Table Of Contents

Procedures

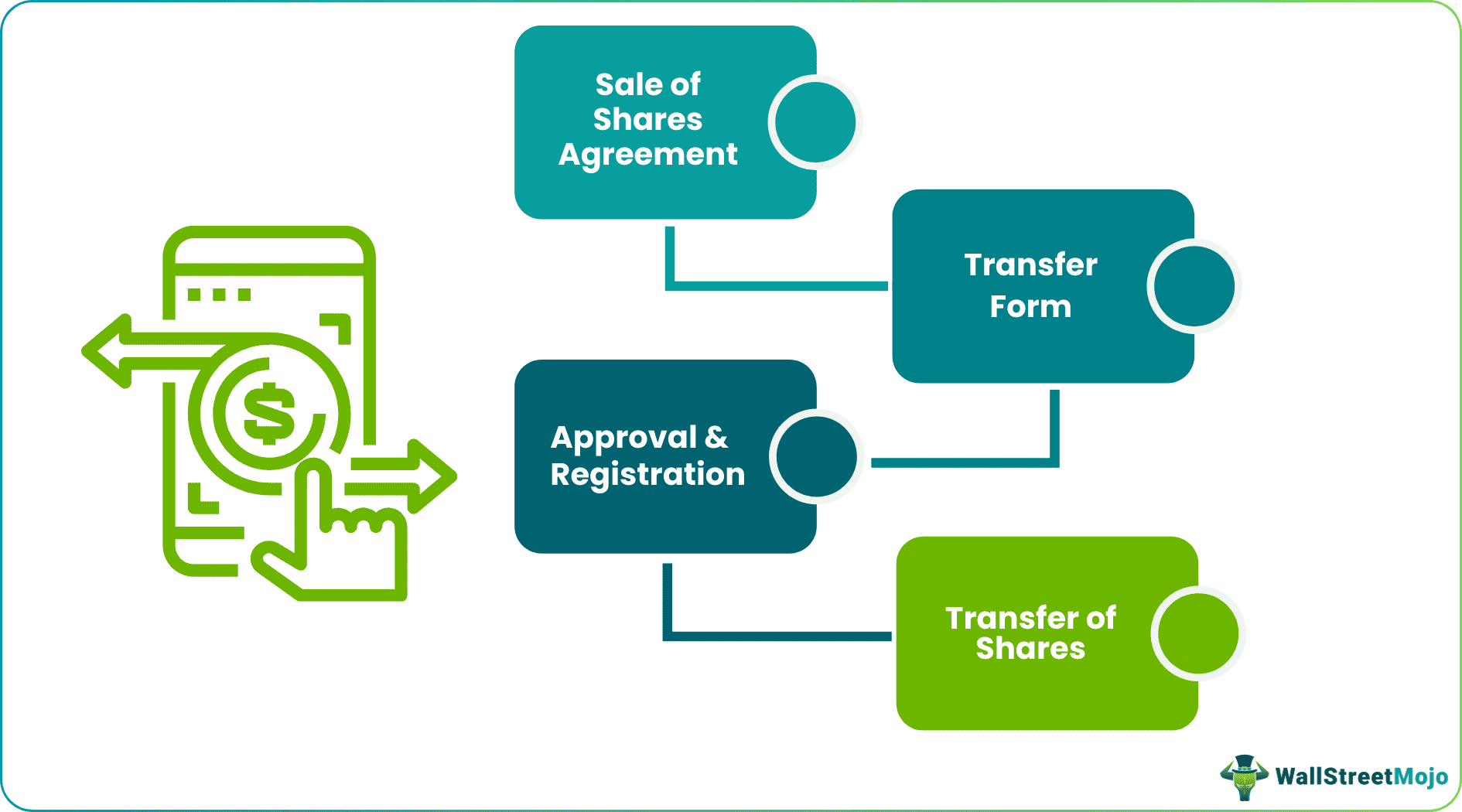

A physical or electronic transfer of shares has the following steps to follow to complete the transfer:

Step #1 - Sale of Shares Agreement

Both parties (buyer and seller) agree to the purchase and sale of the shares.

Although the agreement is not a legal requirement, drawing a purchase and sale agreement in writing is advised. Then, when the transfer occurs electronically, the seller can execute their stock transfer form and the buyer’s payment details.

However, it is always advised to draw out this form as it creates a legal record between two parties that can be referred to in case of discrepancies or disagreements. This written contract is also called a Share Purchase Agreement (SPA).

Step #2 - Transfer Form

It holds the details of the buyer and seller, the number of shares being transferred, the type of shares, and the decided price. Unless an exception of rule applies, the initiator must pay stamp duty to the concerned authorities depending on the jurisdiction of the transfer. Once the authorities stamp the share transfer form, it can be presented to the company for registration.

Step #3 - Approval/Rejection

When submitted to a company for registration, a stock transfer form is subject to a statutory obligation from the directors on the board. They can accept or reject the application. If the application is approved, the registration process is commenced. On the other hand, if it is rejected, they provide the registering parties with the reasons for refusal.

Step #4 - Issuing the Share Certificate

The new share certificate issued by the company is proof that the transferee is legally the owner of the shares. This certificate must be issued within two months of the transfer. However, as most transfers happen electronically, the new share certificate is issued by the company within a week or two.

Simultaneously, the company must update its registers with the new owner's details and include the updated list of shareowners as a part of their subsequent confirmation.

Types

The most common types of share transfers are as discussed below:

- Bonus Issue - This transfer occurs when the company issues additional shares from its authorized capital to existing shareholders to raise more money.

- Buy-Back/ Purchase - A buy-back occurs when the company purchases shares from an existing investor or shareholder. This nature of purchase usually occurs in a situation where the company wants to exercise more control over the organization.

- Transfer - An existing shareholder transfers their shares to another company investor or a non-investor in the company for various reasons.

- Gift - When existing shareholder wants to present their dear ones with a gift that has a significant impact, they can choose to transfer the ownership to their names. This process is usually carried out through drafting a gift deed.

Requirements

After both parties involved have thoroughly gone through the Articles of Incorporation to ensure the company does not restrict the transfer, they can draft an agreement on the share transfer, after which the following information requirements must be catered to:

- Company’s name and number.

- Type of shares and quantity being transferred.

- Name and address of the transferor.

- Name and address of the transferee.

- Price of shares.

- Signature of the transferor.

- Stamp duty receipt, if applicable.

Restrictions

Since the transfer of ownership of shares can bring significant changes in the structure of control and management of the company, especially unlisted or private companies, exercise some restrictions to keep the company's control intact.

The obligation and rights relating to share transfers and restrictions are mentioned in the constitutional documents or the shareholders' agreement.

It is essential to remember that the provision in the company's constitutional documents, such as the Articles of Association, will automatically restrict any new shareholder. On the flip side, the shareholders' agreement will specify only the shareholders that have agreed to the terms of it.

With that being established, let us discuss some of the most common restrictions in share transfers:

- Power to Deny Registration - The board of directors’ right to deny approval of share transfers in certain circumstances can be limited depending on the agreement between the shareholders and the company.

- Prohibitions - Under this provision, the shareholder is restricted from transferring shares in a specific time frame, or a particular type of share is prohibited from being transferred.

- Pre-exemption - Any shareholder who wishes to transfer shares should offer them to the company's existing shareholders, often at an agreed price. This provision is a common practice in private companies to disallow third parties from entering the ownership hierarchy.

Tax Implications

Depending on when the share transfer process is carried out, the existing owner of shares might be liable to pay short-term capital gains or long-term capital gains tax.

In addition to that, depending on the type of transfer, stamp duty might be applicable. The stamp duty is usually 0.5% of the value paid for the shares.

Frequently Asked Questions (FAQs)

If the transfer occurs in physical form, the transferor must pay 0.015% towards stamp duty. However, if an electronic transfer of shares is carried out, the transferee has to be 0.015% on a delivery basis and 0.003% on a non-delivery basis.

The transfers settled without the involvement of a clearing house of the exchange, or a clearing corporation is off-market transfers of shares. These transfers can be made from or to sub-brokers or delivered for trade-to-trade transactions.

First, the investor has to fill out a Delivery Instruction Slip or DIS to their current broker. Their broker, in turn, forwards the DIS request to the depository. Finally, the repository transfers the shares to the new Demat according to the instruction.

It is optional for an investor to execute a gift deed for gifting shares to their loved ones. However, As shares are movable properties, executing a gift deed will help the investor have a legal record proving the transfer.

Recommended Articles

This has been a guide to what is Transfer Of Shares. We explain its types, requirements, restrictions, and comparison with the transmission of shares. You can learn more about it from the following articles –