Table Of Contents

What Is Trading Discipline?

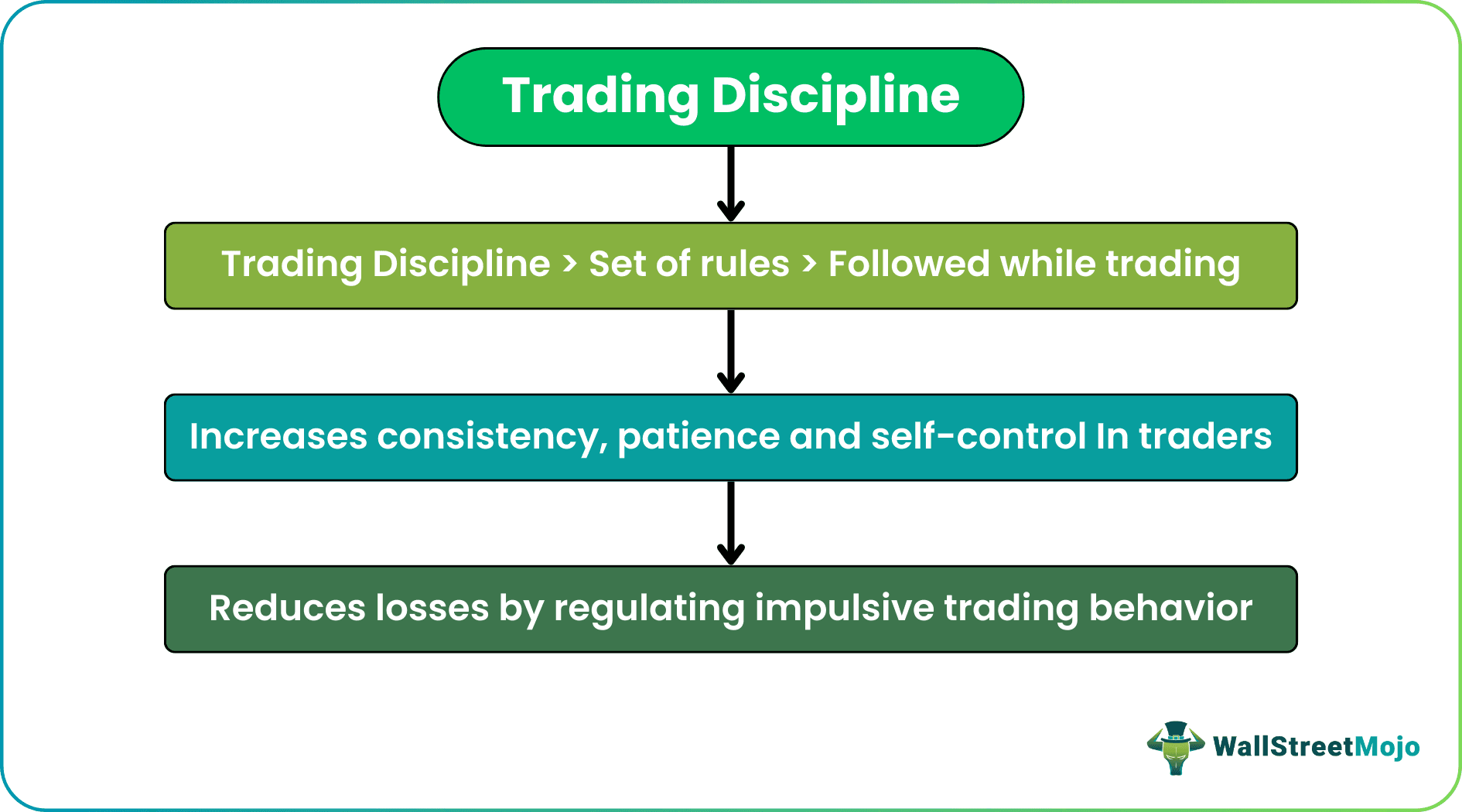

Trading Discipline refers to the ability to follow a defined plan or a systematic process while trading in equity or foreign exchange (forex) markets without being swayed by emotions or impulsive behavioral tendencies. The primary goal of this approach is to allow traders to minimize losses in these markets while aiming for profits.

The trading discipline rules date back to the 20th century. American stockbroker Jesse Livermore mentioned intraday trading discipline during the early days of ticker tapes and bucket shops. Also, journalist Edwin Lefèvre contributed to this concept through the book Making of a Stockbroker. While they recognized the value of trading discipline, they also cautioned traders against rigid compliance with rules without considering market conditions.

Table of contents

- What Is Trading Discipline?

- Trading discipline refers to strategies traders develop to promote financial safety and profit-making in markets. It includes exercising self-control and developing patience during trading sessions to reduce losses.

- This idea took hold in the 20th century during the times of ticker tapes and bucket shops.

- Certain factors can disrupt trading discipline. These include the fear of missing out, market sentiments, emotions, and market volatility.

- It is possible to achieve discipline in this form by following a trading strategy or plan, maintaining consistency in execution, researching well, and using risk management tactics.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Trading Discipline Explained

Trading discipline is a crucial component of successful market trading that works on a defined plan. It enables traders to make rational decisions, keeping a specific purpose in view, even when making decisions based on emotions is a possibility. Also, it ensures that traders consistently comply with defined trading strategies and follow a set process, irrespective of market reactions or movements. They use it as a roadmap for booking higher profits while minimizing losses. If a trader deviates from the trading strategy, they might have to bear huge losses.

Typically, traders employ certain risk management tactics and analytical tools to develop the trading strategy and maintain the required level of discipline. The criteria for entering and exiting trades, position sizing, and other parameters are defined as part of the trading strategy to avoid losses. A well-thought-out strategy helps traders avoid emotional trading and overtrading.

Developing discipline in this form involves controlling many factors that usually influence trading. It includes mastering emotions, avoiding making decisions based on the Fear Of Missing Out (FOMO), following inconsistent or impulsive market practices, and falling prey to market sentiments. For instance, if a trader tries to purchase a stock due to FOMO, they may end up diverting from their strategy.

Involving emotions may hamper the achievement of investment goals. Such steps are usually taken under conditions of market volatility. Traders must build the ability to stick to trading rules. At times, deviating from set strategies may lead to a win. However, it is neither guaranteed nor sustainable.

Many traders with a rational approach believe in playing it safe to ascertain sustainability and long-term success. In this context, playing it safe does not mean avoiding risk entirely. It indicates managing risk effectively within the framework of a well-structured strategy.

Intraday trading discipline rules are highly relevant in modern times. Stockbrokers believe in creating a strategy that improves trading. To create one, they may use technical or fundamental analysis to track, alter, and monitor their trades based on market movements. They may also use trackers to monitor stocks.

On executing a plan, they monitor it for a certain period to ensure its effectiveness. In this process, they cannot deviate from the plan. Even a 1% change may lead to a favorable outcome, which may result in negligence. Unless a trader incorporates proper discipline, it is tricky to make profits in stock markets.

How To Achieve?

Following tried and tested trading discipline quotes can prove helpful in financial markets. Here are certain rules traders may consider following during trading.

- Ensuring consistency: The first rule to practicing and staying disciplined lies in consistency. As traders continue to follow a strategy without deviating from it, discipline builds. It empowers traders to succeed. Also, the probability of the strategy working in a trader’s favor rises. The same rule applies to maintaining forex trading discipline.

- Maintaining up-to-date market knowledge: The second rule of discipline in trading is gathering regular market updates. Traders should follow recent updates of businesses and related sectors. This allows them to develop strategies and hedge their positions during market volatility. When traders follow the news and make suitable decisions with conviction, they might profit, even though the market indicates a bearish situation.

- Employing risk management tactics: Monitoring and managing risk is crucial in financial markets. Unless traders know how to hedge risks, they cannot survive in the market. Hence, it is vital to arbitrage, hedge, or add a stop-loss while trading. Diversification is another key risk management method.

- Avoiding herd mentality: Avoiding FOMO is crucial for maintaining trading discipline and making judicious decisions. FOMO is a powerful emotion that can steer traders in the wrong direction, forcing them to make impulsive decisions based on the thought or perception that they are missing out on potential profits or profitable opportunities. This feeling can result in the development of herd mentality, where traders follow the crowd without independent analysis or consideration of their original trading strategies.

- Learning from mistakes: Discipline also comes from experience and patience. In many cases, mistakes teach many lessons, including those related to staying calm and patient.

- Keeping greed at bay: Greed may lead to overtrading, and overtrading may lead to losses. Ideally, traders should not succumb to greed as profits are typically realized over long periods.

Examples

Let us study a few examples of trading discipline to understand the concept better.

Example #1

Suppose Sasha is an intraday trader. In the five years of her trading tenure, however, she has incurred huge losses. Jenny, her broker friend, knew Sasha made impulsive stock purchases. She suggested that Sasha start following trading discipline to improve her portfolio returns.

After a few months of consistency and careful portfolio monitoring, Sasha saw a significant improvement in her returns. Earlier, she earned an average return of $5. However, her profits rose to $100 later. Sasha also allocated an extra hour to research before investing in any stock. Soon, she was able to trade efficiently and effectively in the stock market.

Example #2

According to a November 2023 report, South Korea has announced a temporary ban on short-selling shares in the country. This decision was taken to enforce trading discipline and offer a fair environment to retail and institutional investors. The chairman of the Financial Services Commission (FSC), Kim Joo-hyun, also stated that this ban will curb unfair trade practices, particularly by foreign investment banks.

Importance

Let us see why trading discipline is important.

- It proves beneficial at the research stage. Trading discipline helps traders incorporate relevant data that can fill gaps caused by insufficient knowledge. As a result, they can hedge their losses better.

- Traders can book profits. Stockbrokers and forex traders can employ various risk management techniques (such as stop-loss, diversification, position sizing, etc.) to hedge risks or for the purpose of arbitrage. Additionally, it helps them make rational decisions.

- It can inculcate a sense of patience and fairness among investors. It also determines the entry and exit points during market fluctuations. Trading discipline helps traders navigate distractions and noise while building self-control, even in highly bearish markets.

- It prevents impulsive trading due to fear or panic. Traders do not follow the crowd; instead, they follow their plan, which keeps them away from impulsive behavior.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

To be disciplined in forex trading, certain points must be noted. These are:

- Setting a clear goal before entering the forex market is important. Determining short-term and long-term goals is crucial.

- Changing old trading practices and replacing them with a proper trading strategy helps build resilience while facing adverse market conditions and volatility.

- Tracking currency pairs and maintaining a trading journal is useful.

- Reviewing the strategy and learning from mistakes are essential steps for success.

There are certain disadvantages of being undisciplined. These are:

- It typically leads to overtrading, which may result in losses.

- Wrong entry and exit positions can harm a trader’s financial objectives.

- Traders become less immune to market sentiments and fluctuations, which may bring losses.

These terms are used interchangeably sometimes. However, certain subtle aspects highlight the differences between the two concepts. A disciplined trader consistently complies with a well-defined trading plan to support their overall trading approach. While trading in the zone, traders achieve results when they are fully focused and in tune with market movements.

Recommended Articles

This article has been a guide to what is Trading Discipline. We explain how to achieve it and its importance, along with examples. You may also find some useful articles here -