Table of Contents

Trade-Based Money Laundering (TBML) Meaning

Trade-based money laundering, or TBML, is the process of trying to pass illicit transactions as ones with legitimate origins. Terrorists and other criminals use it to move the proceeds from their exploits using the international trade network. Integrating these illicit transactions into the trade system makes it difficult for authorities to trace them.

The most common method of TBML is either over- or under-invoicing goods. The difference between the actual price and the invoiced price is used to enable the flow of funds. Another method often found in trade-based money laundering case studies is the use of false documentation and the creation of layer after layer of intermediaries to justify the cost of the product and hide unethical practices.

Key Takeaways

- Trade-based money laundering refers to the illicit transactions or entities planted to finance illegal activities.

- Under-invoicing, multiple invoicing, over-invoicing, quality misappropriation, and quantity misappropriation are standard techniques used for TBML.

- These transactions and entities are incorporated to fund illegal activities such as human trafficking, terrorism, drug trafficking, or child labor.

- Awareness programs, collaboration among governments, and technological implementation can help prevent TBML activities.

Trade-Based Money Laundering Explained

TBML, short for trade-based money laundering, is a notorious way to use international trading networks. Terrorist organizations and other criminals use these methods to facilitate the flow of funds from or for criminal activities. They use TBML techniques to hide the origins of these funds and try to pass these transactions as legitimate with the authorities.

The Financial Action Task Force (FATF) is an intergovernmental body mandated to be the global watchdog for money laundering and related interests. In 2001, terrorism financing was also added to its mandate. In short, it must prevent trade-based money laundering and other similar illegal activities.

There are multiple ways these activities take form. A few of the most common techniques are over or under-invoicing, false documentation, and misclassifying of goods to escape custom duties. By doing so, these criminals imbed illegal origins of funds into the legitimate trade system. Thus, it is difficult for authorities to tell the difference between a TBML and a legitimate transaction.

TBML poses a grave threat not just to the global financial network but also to social systems. It is used to finance illegal activities like arms smuggling, terrorism, human trafficking, and drug trafficking. In addition to these unethical practices, it isn't easy to find these transactions as they are mixed among legitimate ones.

Therefore, governments worldwide have worked to boost anti-money laundering regulations, encourage more transparency in trade (especially international), and direct law enforcement bodies of different regions to cooperate and collaborate.

Common Techniques

The most common techniques found in trade-based money laundering case studies are:

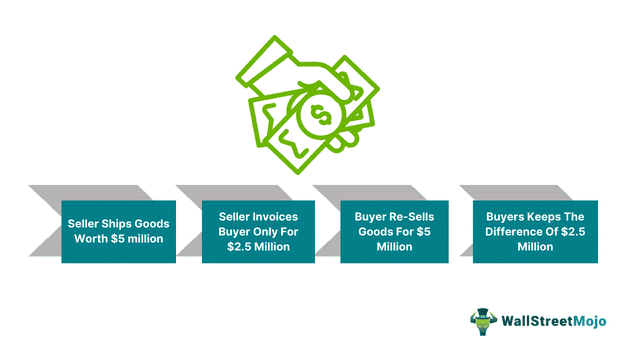

- Under-invoicing: The seller drafts an invoice with a price significantly lower than the actual value of the goods. As a result, the buyer is benefitted through the additional value being pushed to them.

- Over-invoicing: It is the converse scenario of under-invoicing. Here, the seller bills the products at a higher value than their actual price. Therefore, the buyer shall transfer an amount that is significantly higher than the actual value of the products.

- Multiple Invoices: The seller issues more than one invoice for a single shipment of goods. As a result, the buyer transfers funds for multiple invoices for a shipment that was only sent once.

- Quality Misrepresentation: The quality of the goods is tagged as higher than its original quality. Thus, the seller can bill it higher than its actual price and facilitate a higher flow of funds than the trade is actually worth.

- Shipment Quantity Discrepancy: As the name suggests, the invoice intentionally states the wrong quantity of products that are actually being sent on the shipment. Hence, the seller benefits if the quantity is lesser, and the buyer benefits if the quantity is higher than stated on the invoice.

Risk Indicators

A risk indicator in the TBML context points towards a possibility of suspicious or unusual activities occurring in a business or transaction. A few of the most prominent indicators that are flagged to prevent trade-based money laundering are:

- Trade entities with unnecessarily complicated corporate structures that seem illogical. These entities might be shell companies or registered in jurisdictions already flagged as high-risk.

- Entities registered in regions with poor compliance with Anti-money Laundering (AML) and Combating Financing of Terrorism (CFT).

- Trade entities with no online presence or if its online presence shows details different than their initial registration.

- Suppose there are no regular general business transactions. For instance, a company that is registered and has employees but does not disburse salary monthly.

- There is a significant mismatch between the trade volume and the number of staff.

- The entity has bursts of fantastic sales and periods of absolute dormancy with no logical explanation.

- Non-compliance with regular obligations such as filing tax returns.

Red Flags

The most common red flags found in multiple trade-based money laundering case studies are:

- Unusual Shipping Patterns: Unusual routes to destinations are taken to hide money launderers and the origin and destination of illicit transactions. Therefore, any such activity and any shipment sent from or to a known tax haven are met with more than general scrutiny.

- Under- or Over-invoicing Anomaly: This is one of the most common forms of TBML. If authorities find that the goods in the shipment don’t match the price disclosed in the invoice, further investigation is called for.

- High-risk Entities or Jurisdictions: Some locations are notorious for weak enforcement and somewhat relaxed regulations. Therefore, money launderers make maximum use of such destinations or entities to carry out their TBML activities. Therefore, it becomes essential to conduct AML checks.

- Unusual Financing Structures: Some trade transactions are made unnecessarily complicated to hide the origin and destination of funds. These entities might acquire more letters of credit than required or secure unnecessary third-party guarantees. Any such abnormal activity attracts immediate investigation.

Impact On Economies

The impact of these illegal activities is massive on world economies. Despite governments globally taking steps to prevent trade-based money laundering, it is far from contained. Below are a few of the most impacted areas of economies due to TBML:

- Financial losses due to TBML transactions exceeded $9 trillion cumulatively from 2008 to 2017.

- These funds are used in crimes on different levels, such as human trafficking, child labor, drug trafficking, and terrorism.

- The global number of tax evasions arising from TBML activities is around $189 billion annually.

- Luxury goods are most often used for over or under-invoicing scams in TBML transactions.

- It increases the gap between developing and developed economies as countries with relaxed regulations are exploited for such activities.

How To Prevent?

A few measures that can help prevent TBML are:

- No one entity or government can eradicate or prevent trade-based money laundering activities alone. Governments and enforcement bodies need to collaborate.

- Artificial Intelligence (AI), advanced analytics, and other machine learning modes can help boost the tracking abilities of such transactions.

- Governments must strictly enforce AML and CFT transactions or entities and adopt a zero-tolerance policy for such entities.

- Enforcement bodies must be given enough authority to conduct their investigation thoroughly and hold those responsible.

- Educating businesses and curating awareness campaigns can help businesses find unusual patterns. As a result, they can report such transactions or entities to relevant authorities.

Anti-Money Laundering Challenges

The biggest challenges in AML compliance are:

- The methods used by entities (criminals) for money laundering are becoming increasingly complicated. Therefore, tracking and finding these unusual transactions is becoming more challenging than ever.

- Since most of these transactions take place between multiple jurisdictions, the differences between them add to the layers of lies buried in documentation and product quality.

- Multiple steps taken to prevent trade-based money laundering include updating or changing regulations with respect to AML. Therefore, the need to stay updated with recent regulatory changes can be a challenge for authorities.

- The sheer volume of trades happening on a daily basis is enormous. Therefore, tracking such a massive volume of data and finding irregularities is a challenge in itself.