Table Of Contents

What Is Underreaction?

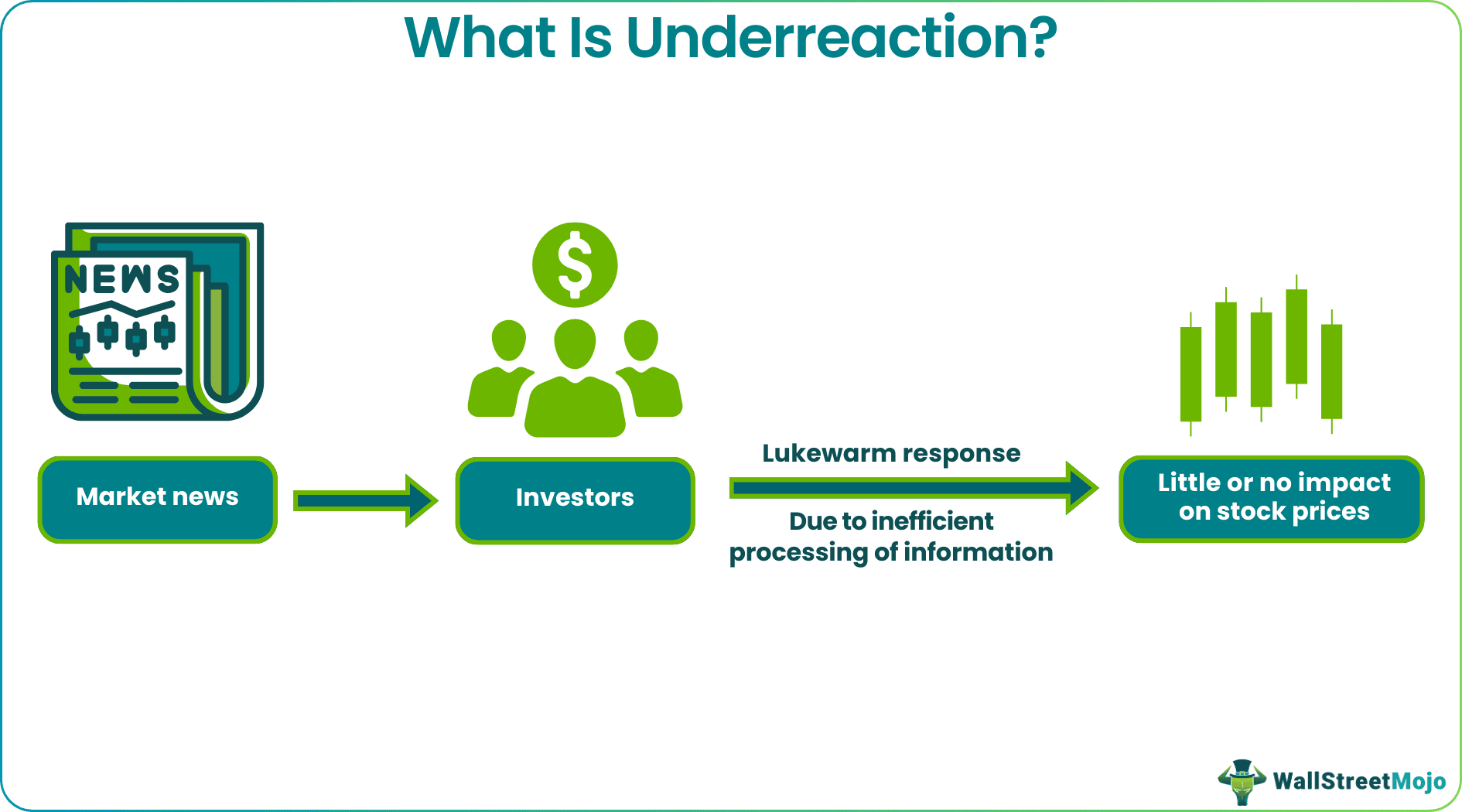

Underreaction refers to the slow and gradual response of investors to a news or event or any fresh information, leading to little or no effect on the stock prices. This, in turn, results in mispriced stocks, making participants undervalue or underestimate the influence of news or other information on the stock market.

The definition of underreaction states that it occurs due to investors' incomplete processing or analysis of the information, and stock prices may not change as promptly or adequately as expected. There are several reasons why the stock market witnesses underreaction, including confirmation bias and cognitive bias. Investors can make wise choices by closely monitoring the market news.

Table of Contents

- What Is Underreaction?

- Underreaction occurs when investors do not quickly react to the market news, thereby leading to little or no adjustment to the stock prices.

- It differs from overreaction, where stock prices move excessively in response to new information.

- Underreaction signals market inefficiency caused by factors like limited attention, institutional constraints, and cognitive biases. It can predict future returns with some level of accuracy.

- The phenomenon gives informed investors a chance to earn abnormal returns by identifying undervalued stocks.

Underreaction In Stock Market Explained

Underreaction in the stock market signifies a situation where the market does not immediately adjust stock prices in response to new market information unless the investors react in a certain way. This may result in mispriced stocks, indicating a lingering drift in the direction of price trends in stocks and markets rather than a sharp rise or fall to fair value. The delay in fully consuming and incorporating new information into stock price adjustments arises from investors' tendency to underreact. This may be due to their adherence to past views and prior information.

It is a standard error made by investors. For example, investors respond favorably if a company reports higher quarterly earnings than anticipated. This reaction from one of the first set of investors to the event results in a slight increase in the stock price. However, the prices do not rise as expected. The immediate response only boosts the stock price movements upward toward the expected level in the months following the announcement, correcting this inconsistency. Investors who purchase the stock immediately after the announcement might not gain much, but their reaction to the event does affect the stock prices of the company significantly.

In contrast, when a firm declares a dividend decrease, the stock price drops and stays at the low for a while. It may drift further down rather than immediately dropping. This is also a case of underreaction, indicating an inefficient market. The stock market often fails to fully incorporate publicly available information due to limited attention, leading to stock mispricing and inducing return predictability.

There is a phenomenon called post-earnings-announcement drift (PEAD), which implies the fake representation of underreaction. It emphasizes the consistency in the stock prices, which do not reflect price adjustments or changes in behavior, pretending investors’ delayed response to the market news, though the same has been widely conveyed and has reached investors on a significant level.

Examples

Let us consider the following examples to understand the concept even better:

Example #1

Suppose Dan, an investor, researches a company called XYZ, Inc. He discovers that it has created a groundbreaking technology that will take over the market in the coming years. He predicts that this information will significantly boost the company's future earnings and its stock prices. However, he notes that there is only a slight change in XYZ Inc.’s stock price, indicating that the market has not yet fully reacted to the news.

Dan realizes that there is a possibility that the news hasn’t reached the concerned investors. He also finds out that the use cases of the technology are limited and inadequate to convince investors to invest in the company's stocks. However, Dan still decides to buy shares of XYZ Inc., hoping the market will eventually realize the business's actual worth, leading to a rise in the share prices.

This indicates how significantly underreactions affect the stock prices and the overall stock market.

Example #2

A study was conducted on 229 firms in the Indonesian Stock Exchange. It examined investors' overreaction and underreaction to financial statements in four key industries - banks, financial institutions, insurance, and investment. It included industries like automotive, wholesale, building construction, cement, food, and beverage from the period 2007-2016.

The analysis found that automotive, building construction, cement industry, and food beverage stocks tend to have more underreaction. The study identifies a positive correlation between the firm’s total assets and its market performance related to the underreaction to the news. It found that when total assets increase, a company’s market value increases.

Therefore, the study concluded that investors tend to buy stocks with more tangible assets when there is good news about increasing profitability and sales. At the same time, they buy stocks with more intangible assets when there is bad news. This suggests that investors should consider the impact of financial statements on their investment decisions, which ultimately would decide their response to the market news, affecting stock prices.

Underreaction vs Overreaction

Overreaction and underreaction in behavioral finance are two sides of the same coin, each with significant differences. Let us have a look at the differences below:

| Key Points | Underreaction | Overreaction |

|---|---|---|

| Concept | It occurs when the market takes too long to factor newly released information into stock prices completely. | Overreaction is when investors exaggerate the significance of fresh information, prompting stock values to fluctuate significantly. |

| Significance | This phenomenon implies that stock prices may not accurately reflect a company's worth, allowing knowledgeable investors to spot undervalued equities and earn unusual profits. | It indicates that stock prices may differ significantly from their fundamental worth, resulting in mispricing and subsequent corrections. |

| Causes | It results from cognitive biases, a lack of focus, and institutional limitations. Investors may undervalue or underestimate the importance of news. Institutional restrictions may prevent speedy adjustments, and poor attention may result in insufficient examination of available information. | Investors often exhibit herd mentality without carefully weighing the information. Exaggerated price changes can also result from overreaction due to emotional factors like fear or greed. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The underreaction hypothesis can apply to both good and bad market news. It occurs when the market fails to adjust stock prices at a desired pace in response to new information, given the delayed response of investors to it. The change is regardless of whether it is positive or negative.

Various research conducted in different periods and market conditions suggests that it is a persistent phenomenon in the financial markets. Even while underreaction varies in intensity, its existence suggests that the market's pricing mechanism continues to be inefficient.

Its general benefits include potential opportunities for savvy investors to identify undervalued stocks and earn phenomenal returns. It gives them a chance to capitalize on mispriced stocks that have not fully incorporated positive news. It helps them tap the untapped potential of stocks.

Recommended Articles

This article has been a guide to what is Underreaction. Here, we explain the concept along with its examples, and comparison with overreaction. You may also find some useful articles here –