Table of Contents

What Is A Triggering Event?

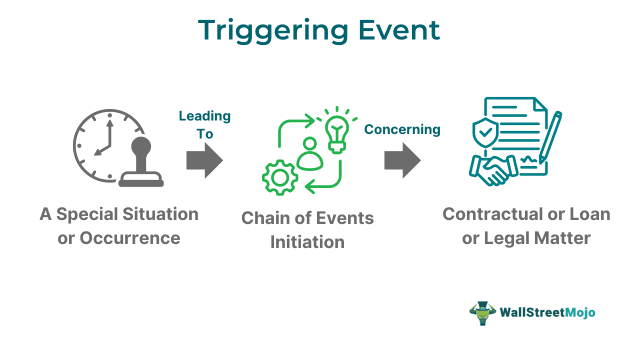

A triggering event refers to a condition or occurrence that initiates a specific liability, activity, or status modification related to a contract, legal matter, or business. It establishes a clear point at which specific actions or responsibilities must be undertaken, such as preserving evidence or activating obligations. Such events are commonly used in litigation, contracts, and business transactions.

Using these events, individuals and organizations effectively manage their contractual and legal obligations. It enables compliance and preparedness to deal with any resulting actions. Financial markets gain stability using clear guidelines on triggering actions necessary to be taken after some specific conditions are fulfilled.

Key Takeaways

- A triggering event can be stated as a situation or event that initiates a particular change in status, liability, or activity pertaining to a business, contract, or legal matter.

- It defines a point when specific obligations or tasks must be completed, like the moment at which commitments take effect or keeping track of evidence.

- It has many types, like- claims-made policies, occurrence policies, tail coverage, injury-in-fact, exposure, manifestation, continuous, and parametric.

- Its importance includes adapting contracts to changing situations, mitigating risk, safeguarding interests, and averting crises. It also facilitates investor adjustments, triggers changes in stock processes and indicates declines in stock prices.

Triggering Event In Finance Explained

A triggering event definition can be stated as a special situation in which the initiation of a chain of events takes place in relation to a contractual or loan agreement for money payment in lieu of equity. These events consist of breaches of covenants, mergers or acquisitions, and financial metrics. They also include death, job loss, and retirement and can be in multiple contract types. In life insurance policies, it may trigger specified events as per the insured's age.

Moreover, these events can either be intangible, like a change in market conditions, or tangible, like meeting financial metrics. It works by acting like predefined checkpoints activating a follow-up event in asset impairment, financial contracts, and risk management scenarios. Such clauses have become common concerning loan documentation, convertible notes, and simple agreements for Simple Agreement for Future Equity (SAFEs). Moreover, these have become integral to financial agreements. It allows automatic responses to dynamic conditions in the absence of constant monitoring.

Hence, it ensures timely decisions in corporate, like form 8-k triggering events, and personal and legal fields, like triggering events for a legal hold. Many organizations have specific triggers for employees that, once met, make them eligible for special company benefits. In investment markets, triggers often take the form of stop-loss orders, which prompt investors to take action to limit potential losses.

Types Of Coverage Causing Triggering Event

Its various types are crucial for making informed decisions and are discussed below:

- Claims-Made Policies: This triggers during a policy period when one makes the claim that is reported, like in errors and omissions (E&O) insurance.

- Occurrence Policies: It is triggered if an incident or event occurs during the policy duration. This is true regardless of when the claim is made, as seen in general liability insurance.

- Tail Coverage (Extended Reporting Period): It elongates the claims reporting period even after the policy expires. It protects incidents occurring during the policy period and reporting afterward.

- Injury-in-Fact Trigger: It comes into action only when actual damage or injury occurs, instead of their time of commitment. It determines the exact time when an injury happens.

- Exposure Trigger: It is triggered as soon as the insured comes into contact with harmful conditions that cause damage. This type of coverage activates due to long-term exposure to harmful substances.

- Manifestation Trigger: Discovery of any damage or injury activates the trigger, determining the time when it was first ascertained.

- Continuous Trigger: All elements of manifestation, injury-in-fact, and exposure triggers combine to initiate coverage. This happens when exposure, injury, and damage are discovered.

- Parametric Triggers: Physical damage does not trigger it; instead, predetermined parameters such as civil authority orders or statistical thresholds activate it. Companies use this for safeguarding against pandemics, floods, and hurricanes in catastrophe insurance.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that a Dallas-based company, Globalet, suffers from a sudden 30% drop in its stock price due to unexpected changes in regulatory compliance. Such a huge decline triggers an insider review, exposing the fact that its subsidiary's fair value has decreased to its carrying amount. Therefore, it conducts a deeper evaluation of the situation and finds that it may be a sign of an event that triggers the event stipulated under ASC 350.

Hence, it decides to initiate a goodwill impairment test. The evaluation finds an impairment of $15 million, which results in charges being recorded in the company's financial statements. Thus, it impacts the company's market position and investor perception.

Example #2

An online article published on June 1, 2022, discusses how the COVID-19 pandemic increased challenges in evaluating goodwill damage due to the pandemic's economic uncertainties. In March 2021, FASB published ASU No. 2021-03, which allows not-for-profit organizations and private companies to examine goodwill events triggering only at the close of reporting periods, simplifying the procedure.

For instance, Del Taco restaurant observed a goodwill impairment equivalent to $87 million in the first quarter of 2020 because of a fall in stock price, but it recovered its price in later quarters. Such an alternative offers relief by offering more appropriate financial information and reducing industry complexity. Moreover, it happened particularly in sectors that were hurt badly initially by the coronavirus pandemic but recovered later.

Importance

Such events play a crucial role in various contexts, including:

- It makes contracts adaptable to changing situations.

- Risk becomes mitigated for insurers using the event of triggering of insurance.

- Well-defined clauses of triggering can help banks safeguard their interests.

- It can avert a major financial crisis, such as the one in 2008.

- It can help investors change to stable investment options like defensive stocks or government bonds during natural disasters.

- Mergers and acquisitions can trigger changes in the stock process of companies, affecting strategy changes by investors.

- It indicates a decline in stock prices during political instability, wars, and trade disputes between countries.