Table Of Contents

What Is Unsystematic Risk?

Unsystematic risk is the risks generated in a particular company or industry and may not apply to other industries or economies. For example, the telecommunication sector in India is going through disruption; most of the large players are providing low-cost services, which are impacting the profitability of small players with small market shares. Small players with low profitability and high debt are exiting the business. As telecommunication is a capital-intensive sector, it requires enormous funding.

Key Takeaways

- Unsystematic risk encapsulates sector-specific uncertainties, as exemplified by India's telecommunications industry.

- Unsystematic risk finds its divisions in business risk and financial risk, delineating distinct facets of this industry-linked vulnerability.

- Unsystematic risk is a dynamic force, its impact fluctuating amidst different sectors. While specific industries wrestle with challenges that impact their financial well-being, the broader economy remains stable.

Types of Unsystematic Risk

It is classified into two categories, namely:

- Business Risk - Business Risk is related to the internal and external of a particular company.

- Financial Risk - Financial Risk is related to currency fluctuations, credit and liquidity risk, political and demographic risk, etc.

Examples of Unsystematic Risk

Example #1

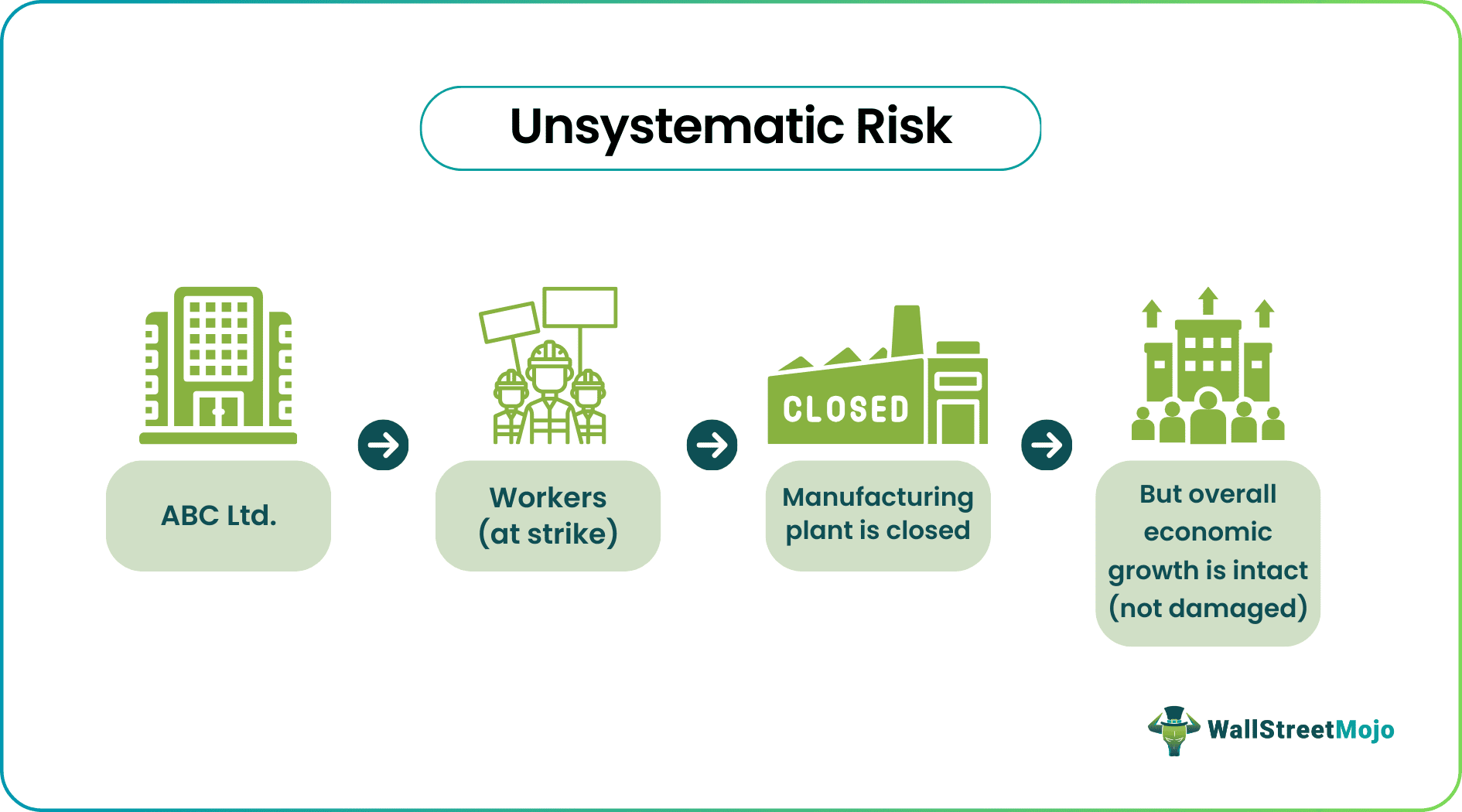

ABC Limited is an automobile manufacturing company based in Europe. Due to a recent strike by the workers of the particular region, the manufacturing plant is closed, and the production activities are stopped for a while. But the demand for automobiles is the same, and the overall economic growth is intact. Thus, the above crisis can be sorted by talking with the workers.

Example #2

Unsystematic risks occur in the case of large portfolios or funds under management. Suppose fund X has 15% exposure in the agriculture industry in Europe. Due to low harvesting conditions across Europe, commodity prices have jumped up, followed by a slump in demand and reduced yields for the farmers. It is a pure case of unsystematic risk, and the matter is related to the agricultural segment in Europe only. So, the portfolio manager can divert the funds exposed to the agricultural industry. The funds can be diverted to US consumption, as the sector has been going very strong recently.

Advantages

- It is strictly related to the particular business or the industry and does not impact the economy. As the nature of risk is business-oriented, the hazards can be controlled by taking several measures, unlike systematic risks.

- By diverting the portfolio or the business, one can avoid the risk and does not negatively affect the entire economy through systematic risks.

- Unlike systematic risks, the factors are majorly internal and can be removed by taking internal measures. While in case of greater unsystematic risks, the problems can be long-lasting, and the remedies can be capital intensive.

- The impact is less severe than the systematic risk, and the scale of impact is relatively lower. While in some instances, the effect of the risk can be painful.

- In the case of systematic risk, a large number of people, capital is involved, while in unsystematic risk, the number of people and the amount of funds is less. It is related to a particular sector that may not be repetitive; the evolution of new unsystematic risks are more than systematic risks.

Disadvantages

- Even if the entire economy is going fine, a series of unsystematic risks can act as a hazard to a particular industry or the business. The profitability may be impacted due to the series of disruptions to the business.

- Sometimes, the risks cannot be avoided due to geopolitical crises, and it takes a long time to settle. While due to lower productivity, investors and people in business feel the pinch as the demand for the product diminishes due to the long unavailability.

- Changes in demand and consumer taste preference may happen when the product is not available to the consumer. For example, the consumers might change their preference for coffee and coffee-based products with lower availability of tea and tea-based products. Thus, the above unsystematic risk can change the customers' preferences, leaving a permanent impact on the sector.

- The nature of risk in cases unsystematic is not repetitive, and most of the time, there is an evolution of new hazards. The policymakers face challenges in resolving the risks as they have to deal with the utmost attention because of its nature.

- Many workers and employers may be badly affected due to the hazards. The critical situation may hinder the sentiment of the business. While in the case of systematic risks, the situations can be handled because of the known challenges associated with them.

- Policymakers have to implement a large pool of resources to resolve the situation. Sometimes the cost of measures becomes very expensive compared to the matter itself.·

- Any risk is unacceptable to the economy, be it systematic or unsystematic. The overall impact of the situation becomes negative to the common masses.

Limitations

- The scale of operation is lower than the systematic risk; thus, the government's involvement is also less. The private enterprise has to resolve the matter most of the time as it does not impact the larger section of the economy.

- Because of its nature, the policymakers neglect the situations and do not come under the limelight as in case of systematic risks.

- The persons involved with the hazards are fewer than the systematic risks, and thus monetary compensation is also less or nil in the case of unsystematic risks. There is a lack of government intervention in this type of risk.

Conclusion

The unsystematic risk is very dynamic; the nature of problems varies from each other. The enterprise which faces these problems experiences growth in profitability while the whole economy is going fine. There is no correlation with the broader economy. The policymaker does not pay attention to the situation as the nature of the risks focuses on the specific industry or sectors, which could be eliminated utilizing private participation only.