Table Of Contents

What Is A Valuation Allowance?

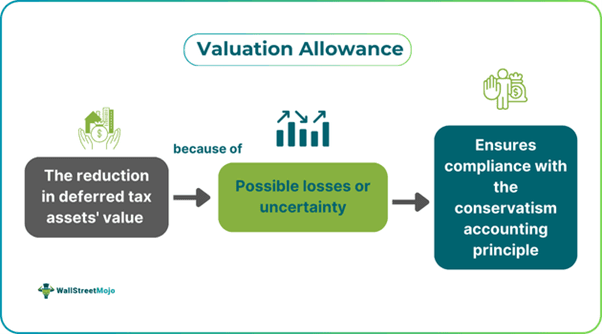

A valuation allowance refers to a decrease in the value of deferred tax assets owing to potential loss or uncertainty. It helps in complying with the conservatism accounting principle, which states that companies should not understate their liabilities and overstate their assets.

Usually, deferred tax asset valuation allowance is a contra account, which means it gets deducted from the actual account balance to display the net value. It helps in making adjustments to the deferred tax assets’ value on the balance sheet and raises the income tax expenses on the company’s income statement.

Key Takeaways

- Valuation allowance refers to lowering a company’s deferred tax assets when it is unlikely for a company to recoup a part or the entire value of those assets.

- This allowance is vital as it makes sure that a business adheres to the conservatism accounting principle.

- To calculate this provision, one must multiply the deferred tax liabilities by the difference between 1 and the expected realization rate.

- Valuation allowance on balance sheets raises the total tax expense, which typically implies an increase in the income tax provision.

Valuation Allowance For Deferred Tax Assets Explained

Valuation allowance meaning refers to a mechanism that offers a way to offset a deferred tax asset or DTA account. It serves as a check on an organization’s natural incentive to understate liabilities and overstate assets.

In case an organization is on a permanent or long-term slide into unprofitability, the accumulated DTA distorts the balance sheet by overstating the value. Unless the company becomes profitable again, those assets have no worth. The business cannot sell them and some other party cannot use them either. In this case, an adjustment is necessary to show that recouping all or some of the DTA is improbable.

For reconciling the organization’s actual value and the balance sheet, this allowance reduces the assets. With the removal of such “phantom” assets, the distortion concerning the company’s value is minimized. As a result, the values on the business’s balance sheet become more in line with the company’s actual value.

Precisely. The mechanism lowers the carrying amount of DTA to an amount that is more than 50% likely not to be realized. Note that the evaluation of taxes must occur to determine the requirement of the valuation allowance on balance sheets. Tax assets taken under consideration include the following:

- DTA resulting from tax temporary differences and cumulative book

- Tax attributes having finite carryforward periods, such as net operating loss carryforwards and tax credit carryforwards

In practice, organizations often record this allowance in a period where they report cumulative pretax losses, which are subject to adjustment for permanent items on the basis of the activities carried out over the past 12 quarters. In that case, companies typically do not factor in future income forecasts as positive evidence.

How To Calculate?

Computing this allowance is not a straightforward process. It involves a lot of estimation and judgment. That said, the following is a general formula that one may utilize to compute it.

Valuation Allowance = DTA (1 – Expected Realization Rate)

Note the expected realization rate refers to the percentage of DTA that a company anticipates that it will realize on a future date. One can project it by utilizing projections, historical data, or any other method. The expected rate may range from 0%-100% based on the uncertainty level and the available evidence’s weight.

When To Apply?

Per ASC 740 of the Financial Accounting Standards Board, the deduction of deferred tax assets by this allowance must take place for a portion of those assets not anticipated to be realized. For the realization of the DTA, companies need to have adequate income during the carryforward period for recouping those assets. Although this period is indefinite, it does not imply that DTA can stay on a company’s balance sheet indefinitely if there is very little chance of realization.

ASC 740 requires the application of this allowance if the negative and positive evidence’s preponderance suggests that the realization of all or a portion of those deferred tax assets will not occur. Per FASB guidance, coming to a conclusion that the valuation allowance on balance sheets is unnecessary is challenging if negative evidence exists. Some examples of negative evidence are as follows:

- Expiration or limitation of carryforward provisions or tax loss carryback

- A fall in demand or market share

- Change in tax regulations or laws that negatively influence tax benefits concerning deferred tax assets

Examples (1 For Calculation)

Let us look at a few valuation allowance examples to understand the concept better.

Example #1

Suppose Company ABC has a DTA worth $50,000, which mainly comprises net operating losses. The organization carries out operations in an uncertain and competitive market and has a track record of losses. It estimates the expected realization rate to be 20% on the basis of its tax planning strategies and projections. So, the company can compute the allowance using the above formula.

Valuation Allowance = $50,000(1-0.2), i.e., $40,000

This means ABC anticipates realizing $10,000 of the DTA only and has to create an allowance worth $10,000 to lower the DTA on the balance sheet.

Example #2

According to a report published on January 27, 2024, Tesla pulled a whopping $5.9 billion from its tax valuation allowance and increased its net income by 4 times the amount recorded in its Q4 earnings report, which was otherwise disappointing.

That said, the Austin, Texas-based vehicle manufacturer made it clear that it was not a case that involved cash infusing the profits. It was a long-awaited and necessary accounting activity that followed the pattern of organizations like Amazon as they achieved profitability.

The executives of Tesla told analysts that their accounting move did not depict earnings. In an earnings call, CFO Vaibhav Taneja emphasized that the maneuver was a one-off non-cash benefit because of their sustained profitability in recent times.

Effect On Income Tax Provision

Since deferred tax asset valuation allowance is a key element of the process concerning tax provision, it has a direct impact on the organization’s earnings, effective tax rate or ETR, and total expense. Precisely, the creation of this allowance negatively influences the deferred tax benefit, leading to a higher overall tax expense, higher ETR, and lower earnings. Note that a higher overall tax expense generally means a higher income tax provision.