Table Of Contents

5 Types of Bankruptcies

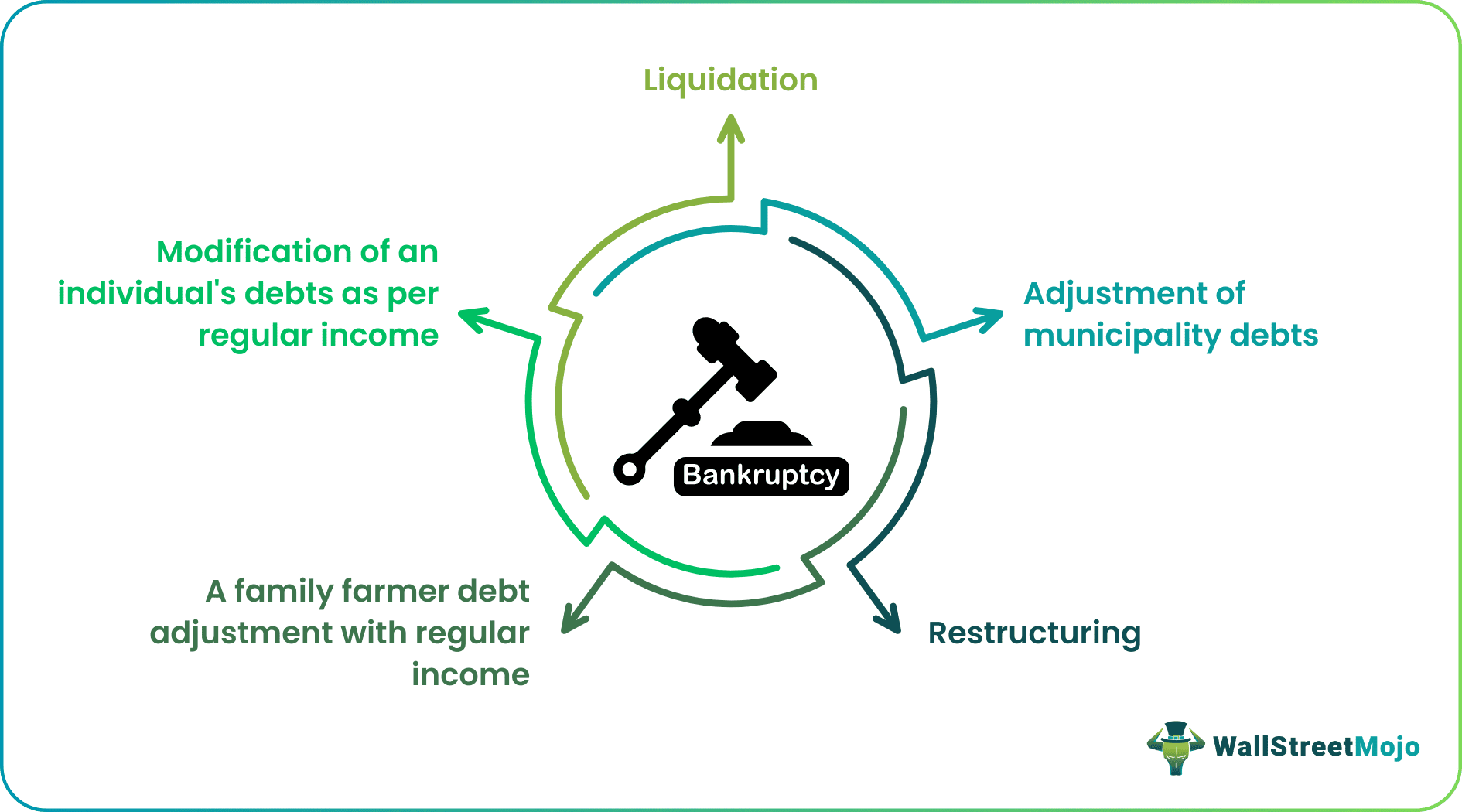

Bankruptcy is a legal course of action that individuals or organizations can undertake when they cannot pay their debt obligations and, therefore, want to free themselves from such obligations. There are primarily five diverse types drawn by the Bankruptcy Code of the United States – including Chapters 7, 9, 11, 12 & 13.

The first obvious effect types of bankruptcy cases have on the individual or the organization is that their credit scores are adversely affected and it makes gaining credit in the future a hassle-filled task. Moreover, the credibility of the organization or their top managerial staff takes a beating and makes conducting business difficult even with the planning of a new enterprise.

Key Takeaways

- Bankruptcy is a lawful action that individuals or organizations take if they cannot pay their debt responsibilities and free themselves from such obligations. The United States Bankruptcy Code has mainly drawn five different bankruptcy types – Chapters 7, 9, 11, 12, and 13.

- Chapter 7 Bankruptcy is the most frequent bankruptcy form filed among persons and is also called "complete bankruptcy," It provides the defaulter with a way to start fresh.

- Chapter 11 Bankruptcy is for commercial companies. They continue business operations by paying creditors as per a court-permitted restructuring plan.

Types of Bankruptcy Explained

Types of bankruptcy according to the bankruptcy code of the Unites States is the provision for an individual or an organization who can no longer repay their debts and cannot function their business due to excessive losses.

The types of bankruptcy chapters have specific types of such cases mentioned and have individuals sort their situations in a timely manner.

In 2002, Worldcom filed for one of the largest bankruptcies ever. Worldcom had $41 billion of Debt while it filed for Chapter 11 Bankruptcy. A respective bankruptcy type is recognized by the Code's chapter that defines the Code.

Let us understand different types in detail with provisions, functions, and implications through the discussion below.

Types

Let us understand the different types of bankruptcy cases with the help of the detailed discussion about each of the chapters under the bankruptcy code.

#1 - Chapter 7 Bankruptcy: Liquidation

Chapter 7 Bankruptcy is also referred to as “complete bankruptcy,” or “straight bankruptcy,” or “liquidation,” which is believed to be the most frequent form of bankruptcy being filed among persons. Chapter 7 enables the defaulter to start fresh.

Under the successful reporting of the Chapter 7 case, a representative gathers the debtor's non-exempt assets, later converted to cash. Subsequently, cash distributions are started to all the creditors as per the bankruptcy law.

One must consider filing for Chapter 7. In several Chapter 7, the debtor gets a release discharging the individual from personal obligation for some known dischargeable debts. At the same time, there is no expectation of any successful debt repayments by the debtor. There are no cosigners in the case, or else court action by creditors becomes pending. Further, companies that demand liquidation of their assets while discontinuing their business could even file for bankruptcy under Chapter 7.

Any individual considering to file Chapter 7 must know that they are susceptible to losing their property while filing for bankruptcy under Chapter 7. Any direct bankruptcy case may not include suggesting a settlement plan, such as that needed while filing for bankruptcy under Chapter 13. However, as an alternative, it needs the bankruptcy representative to collect and send the debtor's nonexempt assets. The creditors would receive distributions following the Bankruptcy Code while selling the debtor's assets.

Chapter 7 Bankruptcy – Eligibility:

Nearly anyone is eligible for filing a bankruptcy petition under Bankruptcy Chapter 7, including partnerships, corporations, couples, and individuals. Chapter 7 enables relief irrespective of the debt amount or if the debtor stands solvent or bankrupt.

A person might not file for Chapter 7, else a different chapter if over the past 180 days a previous bankruptcy case was discarded driven by the willful failure of the debtor to remain present in the court else obey the court else the debtor willingly withdrew the earlier petition post creditors demanded aid from the court to recover property on which they have ownership successfully.

This Chapter allows individuals to discharge their debts. The release of debts isn’t present for partnerships or corporations under Chapter 7. In addition, after having filed for Chapter 7, one isn’t qualified to again file the case for about six years.

Chapter 7 Bankruptcy Example

Acclaim Entertainment, an originally American video game development company, founded in 1987 after a few years of operations, filed for a Chapter 7 case on September 1, 2004, in New York.

Therefore, the company was asked to pay off all their debt that exceeded USD$100 million by liquidating its valuable assets and settling the payment for all its creditors.

Also, have a look at Liquidation Value

#2 - Chapter 9 Bankruptcy: Adjustment of Municipality Debts

For example, just a municipality, school districts, municipal utilities, taxing districts, counties, villages, towns, and cities might file for Bankruptcy Chapter 9. Under this chapter, the municipality is believed to reorder and suggest a reimbursement strategy, similar to the Chapter 11 Bankruptcy case.

Chapter 9 Bankruptcy – Eligibility:

Just a “Municipality” could file for getting respite under Bankruptcy Chapter 9. “Municipality” refers to a governmental sector or public support or any State’s instrumentality. Its definition is wide enough to comprise public enhancement districts, school districts, townships, counties, and cities. The municipality even comprises revenue-generating groups that deliver services that need to be paid by the users instead of through usual taxes, for example, gas authorities, highway authorities, and bridge authorities.

The Bankruptcy Code’s section 109(c) identifies four extra eligibility requests for Chapter 9 Bankruptcy:

- Any organization, governmental officer, or municipality must be authorized by the State law to become a debtor.

- As per section 101(32) (c) of 11 U.S.C, the municipality needs to be bankrupt.

- The municipality needs to express a desire for implementing a strategy for debt adjustments; and

- The municipality needs to do either of the following:

- Attain the creditor’s contract for holding as a minimum a significant number of each class claims that any debtor aims to damage under a strategy for a specific case filed under Chapter 9;

- Failing to capture the contract of creditors that hold a minimum of the number of claims of every class that debtor intends to damage through a strategy while negotiating positively with creditors.

- Unsuccessful negotiation with creditors owing to such negotiations standing unviable; or

- They rationally believe that any creditor might try to get a preference.

Chapter 9 Bankruptcy Example

source: bondbuyer.com

A tiny health care district in Northern California filed for a Chapter 9 petition on October 17, 2010, illustrating the situation as having over 200 creditors and overall liabilities in the range of $10 million to $50 million.

The latest audited financial documents of 2010 indicate that the district possesses $11.7 million worth of remaining bonds, including the 1996 $2.5 million worth of insured revenue bonds, the 2009 $4.9 million worth of insured revenue bonds as well as $4.3 million worth of general obligation bonds introduced in 2001.

#3 - Chapter 11 Bankruptcy: Restructuring

Chapter 11 Bankruptcy is mainly applicable to commercial companies that prefer continuing with their business operations through reimbursing creditors by acting upon a court-permitted restructuring plan.

The Chapter 11 plan allows the debtor with a right to apply for a restructuring plan 120 days after the court's relief order has been released. Debtors are obligated to provide a revelation statement to creditors that enables the latter to assess the plan. However, the plan will eventually get approved by the Court.

Further, the debtor is believed to have several options under Bankruptcy Chapter 11 to force the business towards profitability. These possibilities comprise plummeting debts by reimbursing a part of them whereas settling others, settling troublesome leases and agreements, and redeveloping the business operations. Upon complete strategy implementation, the debtor typically witnesses an integration period and arises with a minimized debt load and a highly profitable and reorganized business.

Chapter 11 Bankruptcy – Eligibility:

Most of the time, companies file for Bankruptcy under Chapter 11 when their overall debts surpass Chapter 13 limits. Businesses and individuals may similarly file under Bankruptcy Chapter 11. Though, Chapter 11 is principally implemented in the case of business debt. To file bankruptcy under Chapter 13, the party must be obliged to pay under $269,250 in unsecured, liquidated, and non-contingent debts, while below $807,750 in secured, liquidated non-contingent debts. A debtor is barred from filing a case under Chapter 11, else any different chapter, under a few conditions such as during the past 180 days a previous bankruptcy appeal was terminated because of the debtor's deliberate disappointment for appearing in front of the court else obey the court orders otherwise the debtor willingly terminated the earlier case once creditors demanded respite from the court for recovering property on which they demanded justice.

Chapter 11 Bankruptcy Example

Enron filed for Chapter 11 bankruptcy when it employed 21,000 people and had a revenue of $111 billion!.

#4 - Chapter 12 Bankruptcy: A Family Farmer Debt Adjustment with Regular Income

The Bankruptcy Chapter 12 allows debt respite to family farmers having a consistent yearly income. Bankruptcy Chapter 12 appears hugely like Bankruptcy Chapter 13 since both these bankruptcy choices enable the borrower to suggest a strategy of debt reimbursement throughout saying three to five years, coupled with a trustee being allocated to overlook the complete bankruptcy process while disbursing the payments received to all the creditors once the case finishes successfully. Chapter 12 enables a family farmer to stay with their operations on the farm, whereas the strategy is being continued.

Chapter 12 Bankruptcy – Eligibility:

- Consistent Annual Income

This Bankruptcy Code illustrates that just a family fisherman or family farmer having a "consistent annual income" might file for Bankruptcy chapter 12 to get some respite. However, chapter 12 allows for conditions in which fishers or family farmers have income generally periodic. This condition is required to make sure that the yearly income of debtors becomes adequately regular and stable for allowing the debtors to pay under the chapter 12 strategy successfully. The debtors filing petition for relief under chapter 12 get free of cost help or respite.

- “Family Fishermen” and “Family Farmers”

This Bankruptcy Code puts “family fishermen” and “family farmers” in two key categories: (i) one person or one person with the spouse and (ii) a partnership or corporation. Fishers or farmers belonging to the first category need to satisfy all the following four conditions on the date when the case is filed for relief qualification under Bankruptcy Chapter 12:

- A single person or a couple must be involved in a profitable fishing activity or a farming activity.

- The overall debts including, unsecured and secured of any operation, need not surpass $1,500,000 in the case of profitable fishing activity or $3,237,000 in the case of farming activity.

- In the case of a family fisherman, a minimum of 80% and in the case of a family farmer a minimum of 50%, of the overall debts that remain constant in amount (removing the debtor’s home debt) needs to be linked with the profitable fishing or farming operation.

- Over half of the consolidated income of any individual or any couple for the previous tax year (else, just for family farmers for both the 2nd and 3rd previous tax years) needs to be achieved from the profitable fishing or farming activity.

Chapter 12 Bankruptcy Example

David is a family farmer who has continued farming his land in Florida, US, for ten years. Suddenly, due to the global downturn in the agricultural market, the price of his crop production declined significantly that forcing the farmer to go into a state of Bankruptcy as the overall cost of production continued to rise whereas, the farm output did not get the right price upon trading that has forced David to file for Chapter 12 to get some compensation. David reports the total debt of his commercial farming operation to be nearly 2,250,000.

Since David complies with all the rules of Chapter 12, he can successfully file a case under the section to get some compensation while continuing with his farming business profitably.

#5 - Chapter 13 Bankruptcy: Modification of an Individual’s Debts as per Regular Income

Chapter 13 Bankruptcy is made for persons who possess a steady income source and wish to pay off all their debts; however, it is incapable of doing so. The Bankruptcy Chapter 13 might be desirable to Chapter 7 science Chapter 13 typically lets the debtor hold on to a precious asset, for example, an individual's house. The debtor is empowered to place and suggest a key strategy in front of the court under Bankruptcy Chapter 13. The strategy describes how the debtor would reimburse creditors with time over a period ranging from three to five years. Finally, the Court should later approve of this strategy.

Suppose the Court accepts the strategy, the debtor would need to pay the creditors via a trustee. Any outstanding debt would be discharged upon the successful plan completion. Hence, the debtor gets protected from all the actions taken by creditors that include an actual agreement with that debtor for the entire strategy’s life, wage garnishments, and lawsuits.

Chapter 13 Bankruptcy – Eligibility:

- Businesses must have adequate disposable income (DPI), including salary or regular wages, pension payments, social security gains, public gains (welfare payments), etc.

- Overall debt should not be extremely high.

- The Bankruptcy filing candidate must be current on their income tax reporting.

Chapter 13 Bankruptcy Example

Josh, a book-seller, has an annual turnover of $1 50,000 and regularly files for income tax annually. However, due to a sudden downturn in the economy, he witnesses significant losses due to continued declining sales as people save more and minimize visiting the shop. Subsequently, Josh has a huge pile of debt, nearly $1, 00,000 with no cash to repay the vendors and creditors.

Under this situation, since Josh successfully meets all the conditions of filing a Chapter 13 petition, he subsequently decides to hire a lawyer and file a Chapter 13 Bankruptcy petition to get some financial respite.

Frequently Asked Questions (FAQs)

Chapter 7 and Chapter 11 are the two primary bankruptcy forms. Chapter 7 bankruptcy involves liquidating assets to pay off creditors. Chapter 11 is concerned with the reorganization. This Chapter helps the company to restore through restructuring.

The three types of bankruptcies available for business are Chapter 7(liquidation), Chapter 11 (reorganization), and Chapter 13 ( individual debt adjustment with regular income).

There are many types of bankruptcy. Still, only two concerns most debtors are Chapter 7(a liquidation) and Chapter 13 (where the debtor pays the debts in five years).