Table Of Contents

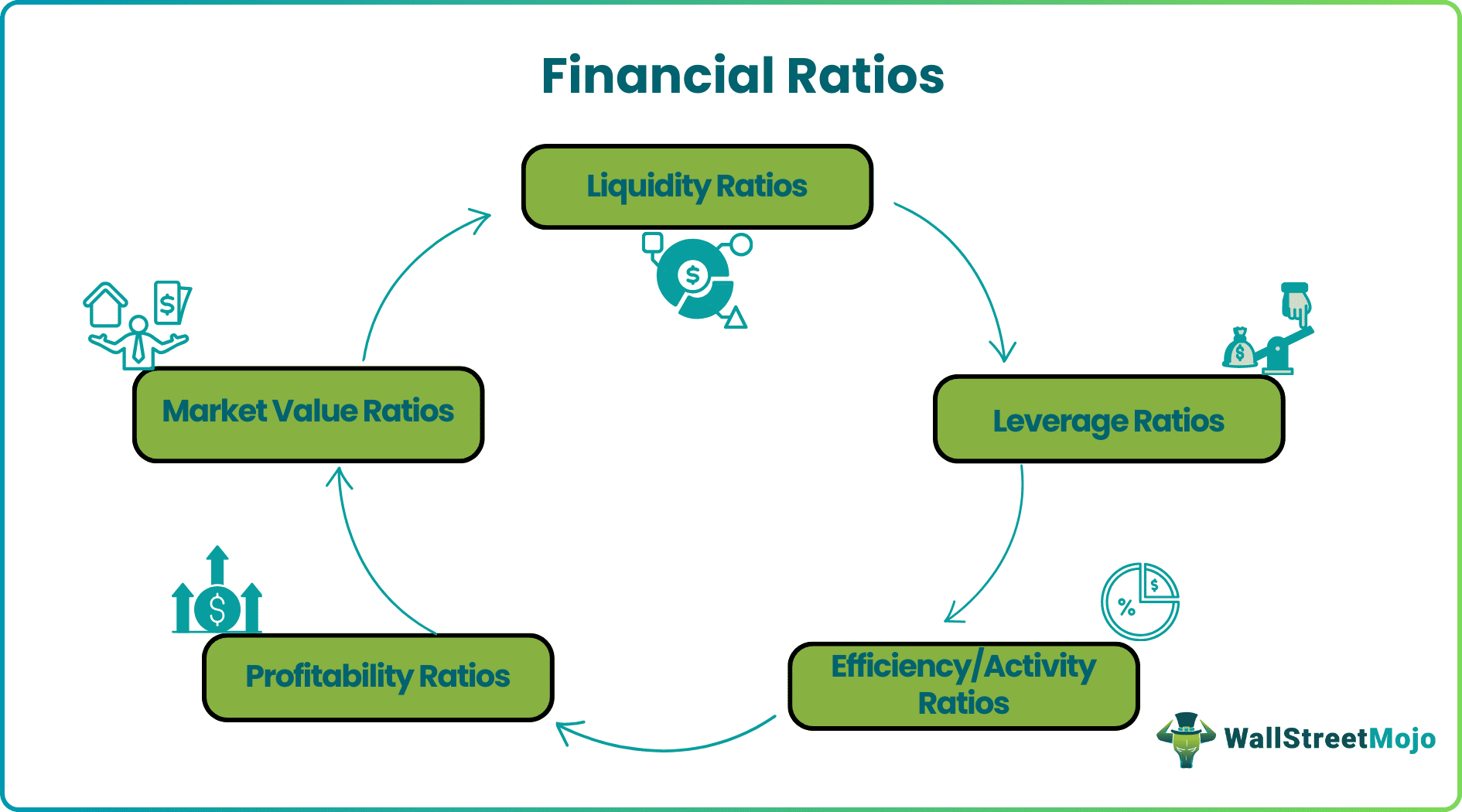

List of Top 5 Types of Financial Ratios

- Liquidity Ratios

- Leverage Ratios

- Efficiency/Activity Ratios

- Profitability Ratios

- Market value Ratios

Let us discuss each of them in detail -

Video Explanation of Financial Ratios

#1 - Liquidity Ratios

Liquidity ratios measure the company's ability to meet current liabilities. It includes the following.

Current Ratio

Determines a company's ability to meet short-term liabilities with current assets:

Under these types of ratios, a current ratio lower than 1 indicates the company may not be able to meet its short term obligations on time. A ratio higher than one indicates that the company has short-term surplus short term assets and meets short-term obligations.

Acid-Test / Quick Ratio:

Determines a company’s ability to meet short-term liabilities with quick assets:

Quick Ratio = (CA – Inventories) / CL

Quick assets exclude inventory and other current assets which are not readily convertible into cash.

If it is higher than 1, then the company has surplus cash. But if it is lower, it may indicate that the company relies too heavily on inventory to meet its obligations.

Cash Ratio

Cash Ratio determines a company’s ability to meet short-term liabilities with cash and cash equivalents(CCE):

Cash ratio = CCE / Current Liabilities

Operating Cash Flow Ratio:

Determines the times a company can meet current liabilities with the operating cash generated (OCF):

#2 - Leverage Ratios

Under these types of financial ratios, how much a company depends on its borrowing for its operations. Hence it is important for bankers and investors who wish to invest in the company.

A high leverage ratio increases a company's exposure to risk and company downturns, but in turn, also comes the potential for higher returns.

Debt Ratio

This debt ratio helps to determine the proportion of borrowing in a company’s capital. In addition, it indicates how much assets are financed by debt.

If this ratio, in addition, is low, it indicates the company is in a better position as it can meet its requirements out of its funds. The higher the ratio, the higher is the risk. (As there will be a huge outgo on interest)

Debt to Equity Ratio:

The debt-equity ratio measures the relation between total liabilities and total equity. It shows how much vendors and financial creditors have committed to the company compared to what the shareholders have committed.

Debt Equity Ratio = Total Liabilities / Shareholders Equity

If this ratio is high, then there is little chance that lenders may finance the company. But if this ratio is low, the company can resort to external creditors for expansion.

Interest Coverage Ratio:

This type of financial ratio shows the number of times a company's operating income can cover its interest expenses:

Interest Coverage Ratio = Income from Operation/ Interest Expense

Debt Service Coverage Ratio:

The debt service coverage ratio shows the number of times a company’s operating income can cover its debt obligations:

#3 - Efficiency / Activity Ratios

Under these types of financial ratios, Activity ratios show how a company utilizes its assets.

Inventory Turnover Ratio:

Inventory turnover shows how efficiently the company sells goods at less cost(Investment in inventory).

Inventory Turnover ratio = Cost Of Goods Sold / Inventory

A higher ratio indicates that the company can convert inventory to sales quickly. A low inventory turnover rate indicates that the company is carrying obsolete items.

Accounts Receivable Turnover Ratio:

Accounts Receivables turnover determines the efficiency of a company in collecting cash out of Credit sales made during the year.

A higher ratio indicates higher collections, while a lower ratio indicates a lower cash collection.

Total Assets Turnover Ratio:

This type of financial ratio indicates how quickly total assets of a company can generate sales.

For example, a higher asset turnover ratio indicates the machinery used is efficient. A lower ratio shows the machinery is old and not able to generate sales quickly.

#4 - Profitability Ratios

Most used indicators to determine the success of the firm. The higher the profitability ratio, the better the company is compared to other companies with a lower profitability ratio.

Margin is more important than the value in absolute terms. For example, consider a company with a profit of $1M. But if the margin is just 1%, then a slight increase in cost might result in a loss.

Gross Profit Margin:

Gross Profit Margin = Gross Profit (Sales - Direct Expenses like Material, Labour, Fuel, and Power, etc) / Sales

Operating Profit Margin:

Operating profit is calculated by deducting selling, general and administrative expenses from a company’s gross profit amount.

Operating Profit Margin = Operating profit / Net Sales

Net Profit Margin

Net Profit Margin is the final profit available for distribution to shareholders.

Return on Equity (ROE):

This ratio type indicates how effectively the company uses the shareholder's money.

The higher the ROE ratio, the better is the return to its investors.

Return on Assets (ROA):

The return on assets (ROA) formula ratio indicates how effectively the company uses its assets to make a profit. The higher the return, the better the company in effectively using its assets.

#5 - Market Value Ratios

Under these types of ratios, Market value ratios help evaluate the share price of a company. It indicates to potential and existing investors whether the share price is overvalued or undervalued. It includes the following:

Book Value Per Share Ratio:

Book Value Per Share Ratio is compared with the market value to determine if it is costly or cheap.

Dividend Yield Ratio:

The dividend yield ratio shows the return on investments if the amount is invested at the current market price.

Earnings Per Share Ratio (EPS):

The earnings per share ratio (EPS) indicates the amount of net income earned for each share outstanding:

Price-Earnings Ratio:

The price-earnings ratio is calculated by dividing the Market price by the EPS. Then, this ratio is compared with other companies in the same industry to see if the company's market price is overvalued or undervalued.

Recommended Articles

This has been a Guide to Types of Financial Ratios. Here we discuss the Top 5 financial ratios, including liquidity ratios, leverage ratios, activity ratios, profitability ratios, and market value ratios. You can learn more about financing from the following articles –