Table Of Contents

What Is Tulip Mania (Dutch Tulip Bulb Market Bubble)?

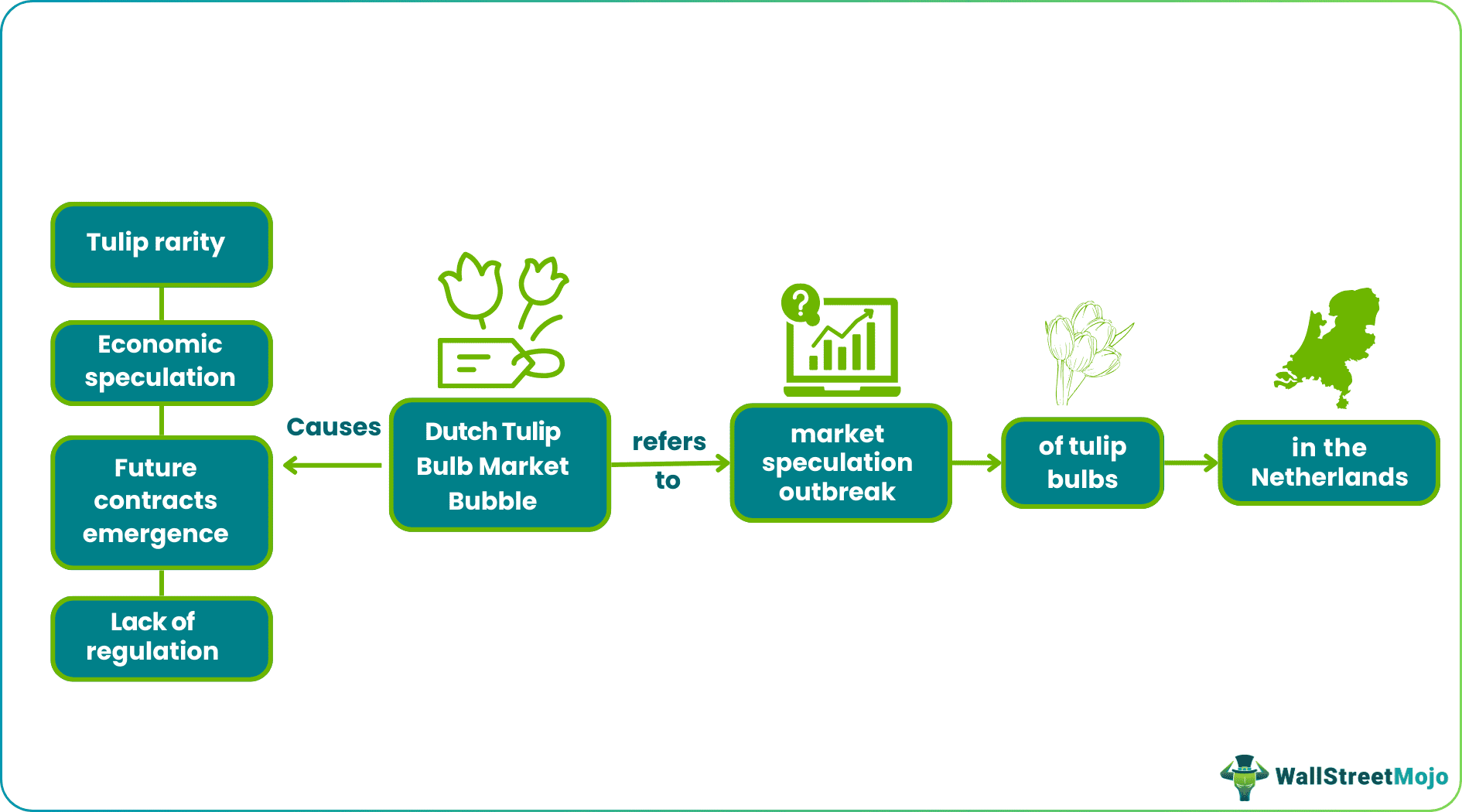

Tulip Mania, also known as The Dutch Tulip Bulb Market Bubble, was a speculative frenzy in the Netherlands during the 17th century, specifically from 1636 to 1637. The purpose to understand this bubble is to highlight the risks of speculative investing and the potential consequences of irrational market behavior.

The Tulip Mania is a classic example of irrational exuberance and speculative mania. It highlights the dangers of speculation and the potential for significant financial losses when market sentiment shifts. Its importance lies in being one of the earliest examples of an economic bubble, serving as a cautionary tale and contributing to understanding market psychology and financial history.

Table of contents

- What Is Tulip Mania (Dutch Tulip Bulb Market Bubble)?

- The Tulip Mania was a period of intense speculation, with investors buying tulip bulbs hoping to profit from rising prices.

- The bubble was fueled by irrational exuberance, as the perceived value of tulip bulbs far exceeded their intrinsic worth.

- The bubble burst in February 1637, leading to a sharp price decline, panic selling, and significant financial losses for investors.

- It highlights the dangers of speculative investment bubbles and the potential for significant financial losses when market sentiment shifts.

Tulip Mania Explained

The Dutch Tulip Bulb Market Bubble, also known as Tulip Mania, is a significant event in economic history and a historical case study illustrating the potential consequences of speculative market behavior and the risks associated with investment bubbles. By examining the Tulip Mania, historians and economists gain insights into the dynamics of financial markets, the psychology of investors, and the broader socio-economic context of the 17th-century Netherlands. It continues to be discussed and analyzed to understand the complexities of market speculation and its impact on societies.

The Tulip Mania is a classic example of irrational behavior and speculative mania. It highlights the dangers of speculative investment bubbles and the potential for significant financial losses when market sentiment shifts. The event also demonstrated the limits of government intervention in controlling market forces and preventing economic downturns.

Although some aspects of the Tulip Mania narrative have been subject to historical debate and interpretation, some argue that the extent of the bubble and its economic impact may have been exaggerated over time. Nonetheless, it remains a fascinating and widely discussed episode in economic history.

History of Tulip Mania

It is often considered one of the first recorded economic bubbles in history. It occurred in the Netherlands during the 17th century, specifically from 1636 to 1637. During this period, tulip bulbs became extremely popular and were seen as a status symbol among the Dutch elite. As a result, the demand for tulips soared, leading to a rapid increase in their prices. As a result, speculators, including merchants, craftsmen, and even common people, started investing heavily in tulip bulbs. The hope was to make substantial profits.

At the bubble's peak, rare tulip bulbs could be sold for exorbitant prices, sometimes reaching the equivalent of a luxury house or a year's income for a skilled craftsman. As a result, the tulip market became highly speculative, with people buying and selling bulbs multiple times without even taking physical possession of them.

However, the bubble eventually burst in February 1637. Prices collapsed dramatically, and panic selling ensued. As a result, many people who had invested heavily in tulips faced significant financial losses. The government attempted to intervene and prevent further economic damage, but the damage was already done.

Causes of Tulip Mania

Let us look at the causes that contributed to its occurrence:

- Tulip popularity and rarity: Tulips were introduced to the Netherlands in the late 16th century and gained significant popularity among the wealthy and elite. They were considered exotic and represented luxury and refinement. Additionally, certain tulip varieties were rare and difficult to cultivate, adding to their allure and increasing their value.

- Economic prosperity and speculation: The Dutch Golden Age during the 17th century brought about a period of economic prosperity that fueled speculative investing. The newfound wealth and expanding middle class created a desire for conspicuous consumption and investment opportunities. Tulip bulbs presented an attractive investment due to their rising prices and the potential for quick profits.

- The emergence of futures contracts: A unique factor in the tulip market was the development of futures contracts. These contracts allowed investors to buy tulip bulbs at a predetermined price for future delivery. The ability to trade bulbs without physical possession facilitated speculative trading and rapidly escalated prices.

- Social and cultural factors: Tulips became a status symbol among the Dutch elite. Bulb ownership was a display of wealth and taste. This cultural trend further increased the demand for tulip bulbs and drove up prices. The market frenzy was fuelled by social pressure to participate and fear of missing out on potential profits.

- Lack of regulation: The tulip market was largely unregulated, allowing speculation to run rampant. There was no central authority overseeing trading practices or ensuring fair valuation. This lack of oversight contributed to the formation of a speculative bubble. Market participants were driven more by irrational behavior and speculation than by intrinsic value.

Effects

Let us look at the effects on various aspects of the economy and society:

- Economic consequences: When the tulip bubble burst in 1637, the prices of tulip bulbs plummeted, leading to widespread financial losses for investors. Many individuals and businesses faced substantial debt and bankruptcy. The collapse of the tulip market resulted in a significant economic downturn and a loss of confidence in speculative investments.

- Social and cultural impact: The tulip mania had a lasting impact on Dutch society. The bubble's collapse shattered the perception of tulips as a symbol of wealth and prestige. In addition, the event exposed the risks and folly of speculative investment, causing a shift in attitudes toward financial speculation and a more cautious approach to investing.

- Government intervention: In response to the crisis, the Dutch government took measures to stabilize the situation and mitigate the economic damage. Contracts made during the speculative frenzy were declared null and void. It relieved some debt burdens on individuals. However, these interventions could not reverse the economic downturn entirely.

- Speculation: It highlights the dangers of speculative bubbles, irrational exuberance, and the potential consequences of unchecked market speculation. The event has since been studied and referenced in economic literature. It contributes to a better understanding of market psychology and financial market dynamics.

- Long-term impact on the tulip industry: Despite the bubble's collapse, the tulip industry survived and continued to flourish in the Netherlands. However, the market shifted towards a focus on tulip cultivation rather than speculative trading. The tulip trade became more regulated, with measures implemented to prevent excessive price volatility and fraudulent practices.

The Bubble Burst

The bursting occurred in early February 1637. The exact trigger or catalyst for the bubble's collapse is not definitively known, but several factors likely contributed to the sudden decline in prices and the subsequent panic selling:

- Profit-taking and speculative fatigue: As the tulip prices soared to unprecedented levels, some savvy investors began to take profits and sell their holdings. This initial selling pressure caused a slight price decline, leading others to follow suit and sell their bulbs.

- Lack of buyers: As the selling pressure intensified, there was a sudden lack of buyers in the market. Speculators, who had previously been eager to acquire tulip bulbs at any price, became hesitant due to the rapidly declining prices and concerns about the market's sustainability.

- Negative news and skepticism: Reports of corruption and fraudulent practices within the tulip trade began circulating, eroding confidence in the market. Additionally, some prominent individuals started expressing doubts about the inflated prices of tulip bulbs, causing further skepticism among investors.

- Panic selling: As the market sentiment shifted from optimism to fear, panic selling took hold. Investors rushed to sell their bulbs at any price, fearing the bubble would burst entirely and leave them with worthless investments. This wave of panic selling caused prices to plummet rapidly.

- Government intervention: The Dutch government intervened to restore stability to the market and prevent further economic damage. They declared that tulip contracts made during the bubble's peak were null and void, relieving some of the financial obligations. However, this intervention could not prevent the collapse of the bubble.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

During the Tulip Mania, certain rare tulip bulbs were more valuable than gold, with their prices reaching extraordinary levels due to speculative trading and market frenzy.

The main lesson learned from the Dutch Tulip Bulb Market Bubble is the cautionary tale of speculative investing, highlighting the risks of irrational exuberance, the formation of asset bubbles, and the importance of rational decision-making in financial markets.

A fun fact about the Tulip Mania is that at the bubble's peak, tulip bulbs were a form of currency in some transactions. People exchanged bulbs for goods and services. This further exemplifies the extent of the speculative mania surrounding tulips at the time.

Recommended Articles

This article has been a guide to what is Tulip Mania (Dutch Tulip Bulb Market Bubble). We explain the topic in detail with its history, causes, effects, and the bubble burst. You may also find some useful articles here -