Table Of Contents

Trial Balance - Example #1

As per the definition of the trial balance, it is the first step in the preparation of the accounts of the statement of any firm. It is prepared at the end of the year of an accounting period to assist in preparing the final accounts.

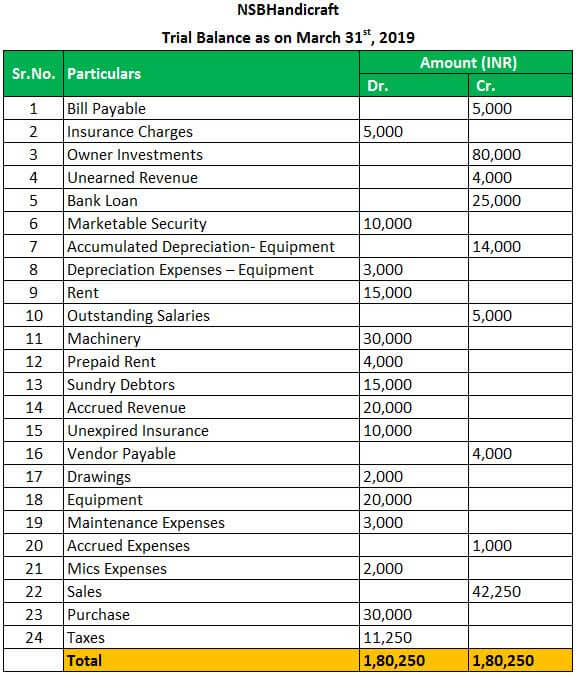

Let’s take the first example of NSBHandicraft. We will prepare the trial balance as per the transactions shown below table for the firm on March 31st, 2019

As per the transactions shown above, now we will prepare the Trial Balance for NSBHandicraft as of March 31st, 2019.

As per the trial balance prepared for NSBHandicraft as of March 31st, 2019, we can see that the total of the Debit side is the same as the total of the credit side in the trial balance. We proceed with preparing other financial statements, such as Profit and Loss Accounts, Balance sheet, etc., by using trial balances.

Trial balance is the first step in preparing the financial statements of any firm. Suppose if the total of both debit and credit sides is not matching, then we have to check the journal entries again and find out what was accounted for wrongly with the transaction.

Trial Balance - Example #2

Trial Balance is the end of the accounting process and the first step in preparing a final firm account. In the double-entry accounting system, each debit balance will have the same credit balance amount. If there is a difference between all debit and credit balances, there would be some errors in the posting of the accounting transactions.

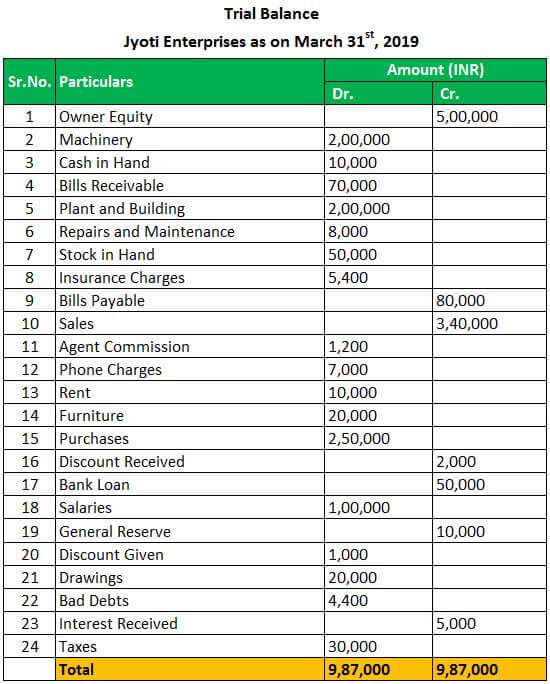

Let’s consider another example to understand the method of preparation of trial balance. Below are the balances from the books of Jyoti Enterprises as of March 31st, 2019.

Now we will prepare the trial balance for Jyoti Enterprises on March 31st, 2019, as per the balance is shown above,

As per the trial balance prepared for Jyoti Enterprises, we can see that both sides of the trial balance are the same, indicating no error in ledger posting during the financial year. The trial balance shows all debit and credit balances in one statement, and from here, we will start preparing other financial statements of the firm.

Trial Balance - Example #3

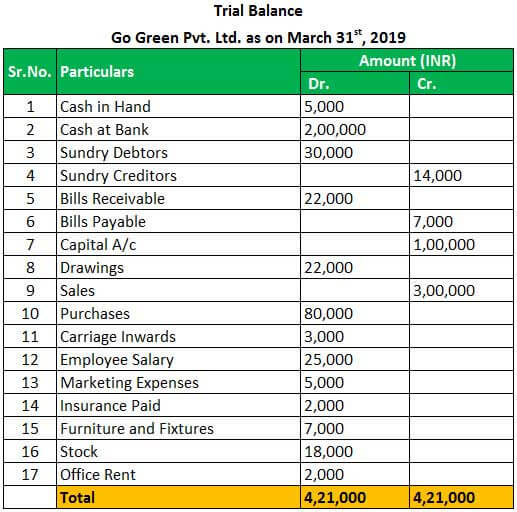

From the above two examples, we have seen that both debit and credit side balances are the same in the trial balance, indicating no error in posting accounting entries. Sometimes due to the non-awareness of the accountant about any particular transaction, the accountant would post that transaction in a suspense account, which would clear after discussion with the concerned person for that particular transaction, and the accountant would try to match the end balance in the trial balance.

In the same way, we will prepare a trial balance for Go Green Pvt. Ltd as per the balance is shown below from the books of the accounts,

Trial Balance will be,

A trial balance is not an account, but a schedule of all the balances of all ledger accounts on a particular date. The trial balance will have Debit and credit columns, the account with a debit balance will be written on the debit side, and the account with a credit balance, will be posted on the credit column side with the actual balance amount.

Conclusion

So, what we have learned about trial balance from the above examples.

- Trial Balance is the statement of balances of all ledger accounts of any firm on a particular date.

- The total of both sides means the debit and credit sides should be equal, as, for any transaction, there would be a debit and credit for the same amount.

- If the total of the debit and credit sides is equal, the ledger posting for every transaction has been done correctly.

- Suppose the totals of both side columns are not matching. In that case, there is some error in the ledger posting for any particular account. The difference would be posted into a suspense account and rectified post discussion with management and the concerned team.