Table Of Contents

UCITS Meaning

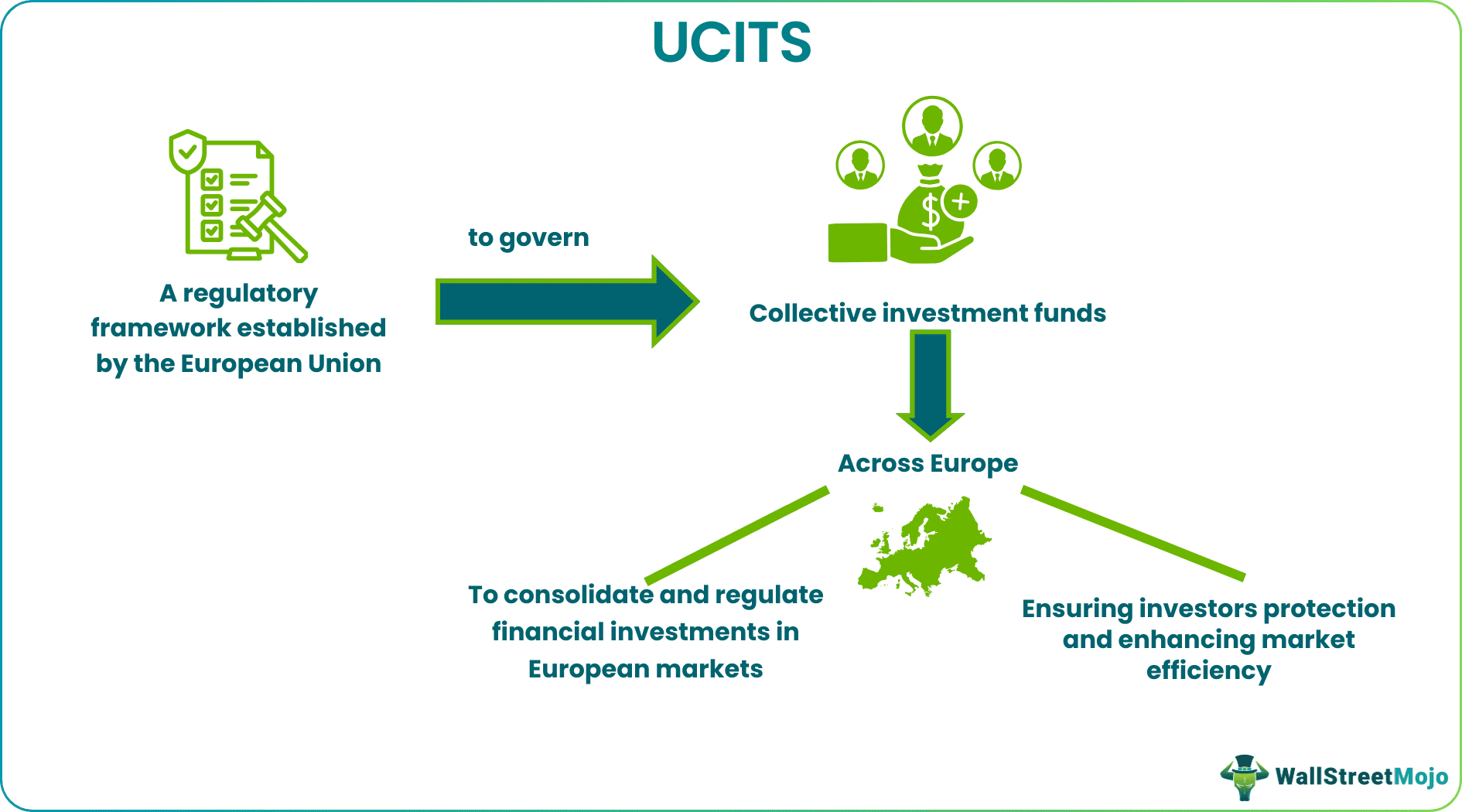

UCITS (Undertakings for Collective Investment in Transferable Securities) is a regulatory framework established by the European Union to govern mutual funds and investment instruments across the EU. Its objective is to unify and streamline financial investments in European markets under a single regulatory authority.

It offers a financial passport for investment firms to operate across all EU countries with consistent regulations.UCITS has centralized major financial services, ensuring investor safeguards, investment disclosures, and various investment types. This has made investment funds more secure and efficient for institutional and retail investors. Furthermore, it has been pivotal in promoting cross-border investment within the EU.

Table of contents

- UCITS Meaning

- UCITS is a regulatory framework established by the European Union to govern investment instruments and securities similar to mutual funds within the EU.

- Its primary objective is consolidating and regulating financial investments in European markets under a single regulatory authority.

- The framework allows investment into liquid assets only. In contrast, AIF (Alternative Investment Fund) can permit investment into any type of fund.

- UCITS funds adhere to the UCITS regulation. At the same time, non-UCITS funds do not fall under UCITS but comply with the domestic law of their respective countries.

UCITS Explained

UCITS legislation, initiated by the European Directive in 1998, regulates the sale, purchase, marketing, and distribution of diverse collective investment funds while prioritizing investor safety. Over the past thirty years, UCITS funds have been regularly updated and revised to regulate European financial markets effectively. It has helped foster a deeper integration of financial markets and enhance capital flows across member countries.

The launch of UCITS in the EU aimed to establish a centralized financial services organization, enabling the cross-selling of mutual funds within the EU and globally. It also sought to enhance the regulation of asset investment transactions among the twenty-eight EU member countries, providing tightly regulated collective investment options for local and foreign investors.

From the investors' perspective, the system offers greater flexibility, enhanced fund security, diversified fund options, and reduced reliance on individual public firms for large-scale collective investments. Structurally, UCITS funds resemble mutual funds, encompassing similar features, regulatory requirements, and marketing models.

These funds unite individual and institutional investors as unit holders, pooling their funds into specific UCITS portfolios comprising securities and cash investments. This structure also presents opportunities for American investors to access more internationally diversified portfolio funds as part of their investment strategy.

The availability of various UCITSs, including L&G hydrogen economy UCITS ETF, Vanguard FTSE All-World UCITS ETF, and Vanguard S&P 500 UCITS ETF, offers investment opportunities for American investors seeking exposure to the European markets.

Working Of UCITS

The working of UCITS funds involves professional money managers responsible for selecting the securities that constitute the fund's portfolio. Investors can get information about the selection process before agreeing to invest in the fund. They can exit the fund anytime by selling their shares on public markets. However, American investors should exercise caution, as investing in it may be considered a passive investment in foreign countries, potentially leading to higher taxes than investing in American domestic funds. Investors need to be aware of the tax implications before making investment decisions.

Rules

UCITS is subject to stringent regulatory and operational requirements mandated by the European Union, which include the following:

- The fund and management team must be based in a tax-neutral European country.

- It should offer investors the option of double redemption within a single month.

- At least 90% of the fund's assets must be in liquid form and should not have exposure to short selling, real estate, or commodities.

- Each asset must represent less than ten percent of the total investment, and the "5/10/40" rule applies, except for index-tracking funds and government-issued bonds.

- Temporary borrowing is not permissible, even for investment purposes.

- There are no specific investor eligibility requirements or minimum investment criteria. Auditors, administrators, and regulated depositaries independently perform support and supervision responsibilities.

- It can function as a single fund or a collection of funds.

- It must comply with EU laws and regulations.

- It needs approval and provides investors with a key investor information document containing comprehensive details.

- A detailed fund prospectus must be available to all investors.

- UCITS must promptly inform investors of any pricing changes related to the sale, purchase, redemption, or issuance of fund shares.

UCITS vs AIF (Alternate Investment Fund)

Let us use the table below to know the differences between the two terms.

| UCITS | AIF |

|---|---|

| Allows investment into liquid assets only. | Can allow investment into any type of fund. |

| Comprises investment into money market instruments, bonds, and securities. | Includes all other investment funds. |

| They have to abide by the regulation of UCITS. | They do not come under the regulation of UCITS. |

UCITS vs Non-UCITS

Let us use the table below to know the differences between the two terms.

| UCITS | Non-UCITS |

|---|---|

| Abides by the Undertakings for Collective Investment in Transferable Securities regulation. | Does not come under the UCITS regulation but follows the domestic law of a country. |

| It can take three forms of investment companies: with variable capital, unit trusts, and common contractual funds. | Four forms of investment companies: investment companies with variable capital, unit trusts, common contractual funds, and investment limited partnerships. |

| After registration of funds in the European Union, the fund has ten days to get marketed in any European member country. | Cannot be marketed in any country other than the domestic country where it was formed. |

Frequently Asked Questions (FAQs)

ETFs (Exchange-Traded Funds) and UCITS (Undertakings for Collective Investment in Transferable Securities) are investment funds but differ in regulatory frameworks. UCITS is a regulatory standard in Europe, while ETF is an investment fund structure. ETFs can be UCITS-compliant, offering more flexibility in investment strategies, while UCITS funds adhere to specific regulations, ensuring investor protections and allowing cross-border distribution within the EU.

The main advantage of it is its high level of investor protection and regulatory oversight. The funds must adhere to strict rules, providing transparency, liquidity, and risk management. Investors benefit from the ability to invest in diversified, professionally managed portfolios with the assurance that the fund operates within the framework of a well-regulated and supervised system.

One disadvantage is the potential limitation on investment strategies due to the strict regulatory guidelines. Undertakings for Collective Investment in Transferable Securities funds may restrict investing in certain assets or using specific derivatives, potentially hindering managers from pursuing certain investment opportunities. Additionally, the compliance and administrative costs associated with UCITS funds can be higher than other investment structures, impacting overall fund performance.

Recommended Articles

This article has been a guide to UCITS and its meaning. Here, we explain its rules and compare it with non-UCITS and AIF, and its working. You may also find some useful articles here -