Table Of Contents

What Is A Trading Desk?

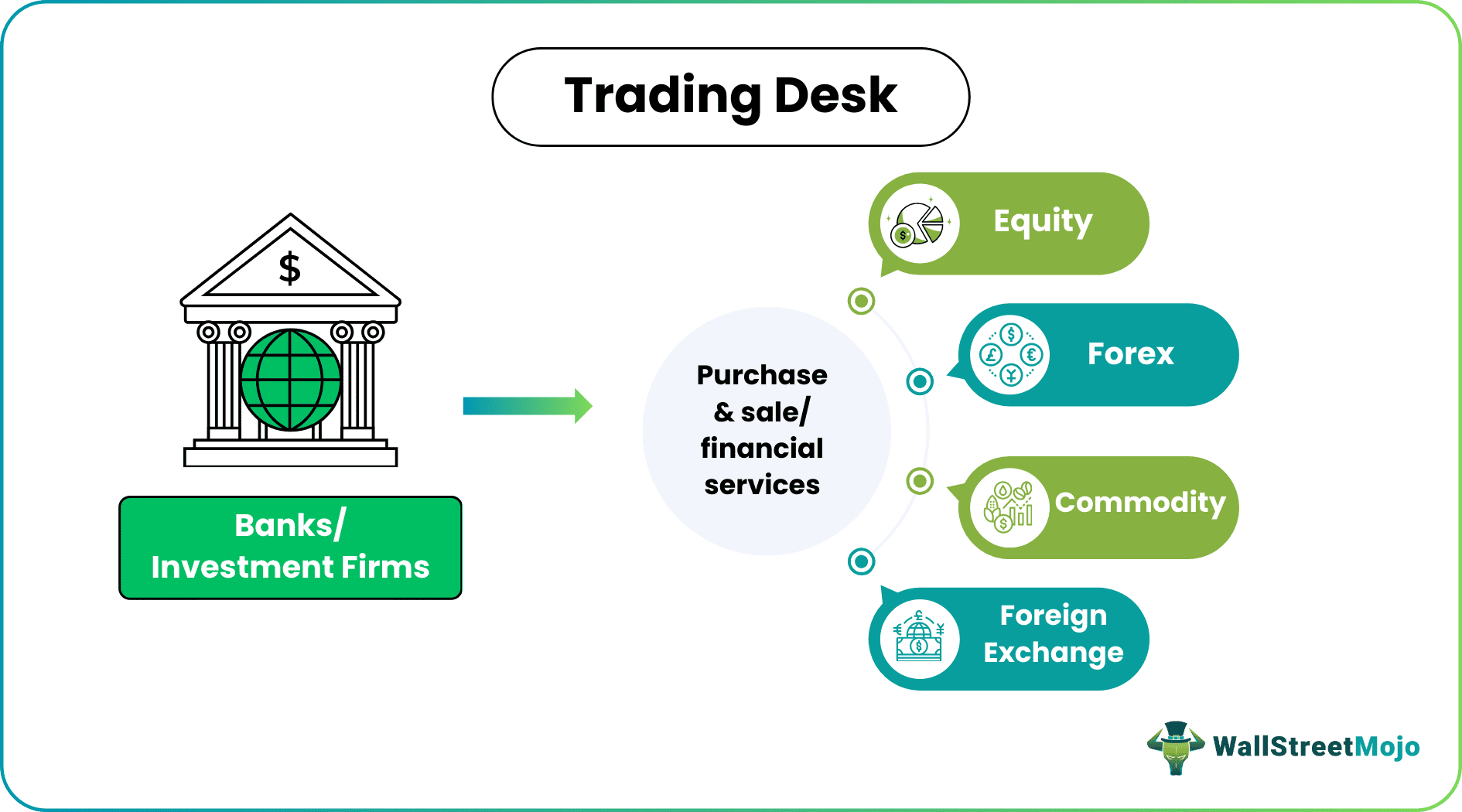

A trading desk is a department in a banking institution or a company where securities like bonds, shares, currencies, commodities, etc., are purchased and sold to facilitate their own or client's trade in the financial markets, and therefore it ensures market liquidity. It also provides support to clients concerning structuring financial products, opportunities, and support agreements between investors and entities. Such desks usually earn commissions as a result of trading activities.

It also provides support to clients concerning structuring financial products, opportunities, and support agreements between investors and entities. Such desks usually earn commissions as a result of trading activities. The department needs a lot of transparency and diligence and also requires relevant licenses for dealing with financial products.

Table of contents

- A trading desk refers to a group of traders and support staff who work together to buy and sell financial instruments. These include instruments like stocks, bonds, currencies, and commodities for an investment firm.

- It helps clients structure financial products and opportunities and supports agreements between investors and entities. Also, it obtains commissions for trading activities.

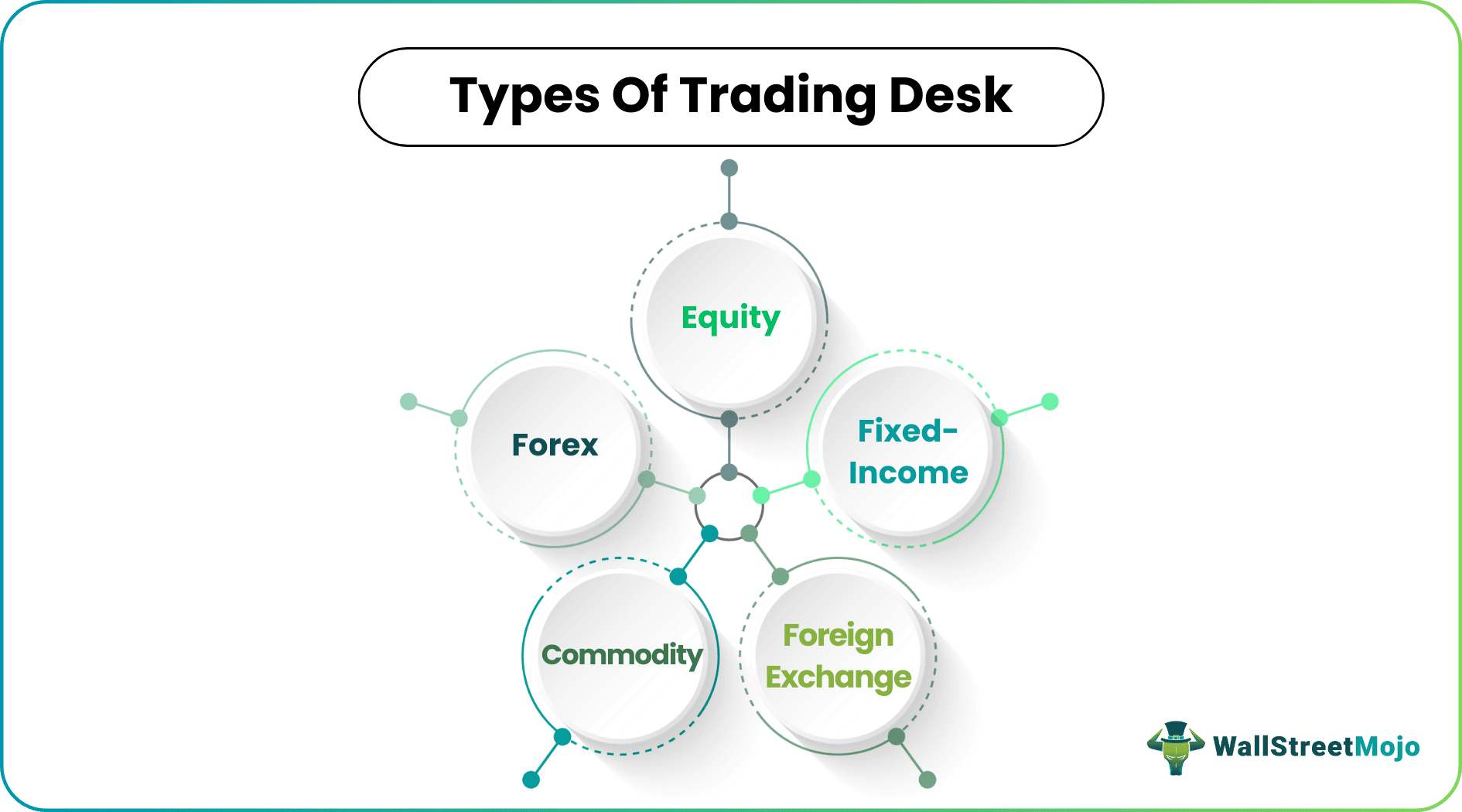

- Equity, fixed income, foreign exchange, commodity, and Forex are the types of trading desks.

- The primary drawback of this department is it needs more transparency, and customers have to pay commission for the services.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How Does Trading Desk Work?

Trading desk is the area allotted in any bank or financial institution, investment firms, etc that is exclusively dedicated to sale or purchase of any type of financial product or service. Some institutions might have different agency trading desk for different products.

- Traders operate in a trading room (also known as the trading floor). A trading room in a financial market usually contains multiple desks that share a huge open space.

- They focus on a particular security type or market segment. Traders occupy these with a license to deal with a particular investment type like equities, securities, bonds, or commodities.

- These licensed traders initially use market makers and electronic trading mechanisms for identifying the best possible prices for their respective clients.

- The client's orders are received by the staff operating from the trading desks from the sales department responsible for providing suggestions on trade-related ideas to financial institutions and investors with a huge net worth.

- Apart from this, trading departments or desks also help investors with various other services such as structuring financial goods, supporting the agreement between investors and entities, etc.

Features

Here are some of the important features of the investment procedure that will be useful to learn in order to understand the concept.

- The agency trading desk is nothing but a desk or a department in a bank or an entity where various types of securities like shares, currencies, bonds, etc., are bought and sold.

- They usually charge a percentage of commission that is earned from trade-related activities. Equity, Fixed income, Foreign exchange, Commodity, and forex are common types.

- It ensures the ease of market evaluation, structuring of financial goods, eyeing for opportunities, providing support to agreements between investors and organization, quality and selective targeting, providing a deeper analysis of client's behavior and characteristics, and so on.

- The drawbacks of bank trading desk or any other financial institution are related party transactions, lack of flexibility, and a negligible amount of transparency.

Types

Let us look at the various types of trading desks available for clients or investors who wish to make investments.

- Equity - This can also be called stock trading desk and can manage almost everything, from trading in equity to various other exotic options.

- Fixed-Income - It can easily take care of various types of bonds, such as corporate bonds, government bonds, etc. Fixed-income trading desks can also manage bond-like instruments that can pay returns.

- Foreign Exchange - This acts as a market maker for allowing the purchase and sale of securities in currency pairs. Foreign exchange trading desks might also participate in activities about proprietary trading.

- Commodity emphasizes greater focus on agricultural commodities, metals, gold, coffee, crude oil, etc.

- Forex - This generally deals with the spot exchange rate lying in an international exchange contract.

Example

Let us try to understand the concept with the help of an example. We assume the ABC Bank has a trading desk for fixed income financial instruments like fixed deposit, government bonds, etc. Thus, any customer, who wish to invest in them can walk in directly to ABC Bank and enquire about the schemes available to invest. They can then select the plan of their own choice as per their profile or investment capacity and invest in them.

This is an example of a bank trading desk of fixed income in which the financial instruments pay a fixed return to the investor. Similarly, there can also be stock trading desk or desks for other financial instruments.

Video Explanation - Trading Desk

Benefits

Here are some of the important and noteworthy advantages of this kind of investment process.

- Ease of Market Evaluation - This can help clients understand the market behavior and learn the ongoing and upcoming movements in the market structure.

- Structuring Financial Goods - These are also capable of helping the clients concerning structuring and conditioning their financial goods and services.

- Supports Agreements - Assists the clients in supporting agreements made between investors and companies.

- Watching for Opportunities - It helps clients watch for ongoing and upcoming opportunities. Upon being able to learn about these opportunities, clients can easily design and take appropriate measures so that they can easily grab these underlying opportunities.

- Quality Targeting - The trading desk operations facilitate quality trading. It means that it is selective and quality targeting instead of unnecessary crowd targeting. Only those clients are targeted that are willing to take active participation in trading.

- Deeper Analysis of Clients' Behavior - Facilitates the deeper analysis of their behavior by learning more about their characteristics, likes, and preferences and accordingly offering them customized investment opportunities.

- Cost Reduction - Helps in the reduction of unnecessary costs.

- Enhances Profitability - This reduces the cost burden, which ultimately signifies an enhancement in profit figures.

- Targeting Audience - It allows targeting the right audience, and the system does not target anybody just for the sake of targeting or initiating clients to make transactions in securities.

Limitations

Along with the advantages, it is also important to analyse the disadvantages of the process also.

- The trading desk operations lack transparency. These offer limited transparency when evaluating performance, conducting analysis, and improving strategies.

- Related party transaction behavior has been seen that clients are apprehensive of using trading desks since it is fully and sometimes in parts controlled by third parties. These third parties make the use of the internal or sister-company trading desk compulsory. This kind of related transaction has resulted in various issues like the client’s finances are not spent as per what he suggested. The client’s money must be spent as per their requirements and willingness.

- Clients will have to pay a commission for the services is the other drawback of trading desks. These are not free services. These services are chargeable, and the clients will need to pay a commission for trading activities.

Trading Desk Vs Demand Side Platforms (DSP)

Let us look at the differences between the two topics.

- The former is a case of management platform whereas the latter is the case of technology platform.

- There is no advertisement exchange in the former’s case but in the latter’s case there is advertisement exchange.

- The DSP involves real time bidding auction which is not the case with the former.

- The former requires more of human involvement than the latter because there is more of planning, optimizing and buying involved in the process.

- The former is more expensive than the latter. The service fee is more for the trading desk than the DSP.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The trading desk must possess one head trader. In addition, it may have two head traders if their roles, duties, and advisors are distinct or have ultimate control over the other. The head trader must supervise the trader's group or trading accounts.

These desks are typically organized based on the type of financial instrument being traded and the targeted market or region. For instance, an equity trading department may be arranged by sector or geographic area, while a foreign exchange trading desk may be organized as currency pairs.

The risk associated with these departments includes credit, operational, liquidity, and market risks. Moreover, the risk level can vary depending on the type of financial instrument traded, the trading strategy used, and market conditions.

Recommended Articles

This article has been a guide to what is a Trading Desk. We explain it with example, differences with DSP, features, types, benefits and limitations. You can learn more about from the following articles –