Table Of Contents

What Is Troubled Debt Restructuring (TDR)?

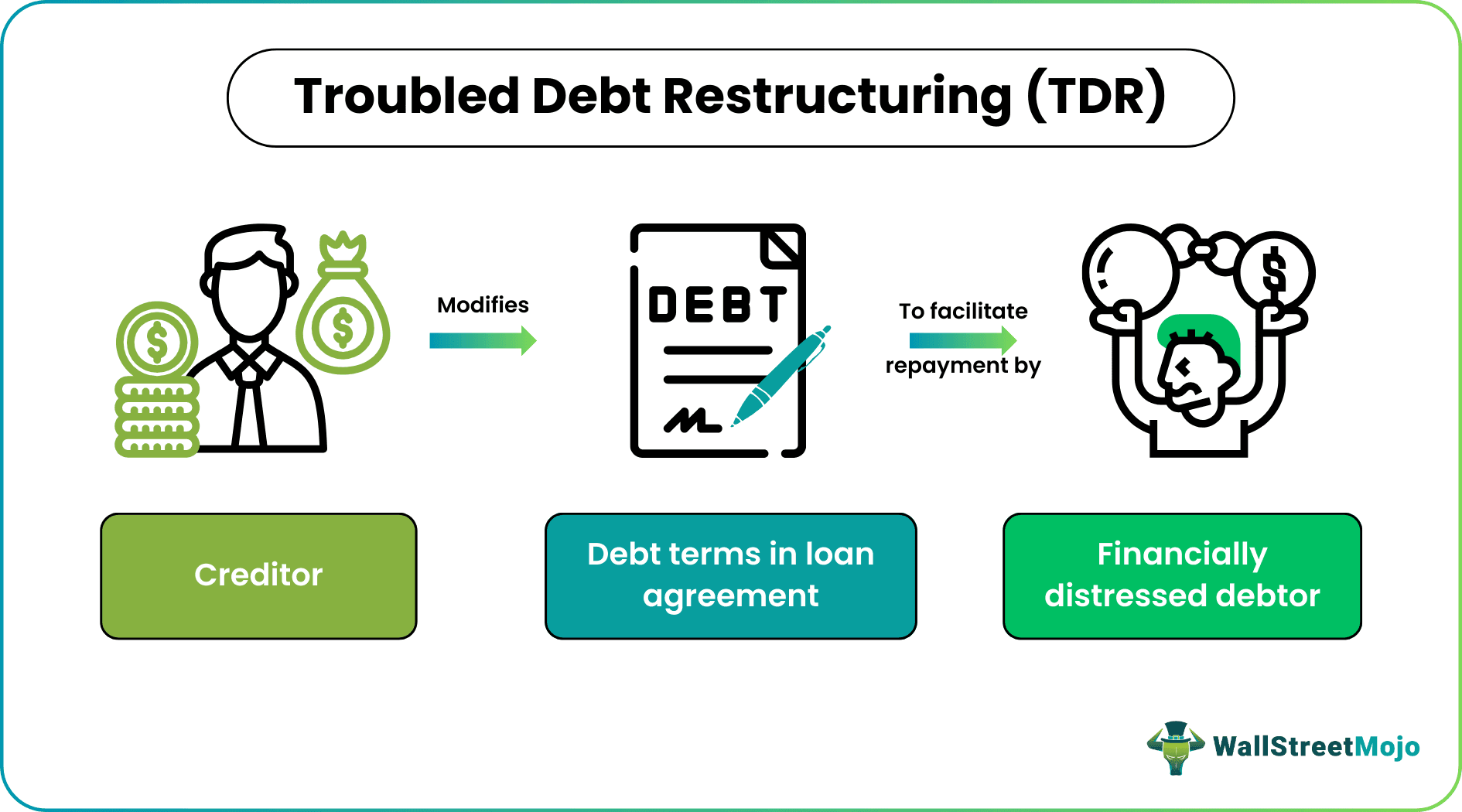

Troubled debt restructuring (TDR) refers to a modification in the loan terms or payment method by the creditor when the debtor faces financial distress. Such an arrangement is favorable for the borrower and lender, enabling the former to manage the debt payment and save the latter from bad debts.

The creditor can allow a TDR concession for better debt management whenever the debtor encounters severe financial issues due to certain legal or economic circumstances. ASC 310-40-35-10 provides guidelines for the accounting for troubled debt restructuring, stating that a TDR isn't recorded as a new loan since it is a part of the lender's previous debt recovery process.

Key Takeaways

- Troubled debt restructuring (TDR) is an alternative for debt recovery adopted by creditors who allow concessions in loan terms, perceiving the debtor's financial turmoil or inability to repay the debt.

- Here, the lenders ease out the loan terms through measures like reducing or eliminating the interest rates, decreasing the outstanding principal amount, lengthening the maturity tenure, or accepting payment through the transfer of assets or securities.

- TDR's purpose is to provide repayment flexibility to the borrowers and avoid potential bad debts.

- The ASC 310-40 guidance states the various principles and methods for accounting for troubled debt restructuring by creditors.

Troubled Debt Restructuring Explained

Troubled debt restructuring (TDR) is a concession the creditor allows when the debtors face inevitable legal or economic consequences that adversely affect their earning potential or debt repayment capacity. Thus, such an arrangement makes the debt payment more manageable and affordable for the debtors. The lender can modify the debt structure in the following ways:

- Reducing the outstanding principal amount,

- Decreasing the interest rates sometimes eliminates the same,

- Increasing the loan tenure or maturity term, or

- Accepting payment in the form of collateral, asset, or securities rather than cash.

Regulatory authorities such as Generally Accepted Accounting Principles (GAAP), International Financial Reporting Standards (IFRS), and the Office of the Comptroller of the Currency (OCC) suggest the proactive engagement of financial institutions and borrowers in restructuring loans with reasonably modified terms, emphasizing the importance of accurately reflecting these modifications in call reports. The purpose is to recognize that, despite economic challenges, numerous borrowers maintain creditworthiness and a willingness to repay, highlighting the mutual benefits of cooperation.

Guidance

Some of the guidelines are as follows:

I. ASC 310-40 Guidance:

- TDRs are to be treated as part of the ongoing loan recovery efforts.

- The original loan's unamortized fees and costs transfer occur to the amortized cost basis of the restructured loan.

- TDR-related legal fees and direct costs expenses accounting occur when they are incurred.

- The loan's amortized cost basis is decreased for any fees acquired with regard to the TDR.

II. ASC 326-20 - CECL (Current expected credit losses methodology) Model:

- The CECL model provides no separate impairment model for debt restructuring in a TDR.

- One must consider a discounted cash flow (DCF) approach for determining the credit losses on restructured loans or reasonably expected TDRs.

- One should identify the reasonable expectation of a TDR at the individual loan level.

- TDR measurement can happen for expected credit losses on either individual or pool asset basis.

III. TDRs and Concessions in the CECL Model:

- TDR-associated concessions must be incorporated into figuring out the expected credit losses.

- A DCF method may come into use for certain concessions, like interest rate concessions and term extensions.

- The effective interest rate used for DCF should be the original effective rate of the loan.

- Historical loss data may already include the effects of TDRs; it doesn't require any adjustment unless future loss mitigation efforts differ.

IV. Identification of Reasonably Expected TDR:

- Reasonably expected TDR identification occurs at the individual loan level.

- The loan modification programs and consideration of credit risk management policies are crucial for identifying potential TDRs.

- Not all identified reasonably expected TDRs may result in executed TDRs.

V. Adjustment to Loss Estimates:

- Entities should consider making adjustments to loss estimates if future loss mitigation efforts differ from the past.

- Recognition of a TDR's effects should occur once a reasonable expectation of a TDR is identified on an individual instrument.

Examples

Let us now understand the TDR concept with the help of the following examples:

Example #1

Suppose, on January 01, 2020, ABC Ltd. took a commercial loan of $25,000 from XYZ Bank at an annual interest rate of 12% p.a., repayable in 5 years. By December 31, 2022, the company has repaid the principal sum of $15,000 with interest. However, due to consistent losses, the company is not in the state of repaying the regular debt installments. The bank considered the situation and decided to restructure the debt by reducing the interest rates to 8% and extending the loan maturity date to December 31, 2026.

Example #2

Zambia's complex three-year debt restructuring process encountered a notable setback when bilateral creditors, including China, mandated increased debt relief from international funds holding sovereign bonds. The challenges began in 2019 as Zambia struggled to repay its international market dollar-denominated government bonds ("Eurobonds"). Amid the COVID-19 pandemic in 2020, the country sought a freeze on debt payments through the G20-led Debt Service Suspension Initiative. In May 2020, President Edgar Lungu's government engaged French firm Lazard to advise on restructuring $11 billion in foreign debts.

Zambia defaulted on debt in November 2020, signifying Africa's first pandemic-era sovereign default. In 2021, opposition leader Hakainde Hichilema secured the presidency. Subsequently, in June 2022, the formation of an official sector creditor committee (OCC) initiated negotiations with bondholders throughout 2022. In June 2023, a restructuring agreement occurred between the "Paris Club" and China, amounting to $6.3 billion. Then, in October 2023, the bondholders devised an "Agreement in principle" proposing debt consolidation. Still, the deal faced a substantial setback in November as the bilateral OCC creditors declined the proposal. It resulted in dissatisfaction among bondholders who considered it highly demanding.

Frequently Asked Questions (FAQs)

The various benefits of TDR for debtors and creditors include:

1. Saving debtors from defaulting on loans

2. Protecting debtors from filing for bankruptcy

3. Reducing chances of bad debts for creditors

4. Decreasing the borrower's financial burden

5. Avoiding creditors from filing lawsuits for debt recovery and

6. Saving debtors from legal consequences

The schedule RC-N records the TDR for all of the following debt types:

1. Real estate-backed loans

2. Loans to depository institutions and acceptance to other banks

3. Financing of agricultural production and other forms of debt allowed to farmers

4. Commercial and industrial borrowings

5. Loans extended to individuals for family, household, and other personal expenditures

6. Official institutions and foreign government loans

7. All other borrowings

Banks may consider the TDR to offer greater flexibility to debtors who would otherwise not be able to pay off the borrowed sum or have defaulted on the previous installment. It can be applicable for short-term and long-term loans by modifying the loan terms in the agreement, such as extending the repayment period or offering lower than market interest rates, with mutual agreement between the bank and the debtor.