Table Of Contents

What Is Transaction Multiples Valuation?

Transaction Multiples Valuation refers to the valuation technique that determines how valuable an entity is at the time of being considered a potential mergers and acquisitions (M&A) target. It becomes an important financial metric to assess values against value drivers, helping investors understand the latest trends on how a particular entity is valued.

It is based on the premise that the value of the company can be estimated by It is based on the premise that the company's value can be estimated by analyzing the price paid by the acquirer company’s incomparable acquisitions. This valuation method is usually used by financial analysts in corporate development private equity firms, and investment banking segments.

Key Takeaways

- Transaction multiples, often termed acquisition multiples, provide a valuable approach to assessing a comparable company by drawing insights from past merger and acquisition (M&A) transactions.

- It's a widely utilized tool within financial analysis, prominently employed across corporate development, private equity, and investment banking domains.

- The transparency of public information makes this approach accessible to all. Leveraging a range-based valuation enhances its reliability and aids in fostering a deeper understanding of the market dynamics.

Transaction Multiple Valuation Explained

Transaction multiple valuation allows analysts or evaluators to examine a potential merger and acquisition target and value it on the basis of the latest trends. As a result, the investors or buyers know how a company is valued or should be priced, and accordingly, they decide if paying for a M&A deal would be fruitful or not.

In an M&A, multiple valuation becomes a method to look at the past Merger & Acquisition (M & M & M & M&A) transactions and value a comparable company using precedents. Analysts use discounted cash flow and multiples to figure out the valuation for a company, while considering the premium paid in the company belonging to a specific industry.

The precedents that valuation experts take into consideration must have certain traits to ensure the valuation is accurate. Some of these characteristics include:

- The target company in question must deal in the goods and services of the same type for better comparison.

- The range of revenue and profits must be the same. Discrepancies may not lead to reliable comparisons or valuations.

- The period of comparison is important as well. Recent trends and timings help figure out a more accurate comparative valuation.

The location of the entities the transactions of which are being compared should belong to the same location. Following the above traits before evaluating company precedents will assure acquisition companies of paying a legible amount for the target company.

How To Calculate?

The obvious question is how financial analysts calculate this multiple. It has two answers. One is short, and another is long.

In short, it’s all dependent on how they identify similar businesses and look at their recent M&A deals. And depending on that, they value the target company.

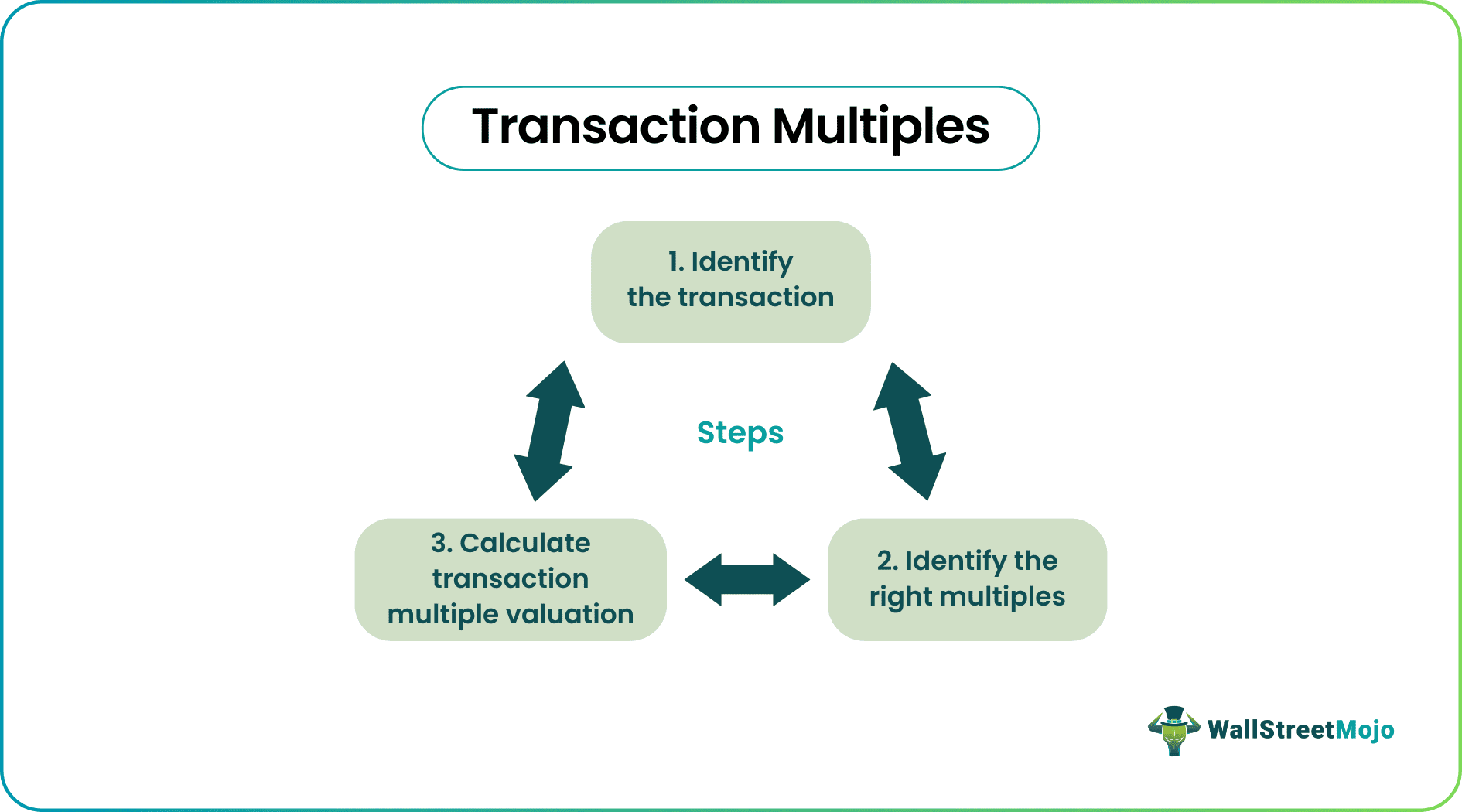

The long answer is a little more detailed. Let’s elaborate step by step.

Transaction Multiples Valuation Video

Step 1 - Identify the Transaction

We can identify the transaction using the following sources -

- Company Websites - Go through the comparable company’s press releases and recent activities section. Go through the other general strategy sections to see the transactions which the company discusses most.

- Industry Websites - You can also refer to industry websites like thedeal.com, which contains almost all the deals from various sectors.

- Bloomberg CACS - If you have access to the Bloomberg terminal, you can also check out the CACS section of the comparable companies.

Step 2 - Identify the right multiples.

For having more clarity on the same, look at the following factors -

- Time of the transaction: The most important filter you should use while looking at M&A transactions is the timing of each transaction. The transactions should be very recent.

- The companies revenue involved in the transactions: You need to go through the annual report to find out the latest revenues. The idea is to choose companies that are similar in revenues/earnings.

- Type of business: This is one of the key factors. It means you should look at the products, and services, target customers of the businesses and select those businesses as comparables. It would be best if you looked at businesses of similar types.

- Finally, the location: The last factor you should look at is the location of the comparable businesses. A similar location would justify because then you would be able to look at regional factors, plus you can see what challenges those businesses in the same location faced.

Step 3 - Calculate the Transaction Multiple Valuation

You need to consider three multiples while looking for similarities in previous transactions. These multiples may not give a very accurate picture of the business, but these multiples will be conclusive enough to make a decision.

- EV/EBITDA: This is one of the most common acquisition multiples financial analysts use. The reason investors/finance professionals use this multiple is that EV (Enterprise Value) and EBITDA (Earnings before interest, taxes, depreciation, and amortization) both take debt into account. The good range of EV/EBITDA is 6X to 15X.

- EV/Sales: This is also another common multiple used by financial analysts/investors. This multiple is significant for certain cases where EV/EBITDA doesn’t work. A start-up has a negative EV/EBITDA. And that's why for small businesses that just got started, analysts use EV/Sales multiple. The usual range of EV/Sales is 1X to 3X.

- EV/EBIT: This is another acquisition multiple that investors and financial analysts use. It is essential because it takes the wear and tear of the company into account. For technology and consulting companies (the companies that are not so capital intensive), EBIT and EBITDA don’t make much difference. EBIT is lesser than EBITDA because depreciation and amortization are adjusted in EBIT. As a result, EV/EBIT is usually higher than EV/EBITDA. The usual range of EV/EBIT is 10X to 20X.

Example

Let us consider the following example to understand the topic in a better way:

Below are the acquisition details of the comparable acquisitions.

| Date | Target | Value of Transaction (in $ million) | Buyers | EV/EBITDA | EV/Sales | EV/EBIT |

|---|---|---|---|---|---|---|

| 05/11/2017 | Crush Inc. | 2034 | Hands down Ltd. | 7.5X | 1.5X | 12X |

| 08/09/2017 | Brush Co. | 1098 | Doctor Who Inc. | 10X | 2.5X | 15X |

| 03/06/2017 | Rush Inc. | 569 | Good Inc. | 8.5X | 1.9X | 17X |

| 10/04/2017 | Hush Ltd. | 908 | Beats & Pieces Ltd. | 15X | 1.1X | 11X |

| Average | 10.25X | 1.75X | 13.75X | |||

| Median | 9.25X | 1.7X | 13.5X |

You need to screen the right transactions and filter out the rest. How would you do that? You would look at the company profiles and understand the transactions closely, and they will only choose the ones that fit the bill.

Then, you would use the right multiples (in this case, we used three) and apply the acquisition multiples to the target company you’re trying to value.

Next, you would value the company by using the right acquisition multiples.

- First, you would look at the range of the acquisition multiples – are they high or low.

- And depending on that, the valuation would be done. And we would have a low range and a high range valuation.

- It would be best if you did this for all comparable transactions. And then finally, we will create a chart to find out the common thread.

- If the right acquisition multiple for your company is EV/EBITDA, the average of 10.25x will apply to the target company.

Advantages

Transaction Multiples Valuation is a method with the help of which a target company for M&A is evaluated so that investors or buyers know how much they should reasonably pay.

Let us check out the benefits of using this valuation metric:

- Anybody can access the information available; because it's public.

- Since the valuation is based on range, it is much more realistic.

- Since you’re looking at different players, you can understand their strategies.

- It also helps you understand the market better.

Disadvantages

Besides multiple advantages, the process also has some flaws, which one must be aware of. Listed below are some of the limitations of this metric:

- While valuing the target company, individual biases would come into place; no one can avoid them.

- Even if various factors are considered, there are still many more factors that are not considered.

- Even if the deals are compared, no deal can be the same. There would be one or more factors that would be different.