Table Of Contents

Underwriter Meaning

An underwriter is an individual or an institution who is involved in the act of underwriting the issue of securities of a company for a fee. Underwriting is an arrangement where certain parties assure the issuing company to take up shares or other forms of securities to a pre-determined extent.

An underwriter can work for financial organizations associated with the mortgage, stock market, insurance, banking, etc. They are primarily concerned with gaining all the information about the finical status of the companies, accurately assessing the risk involved, and helping them determine whether they should take a new contract or not.

Table of contents

- Underwriter Meaning

- Underwriters are individuals or institutions who underwrite the securities of a company. They help determine the prices of a company's share in the market.

- There are different types of underwriters, such as underwriters for insurance, mortgage, securities, real estate, etc.

- They perform the vital task of assessing risks and are a crucial element for areas in the financial market such as insurance, mortgage, securities, etc.

- A degree related to finance, training experience, and certifications can help a candidate ascend in their underwriting career.

Underwriter Explained

An underwriter is defined under section 2(a) (11), Securities Act of 1933, as a person who buys any securities from an issuer to sell or distribute securities on behalf of the issuer. Underwriting is necessary for public issues as it guarantees a full subscription of securities. Accordingly, companies must rely on such agreements before opening the public issue to avoid losses and reduce risks. They happen between the company and parties such as banks, financial institutions, merchant bankers, brokers, or authorized parties.

Underwriters can participate directly or indirectly in such undertakings. These individuals or institutions purchase securities from the issuing company directly from the primary market when the existing shareholders or the public do not subscribe to the shares offered. It is otherwise termed a "firm commitment offering."

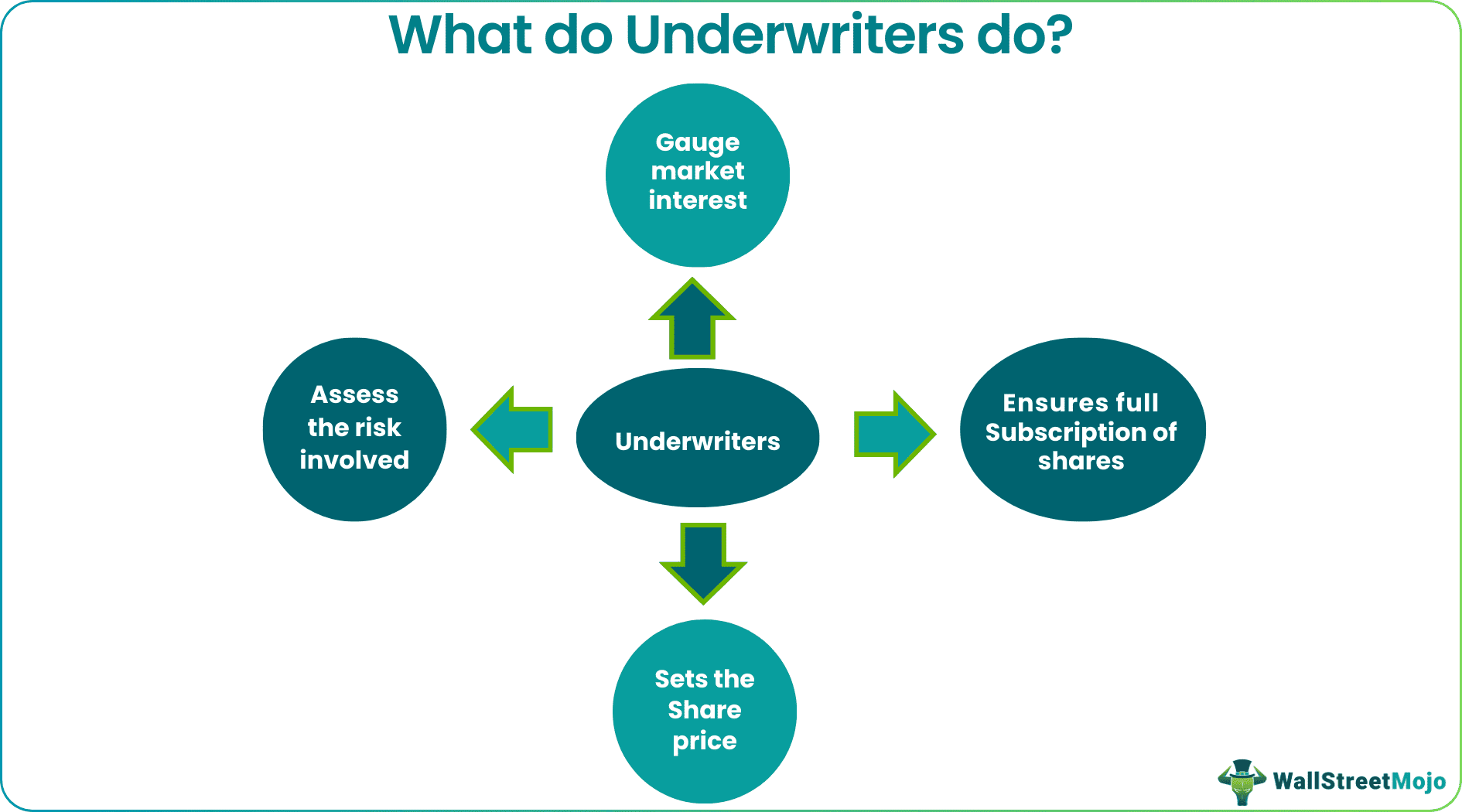

Companies can opt for a public issue, but in most cases, underwriters, through their best efforts, gauge market interest. Their job includes setting the offer price and marketing securities. Underwriting is one of the most important functions of an issue, as an individual or institution undertakes the risks associated with them in returns of a specified premium. They also analyze and evaluate the financial status of an application and convey it to companies to determine whether or not to take it. Underwriting can involve many risks; if the shares remain unsold, they incur huge losses and demand profits that act as rewards for their risk.

A lead underwriter or a bookrunner is usually an organization that assists a company with its initial public offering. A group of underwriters comes together to form a syndicate in such cases, which the lead underwriter leads.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types of Underwriters

#1 - Insurance Underwriters

An underwriter for insurance determines whether an application from the potential client needs further processing; whether they should take up the risk. Moreover, a critical analysis reveals details about the level of risk, the amount of insurance, and whether the applicant has to be granted an insurance policy. For example, individuals can take insurance for health, life, rental or property, etc.

#2 - Stock Market

An underwriter for securities determines the price and risk involved in security. Here, individuals or institutions undertake to underwrite the public offerings. This process ensures the issuing company's full subscription (i.e., raising the full amount of capital).

The underwriting process provides major liquidity for the securities, aiding in their distribution and price stabilization. In addition, investors use information analyzed from the underwriting process to make informed choices.

#3 - Banking or Mortgage

An underwriter for a mortgage suspends, denies, or gives conditional approval of loans after determining a customer's creditworthiness. Basically, they examine the customer's credit history through their past financial transactions or statements. In addition, various parameters such as past repayment of loans and value of collaterals provided for the mortgage, verification of the candidate's identity, employment, stability of income, review of tax returns, reports of fraud, etc., are taken into consideration for the same.

Examples

Check out these underwriter examples to gain a better idea:

Example #1 - Insurance Underwriting

John is an insurance underwriter. His basic job is to determine if an applicant is eligible for insurance. For example, suppose someone wants to take home insurance; John has to evaluate the person's credit history, the house value, and criminal records related to frauds specifically associated with insurance if there is a need. This is because a person with an unsatisfactory credit score will be a high-risk applicant. John can either reject it or provide the applicant with an insurance cover with a high premium as a risk-reward.

Example #2 - Mortgage Underwriting

Jay works in mortgage underwriting. If an applicant comes for mortgage approval, Jay has to verify the person's source of income, the stability of that income, and sources of deposits in the bank account. Details such as the asset's worth, origin, whether it is reliable, and other property details, if any, are also assessed. He might even ask for proof of additional assets if there is a higher risk.

Credit history will be thoroughly examined, including late or default payments, bankruptcy reports, credit overuse, etc. If there is a satisfactory report with a good credit score, the applicant gets loan approval. On the other hand, if the reports indicate high risk, the application gets rejected or charged with high premiums to recover the sanctioned amount.

Example #3 - IPO Underwriting

Jack works in security underwriting. He has to keep an eye on the company's performance and analyze the demand their stocks will get. Various factors such as market share, profits, or losses made the popularity of the products and services. Additionally, he has to check whether the company has any defaults, scams, or scandals to its name, the reason for the IPO, etc., and decide its price. If it goes unsold, he will lose his premium; therefore, Jack must do a critical analysis.

How to Become an Underwriter?

A career in underwriting can be challenging and yet fulfilling with handsome pay. The requirements are as follows:

#1 - Educational Qualifications

Candidates with a bachelor's degree, irrespective of their majors, can start underwriting. But majoring in accounting, business, finance, or mathematics can prove as an added advantage.

#2 - Training

Training experiences are always preferred on the job as they help a candidate learn the process and procedures. In addition, they help broaden one's understanding of the concept and its basics. Joining entry-level jobs in underwriting with banks or other financial institutions can immensely help one in this regard.

#3 - Certifications

Given below are the certifications that can help an underwriting career:

- Certified Residential Underwriter Designation (CRU) - The CRU program from Mortgage Bankers Association (MBA) offers three levels of certification for underwriting professionals with a minimum of one year of industry experience to enroll in level1. Candidates looking to enhance their residential mortgage loan underwriting skills can opt for it.

- Chartered Life Underwriter (CLU) certification - Candidates interested in working in life insurance underwriting can opt for this certification. It is provided by the American College of Financial Services and can help understand risk management, estate planning, and other related concepts. Three years of full-time business experience is a requirement for the certification.

- Chartered Property Casualty Underwriters (CPCU) certification - CPCU certification is offered by the American Institute for Chartered Property Casualty Underwriters in insurance and risk management. Candidates have to comply with ethical standards and complete the required number of experience in hours to get through the process.

- Associate in Commercial Underwriting (ACU) certification - Commercial Underwriting certification is offered by "The Institutes" for the candidate who wants to work in the valuation of Commercial Underwriting Risks. Interested individuals can also learn the use of technology and data analytics involved in the underwriting process through this certification.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions

They are individuals who work on the approval or rejection of insurance applications. Insurance can be applied for cars, homes, life, or health. Their job is to look into the applicant's history; if it's car insurance, the officer in charge will check the driving records; if it is health, the officer shall check medical history. These details are necessary for approvals and to decide on the insurance premium.

Underwriters look for the "risk factor" involved in the application, regardless of insurance, securities, mortgages, etc. They also look for profit in their deals as a reward for the risk taken.

Candidates who possess analytical skills with good computer and mathematical knowledge can make a good career as an underwriter. The average annual pay for insurance underwriters as of 2022 was $101,534 according to Indeed, and hence it can be a good career option.

Recommended Articles

This has been a guide to Underwriter and its Meaning. Here we explain how underwriters work along with examples, its process, types and how to become.