Table Of Contents

Trust Fund Meaning

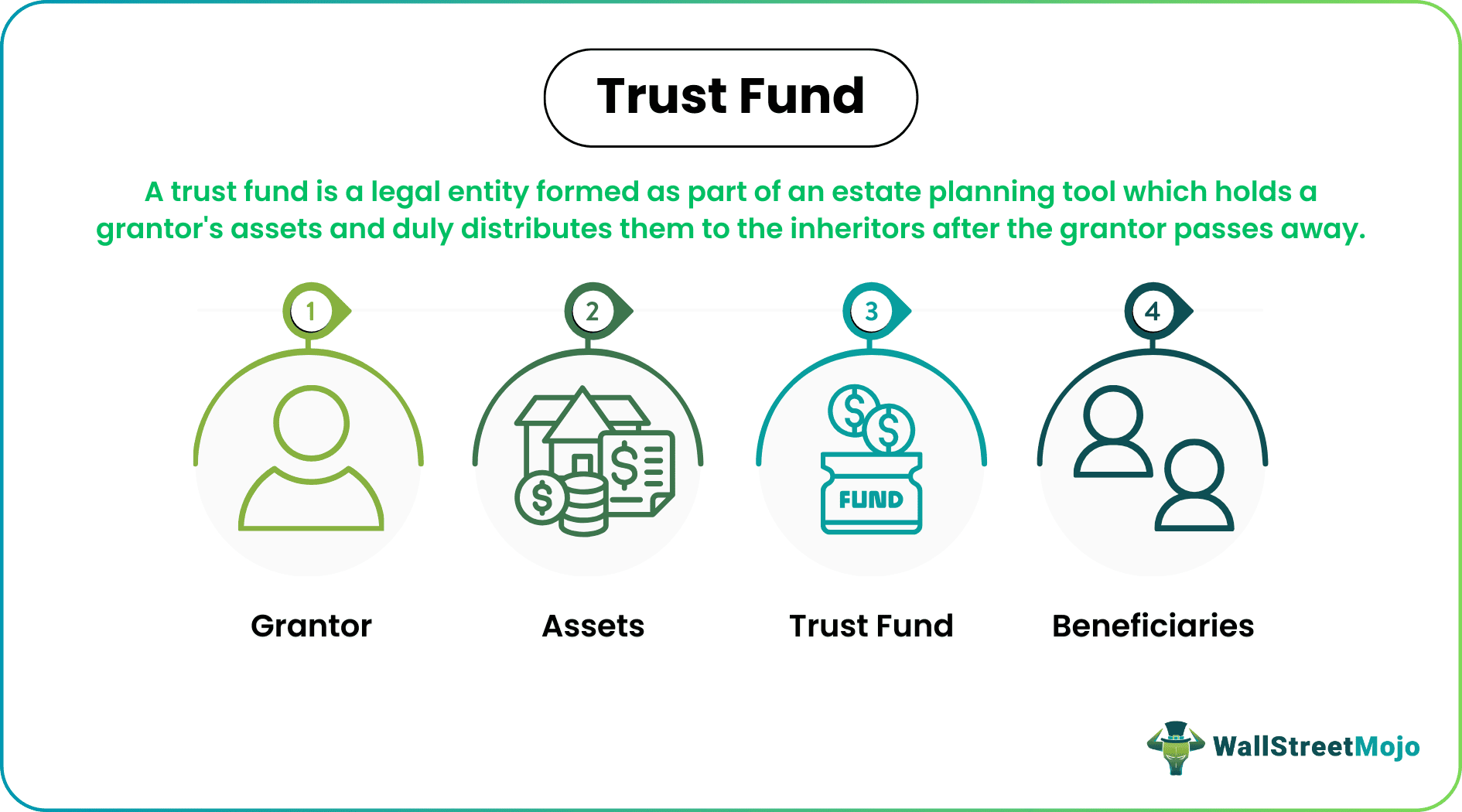

A trust fund is a legal entity formed as part of an estate planning tool which holds a grantor’s assets and duly distributes them to the inheritors after the grantor passes away. These trusts can help settle the inheritance outside of court by ensuring their distribution as per the terms of the agreement.

Different types of trust funds attract distinct advantages, including tax efficiency, protection from creditors and regular income payments to minor beneficiaries.

Key Takeaways

- A trust fund is defined as an entity under which assets of an individual are transferred to allow their in heritence legally. Such a fund is created by parents, or grandparents to pass down their wealth to family members or dependents. An entity can also form a trust to safeguard its assets.

- The parties involved in a trust fund are a grantor, beneficiary and trustee. Grantor is the person whose assets are to be inherited.

- Beneficiary refers to the person who would inherit the grantor’s assets. Examples of beneficiary include family members or a charity. The trustee being an impartial third party, manages the underlying assets of the trust on behalf of the grantor.

- A grantor has to work out several details while opening a trust such as the nature of the trust, number of beneficiaries, total asset under management, conditions to inheritance, tax planning, etc.

How Does Trust Fund Work?

As an estate planning tool, a trust fund allows individuals to legally transfer their assets to the beneficiaries without much hassle. Otherwise, if an individual passes away without a trust in place, inheritors would most often need the help of a court to acquire their inheritance.

The parties involved in a trust fund are a grantor, beneficiary and trustee. The grantor is the person whose assets are to be inherited. As such, the grantor sets up a trust fund with the help of an attorney. These days one can set up trusts on their own as well using web applications and sources.

Beneficiary refers to the person who would inherit the grantor’s assets. Examples of beneficiaries include family members or a charity. The grantor, along with the estate planning attorney, prepares a trust agreement, determines its terms and appoints a trustee.

The trustee being an impartial third party manages the underlying assets of the trust on behalf of the grantor. When the grantor passes away, the trustee dutifully transfers them to the beneficiary as per the terms of the trust agreement. Therefore, it is highly essential to select a trustworthy trustee who’d ethically observe fiduciary duties even when the grantor is no longer around.

Features of Trust Fund

Let us look at the features of trust funds which will throw light on their advantages as well.

- Trust agreement – the grantor prepares an agreement that declares the terms of the trust management and asset transfer. For example, the agreement will specify total number of beneficiaries, their ratio in inheritence, assets under the trust, etc.

- Variety of assets – one can hold a variety of assets in a trust such as property, bank account, insurance, investment securities, vehicle, gold, etc. In this regard, it is important to note that a trust account refers to a bank account that is under a trust fund. A financial advisor can advice better on assets to be kept under the trust as it would be futile to put an insurance account that already has a beneficiary.

- Ownership – the ownership title of the assets depends on the type of trust. In irrevocable trusts, the grantor transfers the ownership title to the trust and so the trust owns all the assets.

- Management – the trust’s management depends on its type. For example, a living trust allows the grantor to use the assets under the trust. As such, in many cases, the grantor becomes the trustee. A new trustee takes over upon the grantor’s demise.

- Conditions – Many times, grantors add conditions to inheritance to safeguard their wealth. A common example is when it is stated in the agreement that the minor beneficiaries can only inherit after turning 21. Until then, they can be allowed a fixed allowance for living expenses, college fees, etc.

- Income - Investments including the bank account under a trust fund may continue to earn income and gains throughout their existence. They enhance the value of assets and the trustee needs to pay taxes on them. In a living trust, the grantor is obligated to pay taxes on the income earned from the trust assets because the grantor will retain their ownership as long as alive.

- Taxes – Some types of trust do not attract estate tax while others will require the beneficiary to pay them during inheritance. Tax rules often vary as per the state laws.

- Overall – Trust fund is a crucial tool used for family wealth management, family tax planning, and making sure that grantors pass down their wealth to their dependents in a hassle-free manner.

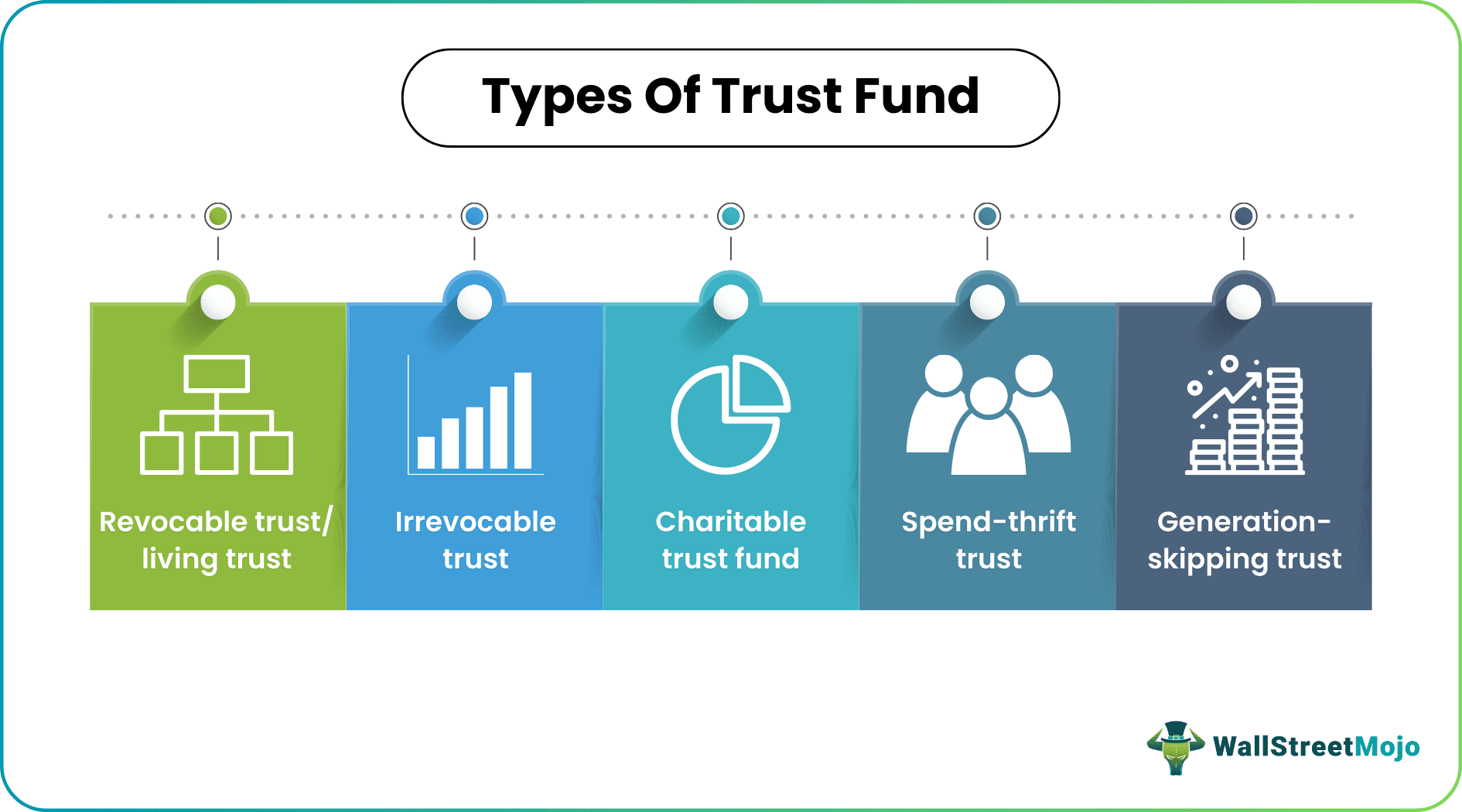

Top 5 Types of Trust funds

Given below are the different types of trust funds.

#1 - Revocable Trust/ Living Trust

One can alter the terms of this trust as long as the grantor lives. The grantor also retains ownership and access to the assets under the trust. In most cases, the grantor assumes the role of a trustee in revocable trusts.

Under this arrangement, the income earned from the assets in the trust will be taxed as part of grantor's income as long as the grantor lives. Revocable trusts usually change into irrevocable trusts after the grantor passes away.

#2 - Irrevocable Trust

The terms of an irrevocable trust cannot be changed or revoked in most cases once the trust is formed. The grantor losses ownership of the assets once they are transferred to an irrevocable trust. As such, the grantor will not be considered the legal owner of the assets under the trust. In addition, any creditors of the grantor cannot hold a claim against the these assets. An irrevocable trust also reduces taxes as the assets in the fund are not considered to be held by a grantor. Since the terms cannot be easily revoked, one must think it through before opting for this type.

#3 - Charitable Trust Fund

When grantors want their wealth or a part of it to be utilized for a greater good, a charitable trust is formed. The asset pool that the grantor contributes often forms the part of the corpus fund, which is generally maintained for eternity. The income generated from the assets is used to fund charitable causes.

#4 - Spend-thrift Trust

Such a fund is formed when grantors believe that their heirs cannot responsibly handle their inheritance. Hence, they feel the need to appoint an independent entity (trustee) to ensure that the assets are used only for purposes that the grantor has permitted in the deed. These funds have clauses that do not permit the beneficiaries to use their inheritance as collateral.

#5 - Generation-Skipping Trust

This is a tool to transfer your wealth to your grandchildren/great-grandchildren directly rather than passing it down through their parents. They generally save the spouse or children from high estate taxes when they are of high value.

#6 – Others

There are many other types of trusts other than those mentioned above that can help with the peculiar needs of inheritance.

Frequently Asked Question (FAQs)

A trust fund is formed by individuals or entities to neutrally and legally transfer their belongings to their inheritors. It is formed by the grantor of an inheritance who prepares a deed dictating the terms of the trust. Thereafter, a trustee is appointed who manages the trust as per the deed and transfers the assets to the beneficiaries.

Trust funds are an essential estate planning tool that allows the legal transfer of wealth. It ensures that the assets remain in safe hands and are well-managed by a neutral party until the beneficiary takes their ownership. In the absence of trusts, beneficiaries will have to head to a court to gain access to their inheritance which will be expensive and time-consuming.

Earlier, trust funds were considered restricted to high-net-worth individuals with their massive wealth requiring elaborate estate planning. However, today, middle-class groups have also started opting for trusts. Normally one can start the fund with any amount, although it may vary amongst estate planning companies, portals and platforms.