Table Of Contents

What is Transfer Tax?

Transfer Tax is a charge imposed on the transferor of a particular asset, including real estate or other revenue-generating assets, at the time of transfer of such asset to a transferee. The transfer tax calculator is used and is generally included in the cost of such assets at the time of their sale.

Estate tax or state inheritance tax can be types of inheritance taxes. This tax is levied based on the value of assets such as real estate or bonds when the transfer is to be carried out. State or local governments have a set percentage of the value charged as taxes for the transfer.

Transfer Tax Explained

Transfer taxes are a part of the significant revenue-generating fields for the State. This revenue is in addition to other sources and is an additional income to the government. However, property owners often take advantage of loopholes in the execution of such legislation to avoid/reduce the payment of such taxes.

The base value for such taxes changes yearly, although not huge fluctuations. Additionally, it changes with state legislation and varies from location to location. A few states may not even levy such charges on any transfer.

Usually, the transferer or seller is responsible for filling out the transfer tax form and paying the same. However, some states might not hold the transferer but the transferee to pay the tax depending on if it is being inherited under normal situations or otherwise.

It is vital to understand that some states completely forego such taxes. These states include Mississippi, Louisiana, Indiana, Oregon, Texas, and Wyoming among others.

Individuals who inherit estates with a net worth of less than millions help countless Americans from owing any estate taxes at all. The exclusion amount in 2022 was $12.06 million and raised to $12.92 million in 2023.

It is also important to note that while the transfer happens if the transfer is alive, a gift tax might also be levied on the transferee or the receiver.

How To Compute?

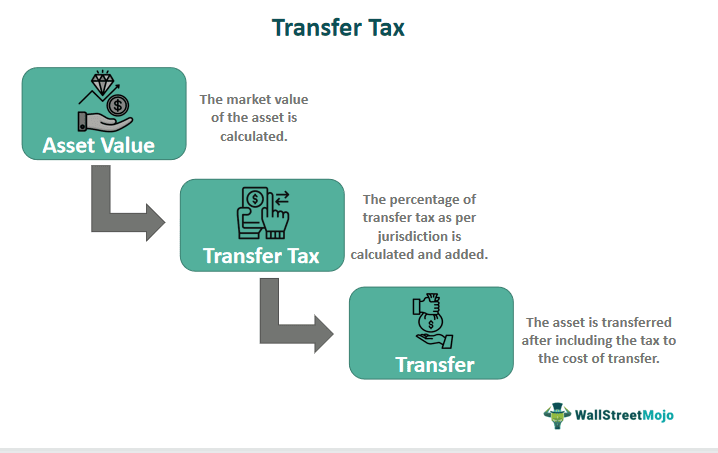

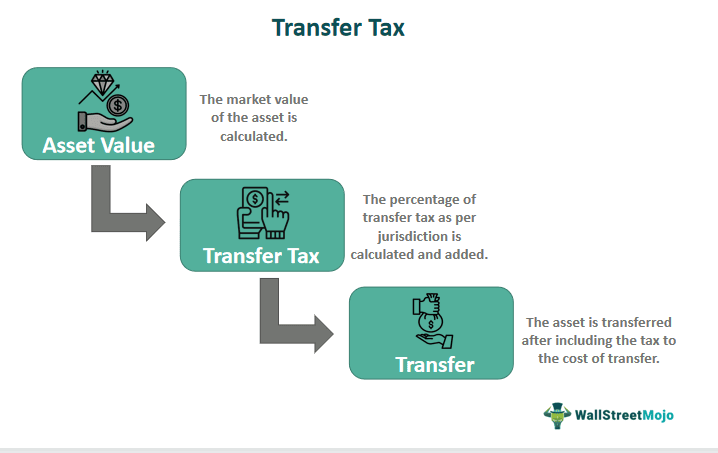

Transfer tax can be a fixed amount or percentage of the asset's original cost, depending upon the terms and conditions set at the time of the original purchase or as per legal norms. The calculation of Transfer tax depends upon the market value of the asset and the State where it belongs. The land transfer tax is levied based on the nature of the property as well. As in, if the property is a residential or commercial property also plays a major role in the percentage of tax.

- It includes the legal costs and charges in such transfer fixed by the legal departments, without any hidden or contingent charges.

- In case of transfer of property after death, these taxes are referred to as estate taxes, which as per the IRS in the U.S., is applied after a base limit of $11.4 million (as of the year 2019).

- In case of transfer, while the transferor is alive, these taxes are referred to as inheritance or gift taxes and levied upon acquiring individuals. Inheritance/Gift taxes are levied on asset value greater than $15,000 or cash in such amount to other individuals and are eligible as and when an asset is transferred.

Federal Tax Limits for New York in the U.S.

As we have learnt that the transfer tax calculator might be different for different states. Moreover, the rates and exclusion number might also change on a yearly basis. Below are the tax limits set by Feds in New York in 2019.

Source: Public Leginfo

Examples

Let us understand the concept of filling out the transfer tax form and the charges levied on either parties with the help of a couple of examples. These examples would help us understand the intricacies of the concept.

Example #1

Miss Anne wishes to exit from her investments in sovereign bonds by transferring the same to her niece. The current price of this bond is $120, and the transfer tax to be paid is 5% of the current market price as per instrument documents. Considering that Miss Anne paid $100 to purchase this bond, how much tax does she pay, and what is her profit made on this investment (if any) apart from coupons received at earlier intervals?

Solution:

Total amount invested: $100

Current market price of the bond: $120

Transfer tax to be paid: 5% of $120 or $6

Total amount paid by Miss Anne: $100 + $6 = $106

Profit received after transfer of bond: $120 - $106 = $14

Example #2

Mr. John wishes to gift his daughter with a car worth $10,000. However, he is worried that a gift tax may be levied on this transfer as per the government legislation. Can you advise him about the calculation of such a tax on this deal?

Solution:

As the value of this transfer is $10,000, which is below the required threshold of $15,000 in a year to be eligible for payment of gift tax, this transaction is not eligible for any gift tax. No transfer tax is levied on this transaction.

Example #3

After Maria’s death, assets worth $12 million were left behind for her heir. Calculate the estate taxes to be paid by her heir upon inheriting the assets.

Solution:

Below is the calculation for the same:

$11,400,000: Nil taxes

First $500,000: 3.06% of $500,000 = $15,300

Remaining $100,000: 5% of $100,000 = $5,000

Hence total transfer taxes to be paid

- = $15,300 + $5,000

- = $20,300

Please refer excel sheet for calculation.

Advantages

Let us understand the advantages of the land transfer tax and taxes levied on similar other income-generating assets through the discussion below.

- Transfer taxes are an additional revenue-generating source of income for the State, in addition to the other determined sources of income.

- These taxes may be evenly or proportionately distributed between the transferor and transferee depending upon mutual negotiations, hence do not form burdensome on one of the parties.

- The limit set on the value of the asset before application of such charge is on a higher side, which avoids smaller transactions to get included in the applicability and thus is helpful to both minimize payment on the side of the transferee and reduce paper-work on the side of the collection center.

Disadvantages

Despite the various advantages mentioned above, there are a few factors that prove to be a hassle or hurdle for both parties involved. Let us understand the disadvantages of the transfer tax form through the points below.

- Due to loopholes in the implementation of such taxes, like a waiver to a spouse in case of estate taxes, eligibility only beyond the base limit, etc., owners of such assets may take advantage and manipulate the payment of such taxes.

- Serves as an additional cost to the actual value of the asset, which sometimes causes avoidance of such transfers as it increases the cost of the transfer.

- These taxes are calculated on the current market value of such assets. Hence, transfer tax paid (if any) at the time of acquiring the asset will be different from that paid at the time of passing on and will be higher in value.

Criticism

Despite the fact that it is a great revenue-generating source for the state, it has been criticized by a part of the society that believes that must be taxable for all irrespective of the amount or be completely tax-free for everyone. Let us understand where these limitations or criticism for land transfer tax and other similar taxes come from through the discussion below.

- The calculation of transfer taxes is dependent on the value of such assets as of a particular date. Hence, fluctuates in cases of forthcoming events on the land where such asset belongs. For example, consider a villa is to be transferred value of which, as of today, is $2 million. Due to specific political events and outbursts of the crowd, the value goes down in the coming week to $1.5 million or lower, and the owner now wishes to make a distress sale. Even though the profit margin goes down, transfer taxes also go down in such cases.

- A significant limitation on the part of collection service is the base limits set on the calculation of such taxes.

- In gift taxes, the transferor is charged with such an amount and not the receiver of such a gift.