Given below are some of the differences between both concepts:

Table of Contents

What Is A Trade Confirmation?

Trade Confirmation is the receipt or document that acknowledges the details of a completed trade through the trader's account. The trader's brokerage issues the document, which is a separate document from the trader's account statements.

These confirmations reveal details such as the name of the investment, number of shares, selling or cost price, commission paid, total transaction value, etc. Traders are advised to check their confirmations periodically. This is because mistakes can always happen, and it is important to rule out the possibility of unauthorized trading activity or fraud.

Key Takeaways

- Trade confirmation is a documentary receipt that contains information about a trade executed. It provides the details of the date, time, money, quantity, etc. involved in the trade.

- Post-trade confirmation is when settlement happens, and making mistakes in the confirmation stage can ruin the settlement duration.

- It is an indication of solidifying the agreement between parties and hence has to be checked thoroughly.

- Documentation of trade is important as it promotes legitimacy and accuracy and minimizes errors. It also helps with easy compliance, risk mitigation, dispute resolution, etc.

Trade Confirmation Explained

Trade confirmation is a document of receipt that states the details of the completed trade. The document contains key trade details such as the date and time of transactions, the quantity bought, consideration, type of transaction, whether buy or sell, short or cover, etc. Furthermore, it also contains counterparty information, broker information, and regulatory information. It is an essential information that helps maintain the financial market integrity.

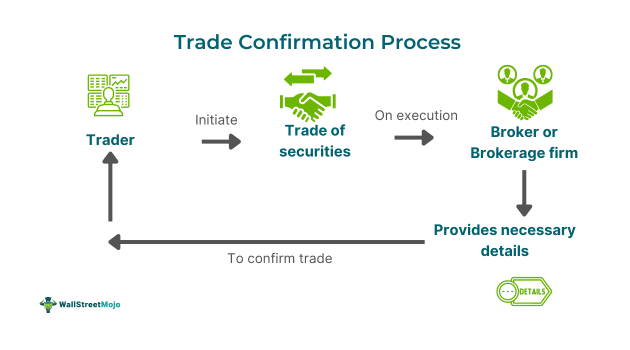

In a trade transaction, the first step is trade initiation, followed by execution and the capture of the trade by the system. This confirmation follows the capture, after which the clearing house takes it up and leads to settlement. Hence, the document solidifies the agreement between two parties to sell or buy securities. It is, hence, a legally binding transaction. The details are later verified and confirmed by both buyer and seller after a trade.

The receipt informs traders if their broker acted as an agent for them and reveals if the brokerage firm or broker has acted as principal for their account. Acting as the principal means acting for the firm or individual's benefit, not the trader. The details can be found by the presence of markups or downs (separately), and those equivalent amounts shall be disclosed.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Indicators

Confirmation is also loosely referred to as technical analysis, where one or more indicators in addition to an existing one support a trend. Technical indicators come into play under this reference of confirmation. They are divided into trend, momentum, volatility, and volume indicators.

- Trend indicators include parabolic SAR and the moving average convergence (MACD).

- Momentum indicators include the commodity channel index (CCI), and the Relative Strength Index (RSI).

- Volatility indicators include standard deviation and Bollinger Bands.

- Volume indicators include on-balance volume (OBV) and Chaikin Oscillator.

Importance

Confirmations are a primary part of the trading process and, hence, play an important role. Below are some points that highlight the importance of trade confirmation documents:

- Legitimacy And Accuracy: Confirmation receipts are fundamental in a trading transaction. It provides the necessary details to check the legitimacy and accuracy of the transactions.

- Verification And Minimization Of Errors: The traders can verify the details and provide ways to minimize errors and misunderstandings. This increases the legitimacy of the financial markets.

- Compliance: Regulations on trading and security are established by bodies that regulate markets, such as the Securities and Exchange Commission (SEC) in the U.S. The rules help implement fair trade practices, and adhering to the issue of such receipts as per the rules helps ensure compliance.

- Risk Mitigation: Confirming the details provided in the receipt helps mitigate settlement risks. This helps identify discrepancies early on and correct them before settlement dates.

- Dispute Resolution: These confirmations are substantial proof of what happened in the trade and the details pertaining to it. Hence, post-trade confirmation, if any issues come up, they can be used as evidence.

- Customer Trust And Audit: This benefit is for the brokers. These receipts become proof of their operational workflow and are proof of accurate recordings. This serves as a record for audit purposes and helps in maintaining customer trust.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Trade Confirmation vs Trade Affirmation

| Parameters | Trade Confirmation | Trade Affirmation |

|---|---|---|

| 1. Concept | It is the documentation of a trade transaction. | A process where one party of the transaction prepares the details of the concept. Transaction and the other party agree on the correctness of the information. This ideally happens after the trade confirmation process. |

| 2. Essence | This process comes before affirmation and involves documentation. | Affirmation is another foundational step in the trade transaction. Where details are agreed upon between the parties involved, it involves verifying the accuracy of the information provided. |

| 3. Parties involved | In the confirmation process usually the trader confirms. | In an affirmation, the trader and the broker affirm the transaction details. |