Top 24 Best Twitter Profiles To Follow In Finance

Table Of Contents

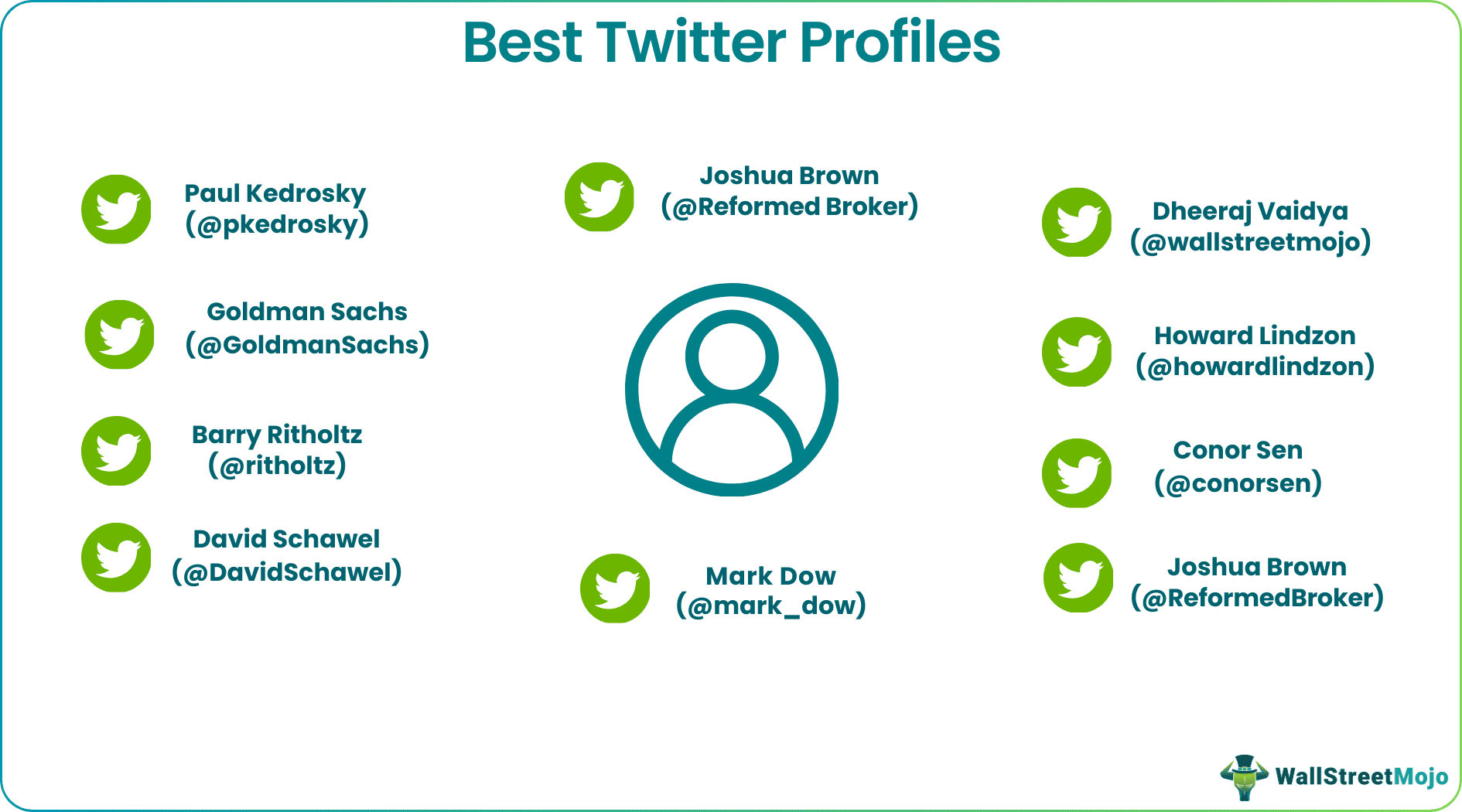

What Are The Top 24 Best Twitter Profiles To Follow In Finance?

As finance professionals, networking becomes quite an essential part of the job. Since Twitter is a growing social media site that people are frequently accessing and using, it is a good avenue to connect with some of the famous personalities of the finance world.

We have gathered 24 accounts from Twitter to enable you to catch a glimpse of the awesomeness of finance. Finance is not as dull as you think (if you are new to finance chuckle). It has analytics, humor, and timely updates from the world's most influential and important people and institutions.

Table of contents

- What Are The Top 24 Best Twitter Profiles To Follow In Finance?

- Top 24 Best Twitter Profiles to Follow In Finance Explained

- Best Twitter Profiles To Follow

- #1 - Paul Kedrosky (@pkedrosky):

- #2 - Goldman Sachs (@GoldmanSachs):

- #3 - Barry Ritholtz (@ritholtz):

- #4 – David Schawel (@DavidSchawel):

- #5 - Dheeraj Vaidya (@wallstreetmojo):

- #6 – Howard Lindzon (@howardlindzon):

- #7 – Conor Sen (@conorsen):

- #8 - Joshua Brown (@ReformedBroker):

- #9 - Mark Dow (@mark_dow):

- #10 - Meb Faber (@MebFaber):

- #11 - Eric Jackson (@ericjackson):

- #12 - Michael Kitces (@michaelkitces):

- #13 - Aswath Damodaran (@AswathDamodaran):

- #14 - Keith Kern (@stt2318):

- #15 - Nick Firoozye (@firoozye):

- #16 - Mohamed A. El-Erian (@elerianm):

- #17 - Value Walk (@valuewalk):

- #18 - Morgan Stanley (@MorganStanley):

- #19 - Ian Shepherdson (@ IanShepherdson):

- #20 - Jason Zweig (@jasonzweigwsj):

- #21 - Justin Wolfers (@JustinWolfers):

- #22 - Michael McDonough (@M_McDonough):

- #23 - Cullen Roche (@cullenroche):

- #24 - Eric Scott Hunsader (@nanexllc):

- Recommended Articles

Top 24 Best Twitter Profiles to Follow In Finance Explained

The top 24 best Twitter profiles to follow in finance is a topic, which all finance professionals will be extremely interested to know. Finance is a profession that requires the ability to network and connect with people who have similar interests. This is because it is necessary to always stay updated about what is happening in the industry, new job avenues created, changes in rules and regulations of investment and finance, new products introduced in the market, etc.

Networking will also help in getting ideas and suggestions from the top notch and highly experienced finance professionals who have great experiences in this field and who have seen and adapted to various changes. In this context, Twitter has proved to be a great source of inspiration as well as knowledge because innumerable people from all across the world are using it.

A Twitter profile offers the facility of not only following the posts or tweets of only those people who have been added to an individual’s profile, but also extending the tweets through the use of a hashtag to thousands of people who search for that particular hashtag and follow it.

However, it is always important to go through the profile and then connect, in order to understand whether the personality and their knowledge or experience and whatever they share will be of true value. The more time an individual spends searching for the right person to follow, the better the possibility of getting good knowledge within less time.

Great personalities in the finance world are people whom budding finance professionals can trust and look for guidance. It is always a good habit to examine their Twitter profiles to find out what they follow, to understand their opinion about a particular situation or event, or to check which are the profiles that they follow.

Thus, it is the best platform that can be used to connect and interact with the most powerful and influential people in the finance world and even get personalized responses from them. Some best Twitter accounts to watch out for are given in the list below. Let us study the details of the same and try to connect with them to get the latest updates and financial details on time.

Best Twitter Profiles To Follow

How would you perceive this? Let us say you are being offered all the updates of the world just during the breaks? You do not need to pay for anything nor need to read any books. You do not need to buy any costly materials (though you always can)! Instead, you will open your Twitter account and check updates from the list we are providing below. Will that help? If you are a finance student or an ardent professional, you will be addicted to this list in no time. Just give it a week. And let the magic of Twitter rubs off on you.

Do you want the magic, or are you still feeling anxious about distraction?

Try absorption instead.

#1 - Paul Kedrosky (@pkedrosky):

If you do not think finance guys cannot make you giggle, follow this man on Twitter. He is a venture capitalist, an entrepreneur, and a Bloomberg contributor. He describes himself as an "investor in curious things." He is running SK Ventures with Eric Norlin, a General Partner. Kedrosky is a Ph.D. in Economics of Technology. You can know more about him here – http://paul.kedrosky.com/about.

Tesla with a lock on most crowded equity short https://t.co/yh7rs8wsRl

— Paul Kedrosky (@pkedrosky) May 25, 2016.

#2 - Goldman Sachs (@GoldmanSachs):

Without much ado, you know what Goldman Sachs is all about. Unfortunately, they started their Twitter handle rather late. But whatever they share is the kingdom of gold. They have mentioned that their primary focus on Twitter is to share the "latest in global and local economic progress, firm news and thought leadership content."

Incredible honor to welcome Home Secretary Theresa May to GS London for #TalksAtGS pic.twitter.com/HWT0hhiipV

— Goldman Sachs (@GoldmanSachs) May 26, 2016.

#3 - Barry Ritholtz (@ritholtz):

Love someone witty and cynical about financial markets and financial trends? Follow Barry. He is one of the frequent Bloomberg guests. He is also an author (check out his book), columnist, and stock analyst. In addition, he is the founder and chief investment officer of Ritholtz Wealth Management. He writes regularly on his website https://ritholtz.com/

Dude, where’s your alpha? https://t.co/izD5Jy97OZ via @BV

— Barry Ritholtz (@ritholtz) May 26, 2016

#4 – David Schawel (@DavidSchawel):

If you are in investment or want to do CFA, this is the man you should follow. He is one of the few CFA holders on Twitter who shares insights specifically about interest rates, monetary policy and inflation. In addition, he works as a Fixed Income Portfolio Manager. He writes at https://economicmusings.com/.

Unreal https://t.co/HxZxB1esot

— David Schawel (@DavidSchawel) May 21, 2016

#5 - Dheeraj Vaidya (@wallstreetmojo):

Dheeraj writes a blog named https://www.wallstreetmojo.com/ to help students and professionals become awesome in Financial Analysis. Here, he shares secrets about the best ways to analyze stocks, financial modeling, buzzing IPOs, M&As, private equity, start-ups, valuations, and entrepreneurship.

Equity Research | A complete beginner's guide by WallStreetMojo.#equityresearch #equity https://t.co/ZEHQRBY6ss

— Dheeraj (@dheerajvaidya) May 24, 2016

#6 – Howard Lindzon (@howardlindzon):

Follow him because he takes the best of what stock traders are talking about and shares them on Twitter and his blog. He has been in this investment profession "for pure joy" for the last 20 years. He is the co-founder and CEO of Stocktwits. You can read his blog at - https://howardlindzon.com/.

If the Warriors lose today, they spend the rest of the summer golfing with the Twitter ‘buy’ button team …

— howardlindzon (@howardlindzon) May 26, 2016

#7 – Conor Sen (@conorsen):

If you love stat, you will love this guy. He shares a lot of stats with his Twitter followers. He calls himself a "data junkie." He is also a blogger and portfolio manager. You can read his stuff at – https://csen.tumblr.com/

Obama net johttps://t.co/uGWwf8GgBFb approval among Asian-Americans:

Chinese: +25

Indian: +73 https://t.co/WHQijGhG73 pic.twitter.com/uGWwf8GgBF— Conor Sen (@conorsen) May 24, 2016

#8 - Joshua Brown (@ReformedBroker):

There is rarely any relation between finance and funny, but this guy bridges the gap. He is smart and funny. In addition, he is a financial advisor, blogger, and CNBC contributor. He has written a book "Clash of the Financial Pundits." Moreover, he is the CEO of Ritholtz Wealth Management. Learn more about him - https://thereformedbroker.com/about/.

Over the last 3 years, the top 14 automakers upped their combined R&D spend by $192 million. $AAPL upped R&D spending by $5 billion.

- MS

— Downtown Josh Brown (@ReformedBroker) May 26, 2016

#9 - Mark Dow (@mark_dow):

It would help to look for his macro insights on Twitter by following him. He is a Hedge Fund Manager and an economist. You can know more about him and his insights at – https://markdow.tumblr.com/.

Bye gold! https://t.co/smAevfSSmQ

— Mark Dow (@mark_dow) May 26, 2016

#10 - Meb Faber (@MebFaber):

If you are an ardent learner of finance, this guy will add so much value to your career or curiosity, whatever defines you. He is a researcher and trader. He has accumulated a ton of knowledge about the stock market, specifically valuations, dividends, and asset allocation. He is also the author of "Invest with the House: Hacking the Top Hedge Funds," available on Amazon. In addition, he is the founder and chief investment officer at Meb Faber Research (https://mebfaber.com/ ).

You can debate WHY this is the case, but it is a fact:

S&P 500 median price-to-sales ratio at an all-time high of 2.2 back in 1964. (avg 0.9)

— Meb Faber (@MebFaber) May 26, 2016

#11 - Eric Jackson (@ericjackson):

If you are interested in tech and China, he is the go-to guy for you. His insights are great, and you would be able to learn a ton of things. He is also a Hedge Fund Manager and the CEO of Iron Fire Capital. You can listen to his podcasts at <a href=”https://podcasts.apple.com/us/podcast/the-eric-jackson-podcast/id1009301965?mt=2.

What GSW needs to do now is ask themselves. “what would VCs do down 3-1?”

— Eric Jackson (@ericjackson) May 25, 2016

#12 - Michael Kitces (@michaelkitces):

If you are in the finance profession, you may have heard his name. Yes, he is the nerd guy. So right, he writes at Nerds Eye View. And he is good at presenting great financial insights.

Don’t try to change people’s minds. It’s hard. More results by just making it easier to act for those interested. @DanielPink

— MichaelKitces (@MichaelKitces) May 27, 2016

#13 - Aswath Damodaran (@AswathDamodaran):

If you are struggling with valuations or know something very few cares share on earth about valuation, follow this genius. He is NYU Finance Professor. If you follow his Twitter handle, you will see his insights and learn more than a thing or two to apply to your own Excel sheet. He writes at – com. You can download many charts from his site to help yourself ascertain valuation.

A step-by-step simulation for Apple in May 2016 yields this distribution of values: https://t.co/mlan4490cP pic.twitter.com/0C5a1pJPV7

— Aswath Damodaran (@AswathDamodaran) May 23, 2016

#14 - Keith Kern (@stt2318):

He is an equity trader. And he says that he uses Twitter as his trading diary. So if you want to learn valuable things about trading, you do not want to miss out on this guy. This guy shares more of his insights and offers courses at https://www.traderztoolbox.com/.

closed out 2 more winners today in the swing service.. great MAY. email info@traderstoolbox.net to receive pic.twitter.com/DgoUyRpUzL

— stt2318 (@stt2318) May 23, 2016

#15 - Nick Firoozye (@firoozye):

He is one of the best-known experts in macro. He is the Managing Director of Nomura. He has been nominated as the finalist for Wolfson Prize to provide the best solution for breaking up the euro. He often shares his lectures and important notes. Finance students and professionals can explore a plethora of information through his Twitter handle.

Such a catastrophe, the EU-UK Free Trade deal will come immediately! -- Brexit...’ serious risk’ to global growth, says G7 https://t.co/R5erFX7GJS

— firoozye (@firoozye) May 27, 2016

#16 - Mohamed A. El-Erian (@elerianm):

He is the Chief Economic Advisor of Allianz and Chair of President Obama's Global Development Council. He is also an author of New York Best Seller "When Market Collides" and "The Only Game in Town."

.@FT @martinwolf_ :"Monetary policy is not exhausted...But undue reliance...is problematic.” https://t.co/qTHKRbRQcu pic.twitter.com/bAxHgCa92R

— Mohamed A. El-Erian (@elerianm) May 25, 2016

#17 - Value Walk (@valuewalk):

If you want to get great insights on hedge funds, this guy is your pick. He is the CEO of his website, "Value Walk." However, if you are more interested, check out this website at - http://www.valuewalk.com/.

Here’s The One Number You Need To Understand The Copper Market https://t.co/KzIGeLs7Oi pic.twitter.com/I4NXl19li1

— ValueWalk (@valuewalk) May 27, 2016

#18 - Morgan Stanley (@MorganStanley):

If you are in finance or business, you may have heard about Morgan Stanley. It is the American banking giant. You would get a wealth of information about investment banking, securities, wealth management, and investment management. The news and views are superb and solid. Visit - https://www.morganstanley.com/ for more details.

An $MS 529 college savings plan is cheaper than not saving for #college #529Day https://t.co/BozGdGck7f pic.twitter.com/6k5HMdFpbf

— Morgan Stanley (@MorganStanley) May 25, 2016

#19 - Ian Shepherdson (@ IanShepherdson):

He is the chief economist of Pantheon Macroeconomics. He is an econ fact machine. Also, he is a Forbes contributor. He is a very smart guy. He mixes humor and facts in his tweets. You cannot miss his Twitter feed if you want to know the current economics, business, and finance trend. You can also check https://www.pantheonmacro.com/ for more information.

It would look very different ex-mining, and the mining capex collapse is almost over. https://t.co/kexwGIjaR2

— Ian Shepherdson (@IanShepherdson) May 26, 2016

#20 - Jason Zweig (@jasonzweigwsj):

He is a big name in the investment industry. He is the investment columnist for the Wall Street Journal. He is also the editor of Benjamin Graham's famous book "The Intelligent Investor." In addition, he has written two books – "Your Money & Your Brain" and "The Devil's Financial Dictionary." His tweets are being followed by the world's best businessmen and leaders. So, follow his tweets to get the best finance and business industry resources. You can also check out his website http://www.jasonzweig.com/ for more information.

Dear College Students,

Learning occurs when your mind collides with the unexpected and uncomfortable. You won’t find those in “safe spaces.”— Jason Zweig (@jasonzweigwsj) May 26, 2016

#21 - Justin Wolfers (@JustinWolfers):

He is one of the best go-to guys in finance on Twitter. He shares incredible insights, and people worldwide read his tweets. He is a professor of U-M Economics and Ford School. In addition, he is a contributing columnist at New York Times. You can read his writing at http://users.nber.org/~jwolfers/.

Late May polls have typically been wrong by about 9 points. Ignore 'em. https://t.co/686u4DFo78 by @jshkatz @KevinQ pic.twitter.com/WlYm63Wiah

— Justin Wolfers (@JustinWolfers) May 26, 2016

#22 - Michael McDonough (@M_McDonough):

He is the Global Director of Economics/Chief Economist at Bloomberg LP. Previously he worked with Deutsche Bank. He shares a lot of information on finance, economics, and market trends. The main attraction of his Twitter feed is the culmination of charts, inside information and his reflections on different aspects of the market.

What a Difference a Week Makes: Probability of Fed Rate Hikes pic.twitter.com/2nuXbokt8e

— Michael McDonough (@M_McDonough) May 19, 2016

#23 - Cullen Roche (@cullenroche):

He has a lot of good insights to share, and he is very witty. He writes about pragmatic capitalism. Also, he is the founder of Orcam Financial Group. You can reach his blog - https://www.pragcap.com/ for more information.

The stock market is the only market where things go on sale, and all the customers run out of the store....

— Cullen Roche (@cullenroche) August 24, 2015

#24 - Eric Scott Hunsader (@nanexllc):

His tweets are focused on stock markets. He deals with data and is also the founder of Nanex LLC. He also created NxCore, enabling a rich streaming data feed that allows unparalleled market analysis. He can be reached at tip@nanex.net. You can also check out http://www.nanex.net/ for more information.

The Worst Of Wall Street (#HFT) Is Taking Over Sports Betting https://t.co/4WSCKjUs3P

— Eric Scott Hunsader (@nanexllc) May 26, 2016

Now, suppose you have followed all these people and got a ton of information. How would you get benefit from it? You can use a how-to-guide below to extract the data and learn them to the maximum extent.

Therefore, from the above list we see that the fiancé personalities can extend from investment bankers to experienced traders, economists, company founders, news analysts, news opinion columnists, writers or fiancé influencers who study the market with a lot of interest and details are genuinely interested to impart their knowledge to the rest of the world through these digital platforms and social media sites so that they are able to reach out to the maximum number of people within very less time.

It is only a wise decision to use this opportunity to expand one’s financial network to grow in the profession.

Recommended Articles

This article is a guide to what are the Top 24 Best Twitter Profiles To Follow in Finance. We explain it along with a list of 24 such twitter profiles. If you want to learn more about investment banking, then you may have a look at the following articles: -