Table Of Contents

Unfunded Liability Definition

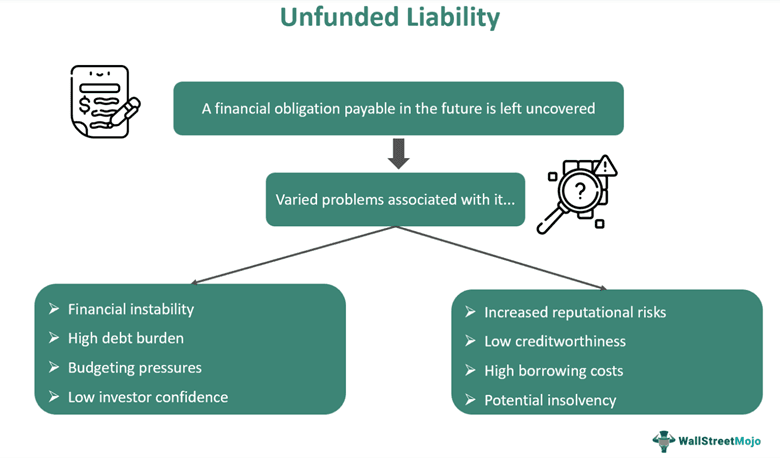

An Unfunded Liability is a financial obligation for which sufficient funds have not been set aside to help cover it. They represent a gap between future expenses and current resources. Typically, pension plans, social security benefits, healthcare plans, employee benefit plans, etc., bring such liabilities as specific benefits are promised over a period to the participants.

These obligations can accrue over time due to various factors, including inadequate funding, economic fluctuations, political instability, taxation, etc. Unfunded liabilities, such as hidden debts, threaten an organization’s future solvency and financial stability. When entities lack the resources needed to meet future financial commitments, budgets are affected, investments decline and promised benefits (social security, healthcare, etc.) may be jeopardized.

Key Takeaways

- An unfunded liability refers to a financial commitment where adequate funds have not been allocated to fulfill the said commitment in the future as and when it arises.

- For instance, a pension plan with insufficient funds comprises an unfunded liability.

- Such liabilities are significant because they represent a hidden debt that can have negative impacts on the future financial stability of individuals, companies, and governments.

- Postponing making arrangements for these liabilities offers flexibility and intergenerational equity in the present, but they can burden future generations, discourage investors, and create fiscal risks.

- They might increase insolvency risks and adversely impact an organization’s other financial health parameters.

Unfunded Liability Explained

An Unfunded Liability poses a significant threat to the future of firms and governments. It must be noted that these liabilities are different from those arising from debt financing. Unlike regular debt, which involves a repayment plan, these liabilities represent unfulfilled obligations for a specific purpose with no immediate resources to cover them. This can lead to problems at varied levels.

Governments and companies with unfunded liabilities may face budgetary constraints, forcing them to cut vital services, increase taxes, or borrow more money. This can lead to a negative impact on economic growth and investor confidence. For organizations, such liabilities could affect credit ratings and general financial health.

High levels of unfunded liabilities can create uncertainty and risk for investors, leading them to withdraw their funds. This can reduce capital available for businesses and projects, further hindering economic growth.

Unfunded government programs like Social Security and Medicare are particularly vulnerable. If not addressed, these programs may not be able to fulfill their promises, leaving citizens unprotected and jeopardizing their retirement security.

Immediate and proactive measures are crucial to address unfunded liabilities. They are:

- Increased Contributions: Injecting more resources into the fund is necessary to bridge the gap between assets and liabilities.

- Responsible Reforms: Reviewing and adjusting benefits and contributions to ensure long-term sustainability.

- Economic Growth: Promoting economic prosperity creates additional resources that can be used to address unfunded liabilities.

Types

While pension funds are the most prominent example of such liabilities, unfunded liabilities include several other financial obligations payable by different entities.

- Pension Plans: These are defined benefit plans that promise a specific retirement income based on years of service and salary. However, they often lack sufficient funding to cover future obligations, especially in the face of demographic changes and investment losses.

- Government Programs: Many social programs like Social Security, Medicare, and Medicaid fall under this category. These programs rely on current tax revenue to pay the beneficiaries, but projected demographics and rising healthcare costs can lead to significant shortfalls in future years.

- Post-employment Benefits: Certain companies offer unfunded benefits like healthcare or life insurance to retired employees. These liabilities accrue over time and can become a significant financial burden if not managed properly.

- Insurance benefits: Insurance companies need to make arrangements for varied insurance payouts from time to time. These include life insurance, health insurance, etc. While claims are not a given, insurers must be ready to fulfill their financial commitments in case they arise.

- Employee Severance Benefits: Employees leaving an organization may be entitled to receive severance pay, unused vacation time, and other employment benefits if mentioned in their employment contracts. Hence, companies must allocate adequate funds to such financial needs based on attrition rates and relevant labor laws.

Examples

Though social security unfunded liability and pension liabilities are commonly seen, let us see what happens when a company or a government entity accumulates such liabilities. The following are some examples to help readers understand the concept better.

Example #1

Suppose Sunshine Agrotech, a company with a responsible management team, offered its employees a generous defined-benefit pension plan in 2002, promising a comfortable retirement income based on their years of service and salary. However, the leadership failed to adequately take care of the long-term financial sustainability of the pension plan. They underfunded the plan for years, relying on optimistic investment returns and underestimating the impact of inflation and rising life expectancies. As a result, a significant unfunded liability accumulated, reaching a staggering $1 billion figure by 2024.

This unfunded liability now poses a major threat to Sunshine Agrotech’s future. To meet its pension obligations, Jenny, the program manager, outlined certain difficult choices. She said the company might need to pick one or more options from the following:

- Increase its contributions to close the funding gaps in a defined period, meaning the company will need to accept a substantial financial burden.

- Reduce the benefits promised to employees, which will most likely result in employee dissatisfaction.

- The company could secure additional funding from outside sources, which means it will have to bear the cost of borrowing such funds.

- Sunshine Agrotech could consider changing its investment strategy and style to improve return on investment. However, this also involves spending significantly as well as taking on substantial risks to earn returns.

This illustrates the importance of making arrangements on time for such liabilities.

Example #2

A February 2024 report eloquently explains how government debt and unfunded liabilities affect a nation’s growth, with taxpayers being burdened significantly due to high debt levels. The report highlights that an estimated $80 trillion unfunded liabilities have accrued against Social Security and Medicare, while bonded liabilities are another key area contributing to debt burdens across each state in the United States.

The article states that the cascading effects of such hefty debt and unfunded liability amounts bring problems at various levels, with multiple entities being forced to take on heavy financial burdens in the economy. It also briefly touches upon the ways in which the relevant entities try to resolve matters of debt and unfunded liabilities and what happens if a fiscal crisis or an unfunded liability crisis ensues as a result of management failures at multiple levels. The article is an eye-opener in many ways with regard to national debt, unfunded financial obligations, bonded obligations, and taxpayer burdens.

Advantages And Disadvantages

The advantages and disadvantages of unfunded liabilities have been discussed in this section.

Advantages

- Greater Flexibility: An unfunded liability allows for greater financial flexibility in the short term. By deferring funding obligations, governments and companies can free up resources for other pressing needs or investments.

- Intergenerational Equity: Spreading the cost of long-term obligations over multiple generations can be considered fair, as future generations benefit from the contributions of those who came before them. This can be particularly relevant for social programs like Social Security and healthcare.

- Incentives for Growth: Investing an unfunded liability in productive assets can generate returns that help to offset future obligations. This can promote economic growth and enhance the overall financial well-being of a society.

Disadvantages

- Burden on Future Generations: An unfunded liability can create a significant financial burden for future generations, who inherit the responsibility of paying for past financial commitments. This can limit their opportunities and hinder long-term economic growth.

- Reduced Investor Confidence: High levels of unfunded liabilities can create uncertainty and instability, discouraging investors and hindering economic growth. This can lead to higher borrowing costs and reduced access to capital.

- Increased Fiscal Risk: An unfunded liability exposes governments and companies to significant financial risks. Economic downturns, unforeseen events, or poor investment performance can exacerbate these risks, leading to potentially severe financial consequences.