Table Of Contents

Meaning Of Tranches

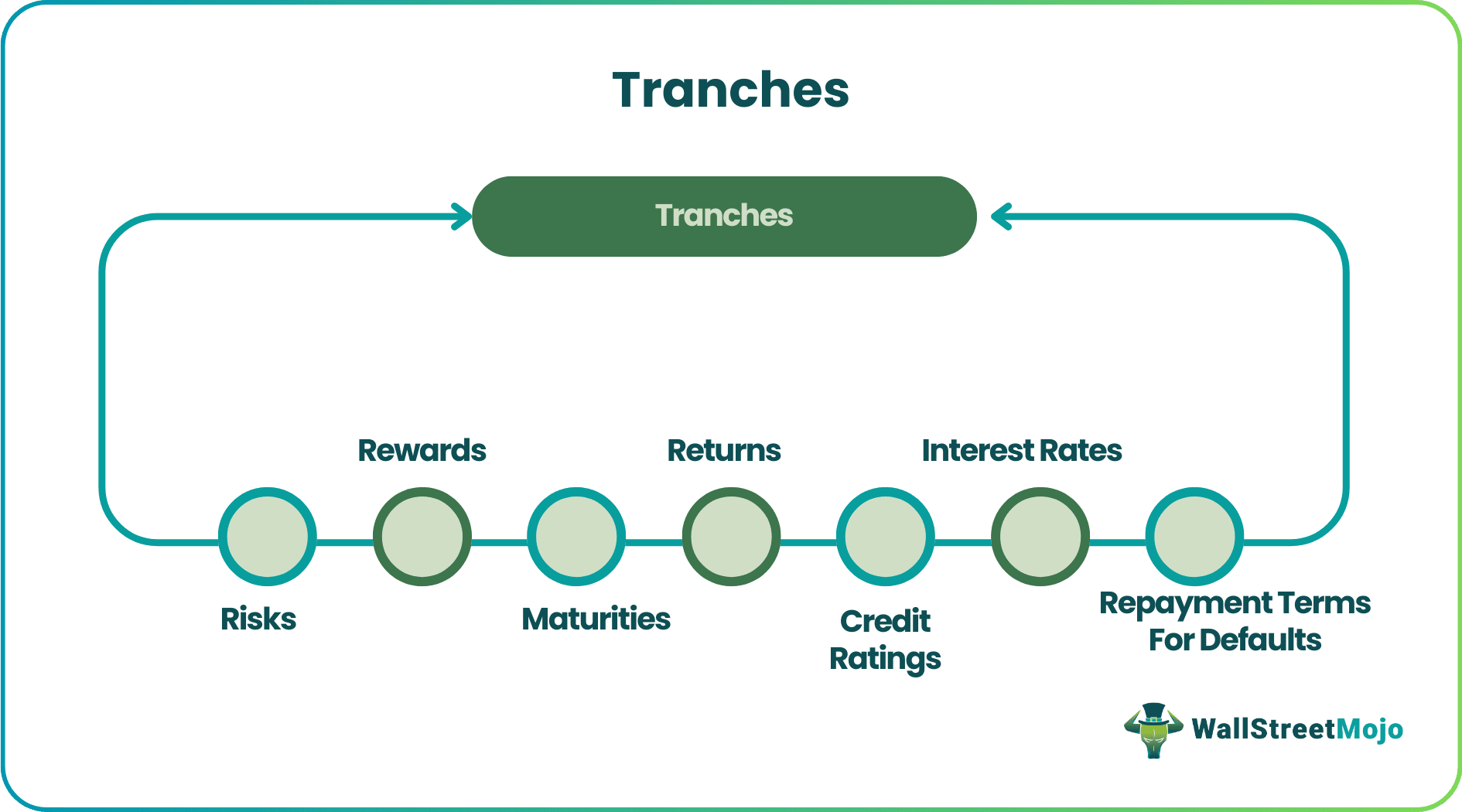

Tranches refer to the segmentation of a pool of securities with varying degrees of risks, rewards, and maturities to appeal to investors. Other classification considerations are returns, credit ratings, repayment terms for defaults, and interest rates. The concept is highly significant in structured financing for debt instruments, including bonds, loans, mortgages, insurance policies, etc.

It typically involves collateralized debt obligations (CDOs) and collateralized mortgage obligations (CMOs). Their segmentation occurs as a part of securitization that lets investors invest in financial products in portions per their long-term or short-term monetary requirements. Furthermore, by customizing their investment strategies, investors can ensure their investment earnings match their cash flow needs.

Key Takeaways

- Tranches meaning refers to the segmentation of a pool of securities with varying degrees of risks, rewards, and maturities to attract investors. Other factors considered in classification include yields, credit ratings, repayment terms.

- It is highly significant in structured financing for debt instruments and allows investors to tailor their investment strategies to their cash flow requirements.

- Segmented securities can be classified into three types based on the risk and return offered by bonds or mortgages - equity or junior, mezzanine, and senior.

- The concept is more common for collateralized debt obligations (CDOs) and collateralized mortgage obligations (CMOs).

How Does Tranches Work?

The word tranches mean portion or slice in French. In finance, the tranches definition refers to the sliced form of CDOs that guarantees each investor a return on their investment. Also, it enables the division of an asset into smaller segments based on investors' risk tolerance. This classification of securities improves the saleability of tradable assets. The availability of offerings in classes of bonds serves individual investor needs, such as future investment and expected returns.

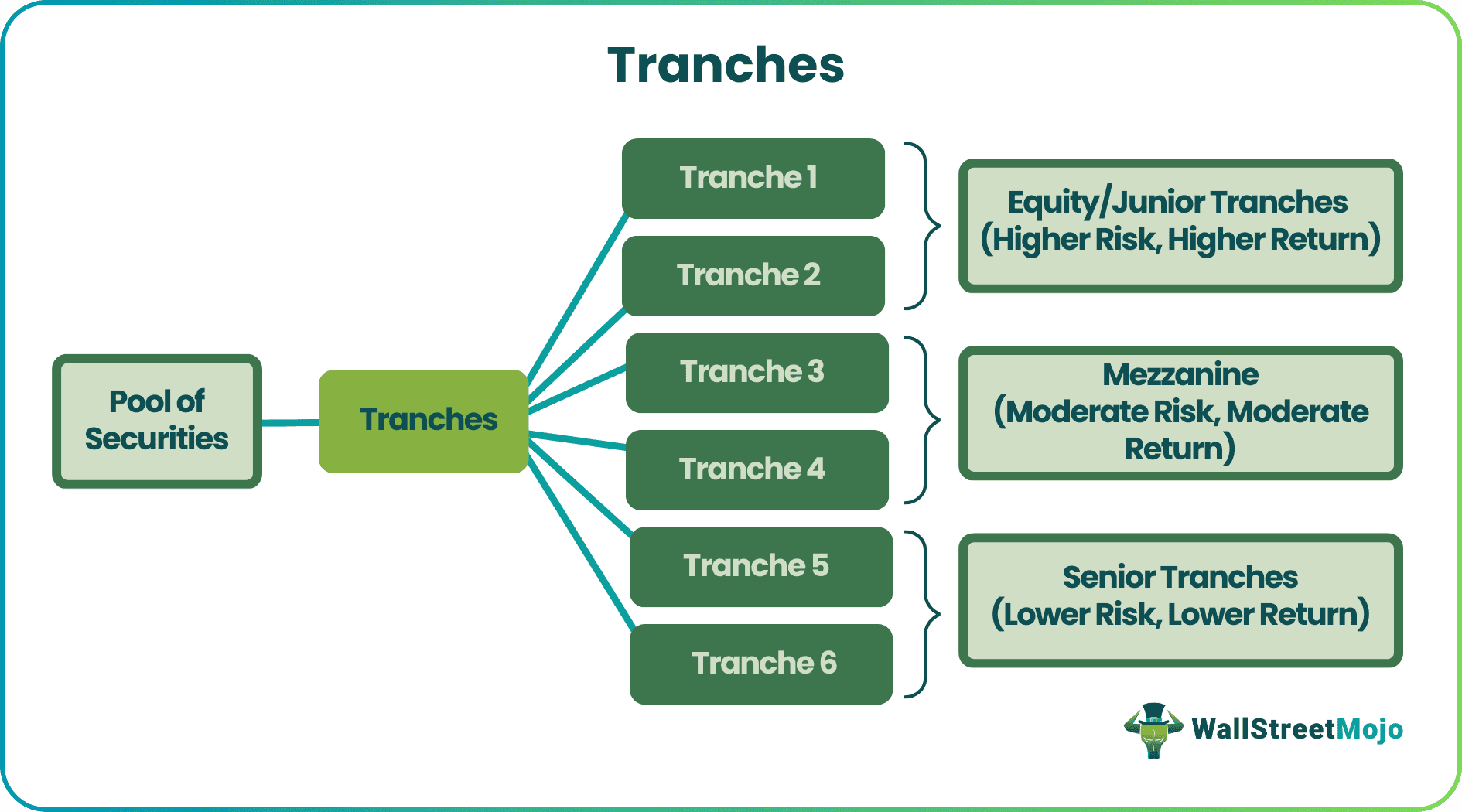

Tranches are groups of securities of a firm in which investors invest. The segmented class of assets determines the amount that traders will receive when their bonds reach maturity. Besides, these portions of bonds or mortgages have varying amounts of risk and maturity. They are of three types based on this – equity or junior, mezzanine, and senior.

- Equity/Junior – It comprises the lower level of investment promising better returns but at a higher risk as they are not asset-backed. Seasoned credit investors prefer this type of tranches investment.

- Mezzanine – It carries a moderate level of risk and expected returns.

- Senior – It includes securities or assets with lower risk and lower expected returns and is suitable for investors with little exposure.

If the market economy is good and borrowers repay on time, returns would be as expected for all three categories of tranches. However, if the market conditions deteriorate, resulting in defaults, nothing will change for mezzanine and senior tranches investors. The former will get the return as expected with no significant risk. And the latter, which is subject to lower risk, will get the desired return or even more than expected. In such a case, equity investors, who are at higher risk than the other two types of investors, receive lower returns and suffer a huge loss.

Examples

To understand what is tranches in an even better way, let us consider the following examples:

Example 1

Investors A, B, and C want to invest in security, but the deal is only suitable for C as the maturity period will serve its long-term need in the next two decades. Hence, A and B decide not to invest as their needs are instant, with two-year and ten-year respectively.

The investment bank considers all the situations and divides assets into three different tranches, making the segments suitable for all investors, i.e., A, B, and C.

This way, A receives the return at the end of two years, B gets it after ten years, and C awaits its share to mature in the next 20 years. Thus, tranches guarantee investors that the desired returns will meet their cash-flow needs by selling shares to them later.

Example 2

The most recent and much-talked-about tranches investment is the one made by liquefied natural gas supplier Qatar Petroleum. It has hired a group of international banks, including Citi, JPMorgan, and Goldman Sachs, among others, for a four-tranche U.S. dollar-driven public debt (bond) sale by the end of June 2021.

The four-tranche debut public bond sale will include three conventional debts maturing in five, 10, and 20 years. Also, there will be a dual-listed Formosa portion for 30-years. Its purpose is to raise $10 billion in the wake of the COVID-19 pandemic, which has resulted in reduced oil and gas prices.

Tranches In Mortgage Market

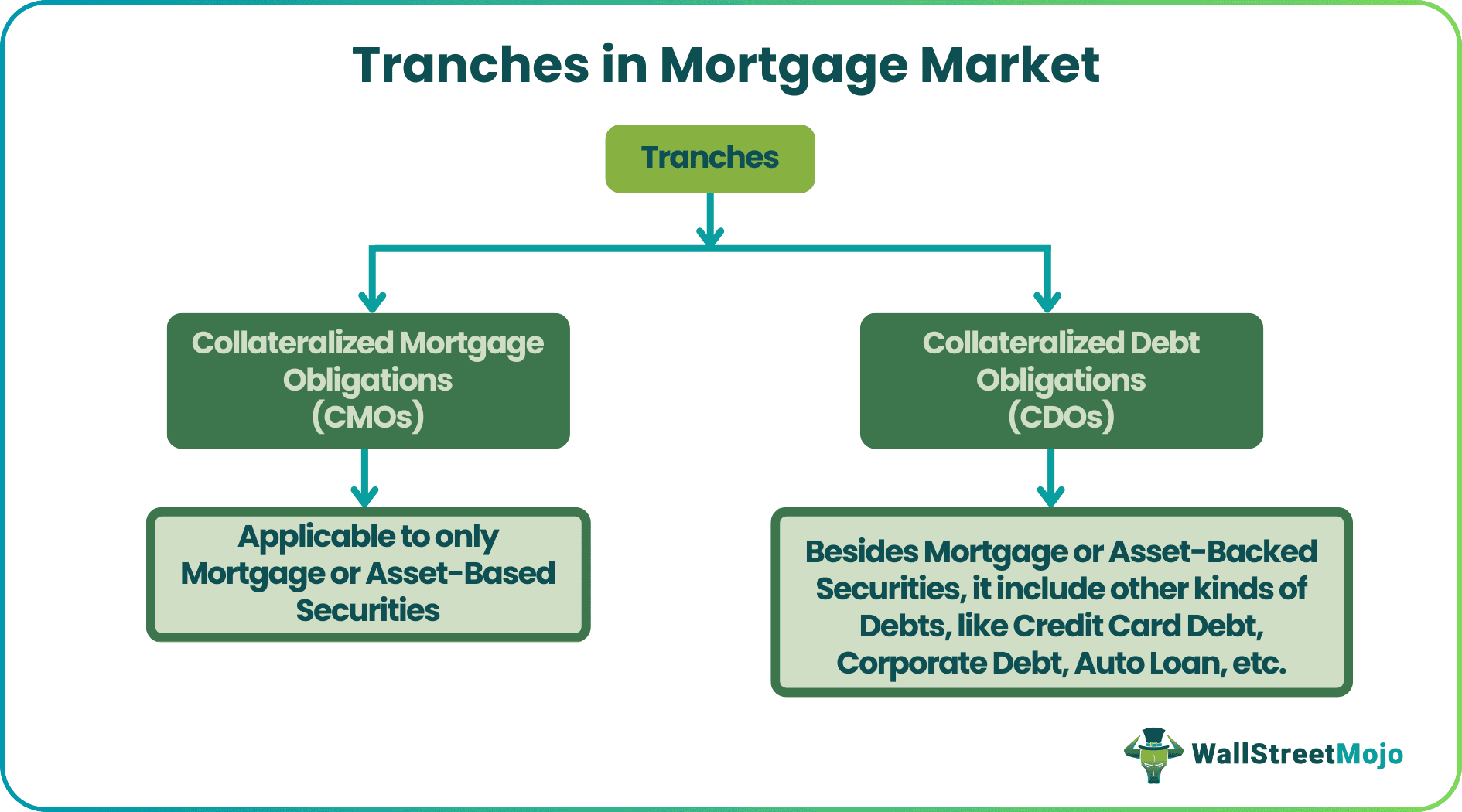

In the mortgage market, tranches are sliced portions of assets in which investors want to invest. These are common in securitized debt products, such as Collateralized Debt Obligations (CDOs) and asset-backed securities, such as Collateralized Mortgage Obligations (CMOs).

In CMOs, the investment bank offers tranches made up of mortgages based on investor’s needs. These portions come with varying maturities, risks, and returns for investors. Here, it is worth noting that safer mortgages carry low-interest rates, whereas risky mortgages have high interest rates.

On the other hand, CDOs are assets that do not limit to mortgage-backed securities. Instead, they also include different kinds of debts, like credit card debt, corporate debt, auto loan, etc. These assets get further sliced into tranches for investors to invest in as per their convenience.