Table Of Contents

What Is Unlevered Free Cash Flow (UFCF)?

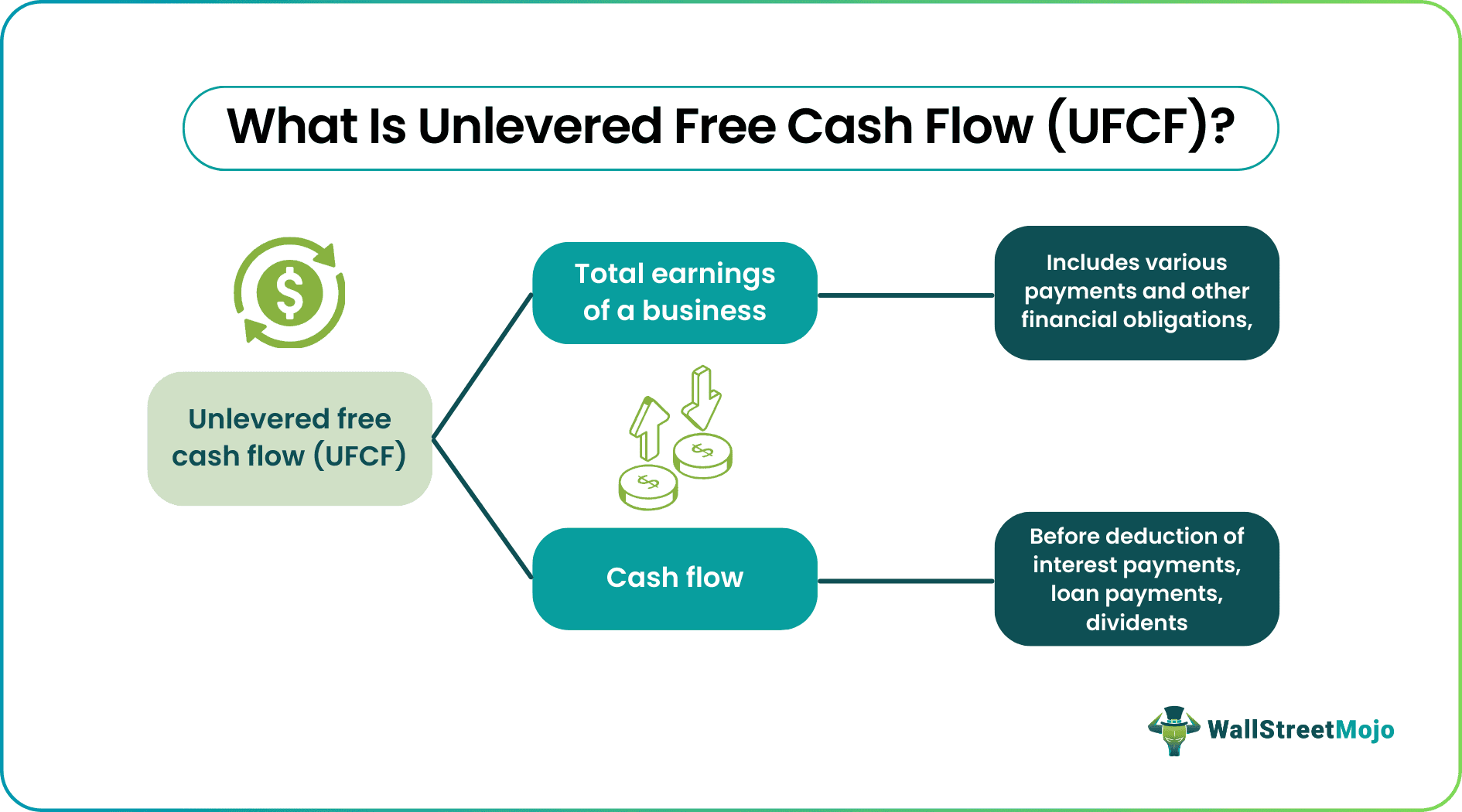

Unlevered free cash flow or UFCF refers to the cash flow or total earnings of a business from its operations before these are accounted for its payment or financial obligation. The UFCF allows investors to determine and evaluate the cash flow that business operations generate for expansion and stability.

The unlevered free cash flow is of interest to investors and shareholders who use these numbers from a company’s financial statement to determine discounted cash flow (DCF) or future returns on their present investments. UFCF, in contrast to levered free cash flow (LFCF), is the cash left with the company post deducting interest payments and other financial obligations.

Key Takeaways

- Unlevered free cash flow is the cash flow generated from business operations or investments post payment of taxes and accounting for working capital expenses.

- In contrast to unlevered cash flow, the levered flow accounts for the debt obligation of an organization, such as its interest and loan payments and dividends for shareholders.

- The EBITDA or earnings before the interest payments, taxes, depreciation, and amortization is first calculated to determine a firm's unlevered cash flow.

- UFCF is of interest to investors and lenders, and thus it is used in determining the discounted cash flow.

Unlevered Free Cash Flow Explained

Unlevered free cash flow definition explains the gross earnings generated by a company from its core and non-core business operations that is not accountable for loan servicing. Moreover, it represents free cash flow from operations available to make payments to all stakeholders, including employees, vendors, interest and loan payments, dividends, etc.

The unlevered cash flow, also known as the Free Cash Flow of the Firm (FCFF), is available to all the equity and debt holders of a company post the deduction of operating expenses, capital expenditures, and required working capital. Later, the determination and accounting for other financial payments, such as interest, dividends, salaries, etc., are charges on levered cash flows.

The levered cash flow explains the cash flow situation of a business that carries out its operations through borrowings and thus attracts interest payments. As a result, the business will charge these payments on the cash flows generated from its business operations.

Similarly, a business may prefer UFCF to account for and determine the discounted cash flow. Again, it is because the future earnings from current investments and business operations should reflect higher cash flows for its investors. Thus, it will help retain the investors as they continue to receive higher returns on costs incurred and also attract potential investors.

Additionally, viewing UFCF separately from levered cash flows leads to ignorance of a well-designed capital structure to save overall cash flows. However, there are certain limitations to accounting and using unlevered free cash flow yield for business valuation.

For instance, some businesses might not focus on improving core, revenue-generating business operations but rather beat around the bush to increase their cashflows in financial statements. It might involve letting go of employees to save on salaries, reduce inventory size, avoid capital investments, or source cheap and poor-quality raw materials to save on operations costs. We will discuss about the cons of this concept of unlevered free cash flow yield later in the article.

Video Explanation Of Free Cash Flow

Formula

To demonstrate, the formula to calculate unlevered free cash flow involves,

UFCF = EBITDA – (T + CE + Increase in Non–Cash Working Capital) + Depreciation and Amortization

Where,

- EBITDA = is Earnings before Interest Payments, Taxes, Depreciation, and Amortization

- T = is Tax Payments

- CE = is Capital Expenditure to be incurred (cost of machines, buildings, and heavy equipment)

Thus, the above details explain the unlevered free cash flow equation. We will study how to use this formula for calculation immediately after this section.

Calculation

Let us look at the application of the UFCF formula and understand its calculation,

| Month | Firm A | Firm B | Firm C | Firm D |

|---|---|---|---|---|

| EBIT | $10,000 | $12,505 | $9,050 | $18,000 |

| Taxes | $3,200 | $3,600 | $1,500 | $1,800 |

| Depreciation and Amortization | $700 | $800 | $600 | $650 |

| Changes in NWC | $8,600 | $9,000 | $7,500 | $9,000 |

| Capex | $5,000 | $8,000 | $5,870 | $6,050 |

| UFCF | -$6,100 | -$7,295 | -$5,220 | +$1,800 |

Thus, the unlevered free cash flow formula includes the conversion of EBITDA to unlevered free cash flow by deducting any capital expenditures, taxes, and expenditures incurred for non-cash working capital (NWC). Specifically, NWC includes a company’s inventory, raw materials, finished goods, and other goods and services that assist it in business operations.

At the same time, adding non-cash expenditures such as depreciation and amortization is necessary to determine a company’s unlevered cash flow.

In this context of unlevered free cash flow equation, we can also peek into the concept of UFCF margin, which is a widely used metric that calculates the unlevered cash flow that is available to the business as a percentage of sales. It is calculated by dividing the UFCF by the total sales figure, multiplied by 100.

Example

Let us look at an example of unlevered free cash flow from net income and consider the same calculation from above to see what its implications are,

| Month | Firm A | Firm B | Firm C | Firm D |

|---|---|---|---|---|

| EBIT | $10,000 | $12,505 | $9,050 | $18,000 |

| Taxes | $3,200 | $3,600 | $1,500 | $1,800 |

| Depreciation and Amortization | $700 | $800 | $600 | $650 |

| Changes in NWC | $8,600 | $9,000 | $7,500 | $9,000 |

| Capex | $5,000 | $8,000 | $5,870 | $6,050 |

| UFCF | -$6,100 | -$7,295 | -$5,220 | +$1,800 |

Firstly, to calculate the UFCF, the EBIT (earnings before interest and taxes) is calculated from the firm's total earnings or cash flow. So, for example, the EBIT of Firm A is $10,000, and for Firm D, it is $18,000.

However, the resultant calculated EBITs of Firm A and Firm D may or may not be their target EBIT or EBITDA.

Thus, as seen in the case of Firm D, a higher EBIT or EBITDA allows a firm to have a higher resultant UFCF. In addition, a higher EBIT of Firm D gives it a positive UFCF or unlevered cash flow. Whereas Firm A, with a lower EBIT, has a negative unlevered cash flow situation.

Further, a negative cash flow of Firms A, B, and C also repels the investors from investing in a company as it reflects a poor capacity to service debt or expand its business operations through debt.

Thus, a higher unlevered cash flow post payment of taxes, incurring non-cash working capital, and capital expenditure will allow a firm to smoothly service its debt obligations in case of an existing loan or future loans. Thus, a firm with negative or low unlevered cash flow should strive to achieve EBITDA targets as soon as possible. Likewise, flexible and higher unlevered cash flows will allow firms A and D to expand their operations and business ventures by leveraging additional debt or borrowings.

Even though the concept of unlevered free cash flow from net income is very useful for any company in various ways, it has some cons that should be understood with clarity.

- It is obvious that companies always try to show a good balance sheet and financial position to its stakeholders. Therefore, there is every possibility that the management may use this concept to manipulate the financial statements. They can cut cost through human resource layoff, delay project execution, or hold back accounts payable for long time, thus raising the UFCF to give a better picture of the business.

- However, it is better to assess whether these steps are genuinely impacting the business in a positive manner, to show improvements in cash flow, else this may lead to downfall.

- Since it does not take the interest on loan into consideration, the value of cash flow remains inflated. The inclusion of interest payment may turn the free cash flow amount negative, which will lead to loss of faith and confidence of investors and stakeholders in the company, ultimately leading to loss of market. Thus, it is noteworthy that this concept basically creates a bubble or a false impression about the company’s financial status.

From the above we can derive the fact that as analysts of investors, it is better to interpret both Unlevered and levered free cash flow of the business, so as to make informed decision.

Use

This type of cash flow plays a significant role in business valuation and comparison. Since it is the cash that is available to all lenders and fund providers of the business, which is before the payment is made towards interest and taxes, it helps in eliminating the impact or effect of the actual capital structure on the value of the business.

The capital structure varies from company to company depending on the fact that the cost of debt may be different. Thus, eliminating the effect of interest on loan makes it feasible for the management to compare its leverage level with its peers, which is possible through UFCF. Therefore, the current enterprise value of the business can be calculated using the UFCF, that make peer comparison possible.

The management may have some limitations while deciding on the capital structure but in theory, they are free to select the structure type they wish to have. So, it is better to take the UFCF for company comparison, which does not account for the actual capital structure.

However, it is widely used for calculation related to the discounted cash flow model, which is built mainly to find out the Net Present Value (NPV), which is a metric that calculates and evaluates the viability of an investment or a project by finding out the cash in-flow and out-flow of the same.

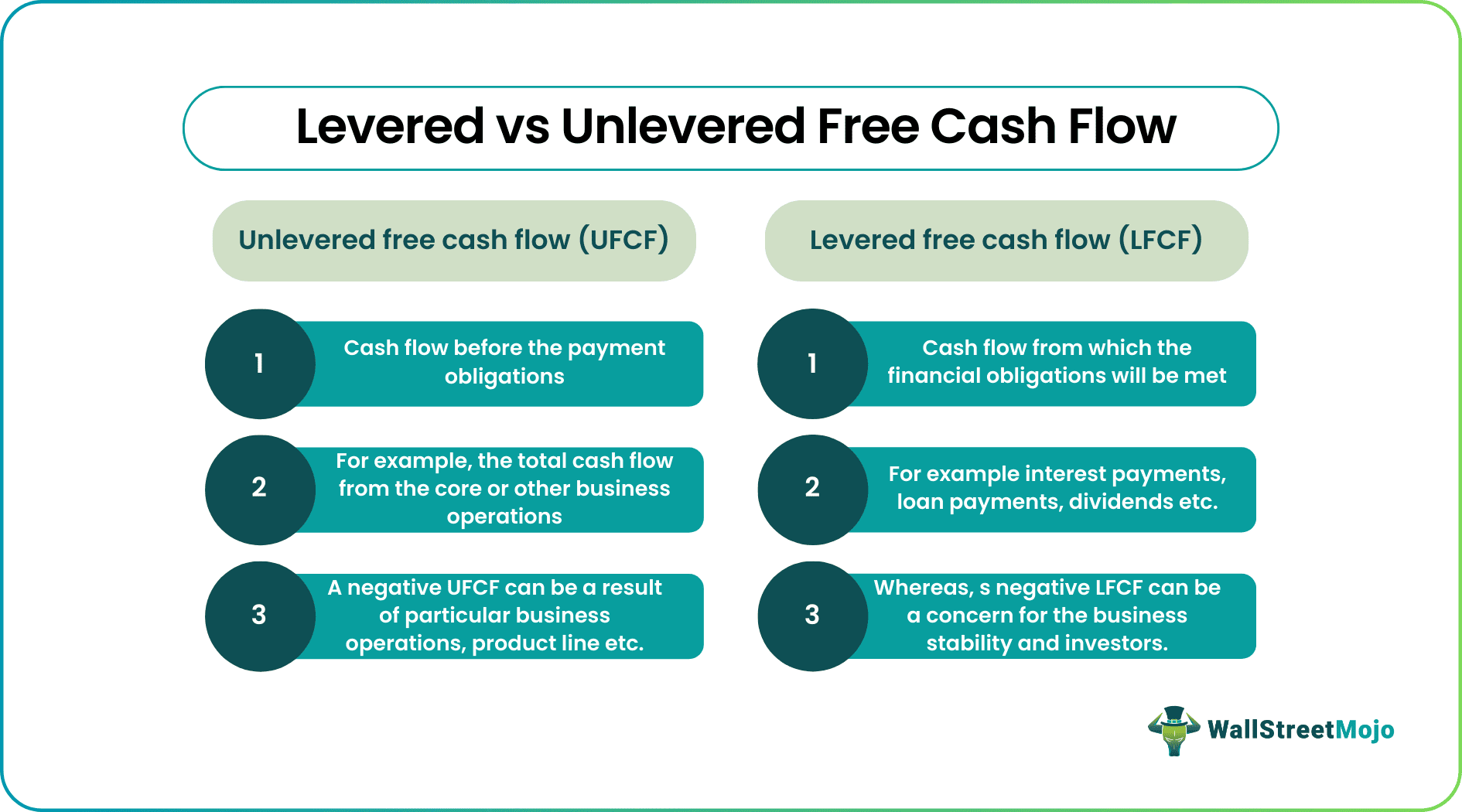

Unlevered Free Cash Flow Vs Levered Free Cash Flow

Unlevered cash flow is the amount of cash flow generated from business operations. It excludes taxes, capital expenditures, and changes in non-cash working capital. On the other hand, levered cash flow accounts for interest and loan payments, dividends, or other such payments that service a company’s debt.

UFCF reflects how a company uses its capital assets to generate cash flows. However, companies with a large debt burden prefer showing their UFCF to attract investors and lenders.

However, before investing and lending, it is important to realize for these stakeholders the difference between a company’s levered and unlevered cash flows as it reflects its ability to pay equity or debt financing obligations.

Another difference between unlevered and levered cash flows is the risk it poses to a company. For instance, a low UFCF is not extremely concerning as it reflects that either the company had no debt obligations or could not afford a debt.

However, if the levered cash flow of a company is low and UFCF is high, it reflects that a company has a significant amount of debt to service. Therefore, it is a matter of concern because if there is a slight decrease in the company's revenues, it can face financial troubles.