Who should attend?

TESTIMONIAL

What learners are saying

Got questions?

Still have a question? Get in Touch with our Experts